Japan's race against the ageing clock

By Atsushi Seike, Keio University

Photo: Evgueni Tchljevski, Flickr

The ageing of Japan’s population is globally unprecedented both in its level and its speed.

The proportion of people aged 65 years old and over is now more than one-quarter of the total population of Japan — proportionally, the largest in the world. This will grow to one-third of the total population in 2035. It took only 24 years — from 1970 to 1994 — for the proportion of Japanese people aged over 65 to increase from 7 per cent to 14 per cent. In European countries it took between 50 and 100 years, and in some cases even longer. Japan’s population has aged twice as fast as Germany’s and more than four times faster than France’s.

Even this understates the scale of the challenge. Not only are there proportionally more people over the age of 65, but the population over 65 is getting older. The proportion of people aged 75 years and over is increasing particularly rapidly, and is expected to reach 20 per cent of Japan’s population in 2035.

This ageing population has an enormous impact on Japan’s economy and society. Its most significant impact is on social security. As a result of this ageing population, total spending on social security was almost 110 trillion yen (approximately US$924 billion) in the 2012 fiscal year — 22.8 per cent of GDP.

Japan will also have to make do with a smaller workforce. Productivity will have to increase if Japanese people are to enjoy the same living standards.

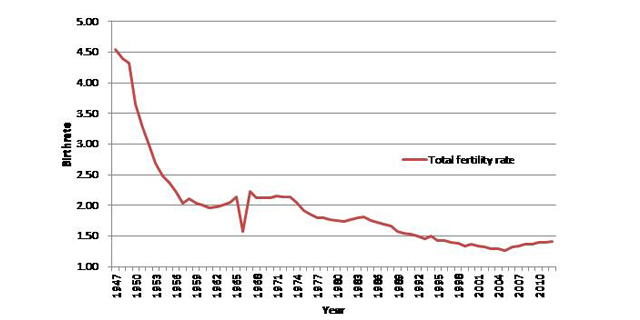

Japan should take every possible measure to cope with an ageing population. One step is of course to stop, or at least moderate, population ageing. This means taking adequate measures to reverse the decreasing fertility rate.

Productivity will have to increase if Japanese people are to enjoy the same living standards.

But even if the fertility rate recovered drastically, it would not make much difference to the dependency ratio, because newborns would not enter the workforce for some decades. Japan must therefore promote the employment of older people.

Trends in the fertility (birth) rate in postwar Japan (1947-2012)

Source: Based on data from the Demographic Statistics Data Book (2014), National Institute of Population and Social Security Research Source: Based on data from the Demographic Statistics Data Book (2014), National Institute of Population and Social Security Research

If older people with the will and ability continue working beyond the current retirement age, it will reduce the average per capita burden of the ageing society. The increase in the number of active workers and consumers in their old age would be a driving force of economic growth on the supply side as well as the demand side of the economy.

The labour force participation rate of Japanese people in their 60s is high compared to other developed countries. This will help Japan deal with demographic pressures and allow it to establish a ‘Life-long Active Society’ in which the will and the ability of older people are fully utilised.

But Japan faces several obstacles that prevent it from promoting higher labour force participation among older people.

One obstacle is the public pension system. Any pension system will naturally make retirement more financially attractive to older workers. Japan’s current system includes strong incentives for pension-age Japanese workers to retire or to reduce their working hours, including an earnings test that lowers the pension rate the more you work. Japan should consider reforming pension eligibility to improve work incentives.

If a firm lifted the mandatory retirement age while leaving seniority-based wages unchanged, it would have to raise its wage bill considerably.

Mandatory retirement practices are still dominant in Japan. While having mandatory retirement from one’s primary job need not entail full retirement, in practice it often does. In Japan mandatory retirement reduces the probability of men aged 60–69 participating in the labour force, all other things being equal. Mandatory retirement also tends to push workers who stay in the workforce into jobs where their acquired skills and knowledge are underutilised, leading to a loss in productivity.

But if Japan revises mandatory retirement practices by lifting the legal minimum age of retirement or by introducing anti-age discrimination legislation, it will also need to change the seniority-based wage and promotion system. If a firm lifted the mandatory retirement age while leaving seniority-based wages unchanged, it would have to raise its wage bill considerably. Tackling this will require cooperation between unions and employer groups.

Encouraging older Japanese people to stay in the workforce will mitigate part of the problem, but not all of it. The social security system also needs urgent reform in order to better cope with an ageing population.

Unlike pensions, medical care, and long-term care — which are guaranteed revenue under Japan’s social insurance system — childcare has historically not had any permanent revenue source.

Benefits for young people should be more generous, particularly with respect to childcare. In the late-1970s, when the fertility rate started declining, the Japanese government should have been concerned about population decline. But it took until the 1990s for the government to introduce the so-called ‘Angel Plan’ — a package of policies, which on the whole was not very daring, to promote comprehensive childcare support.

Unlike pensions, medical care, and long-term care — which are guaranteed revenue under Japan’s social insurance system — childcare has historically not had any permanent revenue source. So in 2013 the National Council on Social Security System Reform, which I chaired, recommended that the government should reserve revenue from the consumption tax for childcare.

Costs in both the pension and in the medical and long-term care systems must also be contained. Changing the pension eligibility age will help with the former, but medical and long-term care spending will be somewhat more difficult to restrain. They will increase at more than the rate of increase of the older population. This is not only because people over 75 years old are more likely to need medical and long-term care, but also because of the increase in the quality and the cost of medicine and care. Addressing this problem will require cooperation with service providers.

Japan’s high debt-to-GDP ratio means that social security system reform is vital. These reforms will no doubt face political opposition from both beneficiaries and service providers. But without them Japan will not be able to sustain the social security system that has enabled it to attain the highest longevity in the world.

About the author

|

|

Atsushi Seike is the President of Keio University and Professor of Labour Economics. He is chairman of the Council for the Promotion of Social Security System Reform (Cabinet Office), President of the Federation of Japanese Private Colleges and University Associations, and Chairman of the Federation of All Japan Private Schools Associations. He was previously Dean of the Faculty of Business and Commerce, and Graduate School of Business and Commerce, Keio University. In the past he has been a Visiting Principal Research Officer at the Economic Research Institute, Economic Planning Institute, and Visiting Scholar at the Department of Economics, University of California, Los Angeles. |

About AJRC

|

|

The Australia-Japan Research Centre (AJRC) at Crawford School of Public Policy conducts research to explore and improve understanding of the economies and economic policy processes in Australia and Japan and both countries' strategic interests in the Asia Pacific economy. Its policy-oriented areas of interest cover developments in regional economic cooperation and integration and encompass research on trade, finance, macroeconomics and structural and regulatory reform, as well as international economic relations. |

Forthcoming events

-

Mr Tomohiko Okabe Brown Bag Seminar

8 May 2015

- Japan Update 2015

12 October 2015

For more information, visit the AJRC website.

Recent publications

-

'How to solve Japan's fiscal sustainability issues'

By Takashi Oshio and Kazumasa Oguro

AJIR Forum

No. 3, 2015

» download

- 'Do Japanese MNCs use Expatriates to Contain Risk in Asian Host Countries?'

By Jean-Pascal Bassino, Marion Dovis and Pierre van der Eng

AJRC Working Paper Series

No. 2, 2015

» download

Contact AJRC

(T) +61 2 6125 0168

(F) +61 2 6125 8448

(E) ajrc@anu.edu.au

Australia-Japan Research Centre (AJRC)

Crawford School of Public Policy

ANU College of Asia & the Pacific

J.G. Crawford Building No. 132

Lennox Crossing Road

The Australian National University

Canberra ACT 0200 Australia |