Post-war tax reviews and the Asprey Blueprint

Event details

Seminar

Date & time

Venue

Speaker

Contacts

This event will be recorded. The Zoom invitation is available here. The audio and PowerPoints are also available in the ‘downloads’ tab above or here.

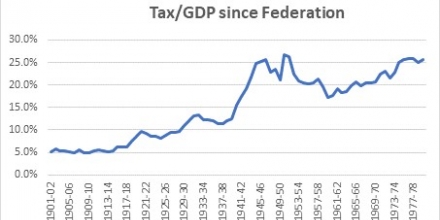

After World War II, international attention turned to economic reconstruction and the transition back to peace-time. As Australia settled into the 1950s and 1960s ‘golden years’ there wasn’t an obvious imperative to tackle basic economic reform and tax design issues. Underlying structural problems were building, though, that would ultimately call for an economic reform agenda and tax would be part of that. This paper tracks these developments, looking at some limited tax reviews along the way: the Spooner, Hulme and Ligertwood committees and the Downing study. The main focus, though, will be on the tax reform blueprint provided by the 1975 Asprey review and the associated Mathews review.

Paul Tilley brings long-standing experience on tax and public finance from his 30-year public service career in Treasury, the Department of Prime Minister and Cabinet and the OECD. Paul has since published a book on the history of the Australian Treasury, teaches a tax policy course at Melbourne University and is currently writing a series of papers on the history of tax reform in Australia. His research and experience is of great relevance to TTPI’s activities.

Please register your attendance at the registration tab above.

Updated: 20 April 2024/Responsible Officer: Crawford Engagement/Page Contact: CAP Web Team