History of state tax reform in Australia

Event details

Seminar

Date & time

Venue

Speaker

Contacts

NOTE: This event will be held in-person in the Molonglo Theatre, Crawford School.

The Audio recording and PowerPoint slides are available in the ‘downloads’ tab above.

Please register your attendance above if you plan to attend in-person as strict COVID-safe guidelines will apply.

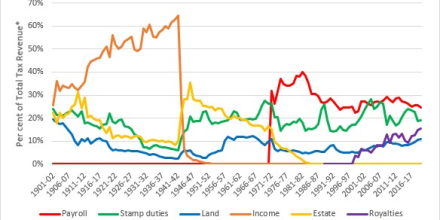

The nature of Australia’s Federation, and Constitution, has given the Commonwealth the main revenue-raising instruments but left the states with large expenditures responsibilities, with the consequent imbalance dealt with by fiscal transfers between the governments. The states still raise around half of their own revenue, though, through various tax and non-tax sources, many of which suffer from poor design and have been eroded by inter-state competition. This seminar focuses on reviews states have undertaken to improve the quality of their tax systems.

Paul Tilley brings long-standing experience on tax and public finance from his 30-year public service career in Treasury, the Department of Prime Minister and Cabinet and the OECD. Paul has since published a book on the history of the Australian Treasury, teaches a tax policy course at Melbourne University and is currently writing a series of papers on the history of tax reform in Australia. His research and experience is of great relevance to TTPI’s activities.

Download Paul Tilley’s working paper State and Territory tax reform.

Updated: 18 April 2024/Responsible Officer: Crawford Engagement/Page Contact: CAP Web Team