Outcome: July 2020

No change in Shadow Board’s view: cash rate to stay low much longer

Australia’s experience with Covid-19 remains favourable by international comparison. This has allowed most states to ease restrictions sooner than anticipated. However, the recent outbreak in Victoria highlight the fragility of this achievement. Uncertainty about the Australian economy remains very high. The latest inflation, from the March quarter, still put the inflation rate at 2.2% (annualized), comfortably within the RBA’s official target band of 2-3%. The dramatic decline of aggregate demand is likely going to produce a significantly lower number for this quarter. Overall, the Australian and global economies remain very weak, and there is significant uncertainty surrounding the near-term economic future. Consequently, the RBA Shadow Board’s conviction that the cash rate should remain at the historically low rate of 0.25% again remains unchanged at 94%, while the confidence in a required rate cut to the lower bound of 0% equals 6% and the confidence in a required rate hike equals 0%.

The increase in unemployment is increasingly showing up in the official statistics. According to the latest official ABS figures, the unemployment rate rose to 7.1% in May, the highest jobless rate since October 2001. Other labour market indicators highlight the economic cost of the Covid-19 crisis: the underemployment rate stands at around 13% and the underutilization rate reached an all-time high of 20.2%. Finally, the labour force participation rate also dropped, from 63.5% in April to 63.9% in May.

The RBA’s emergency policies – keeping the 3-year government bond rate at 0.25 per cent through quantitative easing, providing a $90 billion funding facility for banks – continue to remain in place and will do so much longer, commensurate with the RBA’s announcement that it will maintain the low rate of 0.25 per cent until “progress is being made towards full employment and it is confident that inflation will be sustainably within the 2-3 per cent target band”.

On the fiscal side, after the downward revision of the total value of the JobKeeper program 6 weeks ago additional spending has been announced in the form of a $250 million program to support the arts and the HomeBuilder program to support the construction industry. These are very small relative to the size of the economy. Attention is increasingly focusing on what will supplant JobKeeper and JobSeeker once they run out in September. While still three months away, a sudden withdrawal of income support, and thus aggregate demand, is likely to weaken the economy further, leading to higher unemployment rates, less consumption spending, and falling inflation. Thus, the size of the overall fiscal stimulus for the foreseeable future remains uncertain.

Financial markets have continued their climb since the historical decline in March. The Aussie dollar now trades around 69 US¢ after briefly breaching 70 US¢. Yields on Australian 10-year government bonds, following a spike to 1.13%, are again below 1%. The yield curve in short-term maturities (2-year versus 1-year) remains flat. In higher-term maturities the yield curve is displaying the normal convexity. The stock market also continued to climb; the S&P/ASX 200 stock index now trades well above 6,000.

Forecasts for global economic growth are being continuously revised. The World Bank forecasts, as a baseline, a contraction of global GDP in 2020 of 5.2%, the deepest global recession in many decades. These forecasts have large error bands as there remains considerable uncertainty about the economic response to Covid-19, the degree to which the pandemic is controlled and the speed with which medical treatments and vaccines can be developed. Furthermore, rising geopolitical tensions, especially in relation to China, are damaging global growth prospects. Additional trade restrictions and a fall in Chinese demand for Australian exports (mining, education, tourism) are of particular concern to the domestic economy.

Consumer and producer confidence measures strengthened further, after their battering in April: the Melbourne Institute and Westpac Bank Consumer Sentiment Index now stands at 93.7, compared to 88.1 in May. Retail sales contracted by 17.7% in April, the latest available figure, while private sector credit contracted for the only the second time in eight years. NAB’s index of business confidence climbed from a record low of -66 in March to -46 in April and a further 26 points, to -20, in May. This improvement is matched by rises in the manufacturing and services PMIs, industrial and services sentiment indicators, and capacity utilization. A key measure of the state of the housing sector, the number of building permits granted, shrank by 16.4% month-to-month in May. The construction PMI, on the other hand, rose slightly in the same month.

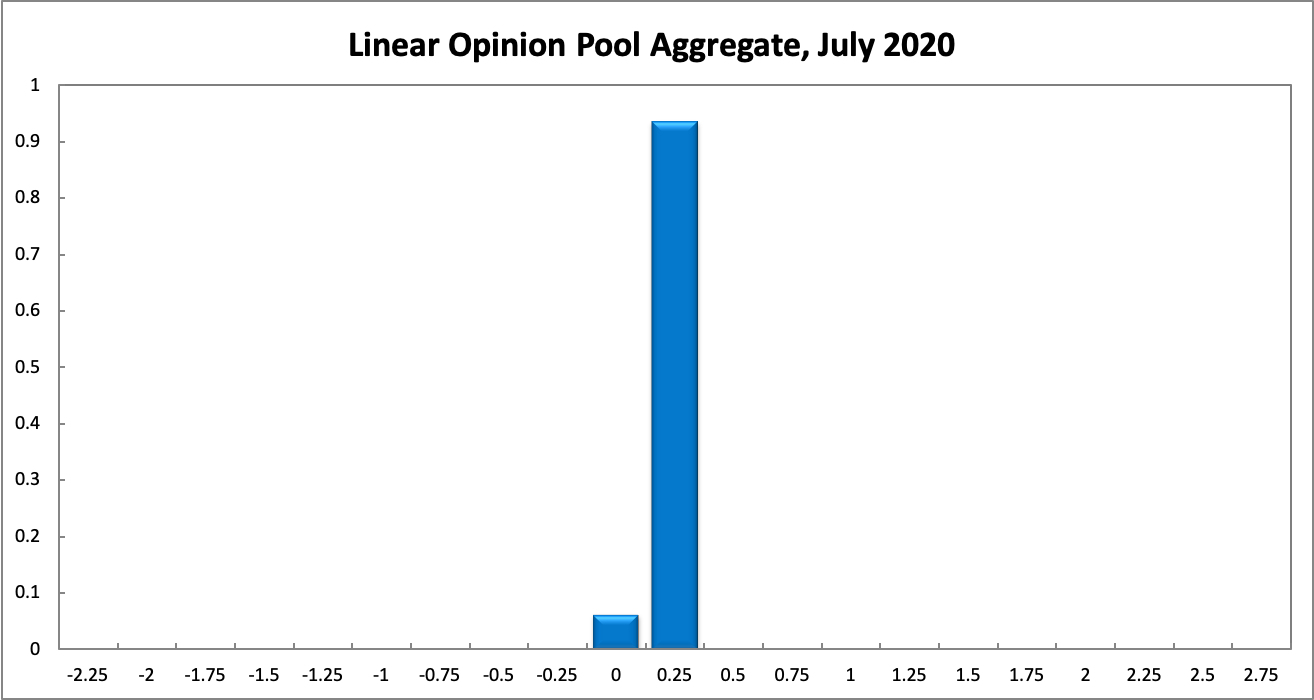

For three months in a row, the probabilities associated with the Shadow Board’s recommendations remain unchanged. The Shadow Board attaches a 94% probability that the overnight interest rate should remain at the historically low rate of 0.25%. The Shadow Board attaches a 6% probability that a final rate cut, to the lower bound of 0%, is appropriate and a 0% probability that a rate rise, to 0.5% or higher, is appropriate.

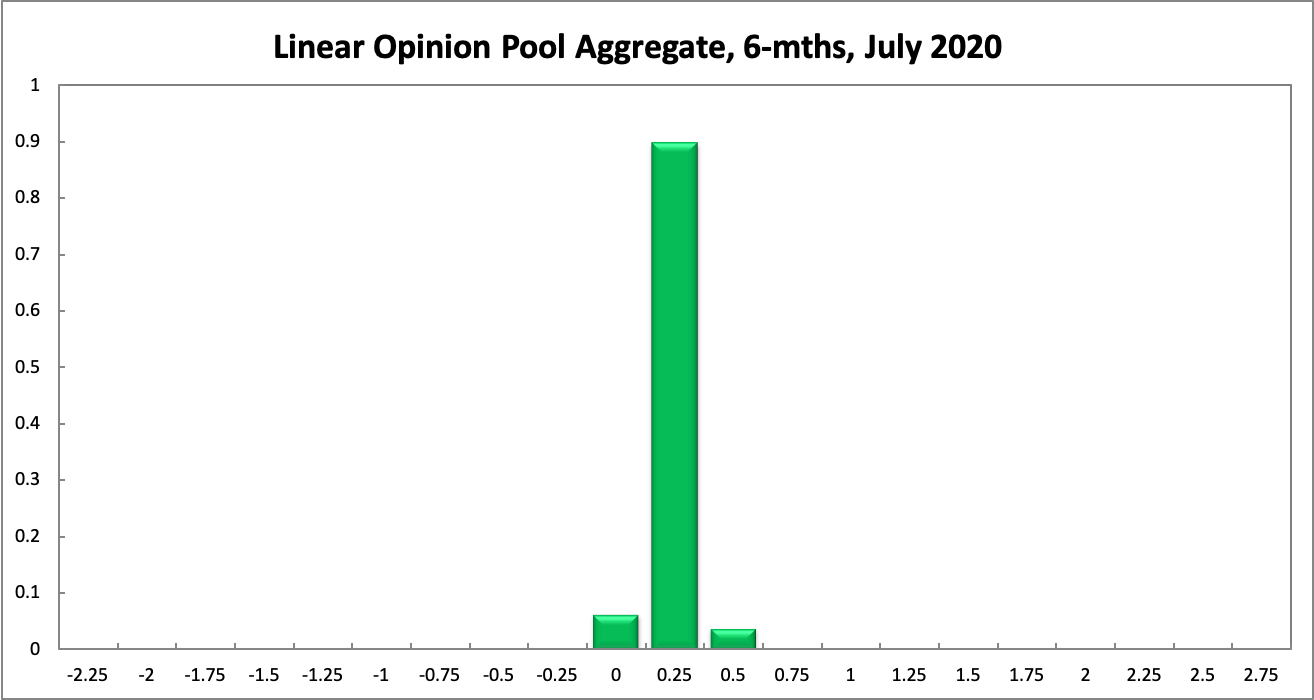

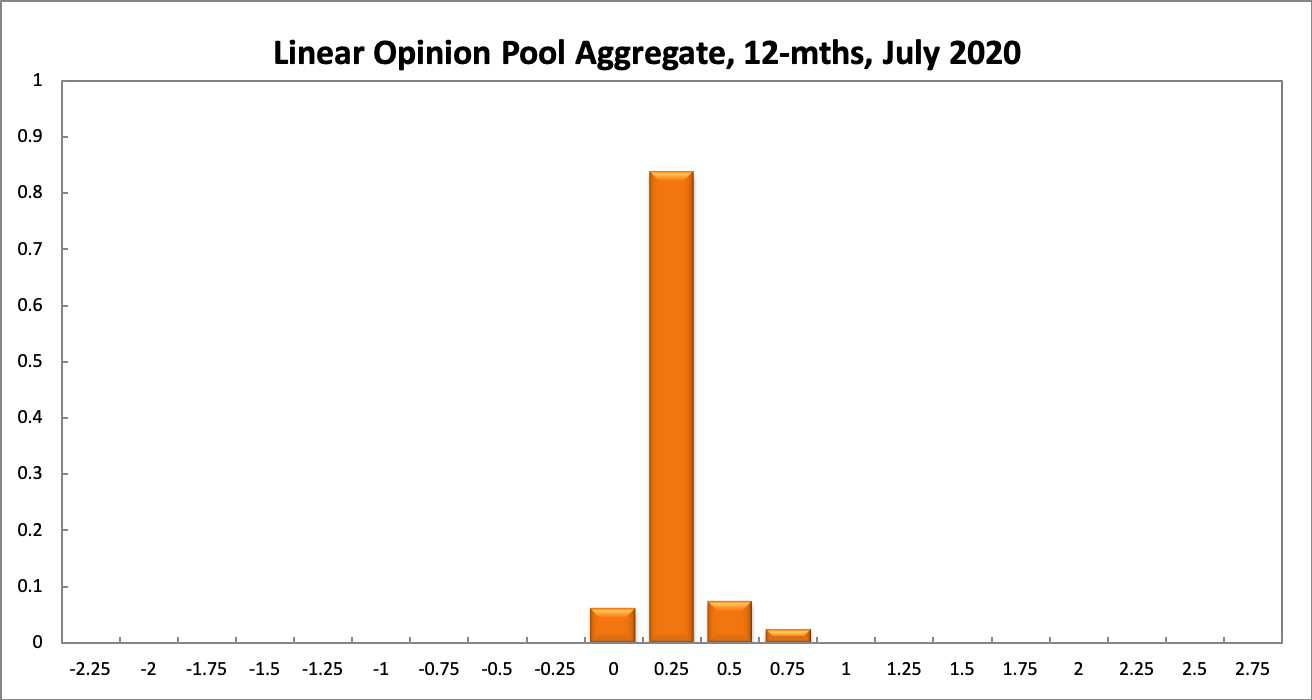

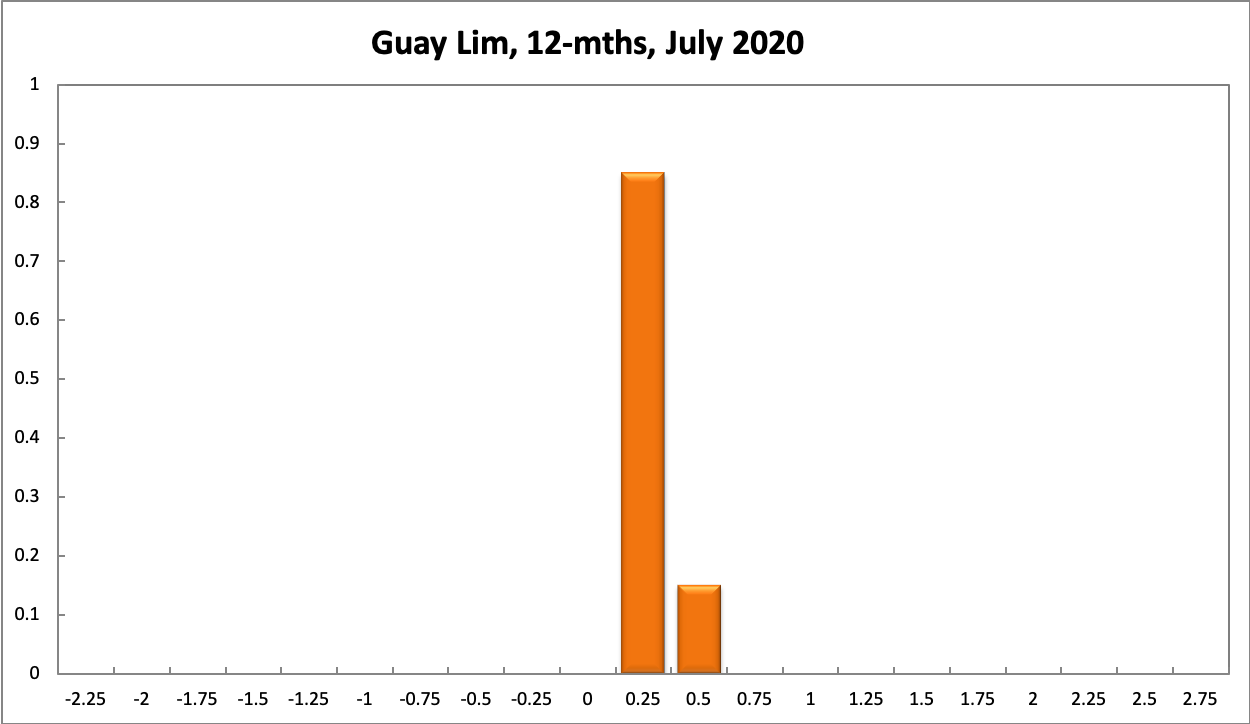

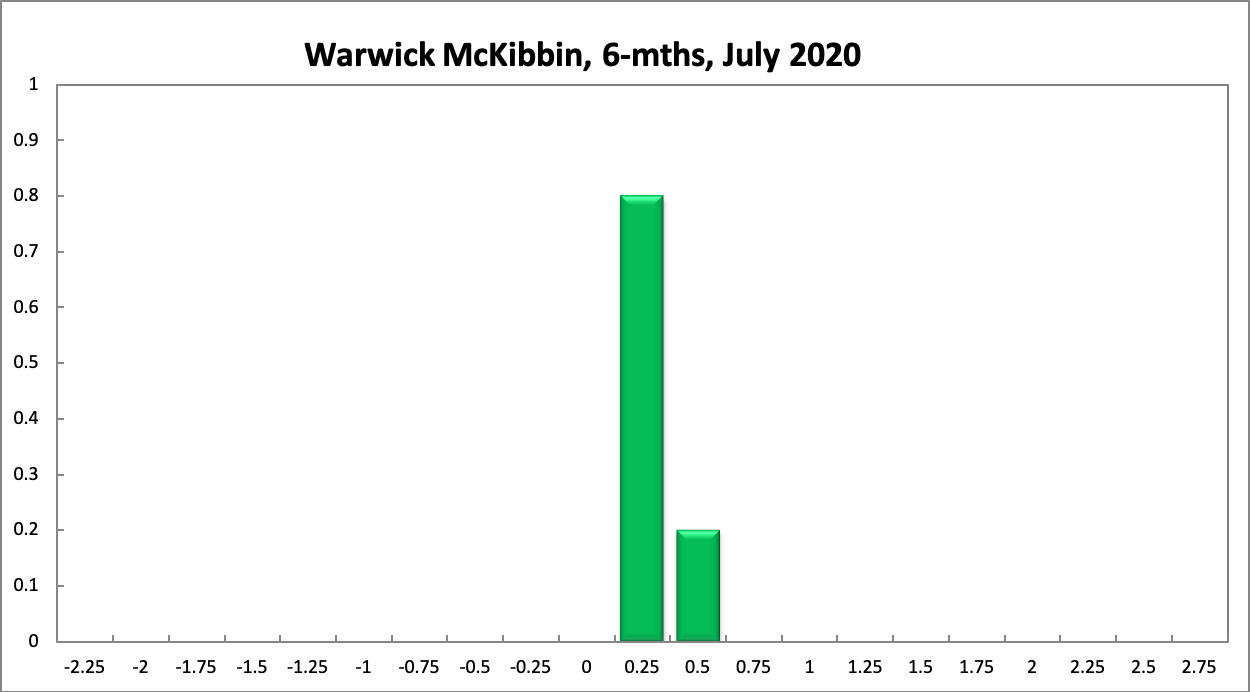

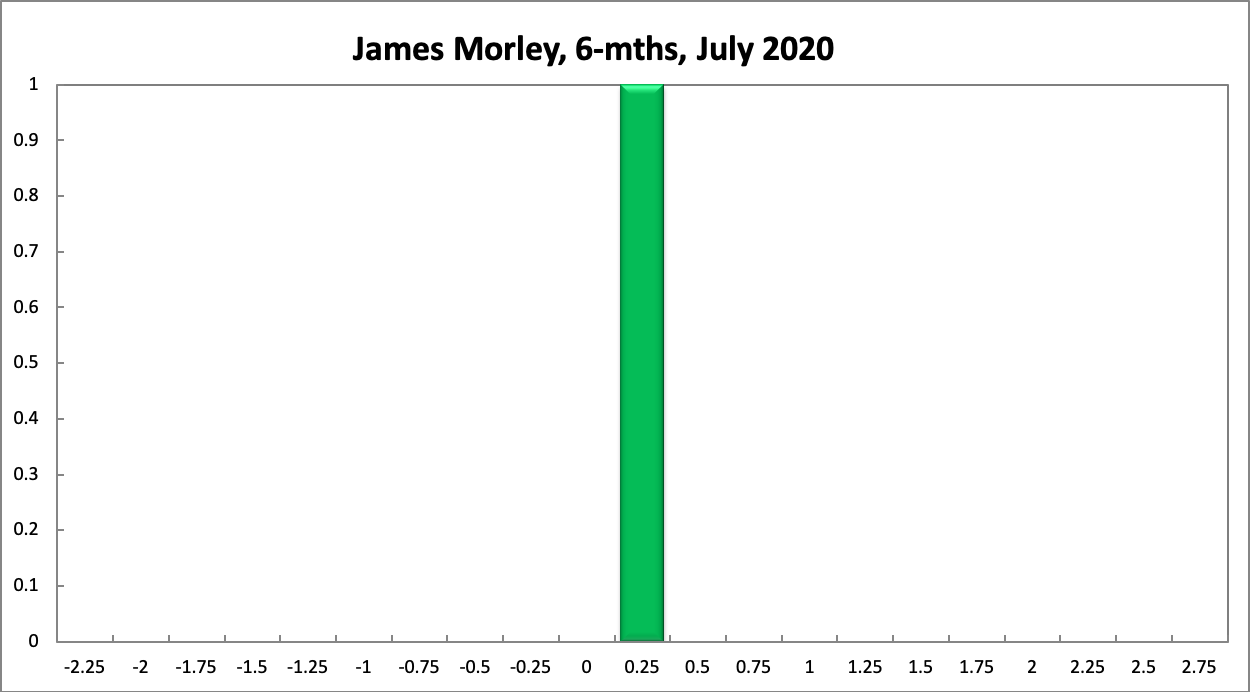

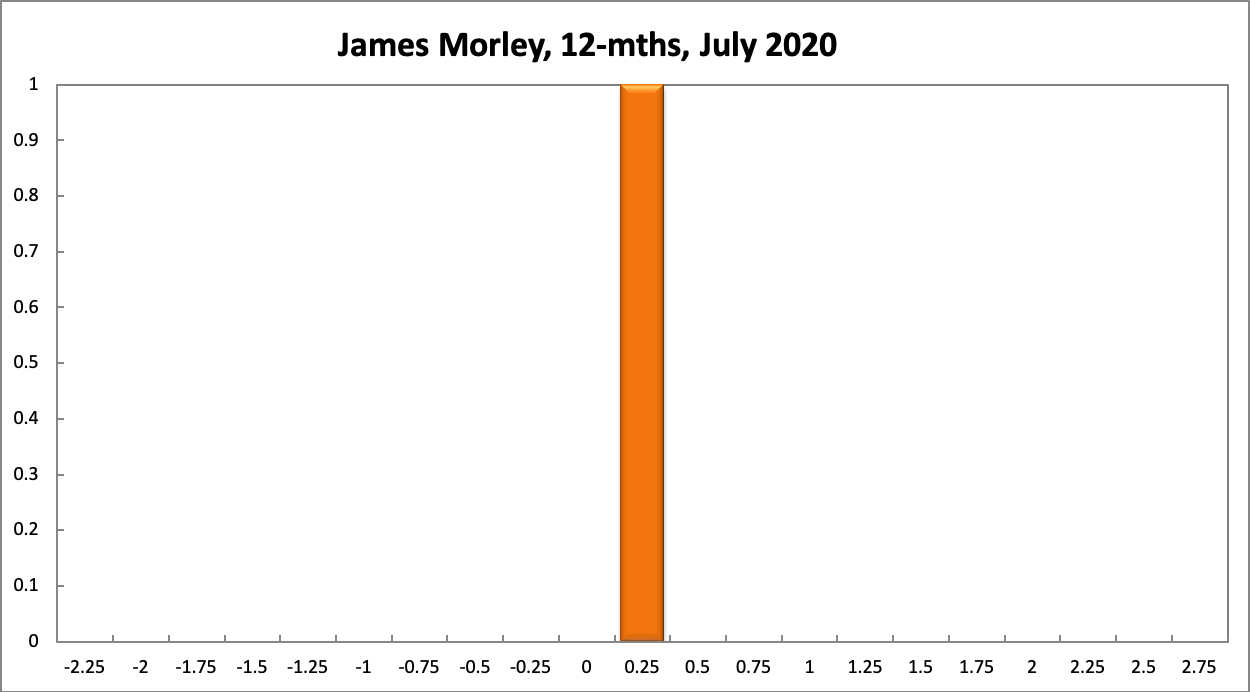

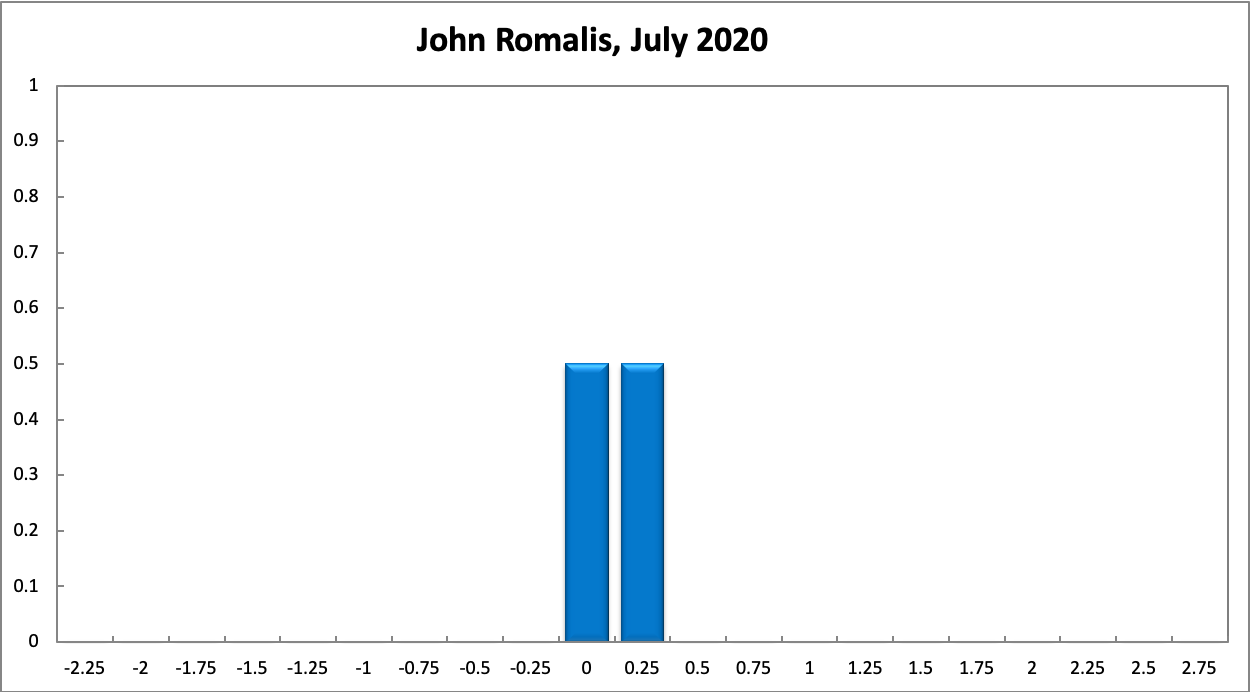

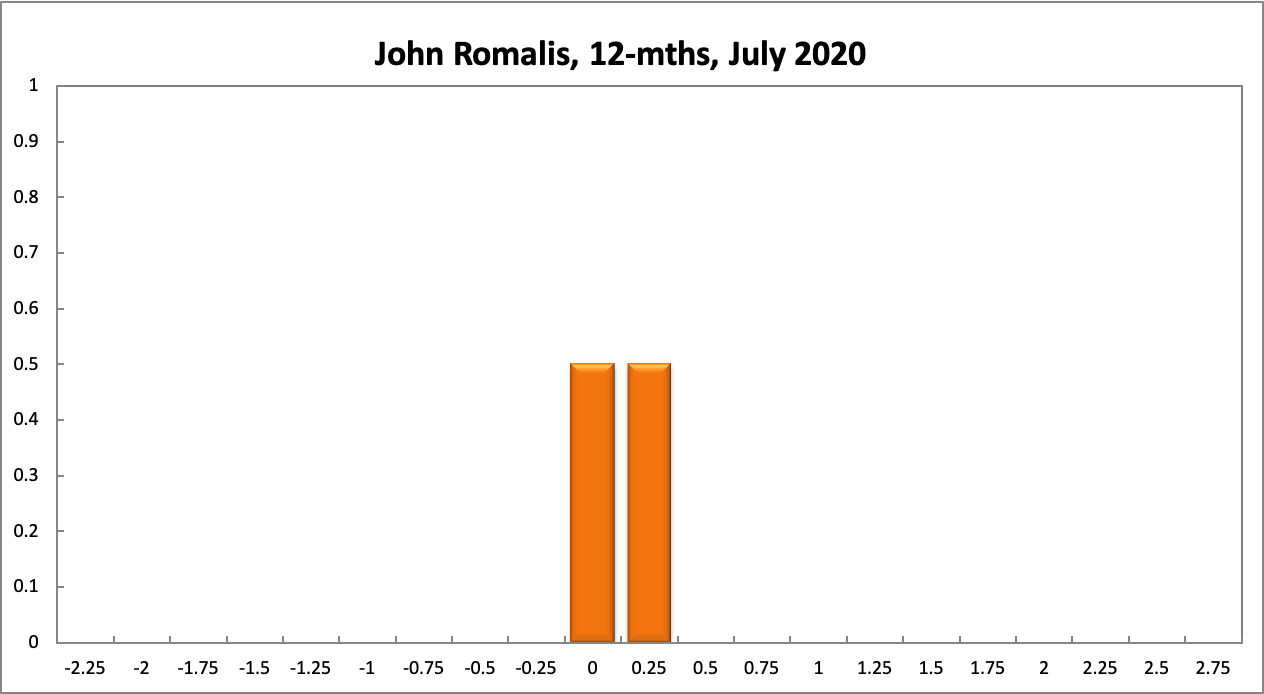

The probabilities at longer horizons also remain virtually unchanged: 6 months out, the confidence that the cash rate should remain at 0.25% equals 90%, the probability attached to the appropriateness for an interest rate decrease equals 6%, while the probability attached to a required increase equals 4%. One year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 84%. The confidence in a required cash rate decrease equals 6% and in a required cash rate increase 10%. The range of the probability distributions over the 6 month and 12 month horizons is also unchanged, extending from 0% to 0.75%.

Aggregate

Current

6-Months

12-Months

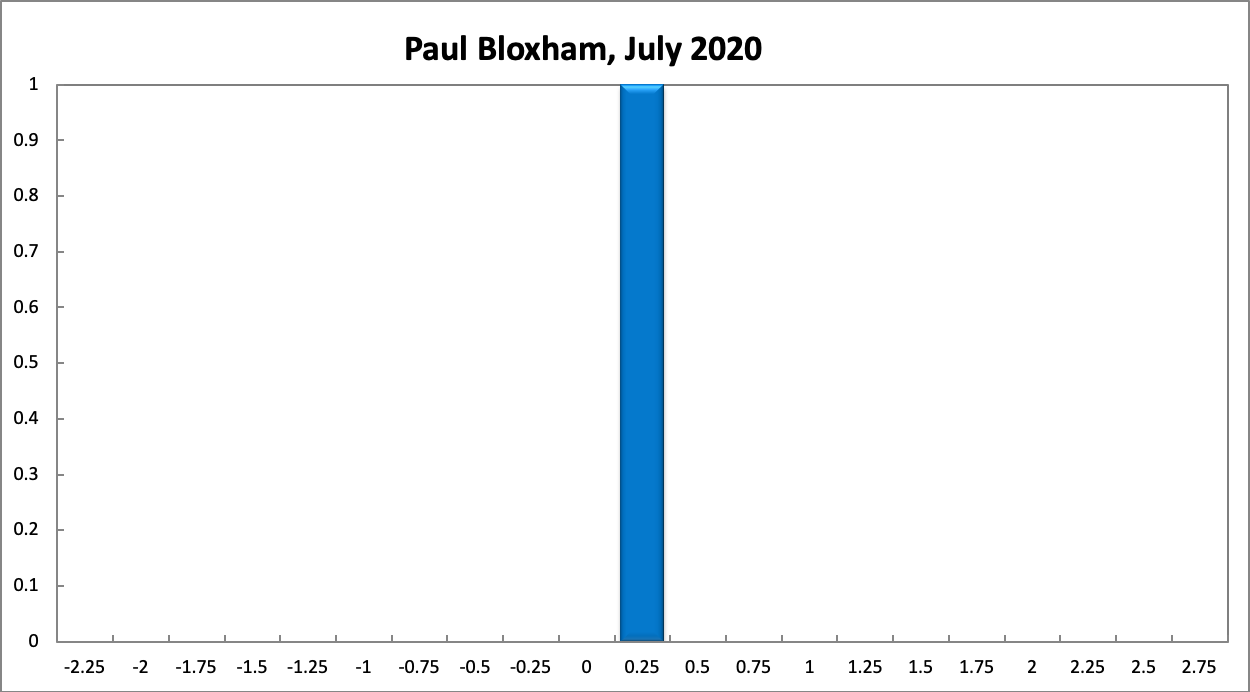

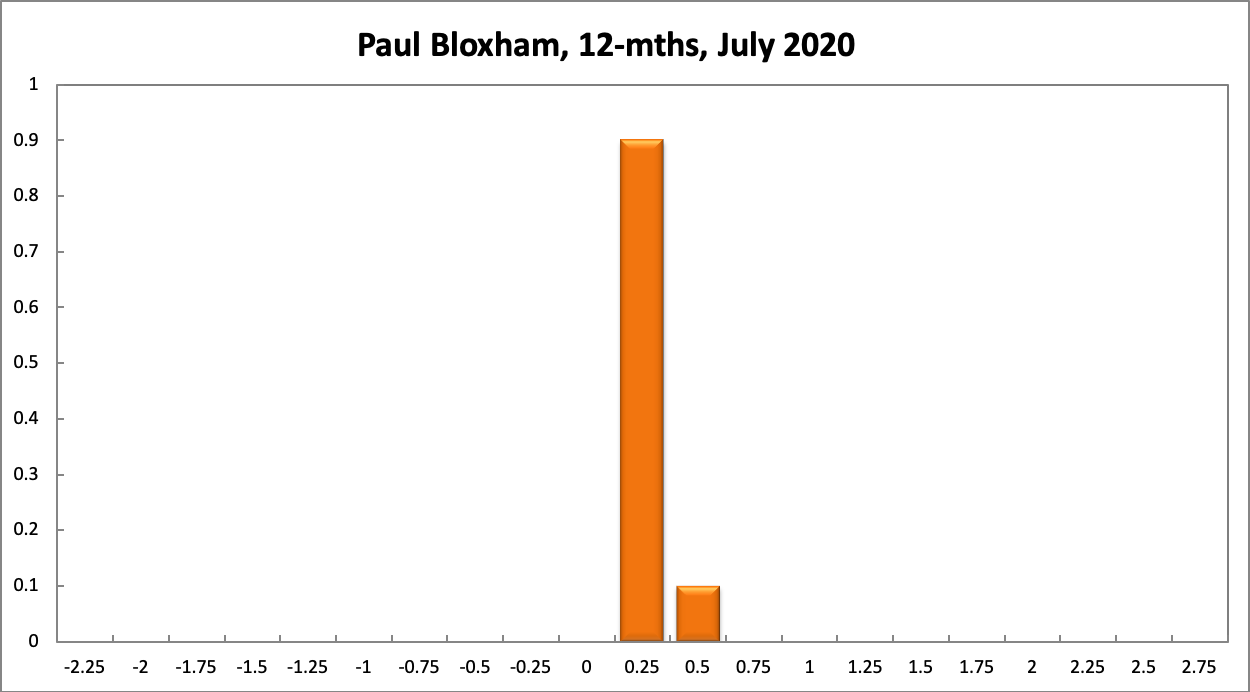

Paul Bloxham

Current

6-Months

12-Months

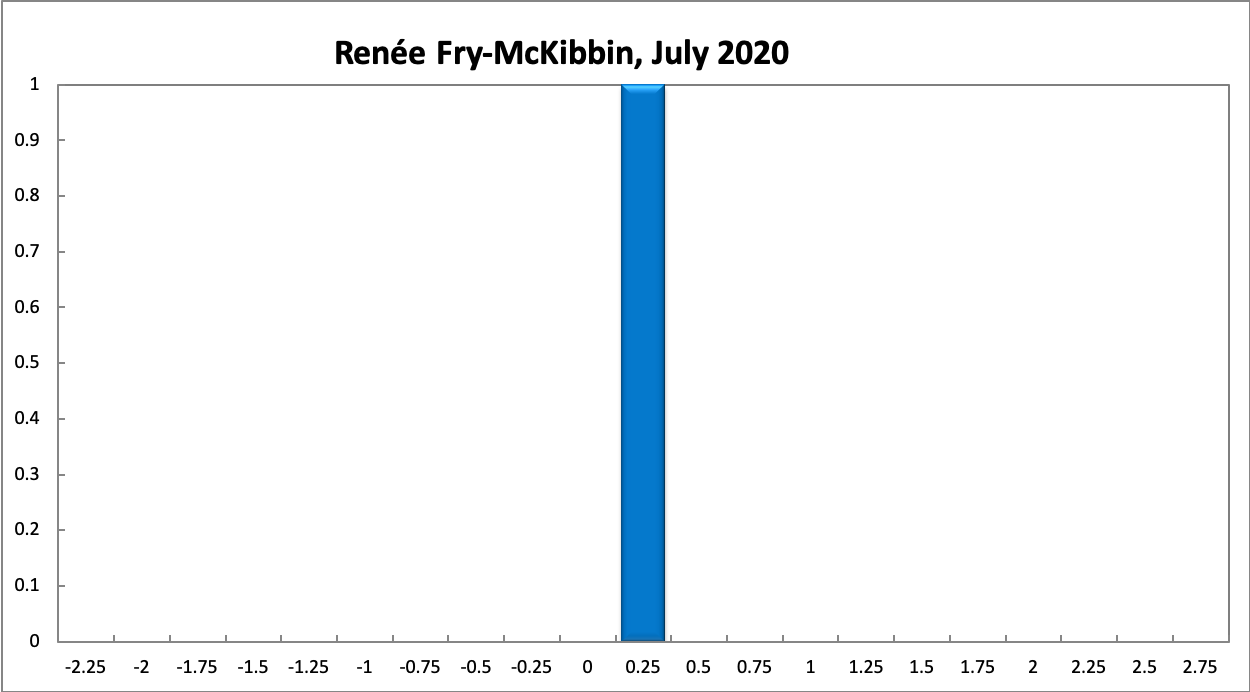

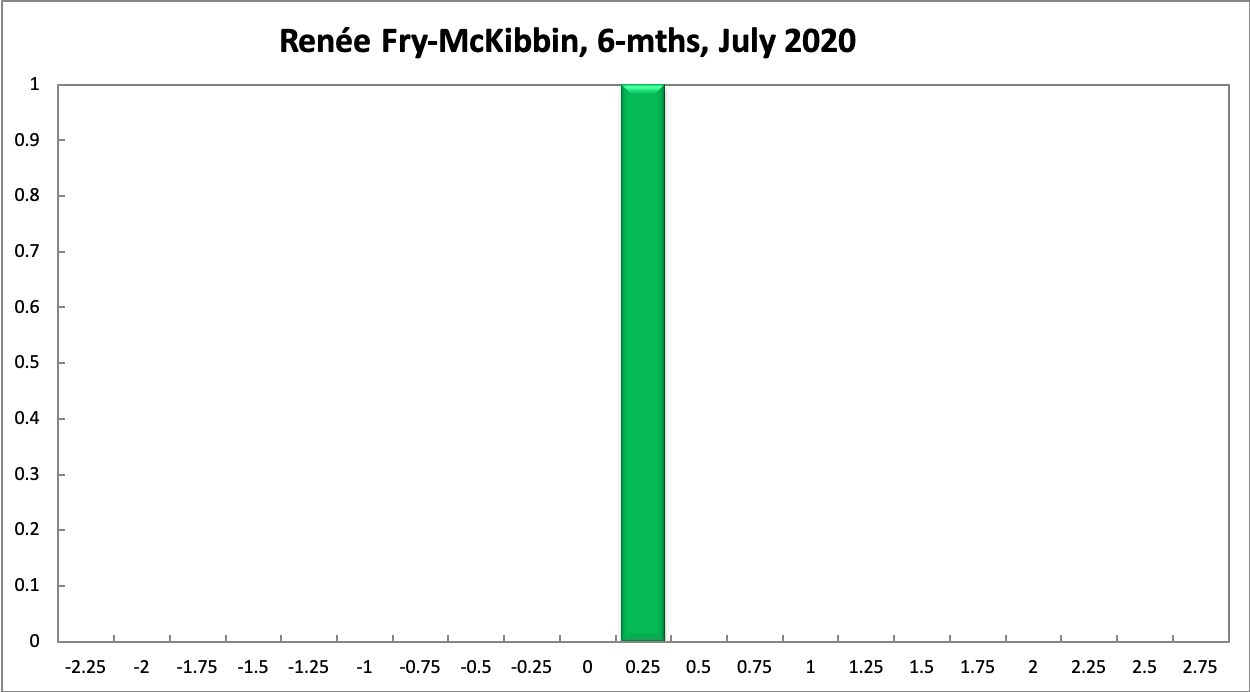

Renee Fry_McKibbin

Current

6-Months

12-Months

Mariano Kulish

Current

6-Months

12-Months

Guay Lim

Current

6-Months

12-Months

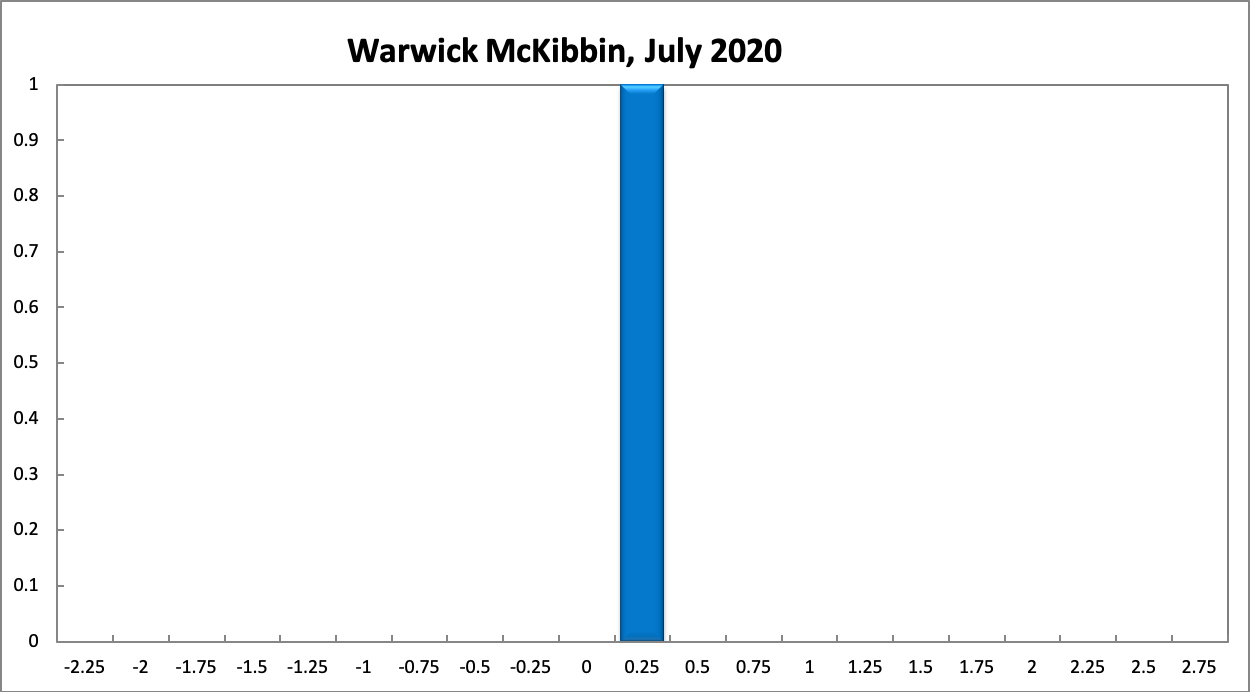

Warwick McKibbin

Current

6-Months

12-Months

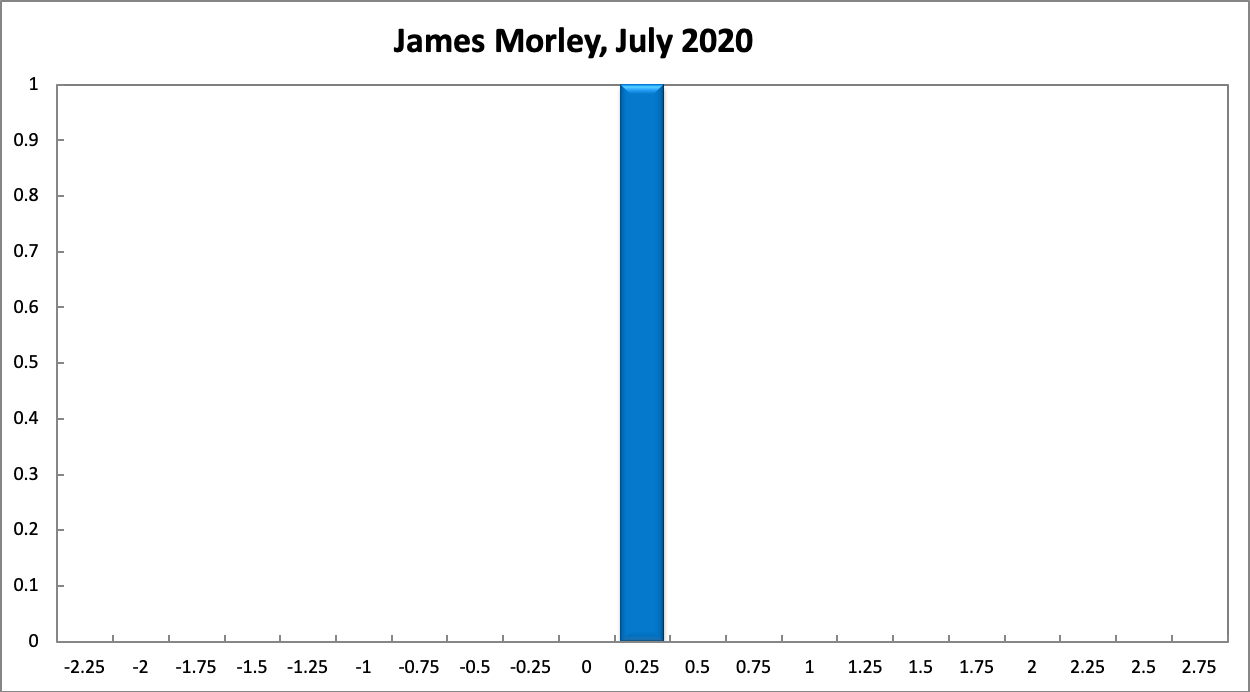

James Morley

Current

6-Months

12-Months

John Romalis

Current

6-Months

12-Months

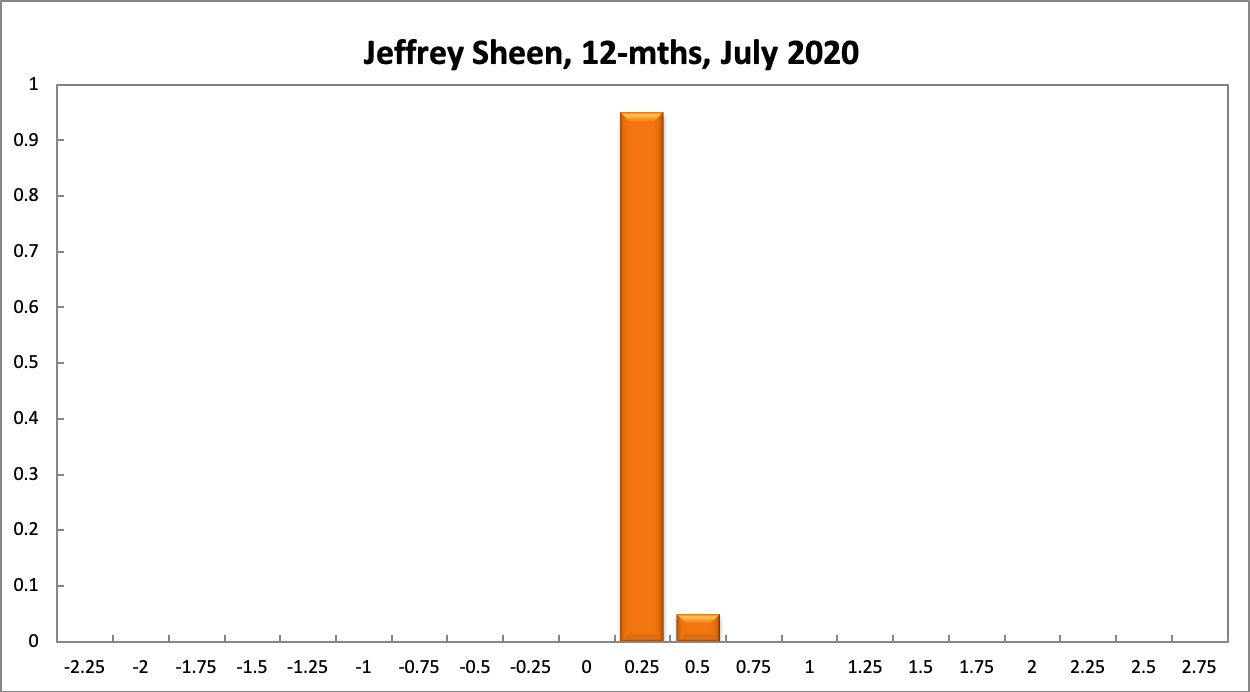

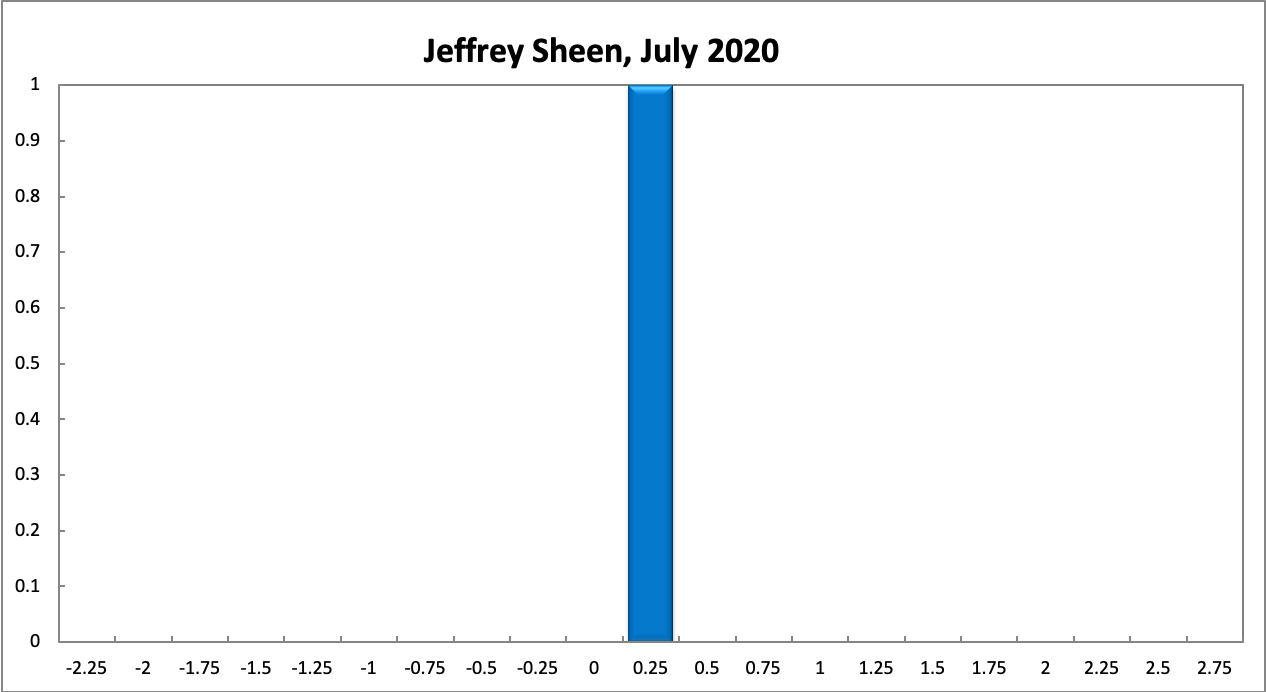

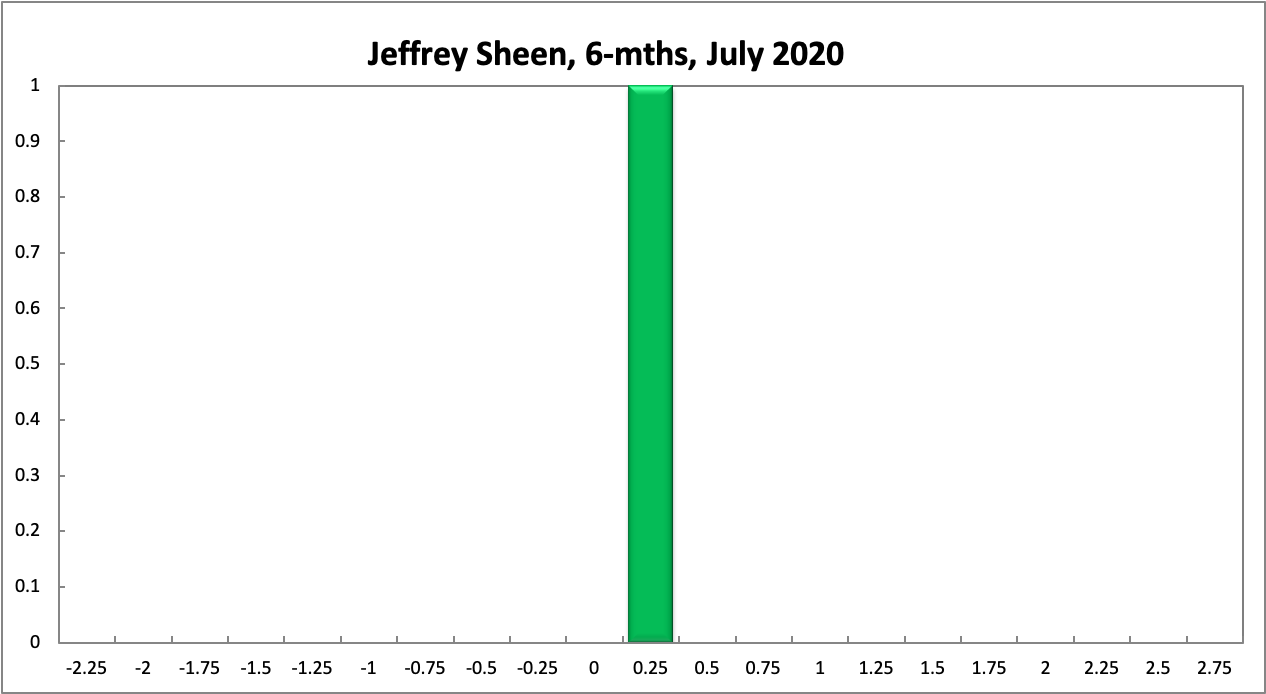

Jeffrey Sheen

Current

6-Months

12-Months