Cautious reopening of the Australian economy but cash rate needs to stay at historic low much longer

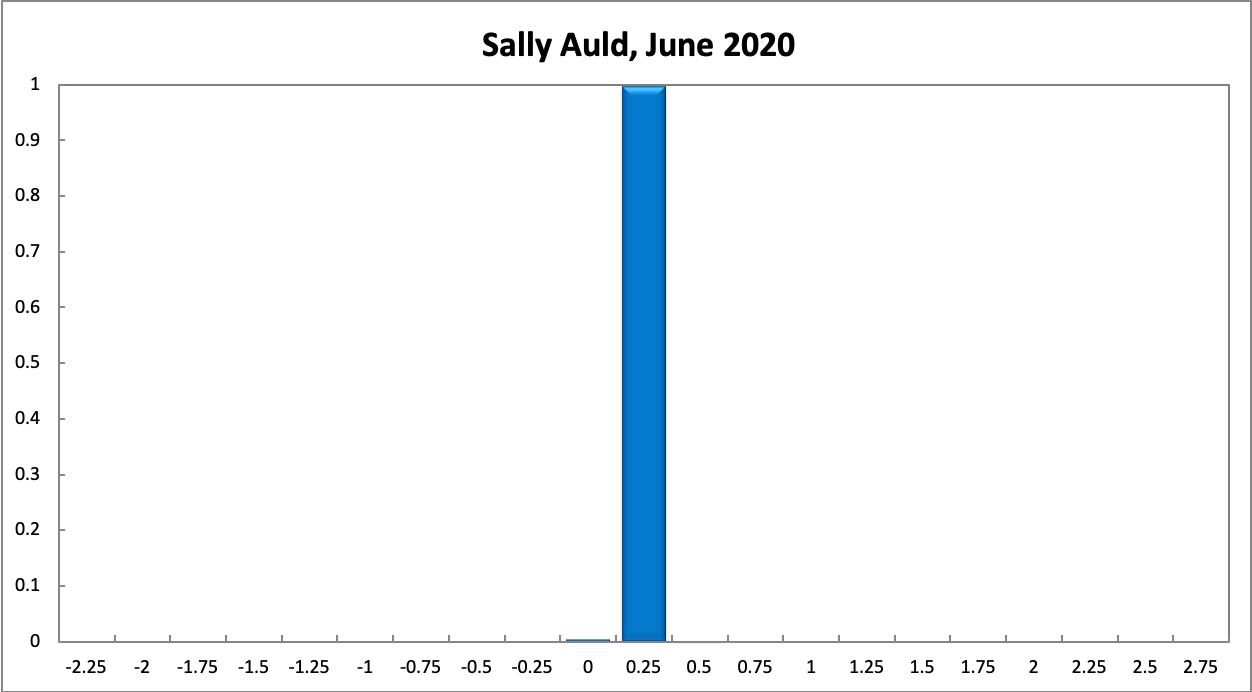

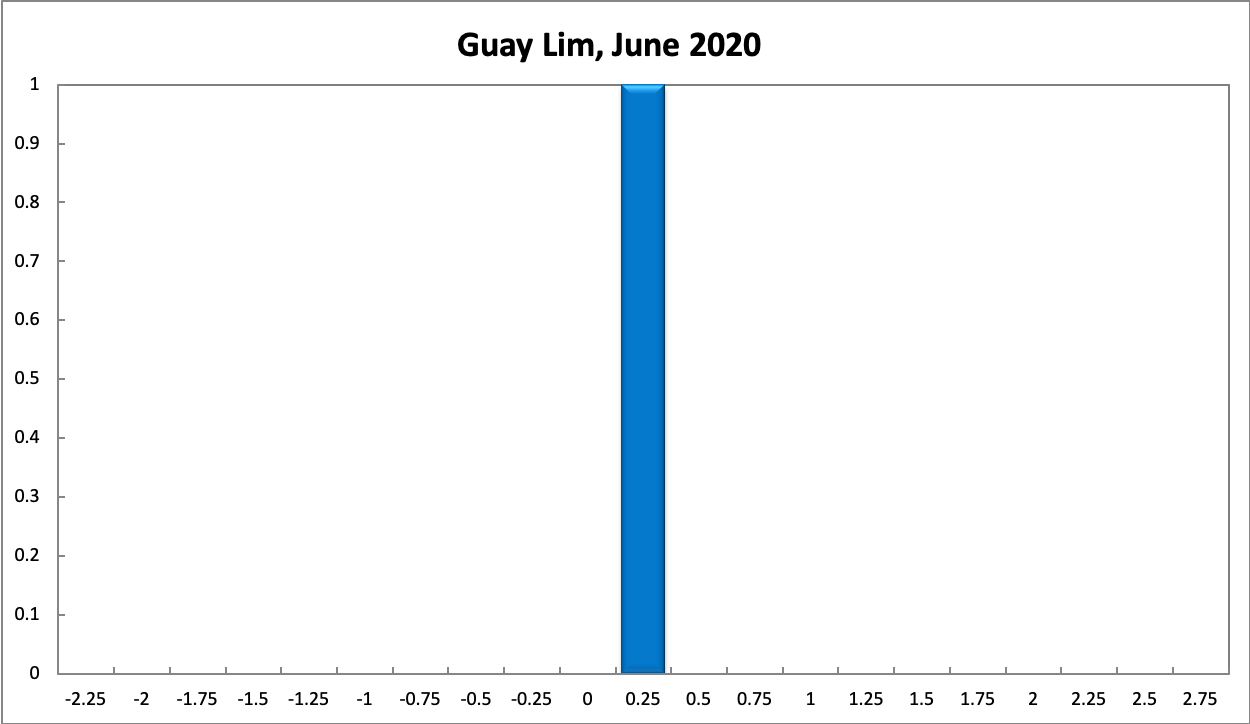

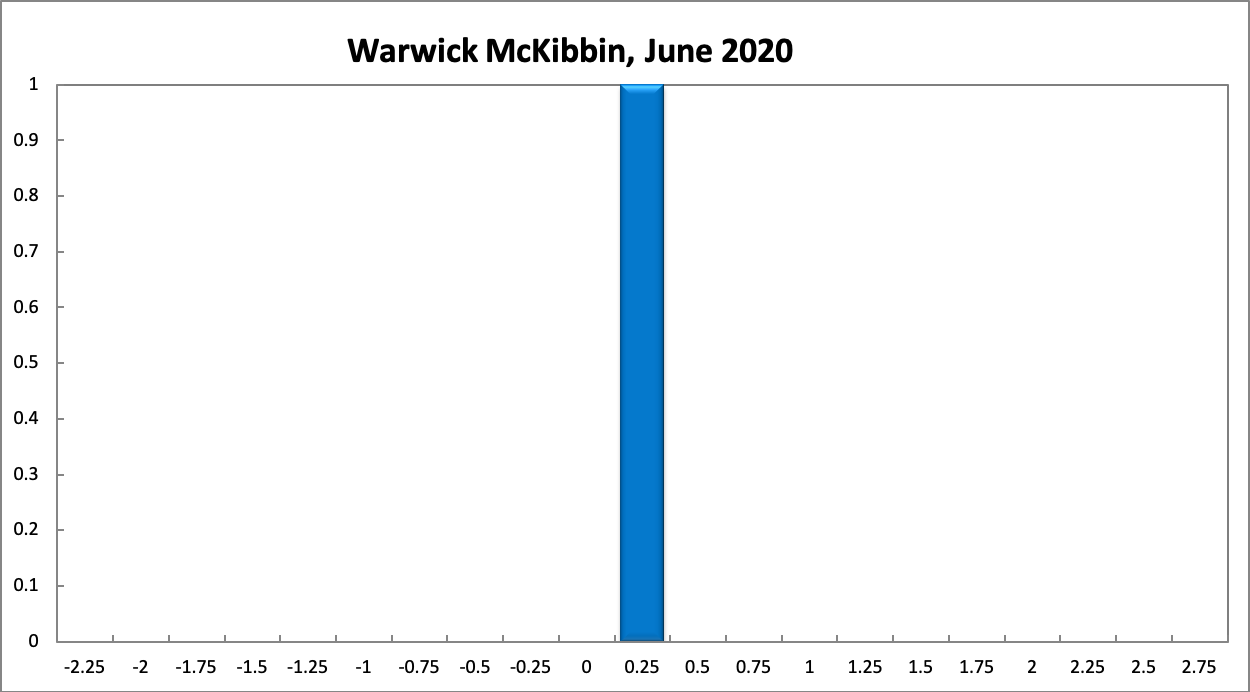

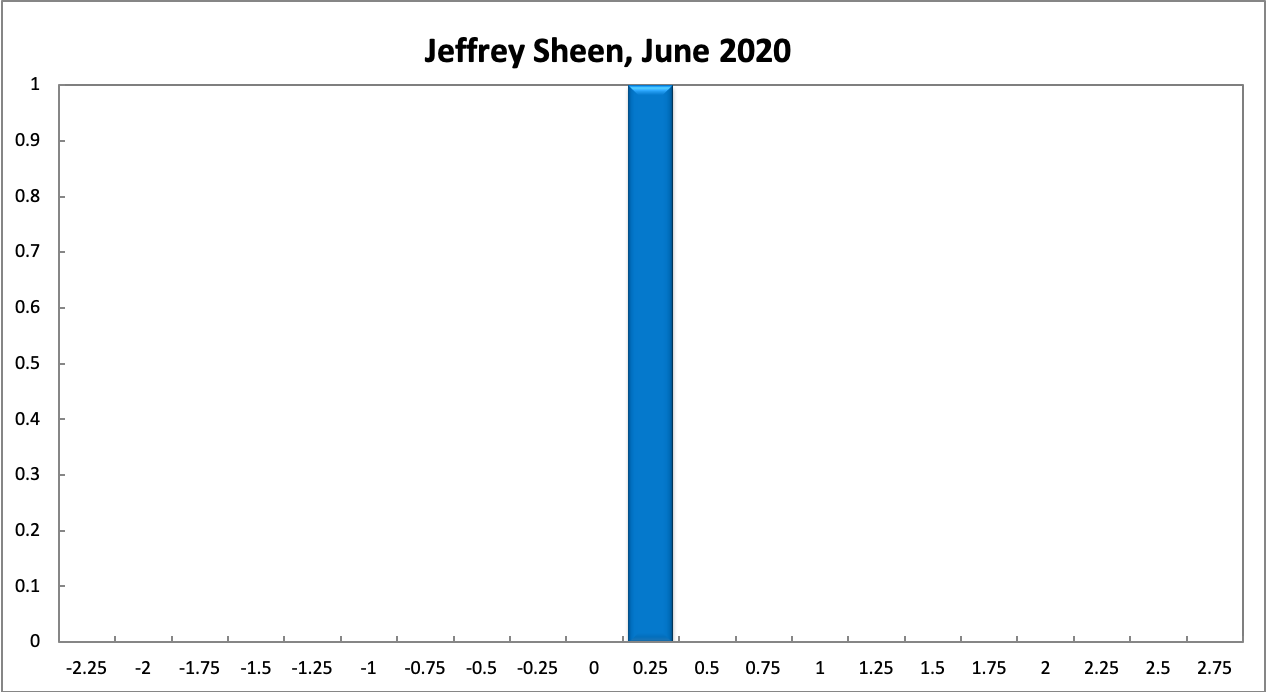

By international comparison, Australia’s experience with Covid-19 has been exceptionally favourable, recording a remarkably low number of infections and casualties. This has allowed most states to ease restrictions sooner than anticipated. Nonetheless, uncertainty about the Australian economy remains very high. Inflation officially still sits at 2.2% (annualized) for the March quarter, comfortably within the RBA’s official target band of 2-3%. However, the dramatic decline of aggregate demand in the current quarter, despite the adverse supply side shock, is widely believed to lead to significant disinflation. Given the overall weakness in the domestic and international economies, as well as the significant uncertainty surrounding the near-term future, the RBA Shadow Board’s conviction that the cash rate should remain at the historically low rate of 0.25% remains unchanged at 94%, while the confidence in a required rate cut to the lower bound of 0% equals 6% and the confidence in a required rate hike equals 0%.

The unemployment rate, according to the Australian Bureau of Statistics, spiked to 6.2% in April, less than expected. A significant further increase for May is expected. The increase in unemployment, however, masks the overall drop in employment of nearly 600,000 as the labour force participation rate dropped from 66 to 63.5. Many other economic indicators are not very helpful in the current climate as a guide for policy, as they are severely lagging.

The RBA’s emergency policies – keeping the 3-year government bond rate at 0.25 per cent through quantitative easing, providing a $90 billion funding facility for banks – are likely to remain in place for a long time, commensurate with the RBA’s announcement that it will maintain the low rate of 0.25 per cent until “progress is being made towards full employment and it is confident that inflation will be sustainably within the 2-3 per cent target band”. More precision around the RBA’s future plans, with a promise to commit, would reduce uncertainty for the private sector. The ANU Shadow Board’s practice of giving probabilistic 6-month and 12-month ahead policy recommendations can assist in this.

Fiscal policy has so far turned out to be less generous than initially calculated, as the total value of the JobKeeper program was revised downward by a massive $60 billion. The government has hitherto resisted calls to direct these unexpected savings to either an extension of the program’s duration or to a broadening of eligibility, for example to tertiary education institutions and casuals. The size of the overall fiscal stimulus for the foreseeable future remains highly uncertain.

Financial markets have extended their rebound after the historical decline in March. The Aussie dollar now trades around 66 US¢. Yields on Australian 10-year government bonds remain below 1%, around 0.89%. The yield curve in short-term maturities (2-year versus 1-year) remains flat. In higher-term maturities the yield curve is displaying the normal convexity. The stock market continued to climb; the S&P/ASX 200 stock index now trades around 5,800.

As many nations have started to reopen their economies, estimates of global economic growth remain fragile, reflecting uncertainty about how the economy responds and whether the coronavirus can be successfully contained. The possible knock-on effects of the global recession (e.g. sovereign defaults, persistent disruptions caused to trade patterns and labour migration) remain a worry. Of particular concern to Australia are the current tensions with China that have seen a 80% tariff raised on Australian barley and threats of further trade restrictions.

Consumer and producer confidence measures have bounced, after their battering in April: the Melbourne Institute and Westpac Bank Consumer Sentiment Index increased by 16% in May, the biggest monthly rise on record. Economic conditions for the next 12 months surged 32%, to 71.2, likely pointing to confidence in an earlier than expected reopening of the economy. NAB’s index of business confidence climbed from a record low of -66 in March to -46 in April. Nonetheless, this number is twice as weak as during the 1990s recession. The poor readings of manufacturing and services sector performance indices, capacity utilisation rates and a host of other measures, confirm the dramatic contraction of the Australian economy. Weakness in the housing market is becoming more visible with falls in building permits, new home sales and the construction PMI. House prices are widely expected to fall, along with rents, as demand for housing has contracted and is only expected to recover slowly.

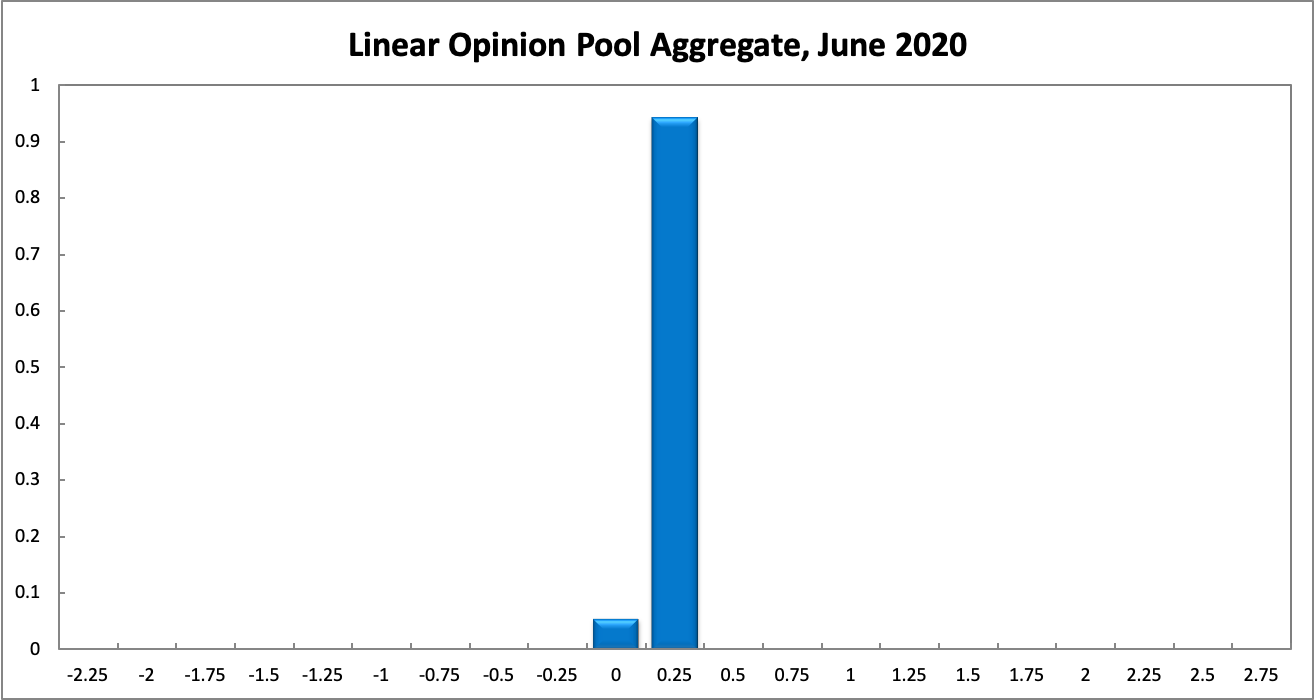

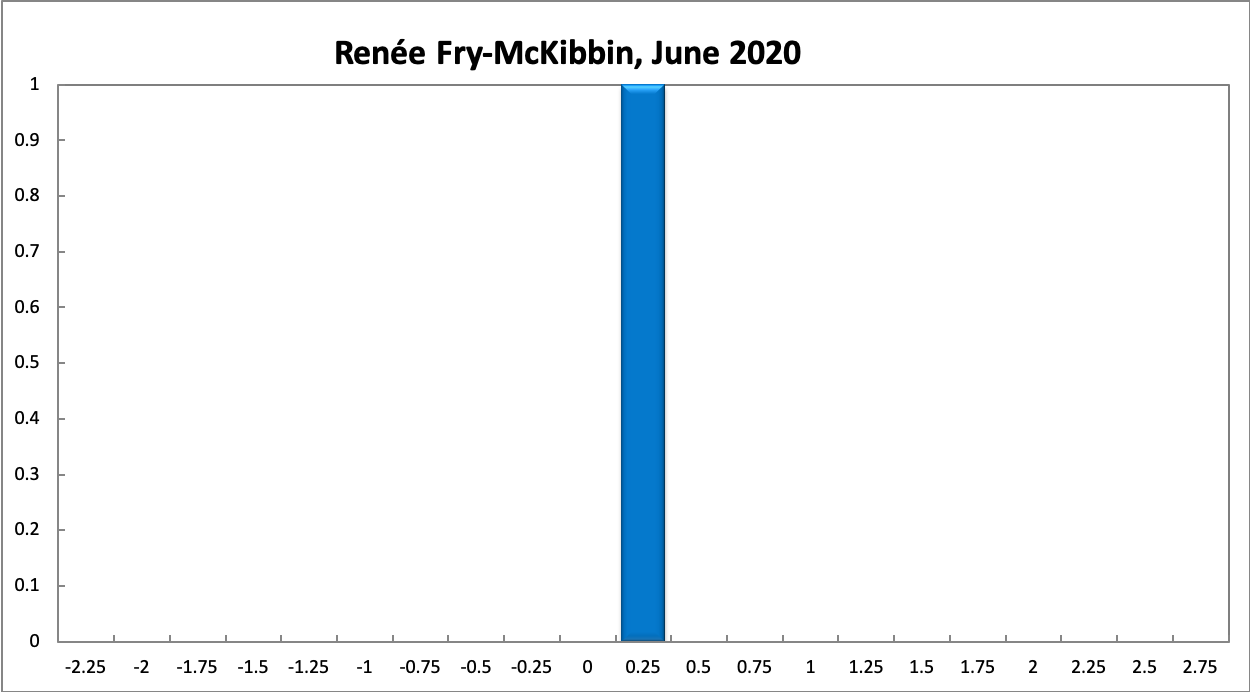

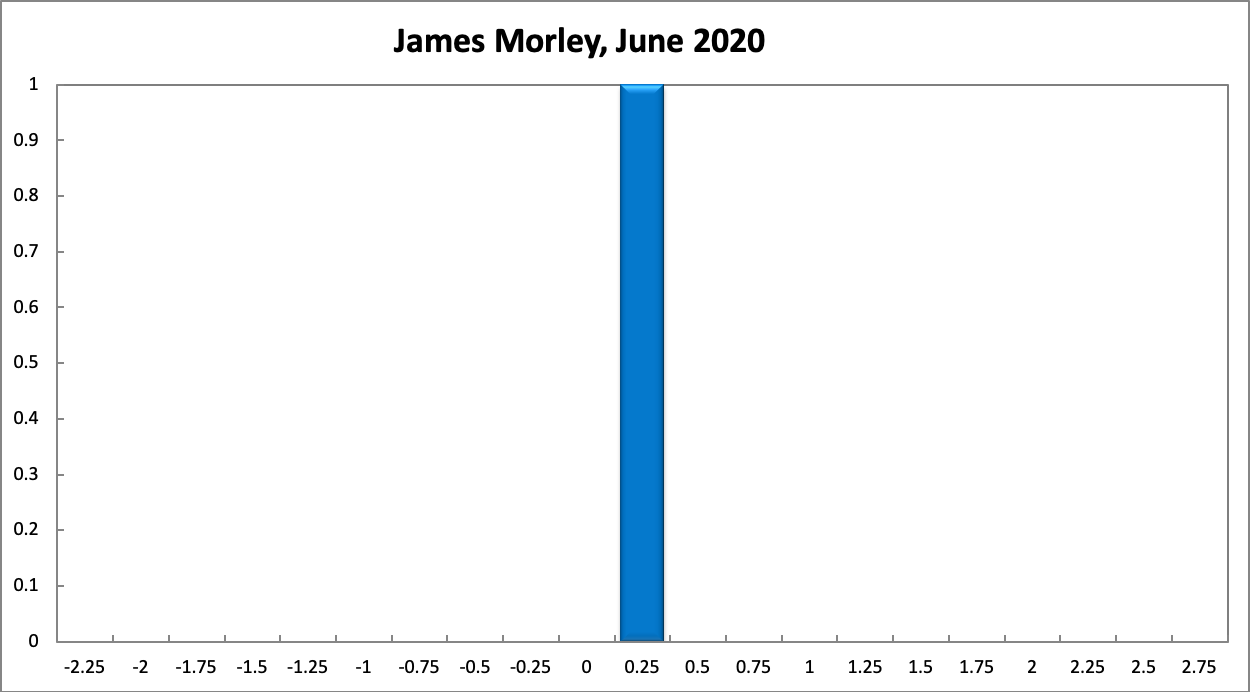

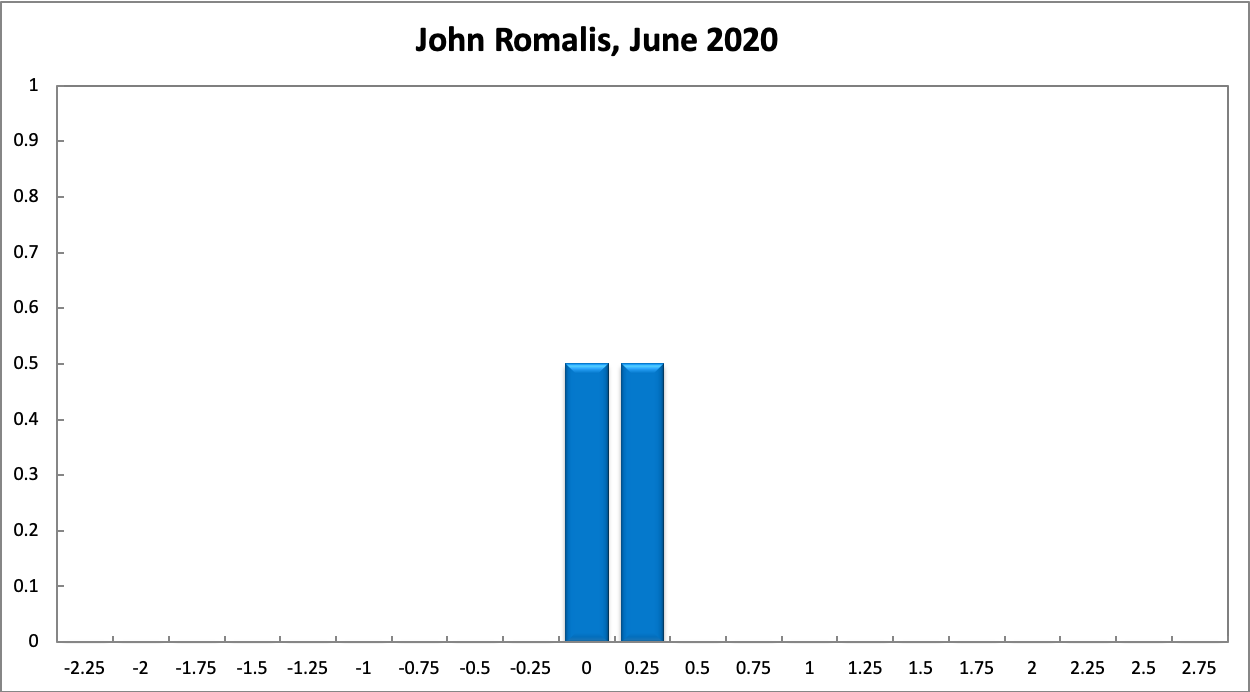

As in the previous month, the probabilities associated with the Shadow Board’s recommendations remain unchanged. The Shadow Board attaches a 94% probability that the overnight interest rate should remain at the historically low rate of 0.25%. The Shadow Board attaches a 6% probability that a final rate cut, to the lower bound of 0%, is appropriate and a 0% probability that a rate rise, to 0.5% or higher, is appropriate.

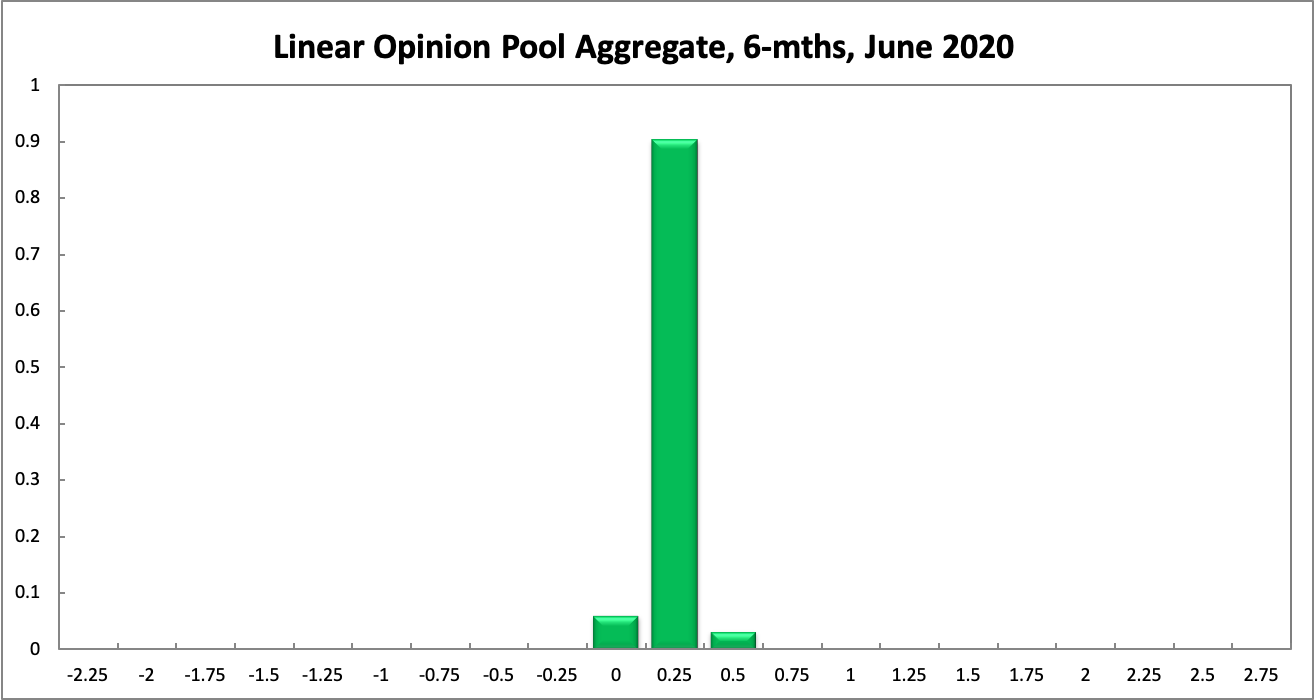

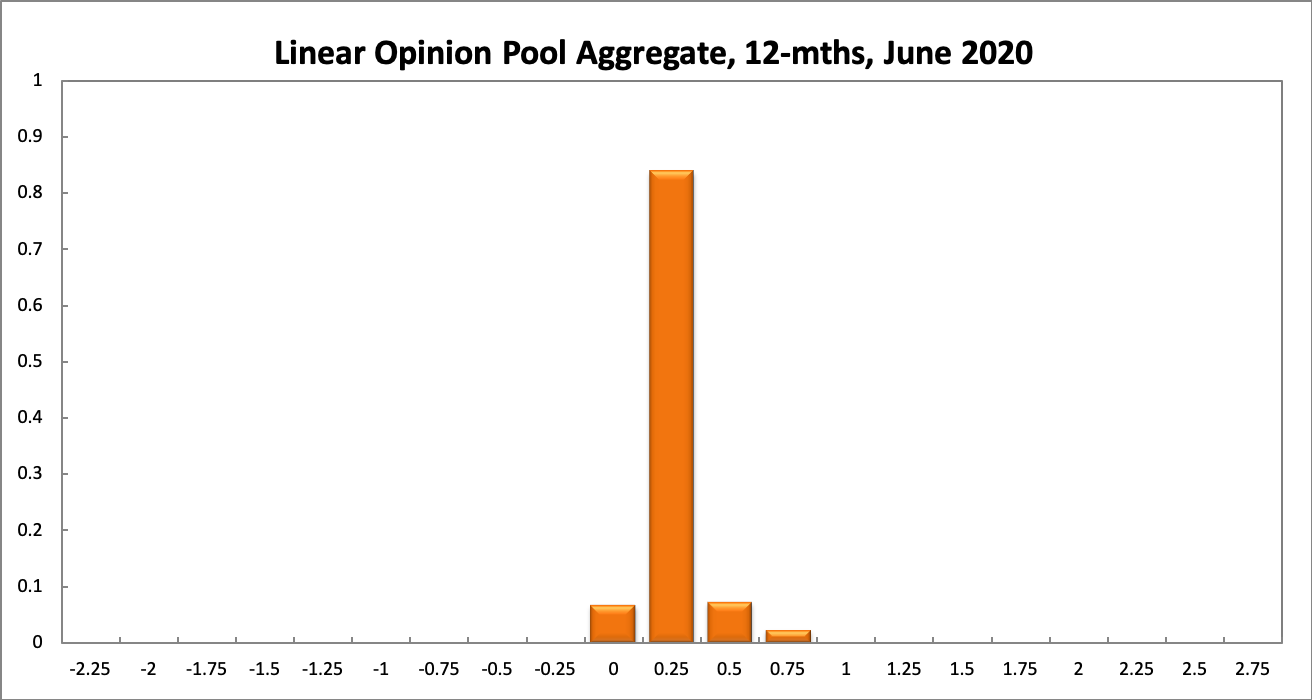

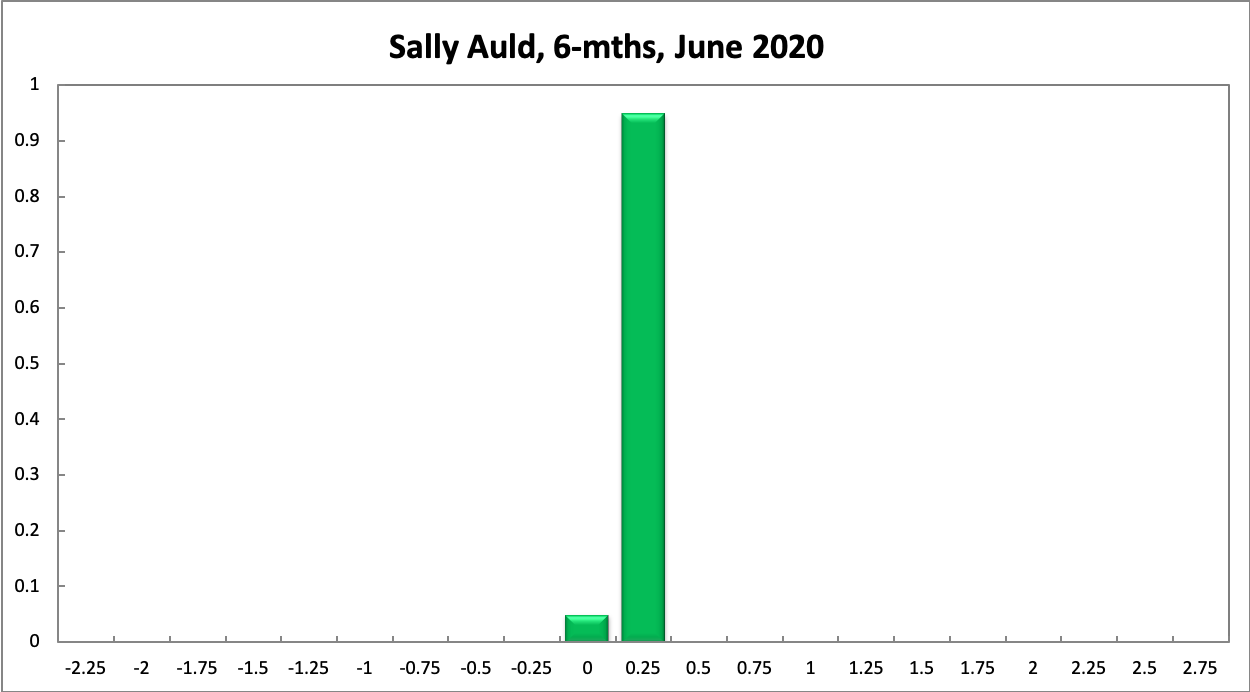

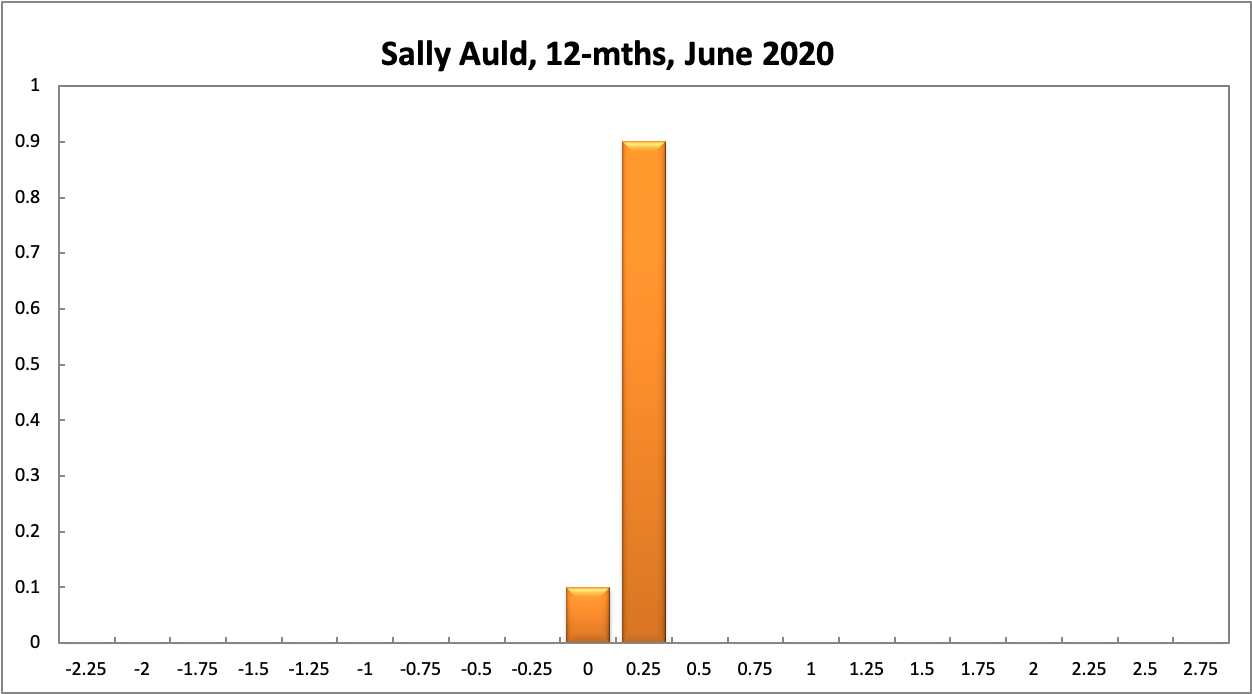

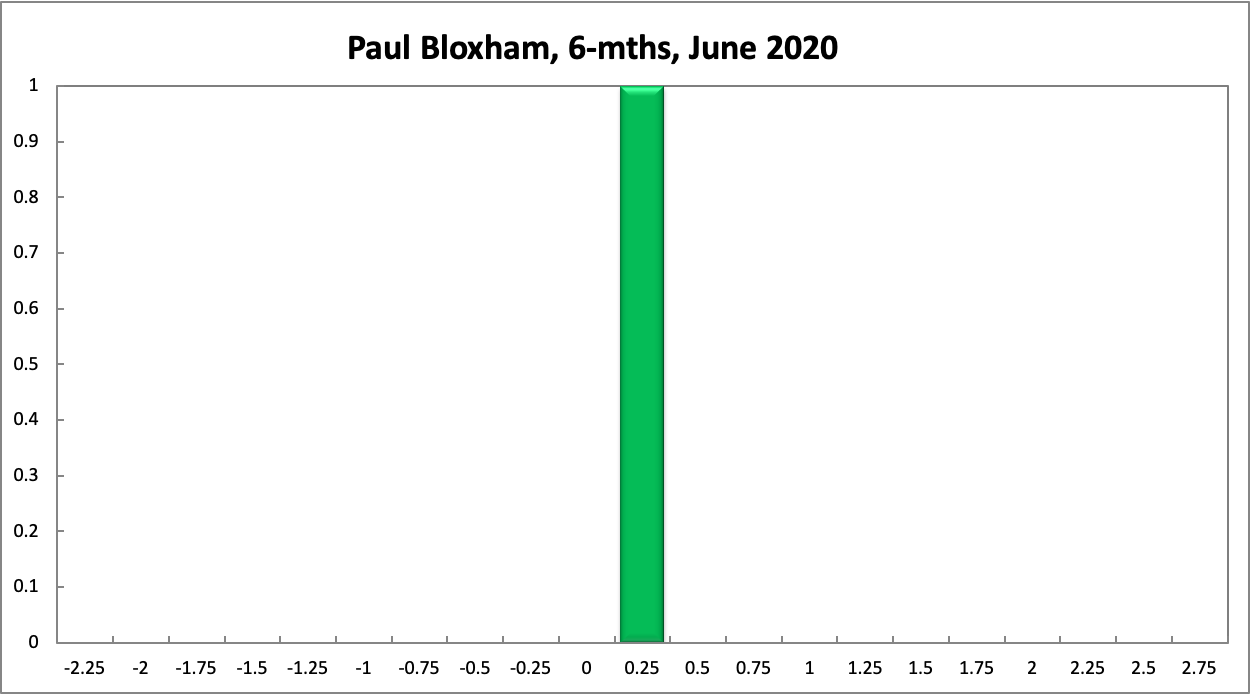

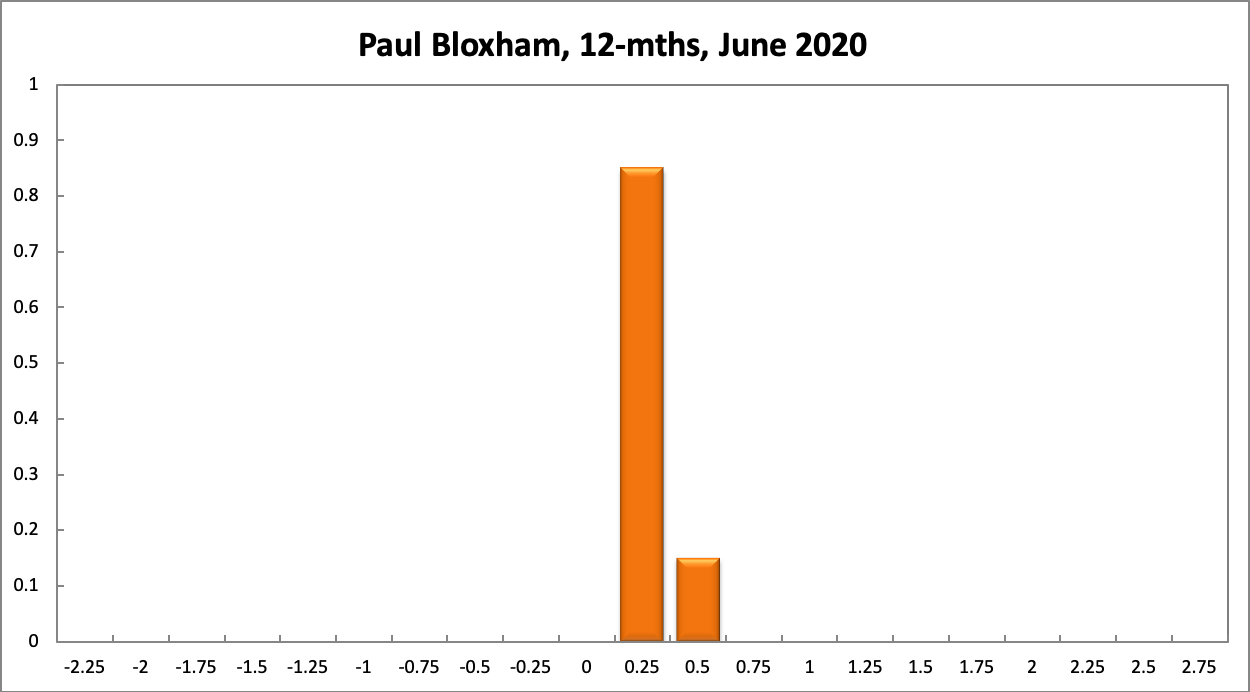

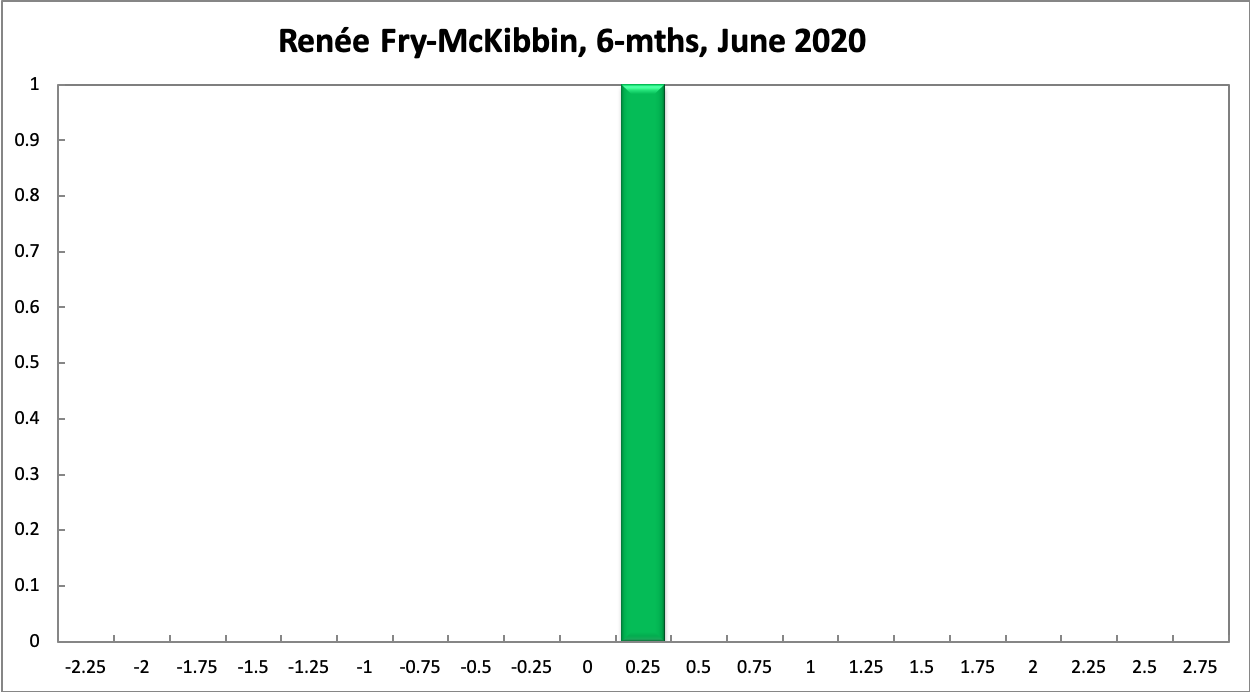

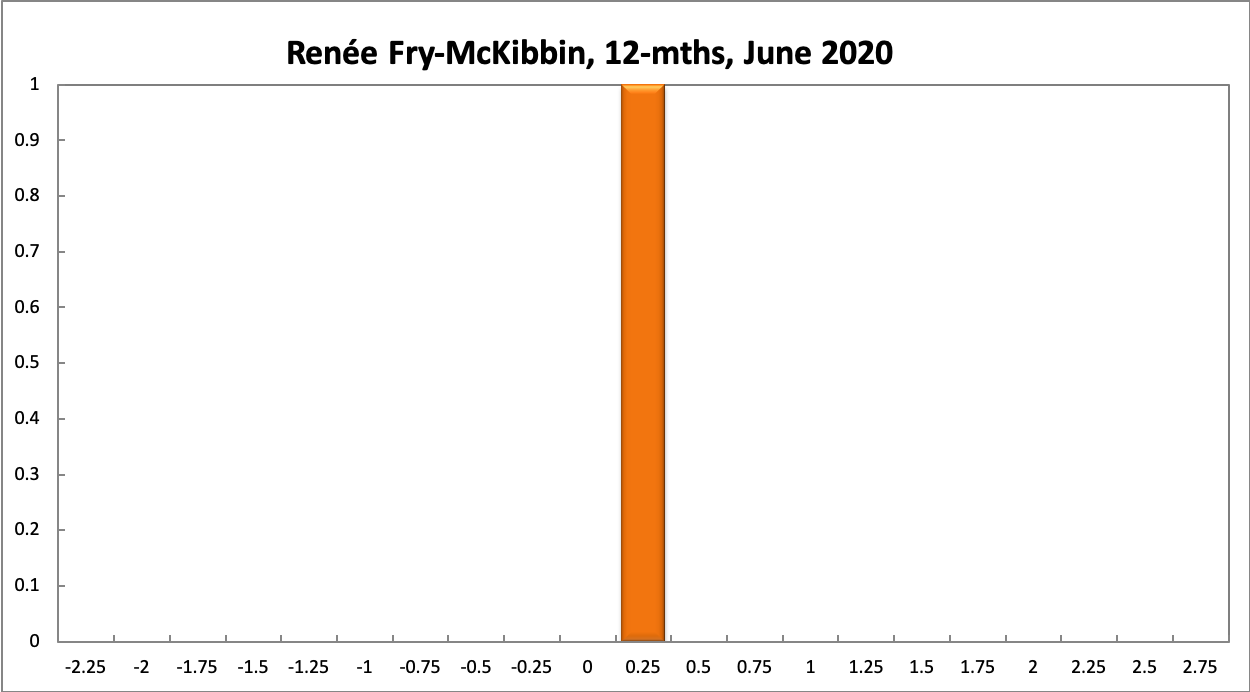

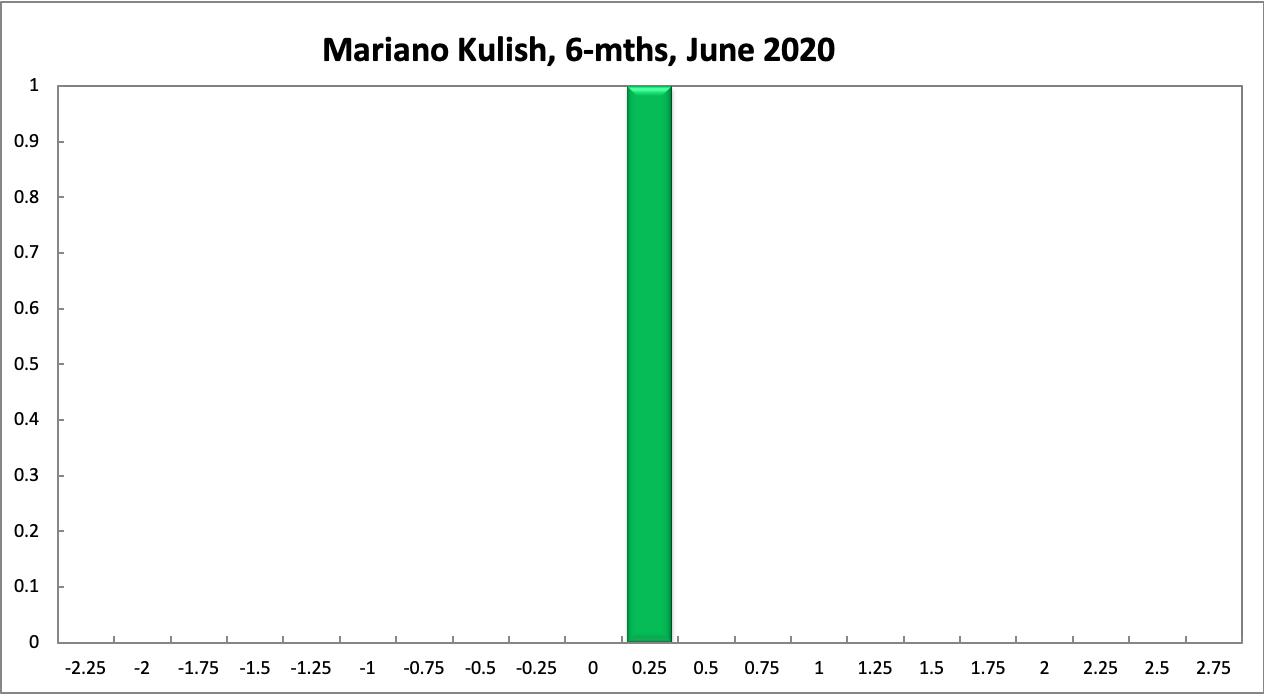

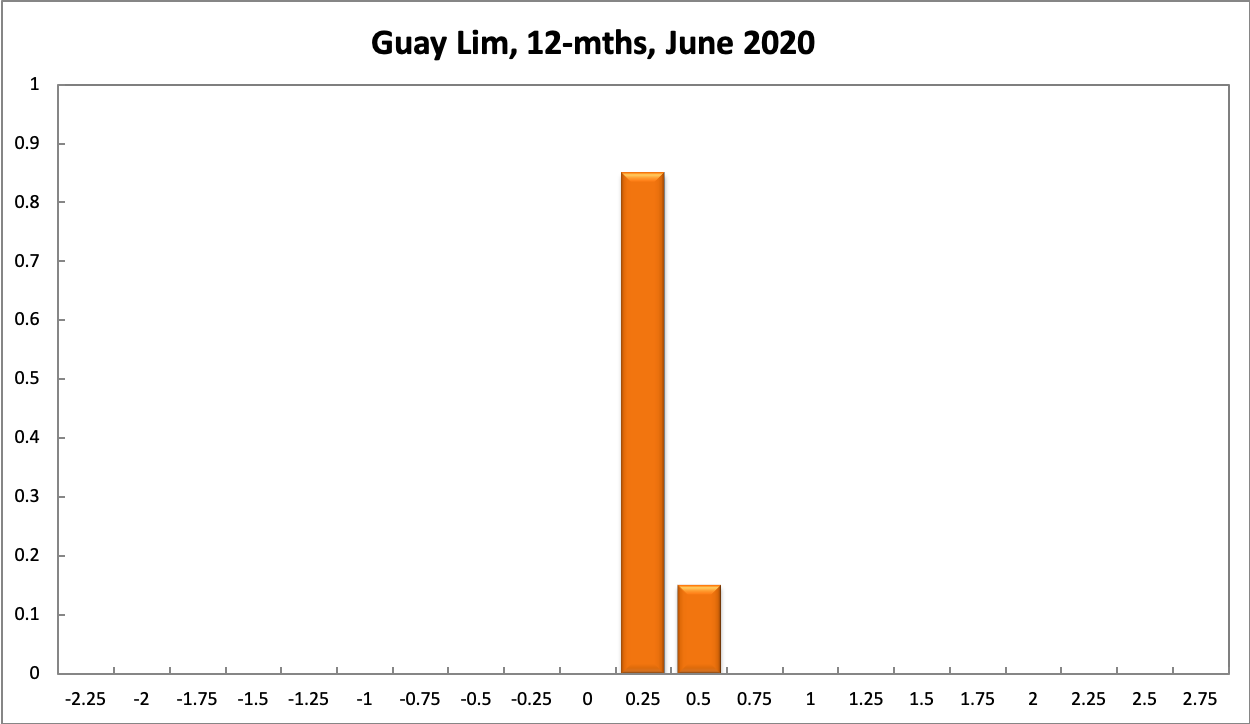

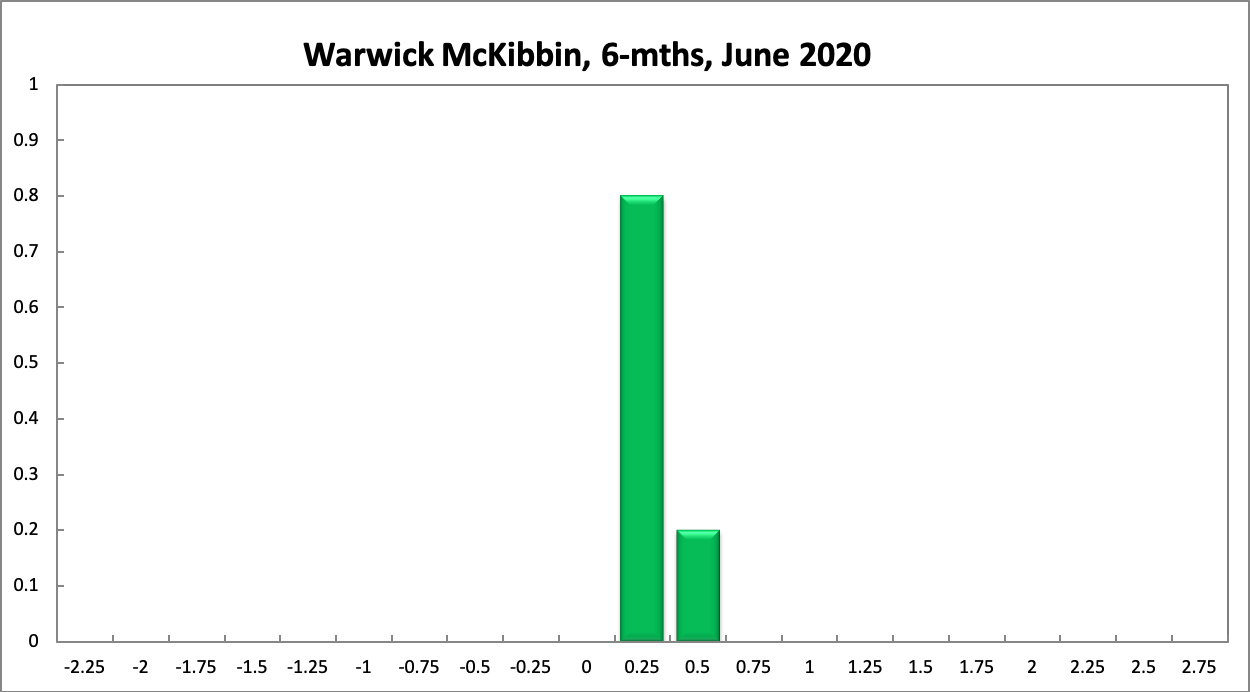

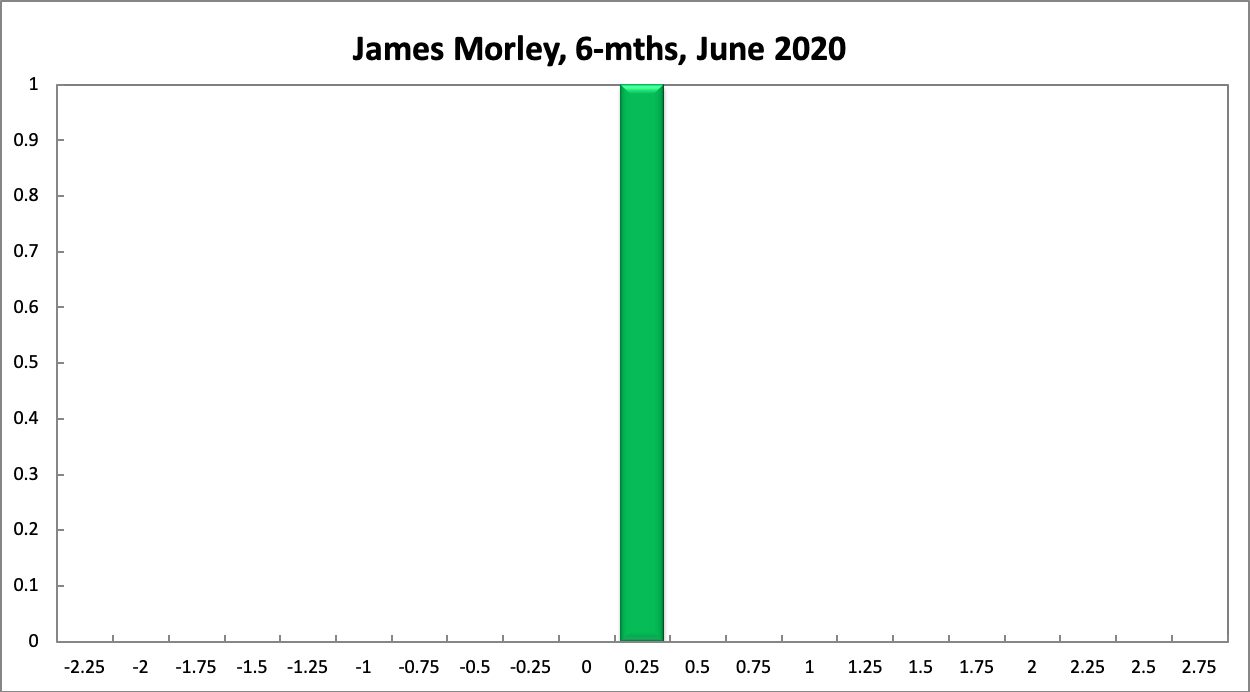

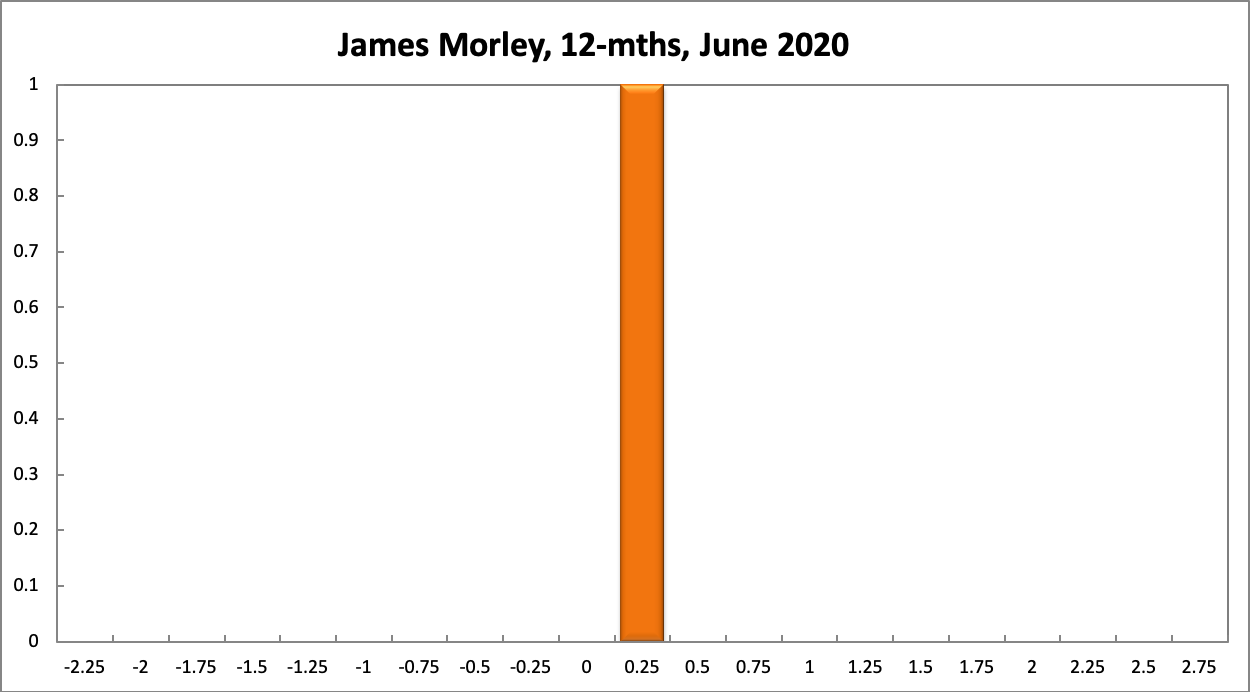

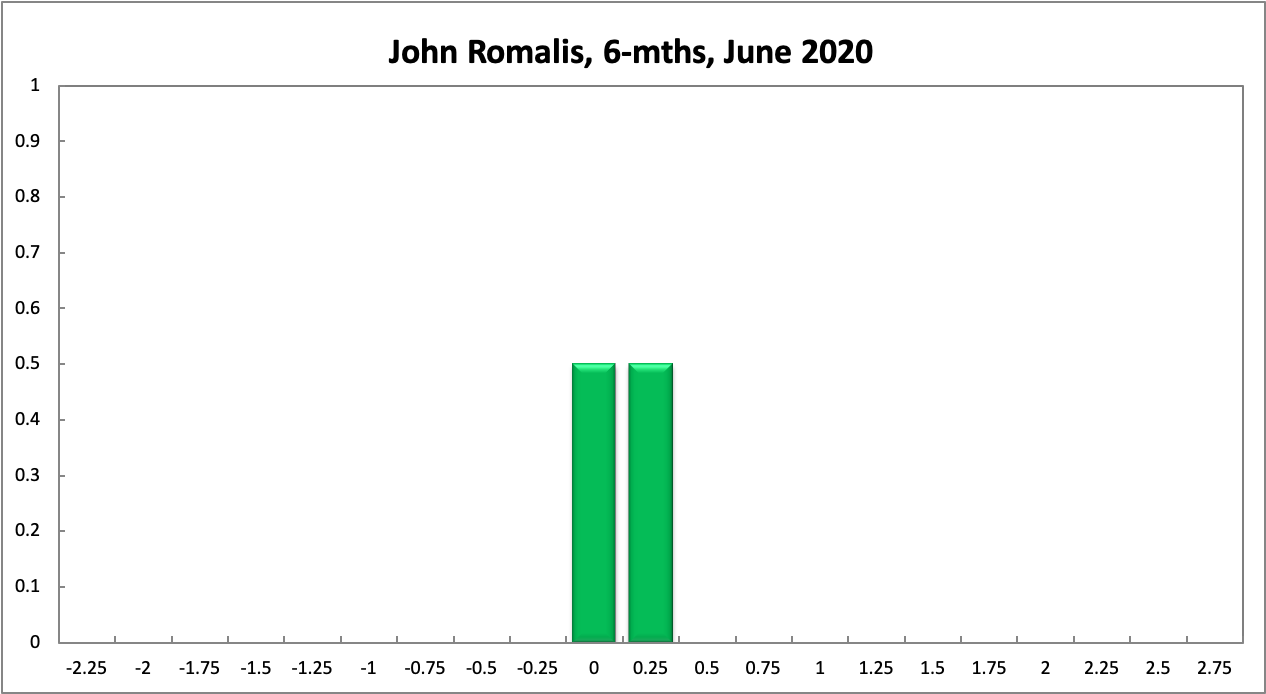

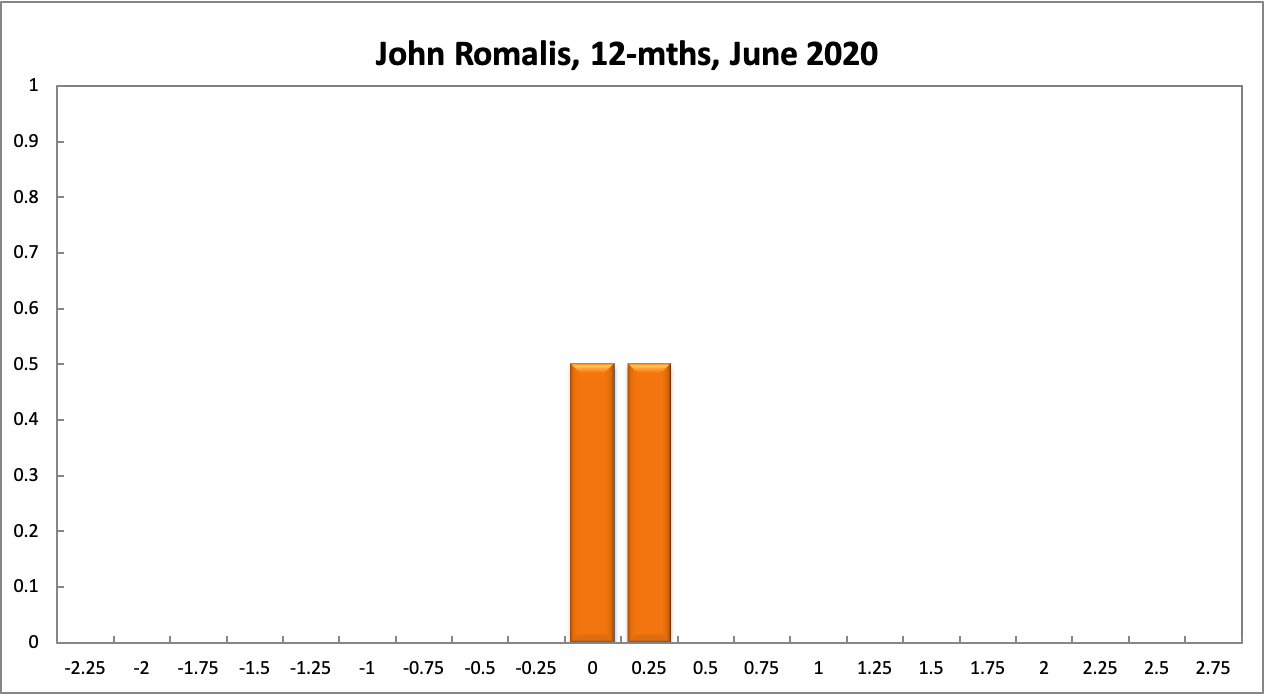

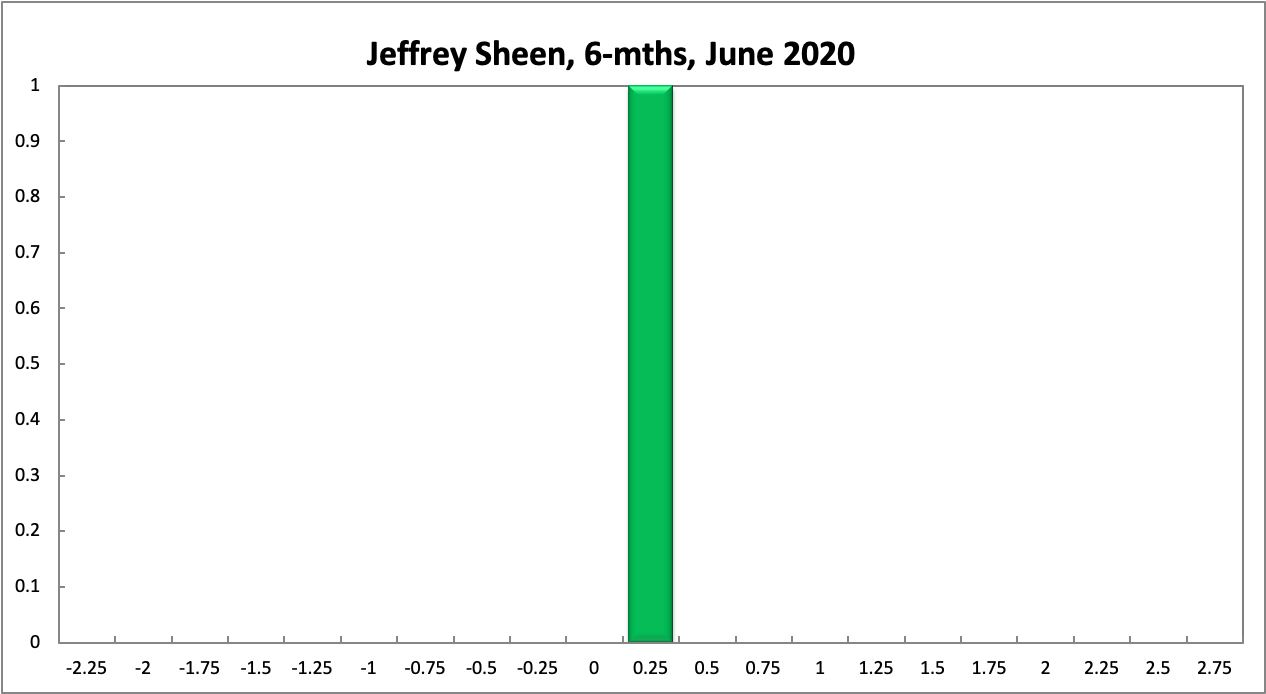

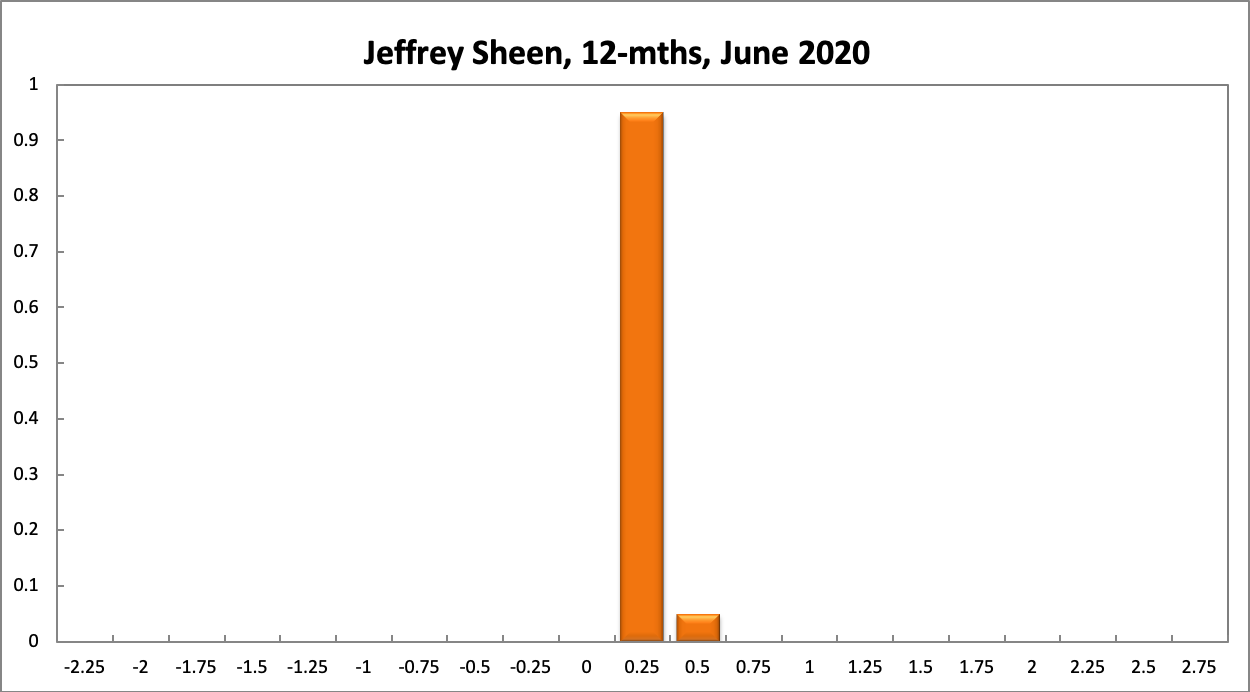

The probabilities at longer horizons are as follows: 6 months out, the estimated probabilities are also unchanged: the confidence that the cash rate should remain at 0.25% equals 91%, the probability attached to the appropriateness for an interest rate decrease equals 6%, while the probability attached to a required increase equals 3%. One year out, the Shadow Board members’ confidence that the cash rate should be held steady is unchanged at 84%. The confidence in a required cash rate decrease equals 7% (unchanged) and in a required cash rate increase 9% (unchanged). None of the members recommends that the Reserve Bank experiment with negative interest rates. The range of the probability distributions over the 6 month and 12 month horizons is also unchanged, extending from 0% to 0.75%.