Shadow Board’s Sentiment Shifts Slightly Towards Rate Cut

Australia’s headline inflation rate, as measured by the quarterly Consumer Price Index (CPI), held steady at 2.4% in Q1 of 2025, the lowest level since Q1 2021. Services inflation dropped from 4.3% in Q4 2024 to 3.7%, largely due to slower increases in rents and insurance costs. This was offset, however, by a rise in goods inflation, from 0.8% to 1.3%, mostly attributable to a rise in electricity prices. Promisingly, the RBA’s trimmed mean CPI, which rose 3.2% year-on-year in Q1 2024, eased to 2.9% in Q1 2025, placing it within the Bank’s official 2-3% target range. The official unemployment rate held steady at 4.1%, while the participation rate increased slightly and employment increased by nearly 90,000. The Federal election, with a resounding victory for Labor, has removed one source of uncertainty but the geopolitical landscape, and US policy in particular, remain cause for concern. After preferring no change in the April round, the Shadow Board’s sentiment has shifted towards monetary easing. It attaches a 38% probability that keeping the rate unchanged at 4.10% is the optimal policy setting, while attaching a 48% probability that a rate cut is called for and a 13% probability that a reversal of the recent rate cut, to 4.35%, or higher, is appropriate.

Labour market conditions remained broadly stable in April 2025. The seasonally adjusted unemployment rate held steady at 4.1%, while the participation rate edged up to 67.1%, suggesting a slight expansion in labour supply. The underemployment rate rose marginally to 6.0%, while youth unemployment declined slightly to 8.8%, indicating modest improvement in opportunities for younger workers. Monthly hours worked across all jobs were unchanged. Total employment increased by 89,000, with nearly 60,000 of those in full-time positions, evidence that labour demand is solid. ANZ-Indeed Australian Job Ads rose 0.5% month-on-month, reversing February’s dip. Meanwhile, wage growth remained moderate: the Wage Price Index rose 0.9% in the March quarter and 3.4% year-on-year, a modest acceleration from the previous quarter, with gains concentrated in the public sector.

Financial markets showed signs of renewed stability and optimism in recent weeks. The Australian dollar stabilised above US$0.64 last Friday, recovering from its earlier weakness. Equity markets continued their upward trajectory, with the S&P/ASX 200 Index rising 0.56% to close at 8,344, after having dipped below 7,400 in early April. This is the highest level in nearly three months and the eighth consecutive session of gains. In bond markets, the yield on the 10-year Australian Government bond remains steady at 4.46%. The yield curve remains inverted at the short end, with the 2Y-1Y spread at -10.2 basis points, while the mid- and long-term segments display normal convexity: the 5Y-2Y spread stands at 23.9 basis points and the 10Y-2Y spread at 89.7 basis points, suggesting that investors anticipate gradual policy easing over the medium term.

Consumer sentiment showed signs of recovery in May 2025, with the Westpac-Melbourne Institute Consumer Sentiment Index rising by 2.2% month-on-month to 92.1. This rebound follows a 6.0% drop in April and marks the third increase this year, supported by stronger financial market performance and renewed political clarity following the Federal election. Although still below the neutral threshold of 100, the index suggests that consumer pessimism is gradually easing. In parallel, household financial conditions appear to be improving modestly, as reflected in private sector credit growth, which rose by 0.5% month-on-month in March, matching the pace of the previous two months. The uptick was broad-based, with housing credit accelerating slightly to 0.5% (from 0.4%) and personal loans increasing by 0.6%, up from 0.2% in February.

Business sentiment showed tentative signs of stabilisation in April 2025. The NAB Business Confidence Index rose modestly to -1, up from a revised -2 in March, reaching its highest level since January, though still in negative territory, indicating lingering caution among firms. Activity indicators painted a mixed but broadly improving picture: the S&P Global Composite PMI posted a reading of 51, its seventh consecutive month of expansion, while the Manufacturing PMI and Services PMI remained in positive territory at 51.7 and 51, respectively. Meanwhile, the Ai Group Australian Industry Index rose by 5.1 points to -15, continuing its gradual recovery from prolonged contraction, with the construction sub-index improving notably to -7.9. However, capacity utilisation slipped to 78.4% from 79%, suggesting that some slack remains in the system, and challenges such as election-related uncertainty and heightened global trade tensions continue to weigh on the manufacturing sector.

Global momentum has weakened over the past month. The IMF’s World Economic Outlook update of 22 April 2025 lowered its forecast for global GDP growth next year to 2.8%, a cumulative 0.8 percentage-point downgrade since January, and now expects world trade volumes to expand by only 1.7% in 2025 as higher tariffs bite. UN Trade and Development’s May “Trade Tensions and Rising Uncertainty” brief warns that continued protectionism could push global growth down to 2.3%, slipping below the 2.5% threshold often associated with recession. On the supply side, China’s new export-licensing regime covering seven rare-earth elements is fuelling concern about input costs for electric-vehicle, wind-turbine and defence manufacturers. Global security risks remain elevated, keeping freight premiums high and adding another headwind to trade flows. For Australia, softer global demand and lingering logistics frictions point to near-term headwinds for bulk-commodity exports, yet the rush by advanced economies to diversify critical-mineral supply chains could bolster medium-term demand for Australian lithium and rare-earth output.

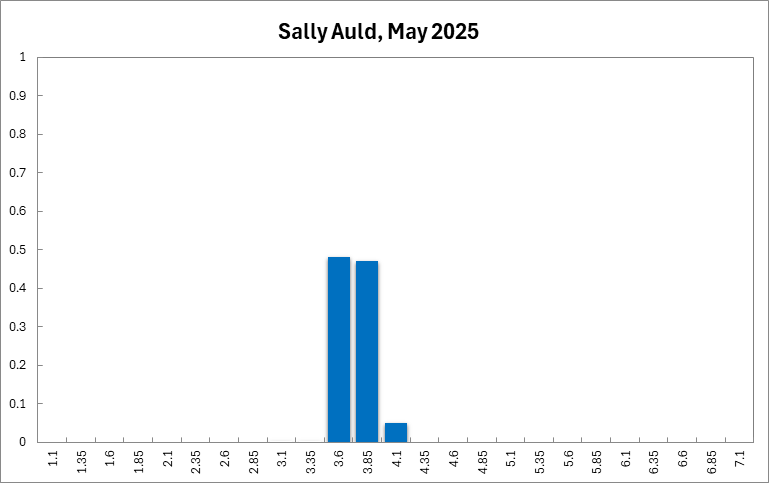

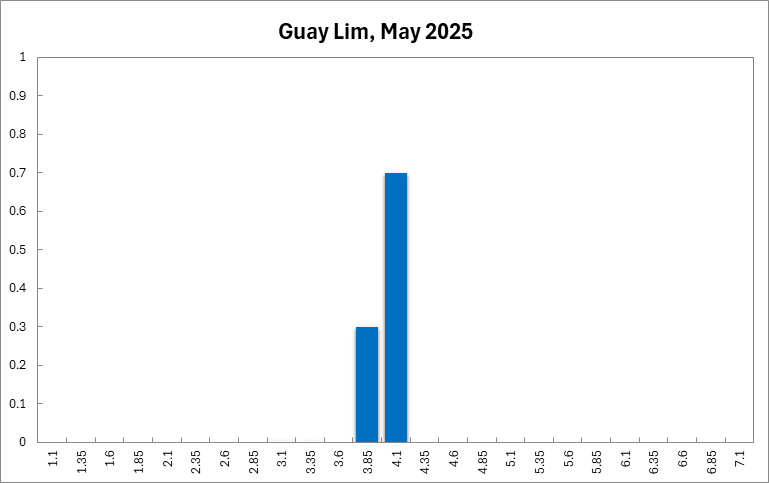

Whereas in the April round the Shadow Board strongly favoured keeping the overnight rate steady at 4.10%, it is now only 38% confident that this is the optimal policy setting. Accordingly, it attaches a 48% probability that a rate below 4.10% is optimal and a 13% probability that a rate above 4.10% is optimal.

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 4.10% equals 22%; the probability attached to the appropriateness of an interest rate decrease equals 63% (up from 48%), while the probability attached to a required increase equals 16% (down from 25%).

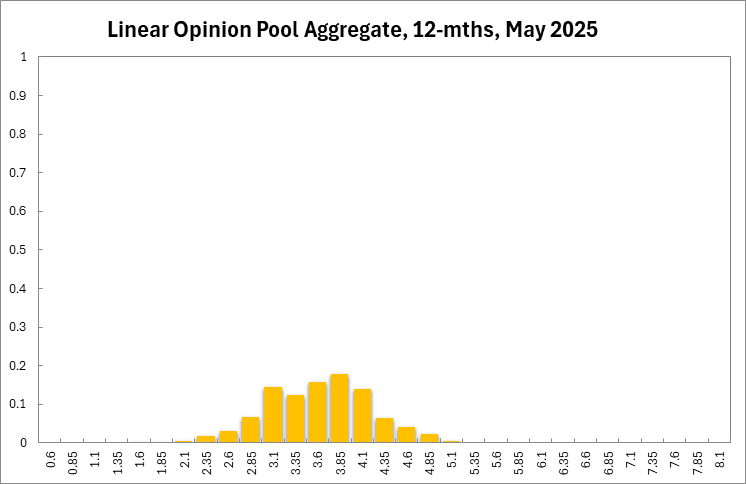

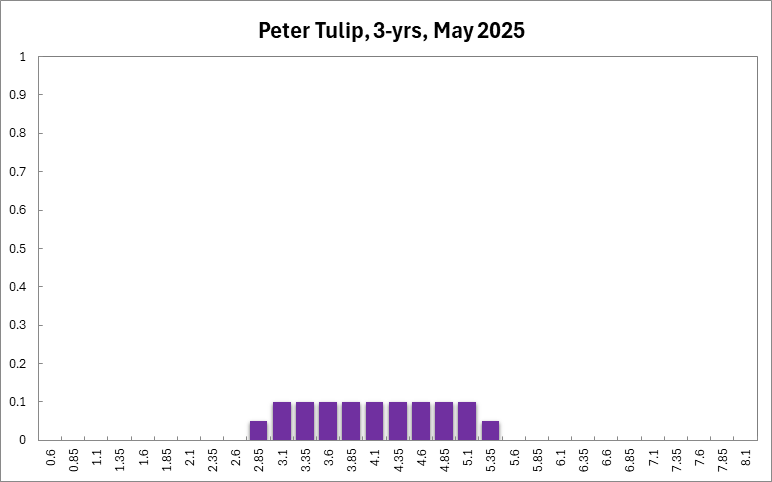

One year out, the Board is favouring further monetary easing: members’ confidence that the appropriate cash rate should remain at the current level of 4.10%, equals 14%, while the confidence in a required cash rate decrease, to below 4.10%, equals 73%, and its confidence in a required cash rate increase, to above 4.10%, is 13%. Three years out, the Shadow Board attaches a 12% probability that 4.10% is the appropriate setting for the overnight rate, a 69% probability that a lower overnight rate is optimal and a 19% probability that a rate higher than 4.10% is optimal.

The range of the probability distribution for the current interest rate recommendation widened marginally, extending from 3.35% to 4.60% (from 3.60% to 4.60% in the previous round). At longer horizons the ranges have also changed only slightly: they extend from 2.60% to 4.60% (previously 2.60% to 4.85%) for the 6-month horizon, from 1.60% to 5.10% (1.85% to 5.35%) for the 12-month horizon, and from 0.60%-5.35% (unchanged) for the 3-year horizon.