After February Cut, Overnight Rate Should Stay Put

The monthly Consumer Price Index (CPI) indicator rose 2.4% in the 12 months to February, according to the Australian Bureau of Statistics, the largest contributors to the movement being food and non-alcoholic beverages (+3.1%), alcohol and tobacco (+6.7%), and housing (+1.8%). There was no news on the quarterly CPI, which grew 2.4% in Q4 2024, and on the RBA’s trimmed mean CPI, which rose 3.2% year-on-year, slightly above the Bank’s official 2-3% target range. The official unemployment rate has held steady at 4.1%, while the participation rate and monthly hours worked fell slightly. The US administration’s announced tariff policy, together with geopolitical tensions, are weighing on the global economy. Following February’s rate cut, the Shadow Board strongly favours keeping the overnight rate at the current level of 4.10%; it attaches a 61% probability that this is the optimal policy setting, while attaching a 19% probability that a further rate cut might be called for and an equal probability that a return to 4.35%, or higher, is appropriate.

The seasonally adjusted unemployment rate remained at 4.1% in February 2025, accompanied by a dip in the labour force participation rate to 66.8%. The underemployment rate continued its downward trend, easing to 5.9%, while monthly hours worked fell slightly to 1,973 million. Australia’s youth unemployment rate held steady at 9.10%, underscoring the relatively stable conditions in the younger segment of the workforce. At the same time, job vacancies climbed from 330,000 in the third quarter of 2024 to 344,000 in the fourth quarter, reflecting ongoing demand for labour. However, ANZ-Indeed Australian Job Ads registered a 1.4% month-over-month decline in February—its first drop since November—after an upwardly revised 1.3% gain in January. Finally, Australia’s seasonally adjusted wage price index increased by 3.2% year-over-year in Q4 of 2024, slowing from 3.6% in Q3 and matching market forecasts.

Over the past week, the Australian dollar slipped below US$0.63, reversing gains from the previous session and signalling renewed volatility in currency markets. The yield on Australia’s 10-year government bond stands at 4.47%, supported by a short-term yield curve that remains inverted (2Y vs 1Y at -8.3 basis points) and more pronounced convexity in the mid- and long-term segments (5Y vs 2Y at 18.9 basis points, 10Y vs 2Y at 72.0 basis points). Meanwhile, the S&P/ASX 200 Index inched up 0.16% to close at 7,982 on Friday, reclaiming ground after earlier losses in the past weeks.

Australia’s Westpac-Melbourne Institute Consumer Sentiment Index jumped 4% in March, reaching 95.9—its highest reading in three years—after posting 92.2 in February. At the same time, retail sales grew 0.3% month-on-month in January 2025, reversing December’s 0.1% decline and aligning with market forecasts. The monthly gains were buoyed by food-related spending, particularly at cafes, restaurants, and takeaway outlets (up 1.1%) and food retailing (up 0.7%). Non-food categories also enjoyed solid growth, led by other retailing (2.4%), clothing, footwear, and personal accessories (2.0%), and department stores (0.6%). By contrast, household goods retailing recorded a sizable drop of 4.4%. Year-on-year, retail sales climbed 3.8% in January, signalling resilient consumer demand.

Australia’s NAB business confidence index slipped to -1 in February 2025, following an upwardly revised 5 in January, marking the year’s first negative reading amid weakness in mining, recreation, and transport. In contrast, manufacturing activity showed renewed vigour, with the S&P Global Flash Australia Manufacturing PMI jumping to 52.6 in March—its fastest growth since October 2022—while the services PMI inched up to 51.2. The Westpac-Melbourne Institute Leading Economic Index added 0.1% month-on-month in February, matching January’s pace, and its six-month annualized growth rate rose to 0.8% from 0.6%. The Composite Leading Indicator improved slightly to 100.23 points from 100.19 in January. However, the Ai Group Australian Industry Index continued its protracted decline, dipping by 1.1 points to -17.6 in February—the thirty-second straight month of contraction—as the activity/sales indicator fell by 3.4 points to -22.6. Finally, the S&P Global Flash Australia Composite PMI advanced to 51.3 in March, its strongest reading in seven months, propelled by upbeat figures in both manufacturing and services. Overall, the signals from the business sector continue to be mixed, with some sectors of the economy struggling and others showing encouraging signs of growth.

Global economic conditions remain fragile, with renewed tariff escalations stoking concerns about global trade and inflation. According to Le Monde (28 March 2025), U.S. tariffs have reached their highest levels since 1945, rattling international markets. In parallel, Bloomberg (29 March 2025) reports that U.S. inflation has already begun to pick up, fuelling expectations of further monetary tightening. The OECD’s March 2025 Interim Economic Outlook highlights subdued but stabilizing global growth, noting that “recent activity indicators point to a softening of global growth prospects”. Furthermore, business and consumer sentiment have deteriorated in many of the world’s major economies, and inflationary pressures continue to linger. The Paris-based institution cautions that policy uncertainties could easily derail improvements, and that continued policy uncertainty will lead to further fragmentation and hurt growth. Meanwhile, there appears to be a modest rebound in Chinese manufacturing output, suggesting potential resilience in regional supply chains. For Australia, these trends highlight the clear downside risks emanating from the global economy, but it may not be all bad, particularly if economic activity in the region remains buoyant and demand for commodities strong.

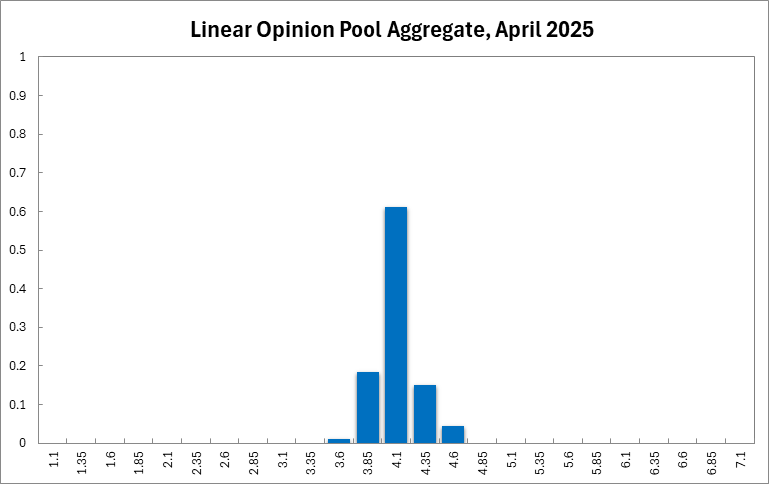

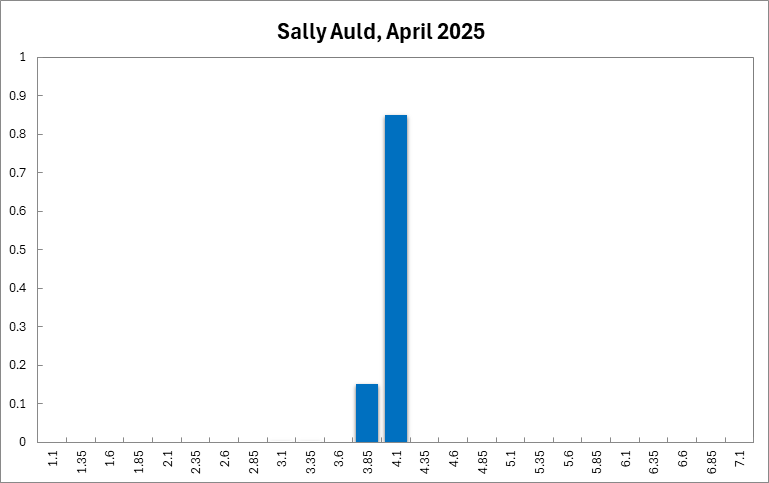

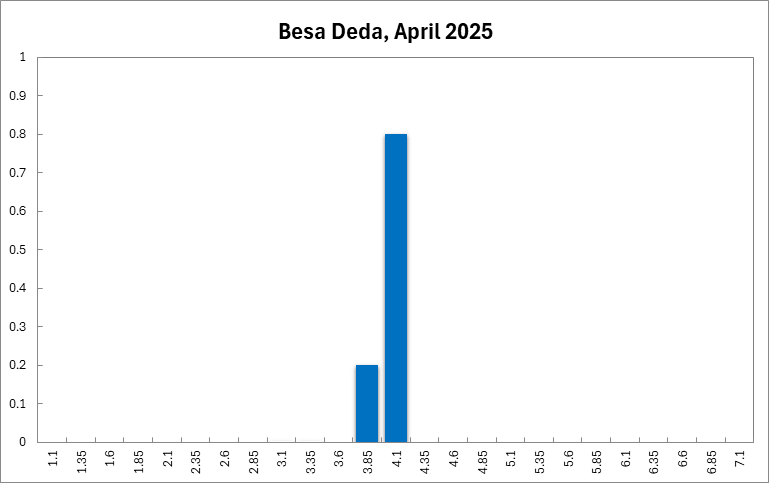

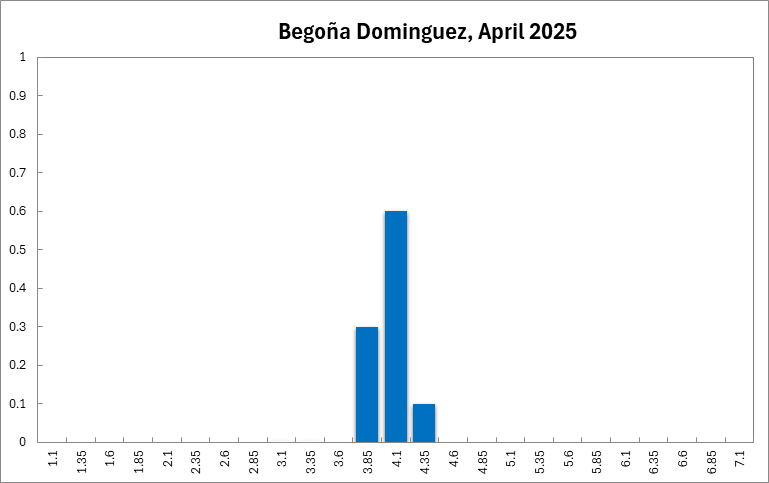

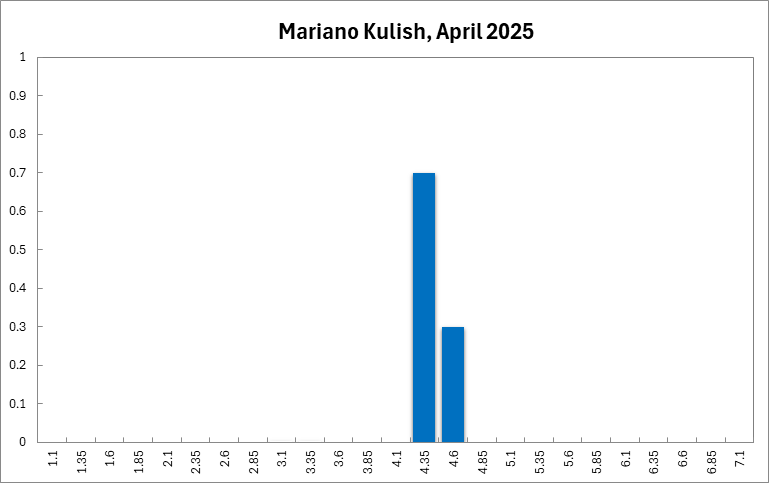

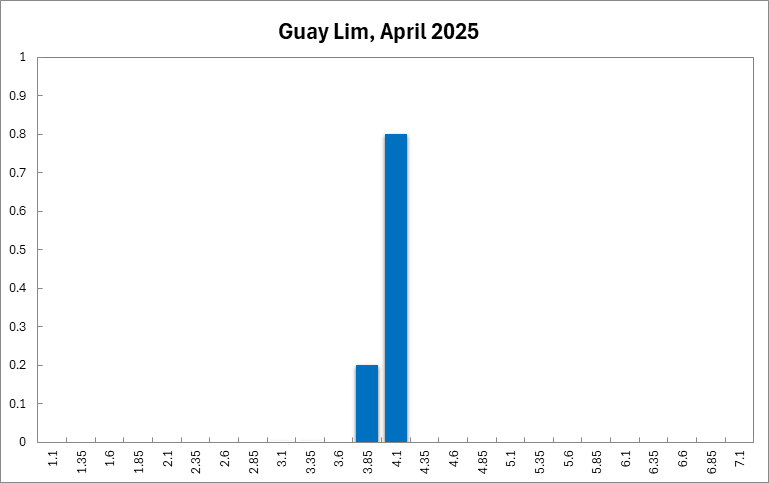

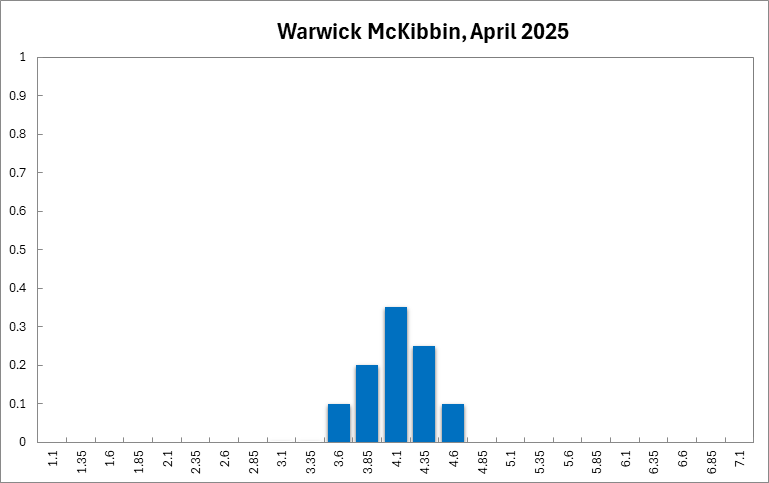

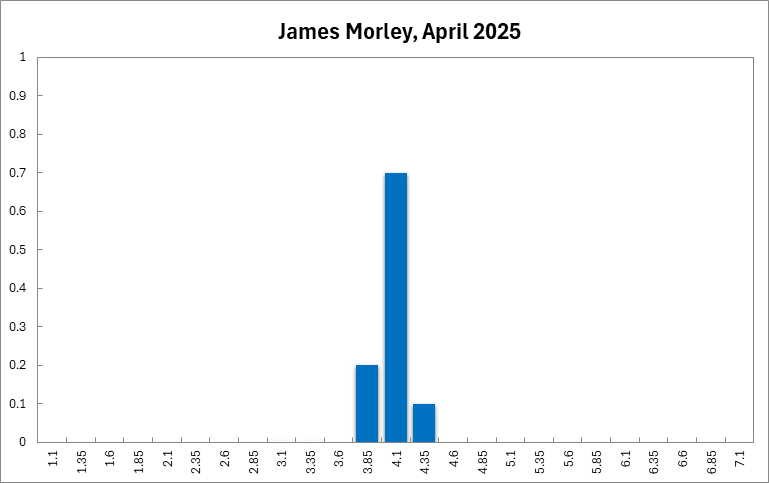

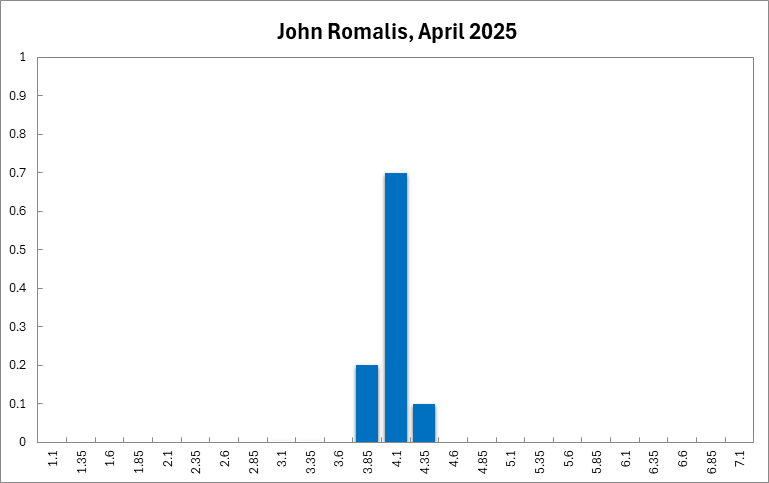

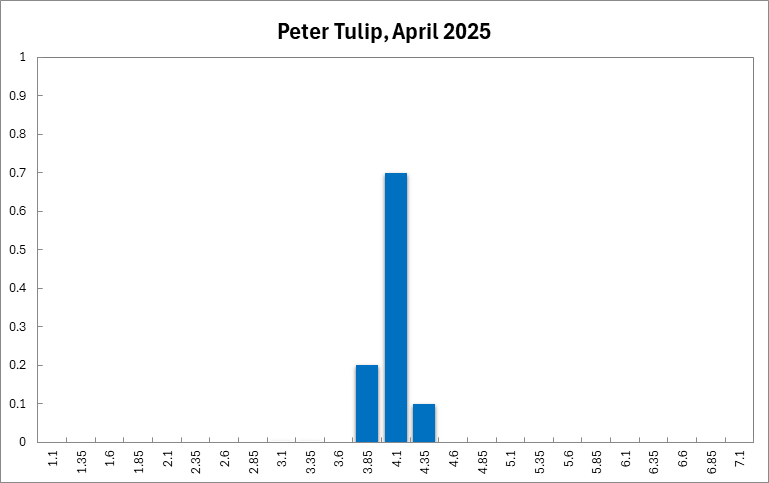

After the last round’s cut in the overnight rate, the Shadow Board strongly favours keeping the rate at 4.10%. It is 61% confident that this is the appropriate setting. It attaches a 19% probability that a rate below 4.10% is optimal and a 19% probability that a rate above 4.10% is optimal.

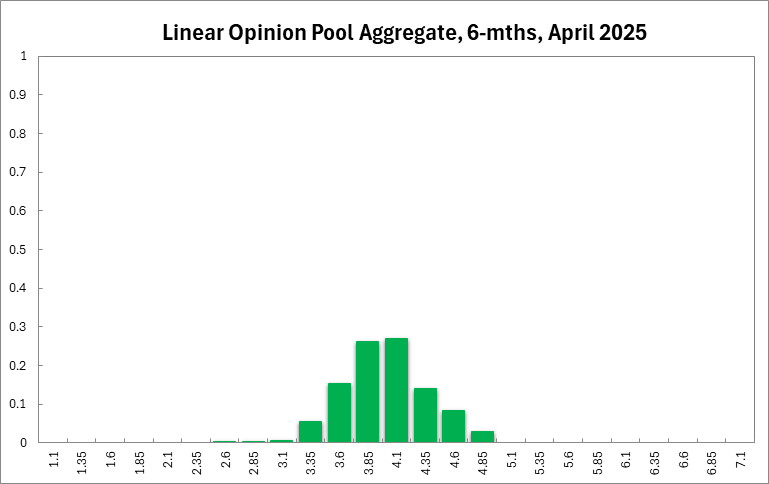

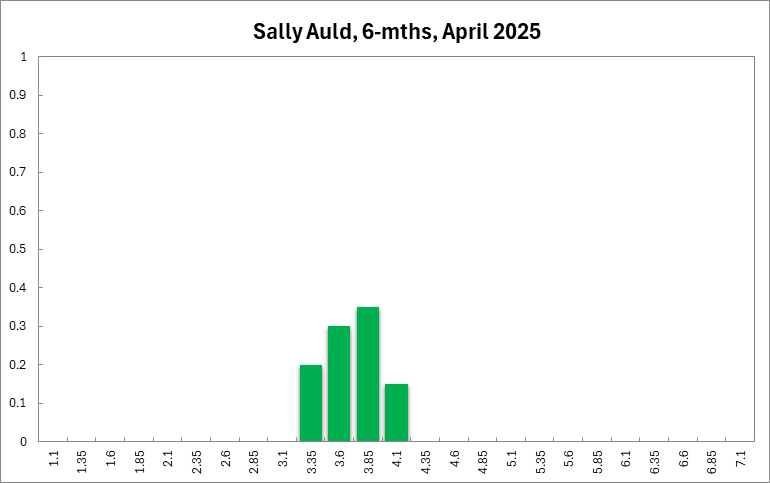

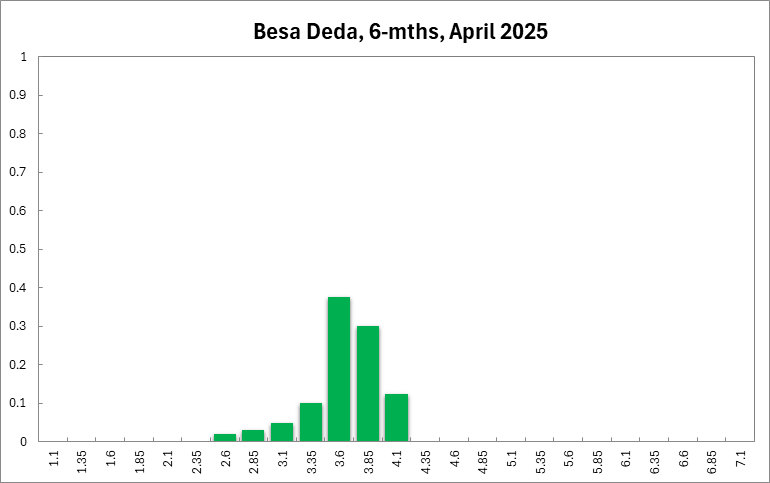

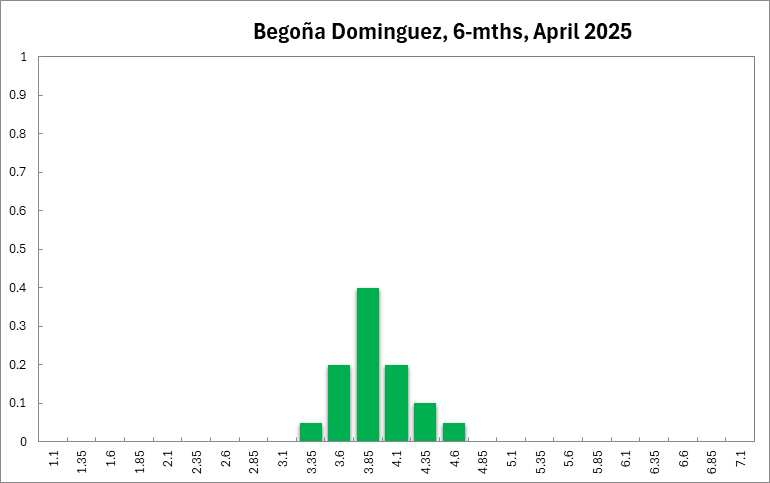

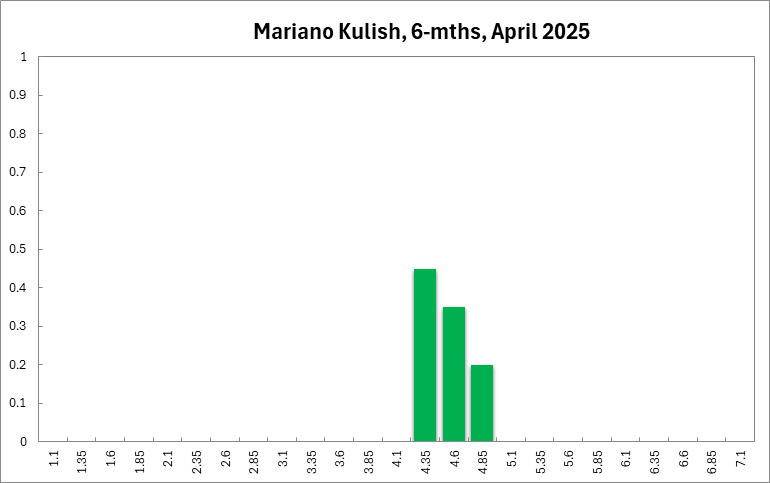

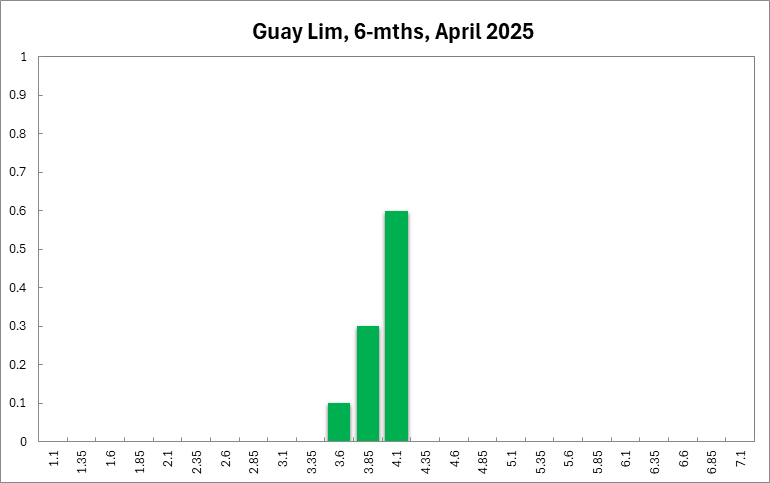

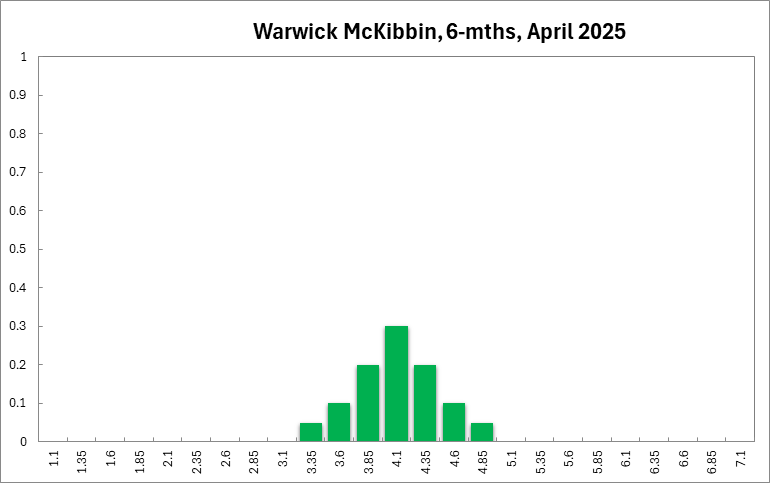

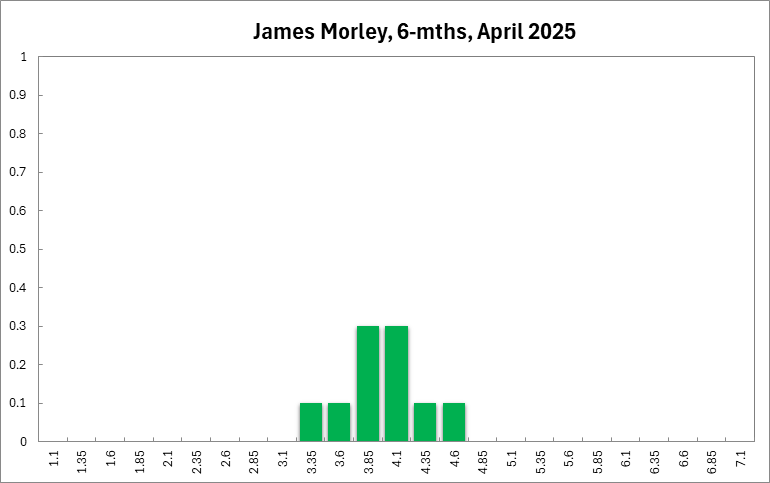

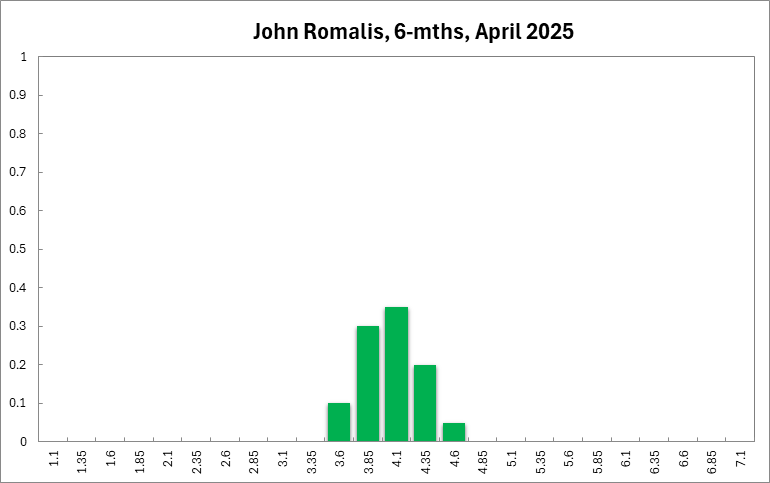

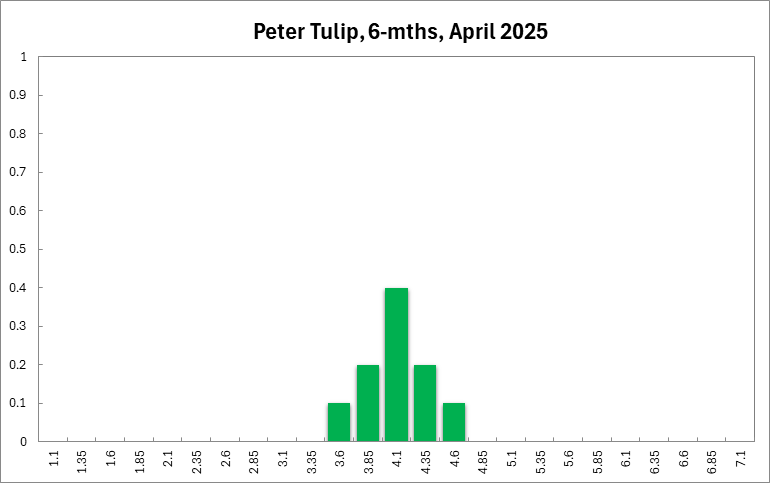

The probabilities at longer horizons are as follows: 6 months out, the confidence that the cash rate should remain at the current setting of 4.10% equals 27%; the probability attached to the appropriateness of an interest rate decrease equals 48%, while the probability attached to a required increase equals 25%.

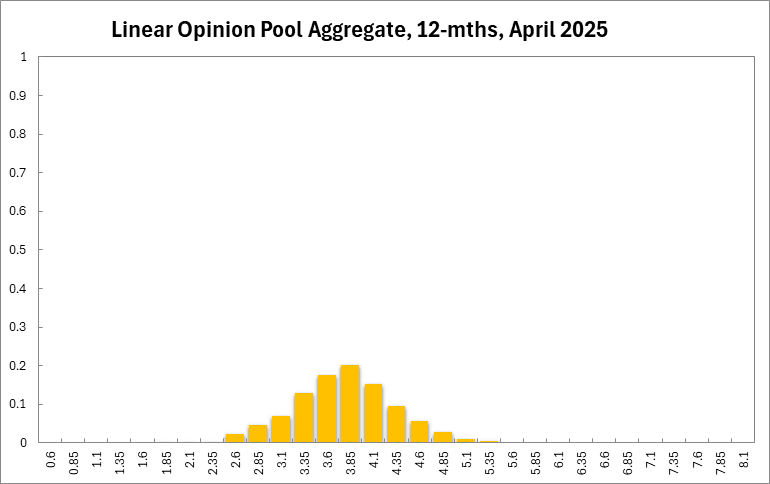

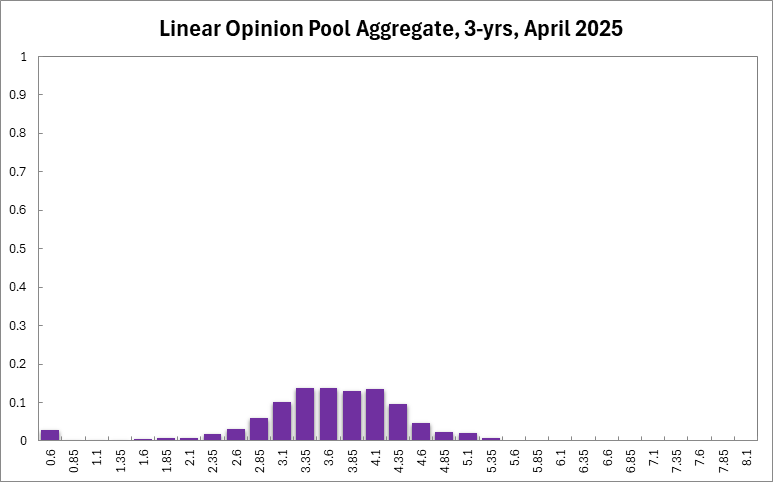

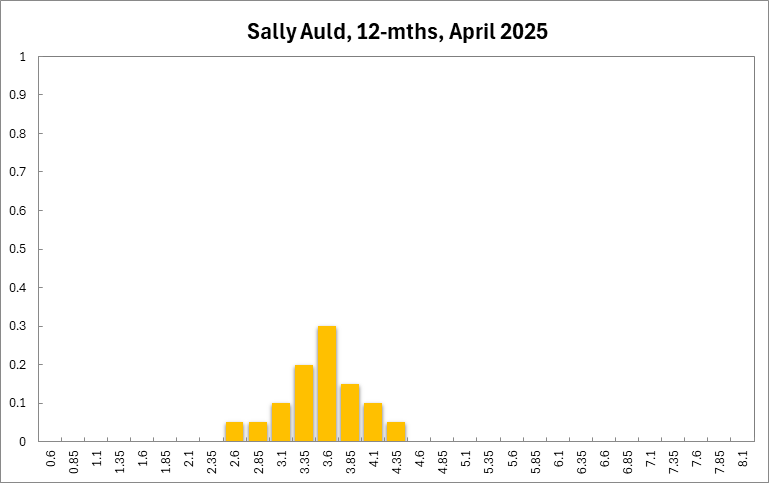

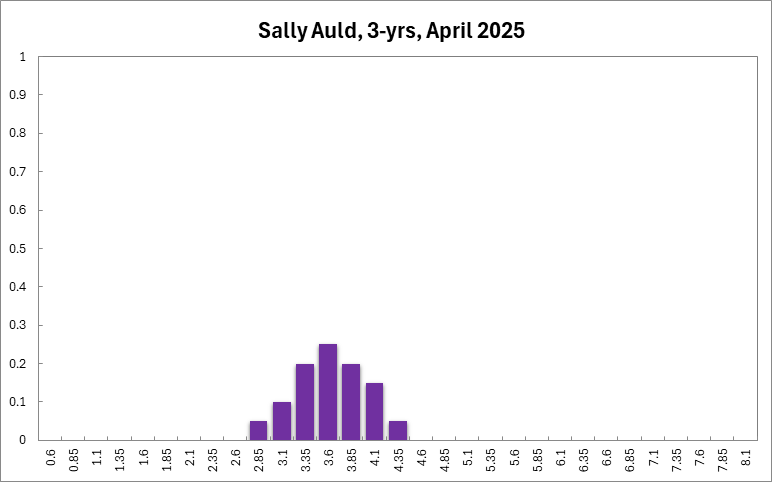

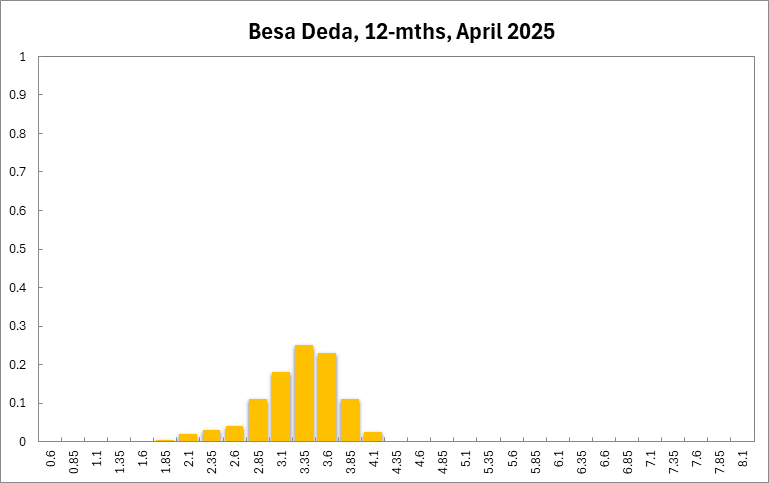

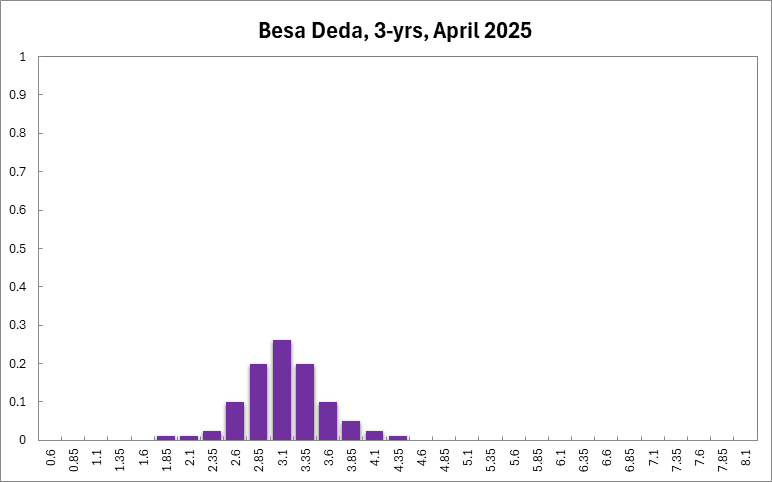

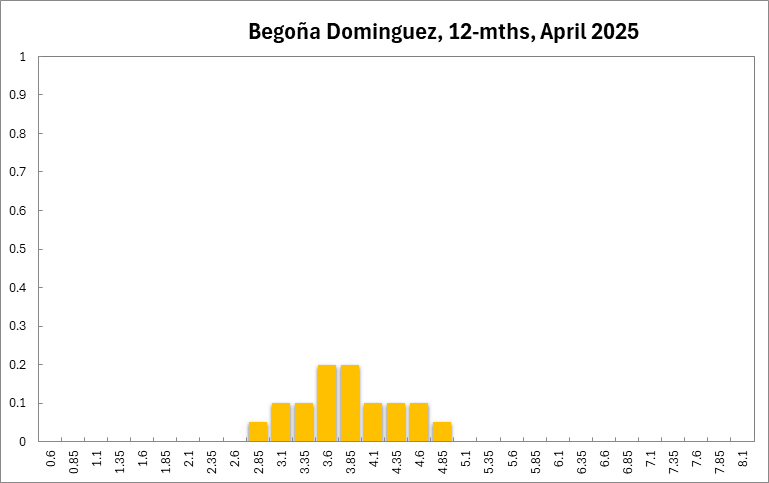

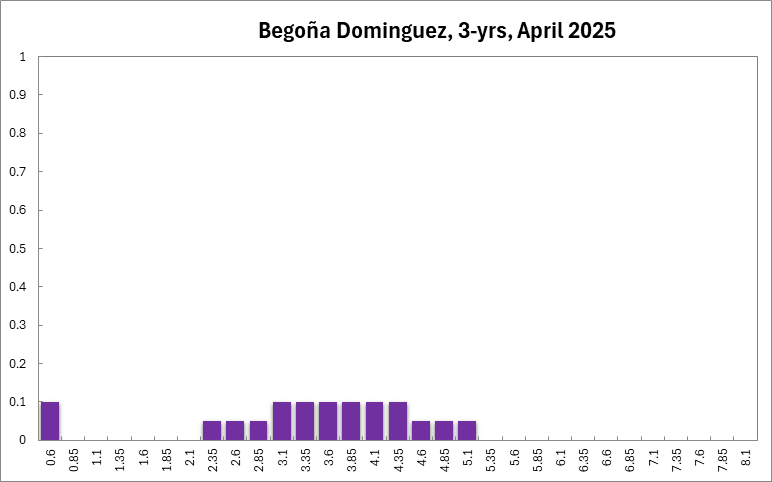

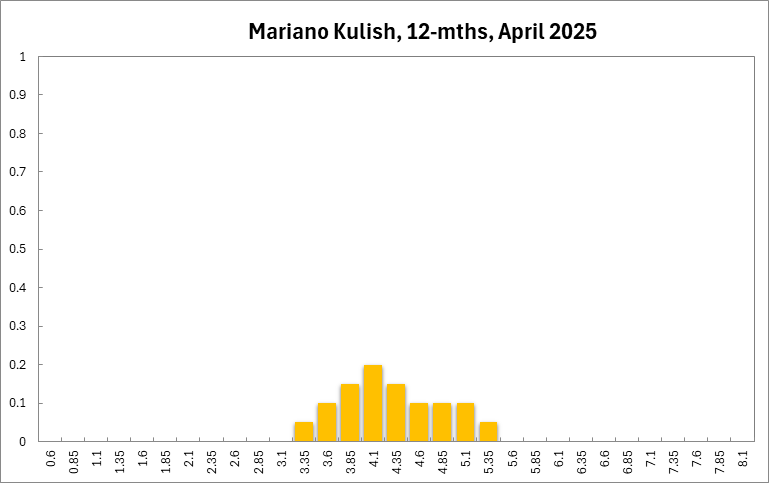

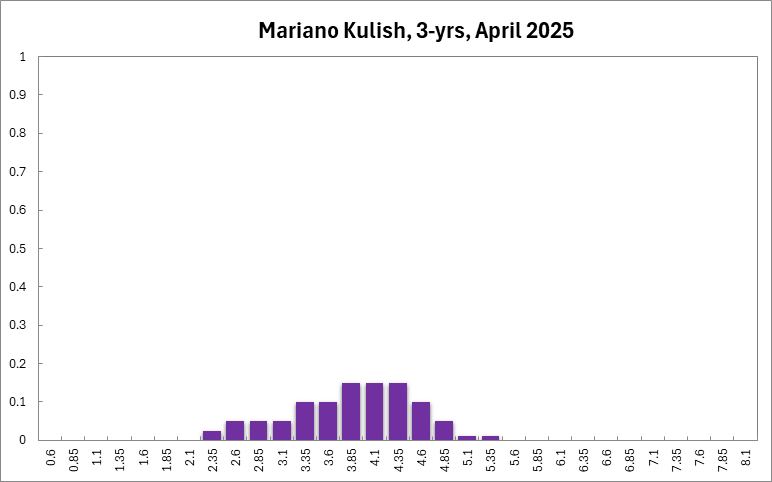

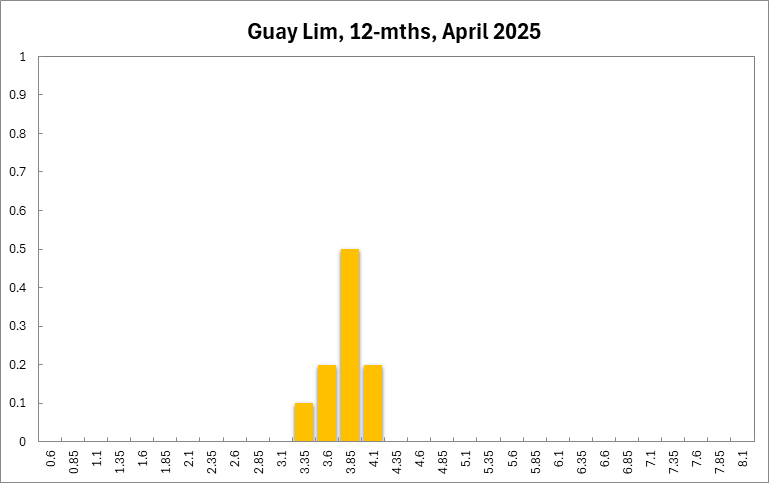

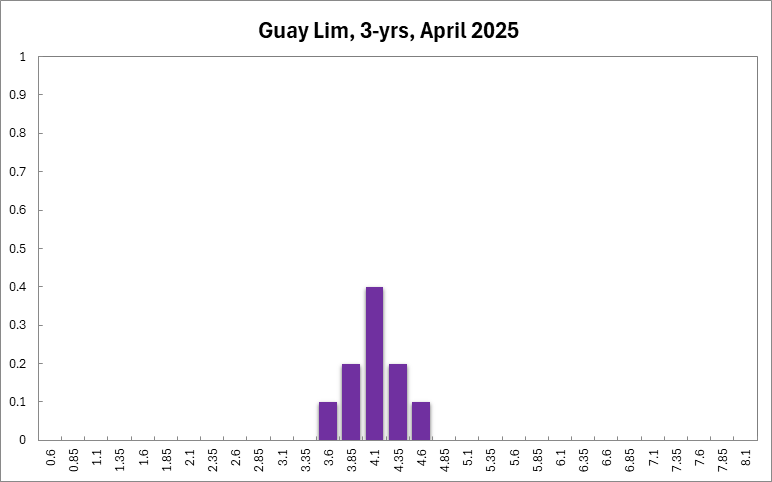

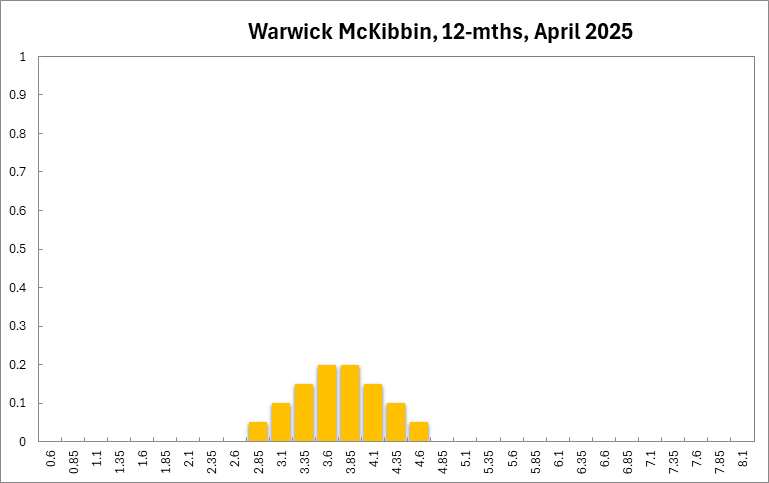

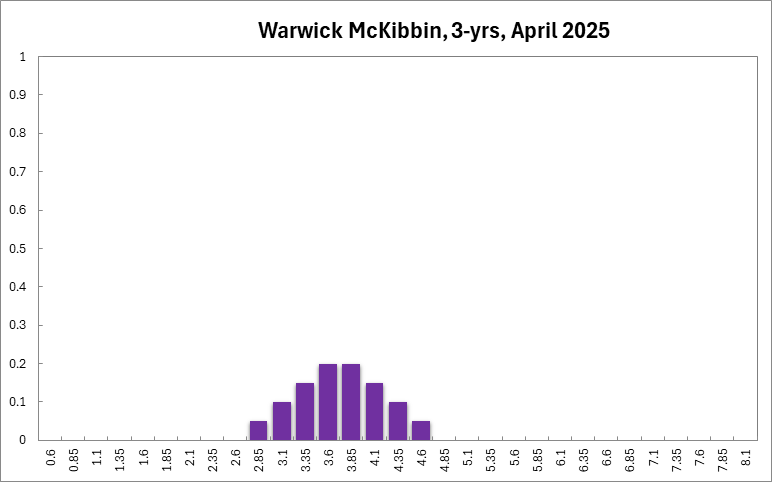

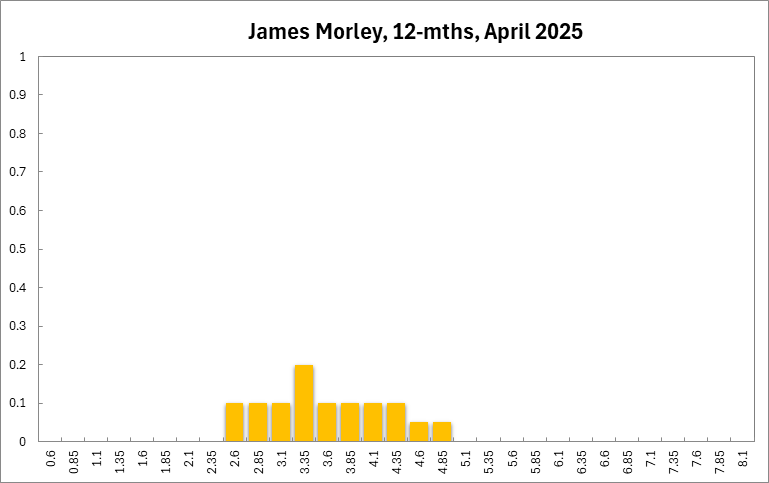

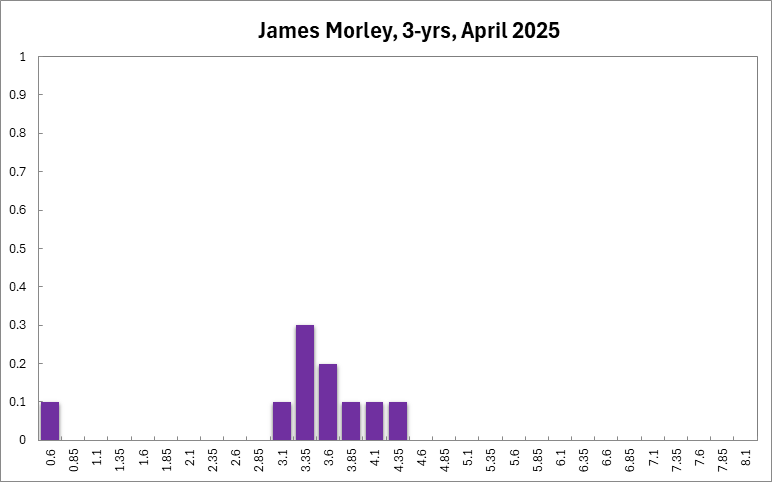

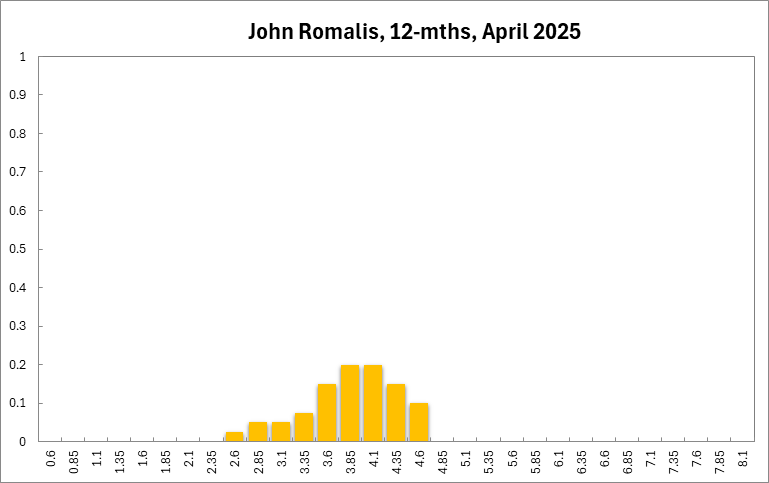

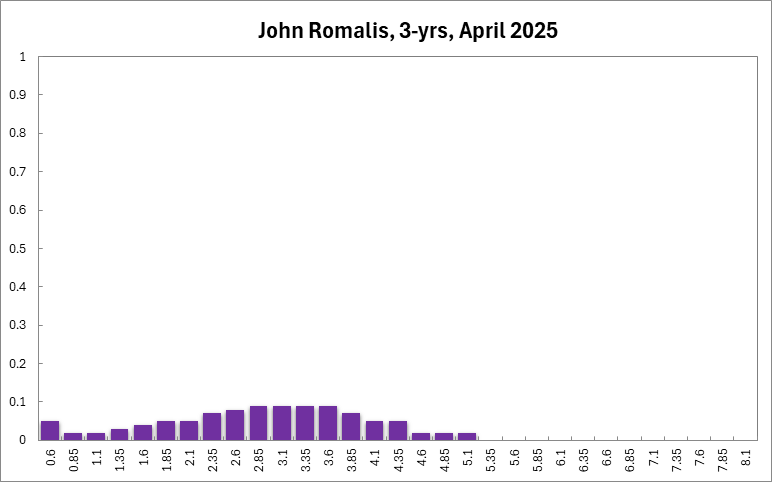

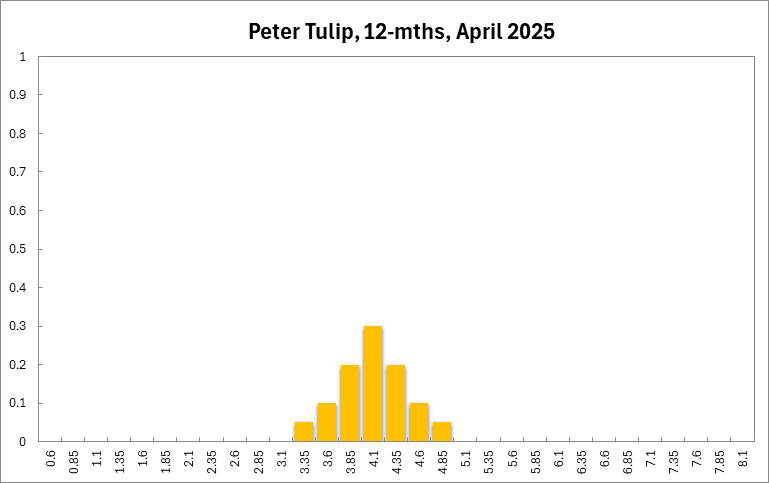

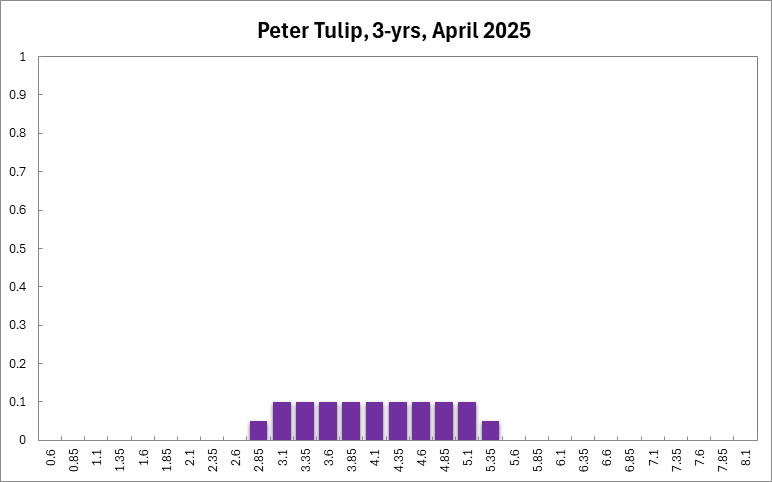

One year out, the Board is favouring further monetary easing: members’ confidence that the appropriate cash rate should remain at the current level of 4.10%, equals 15%, while the confidence in a required cash rate decrease, to below 4.10%, equals 65%, and its confidence in a required cash rate increase, to above 4.10%, is 19%. Three years out, the Shadow Board attaches a 14% probability that 4.10% is the appropriate setting for the overnight rate, a 67% probability that a lower overnight rate is optimal and a 19% probability that a rate higher than 4.10% is optimal.

The range of the probability distribution for the current interest rate recommendation is unchanged, from 3.60% to 4.60% (from 3.85% to 4.85% in the previous round). At longer horizons the ranges have widened slightly: they extend from 2.60% to 4.85% for the 6-month horizon, from 1.85% to 5.35% for the 12-month horizon, and from 0.60%-5.35% for the 3-year horizon.