No comment.

Outcome: July 2025

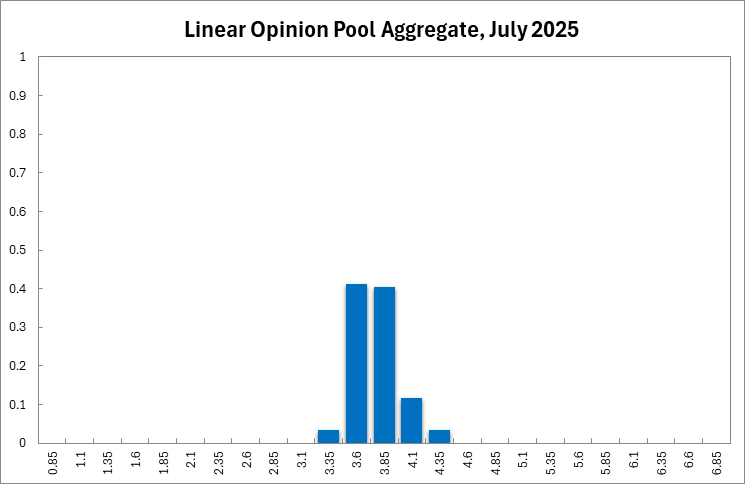

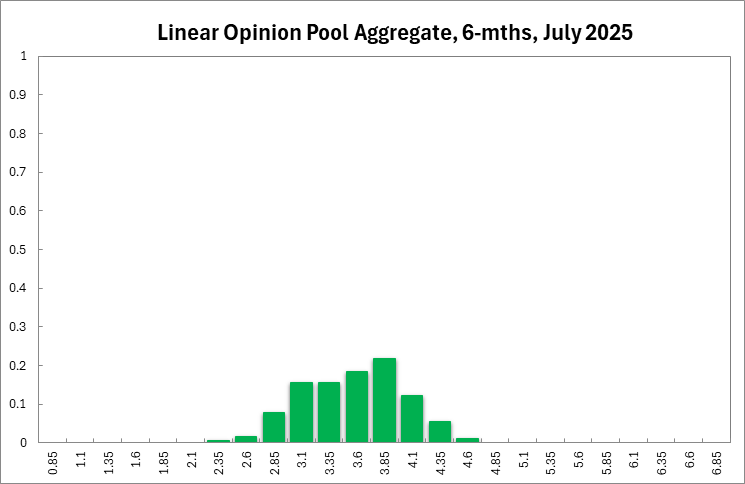

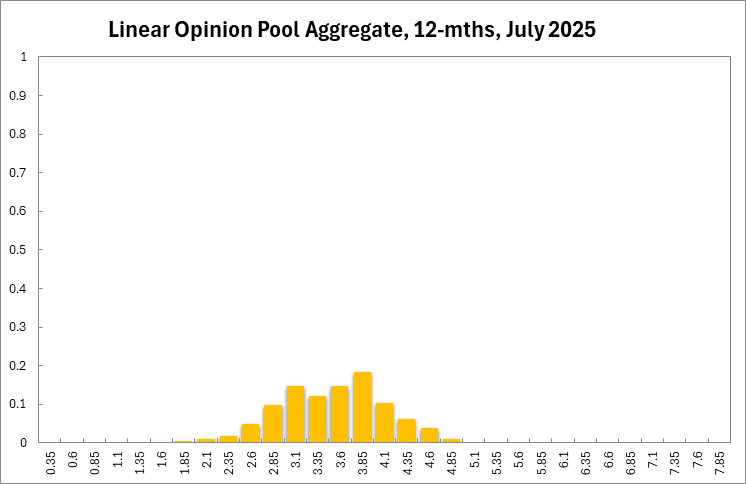

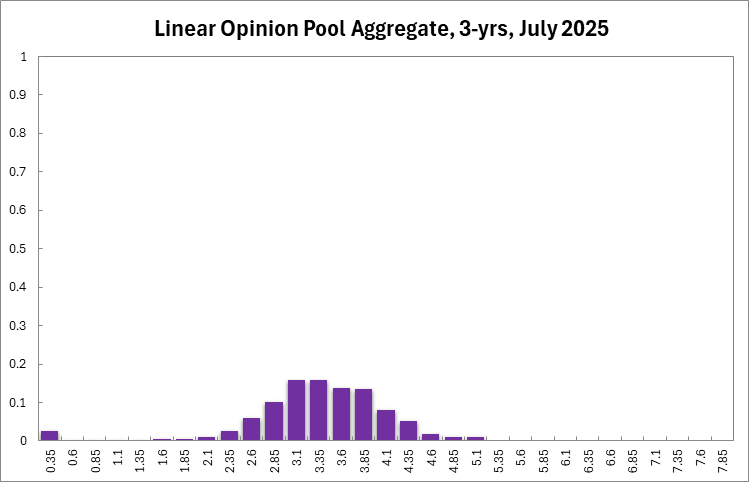

Aggregate

Current

6-Months

12-Months

3-Years

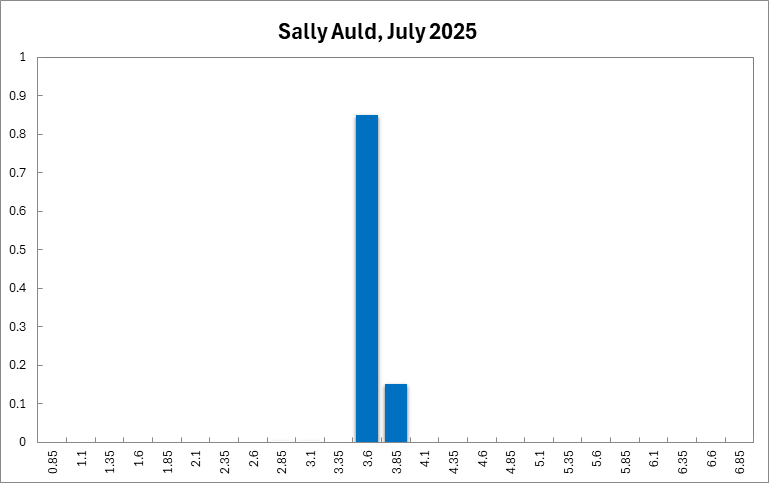

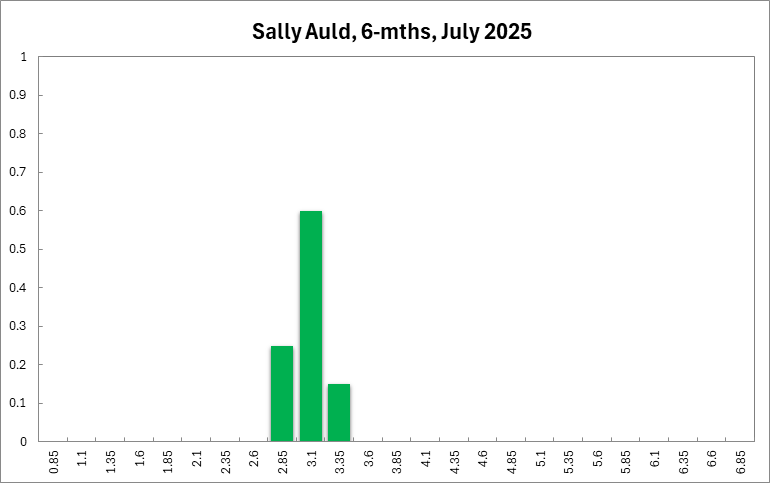

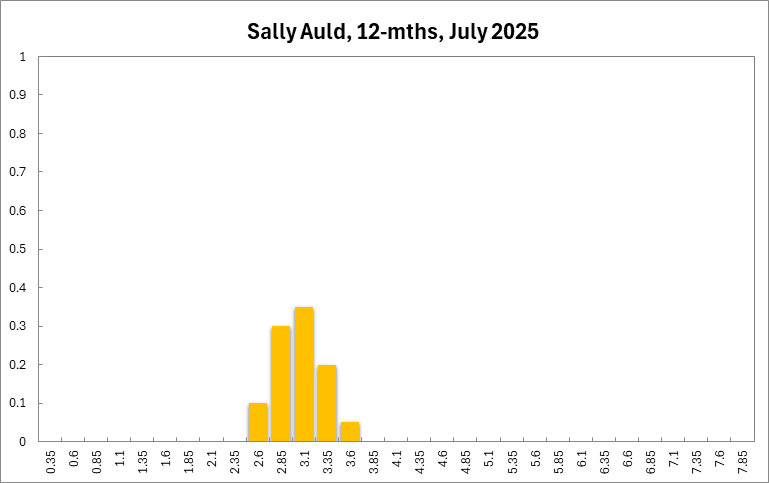

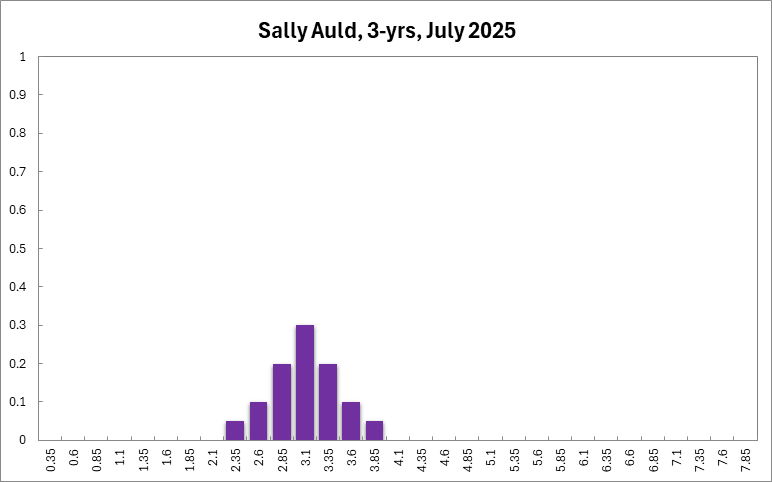

Sally Auld

Current

6-Months

12-Months

3-Years

Comments

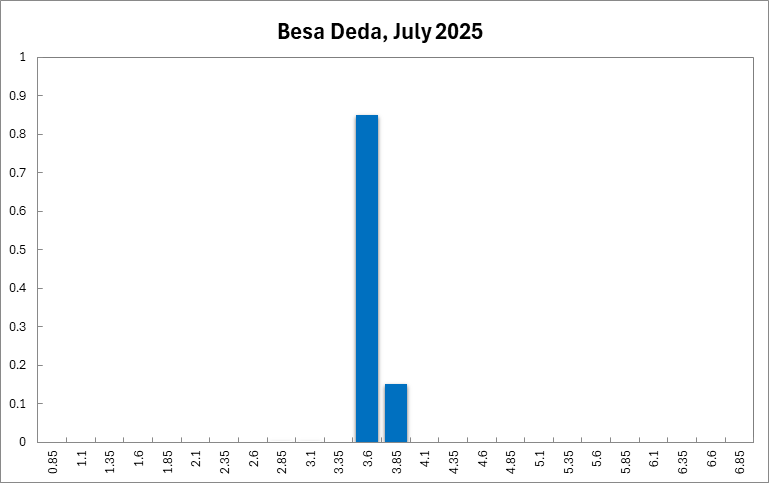

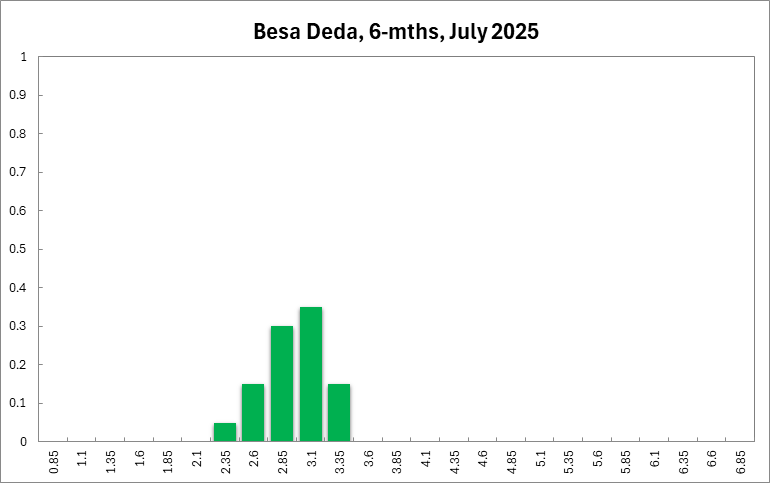

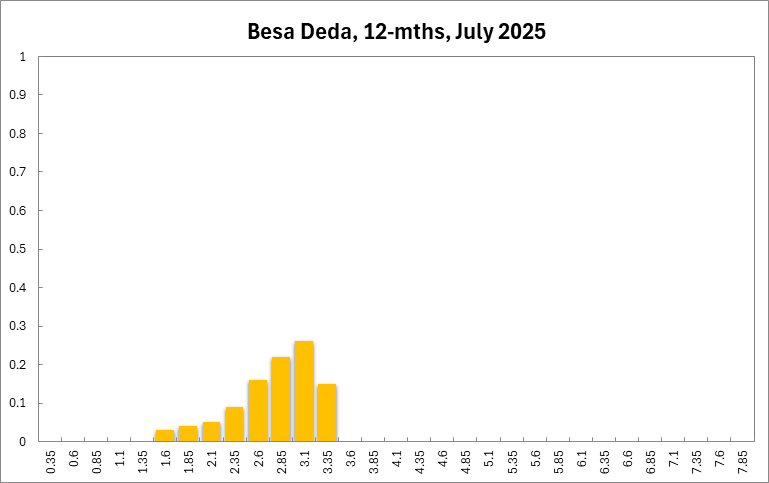

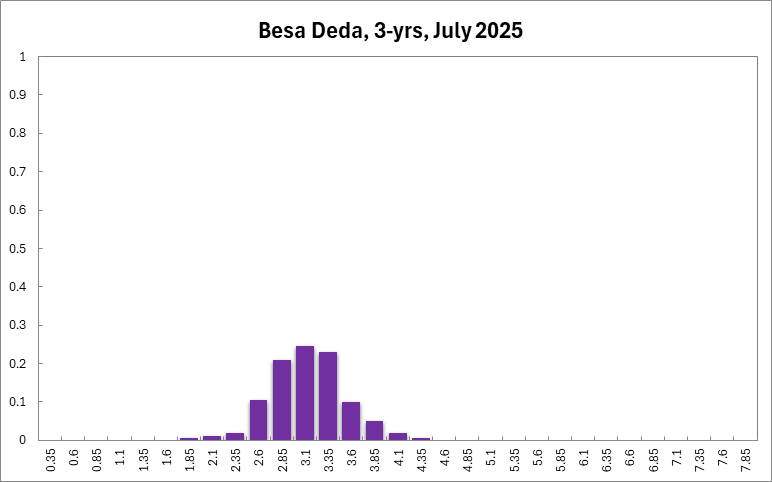

Besa Deda

Current

6-Months

12-Months

3-Years

Comments

No comment.

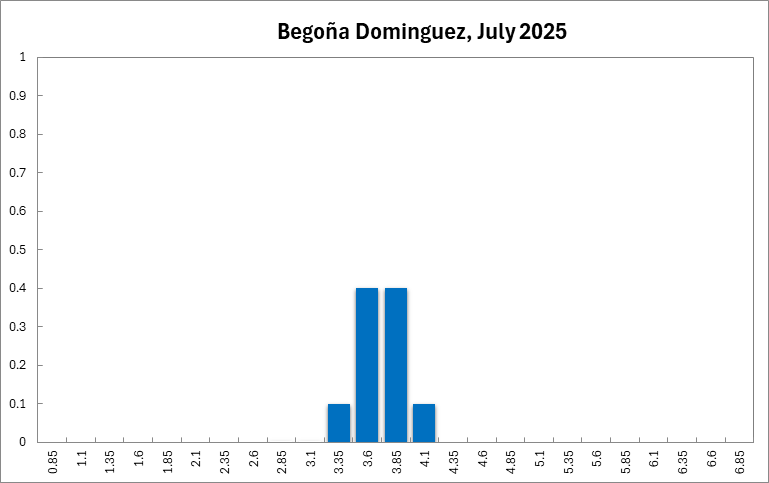

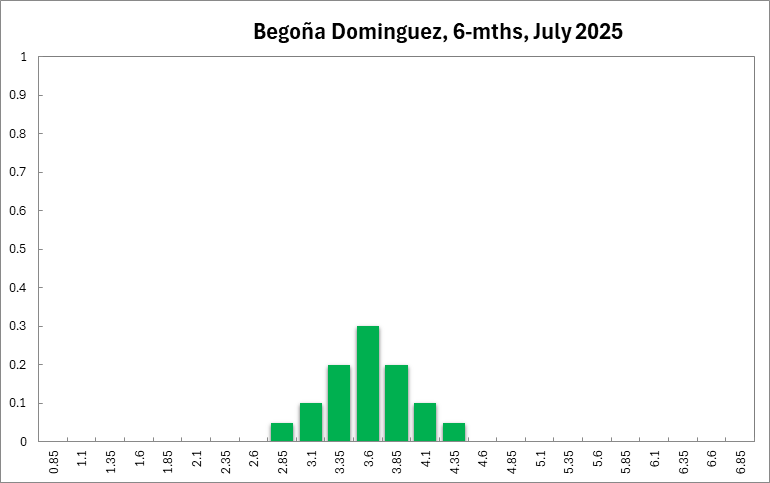

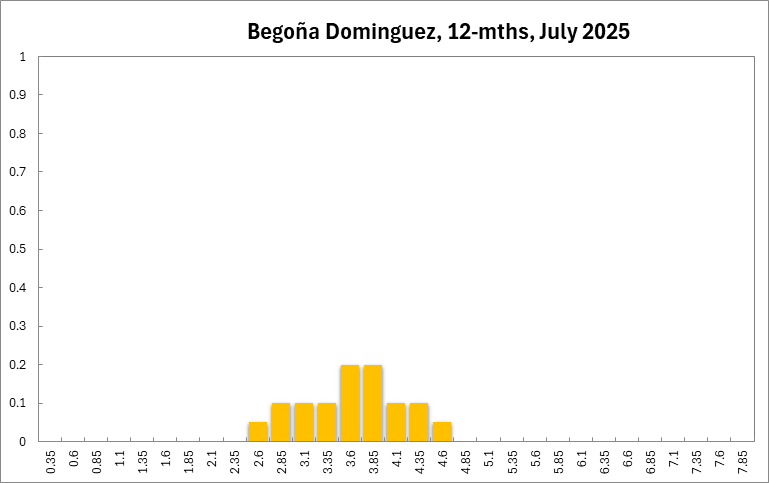

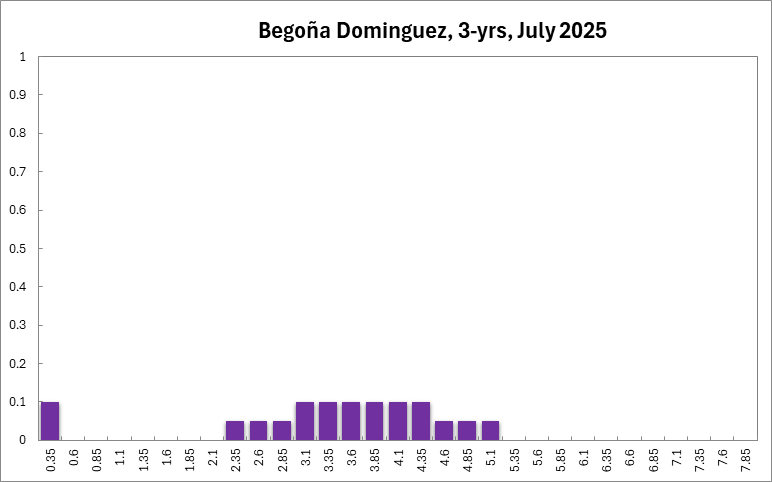

Begoña Dominguez

Current

6-Months

12-Months

3-Years

Comments

No comment.

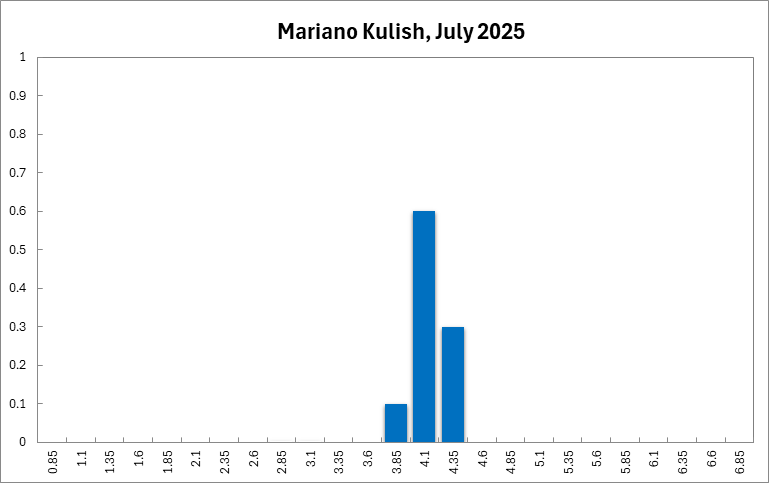

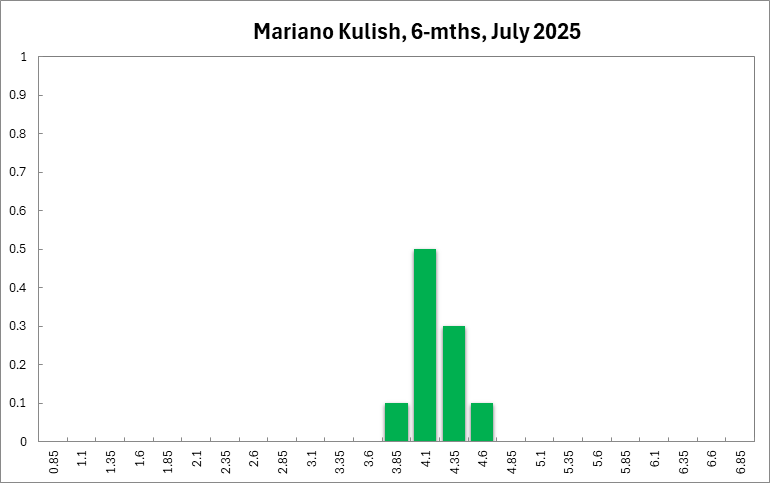

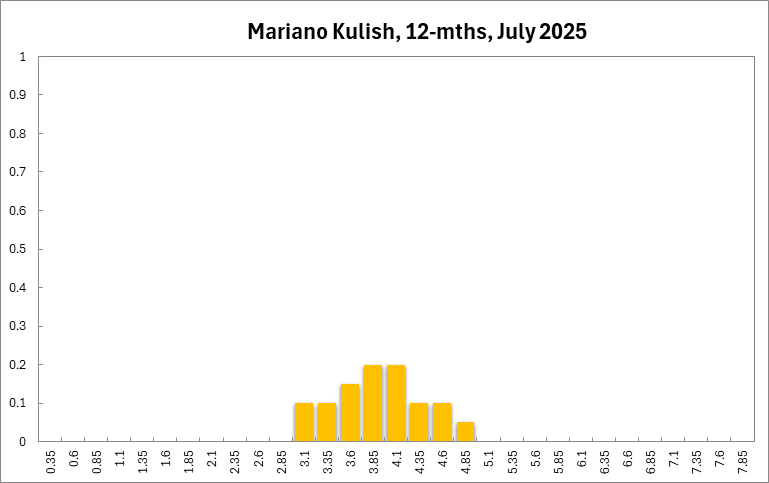

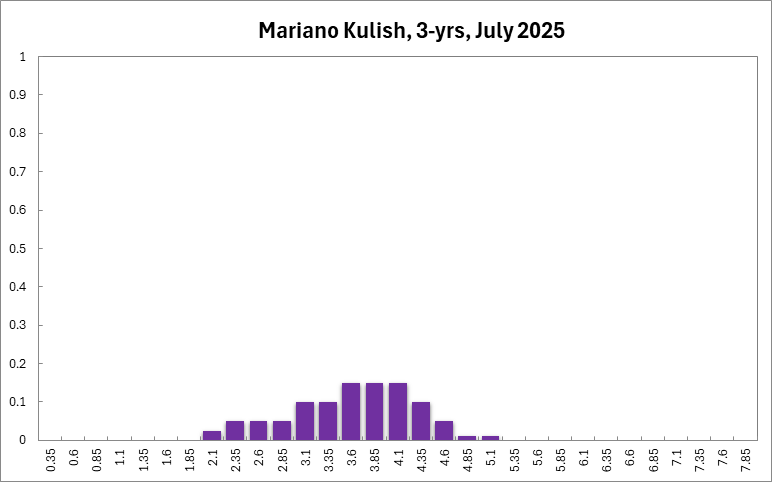

Mariano Kulish

Current

6-Months

12-Months

3-Years

Comments

No comment.

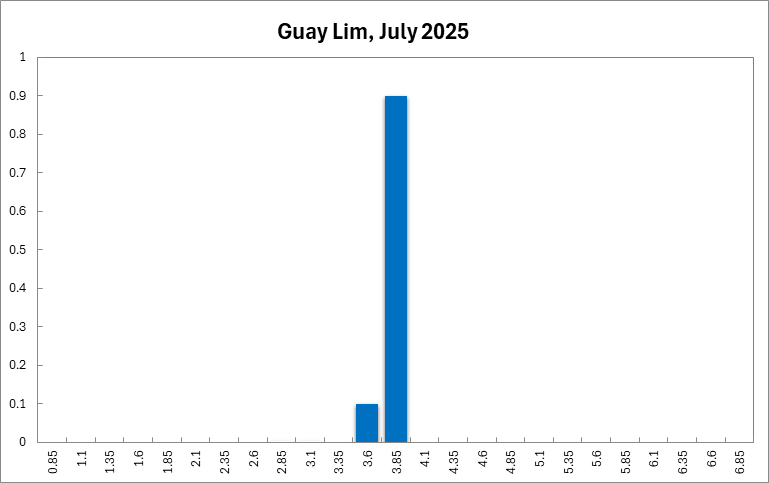

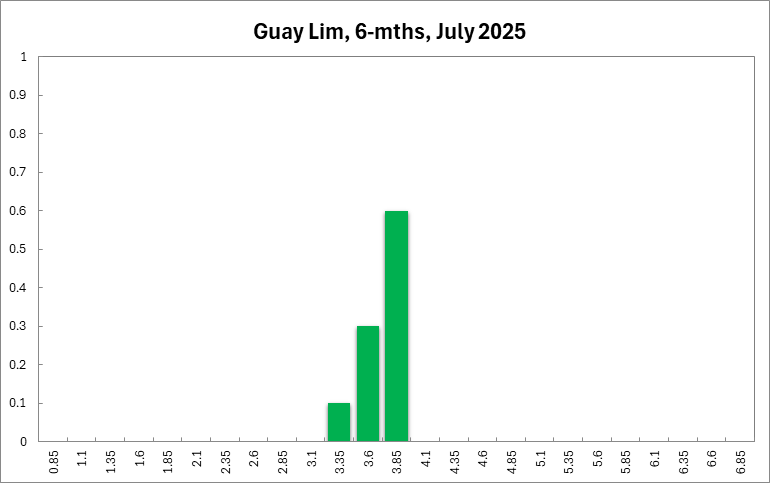

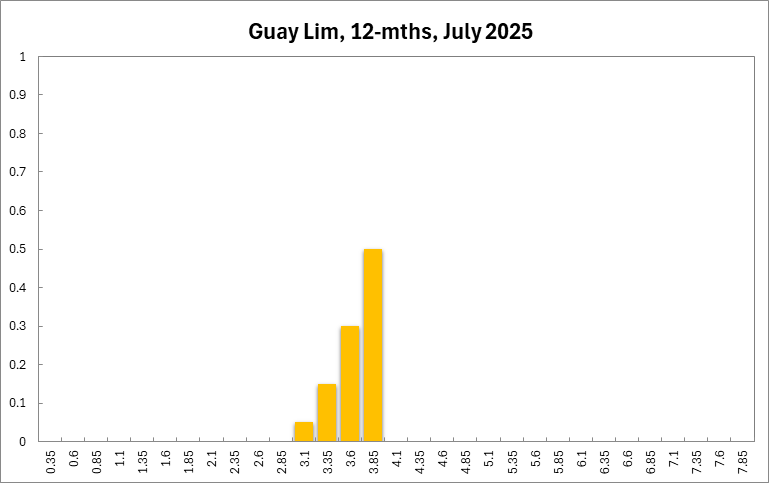

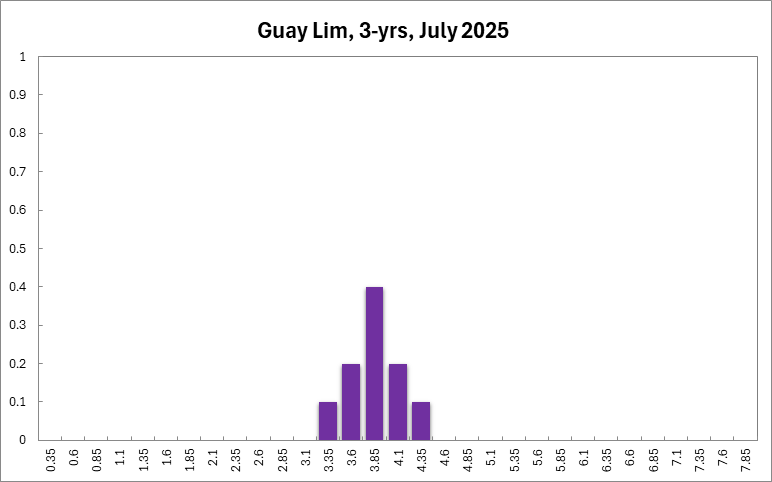

Guay Lim

Current

6-Months

12-Months

3-Years

Comments

No comment.

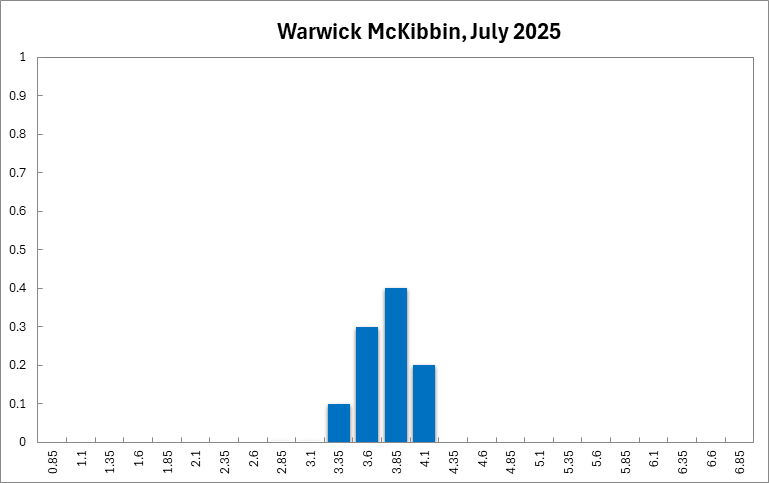

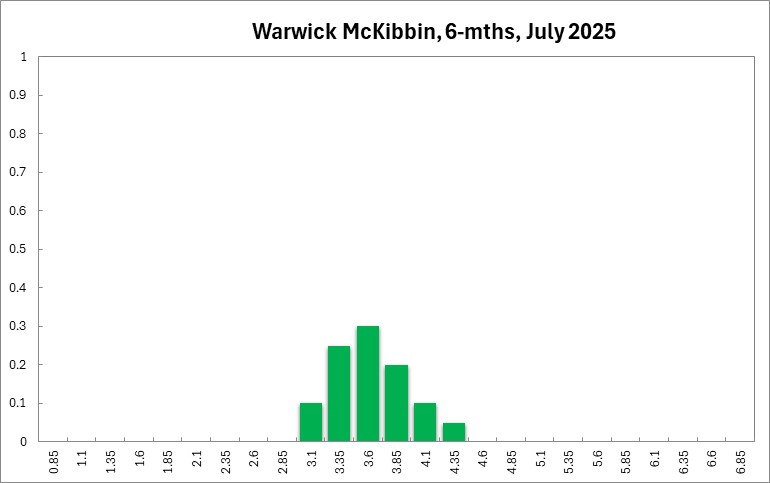

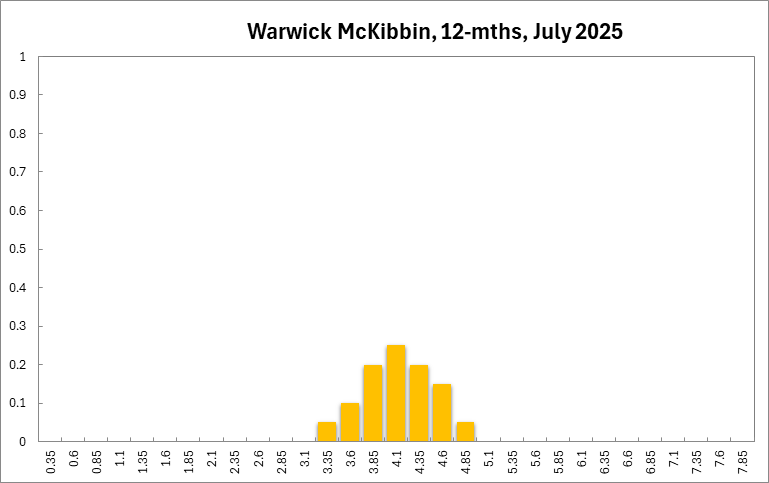

Warwick McKibbin

Current

6-Months

12-Months

3-Years

Comments

No comment.

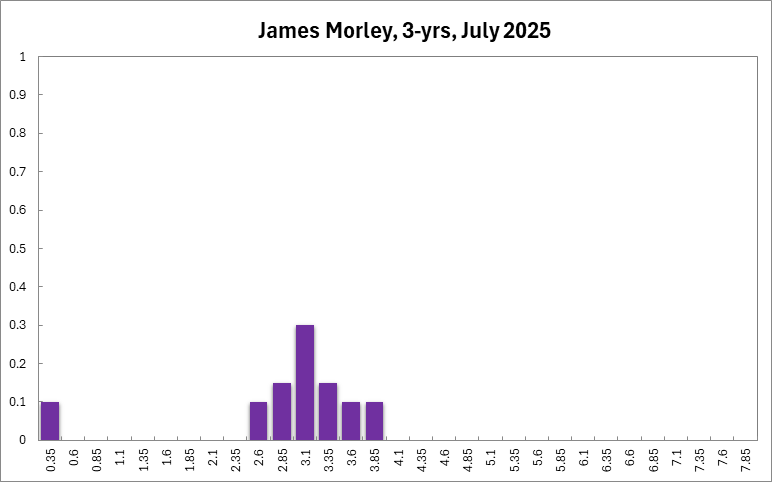

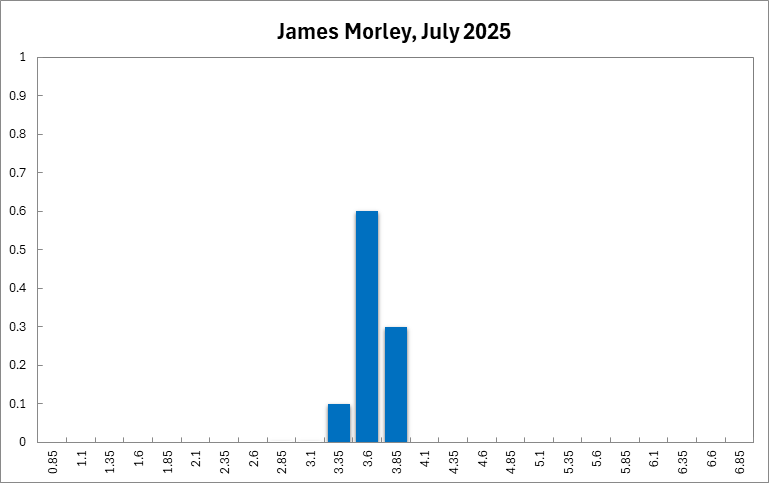

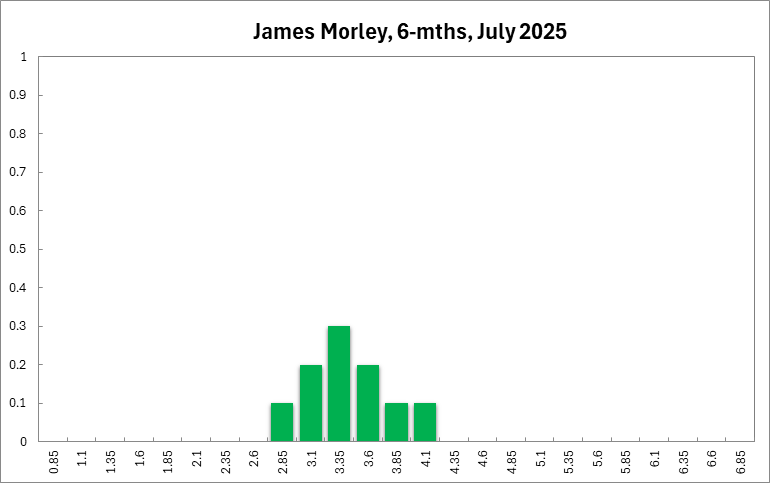

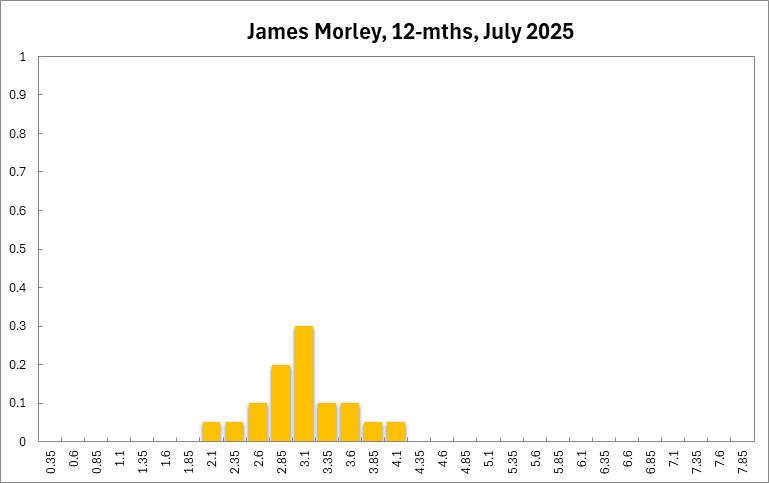

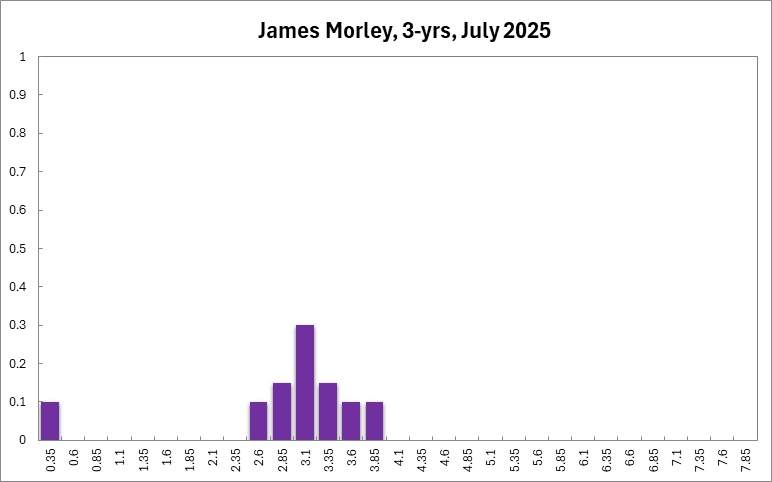

James Morley

Current

6-Months

12-Months

3-Years

Comments

No comment.

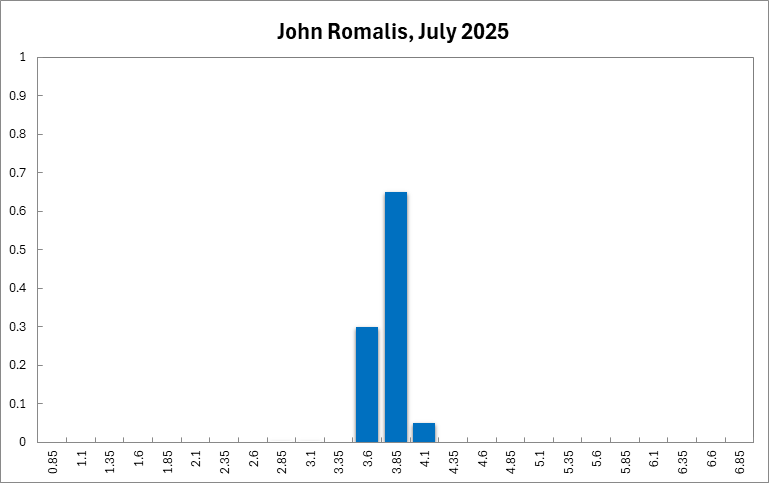

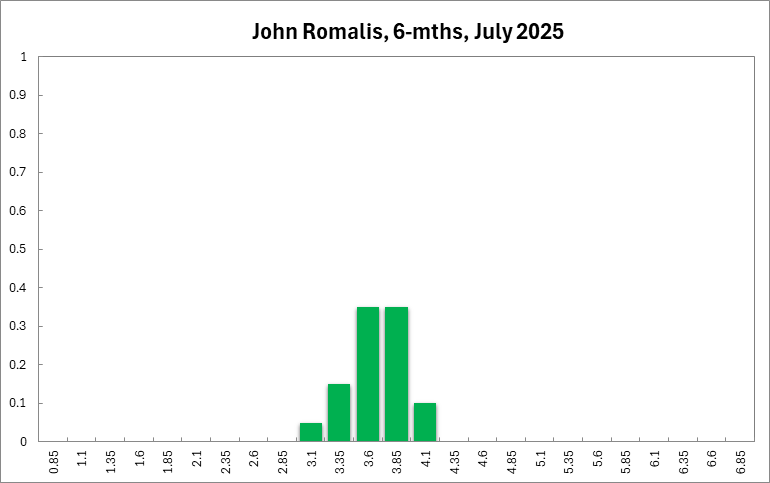

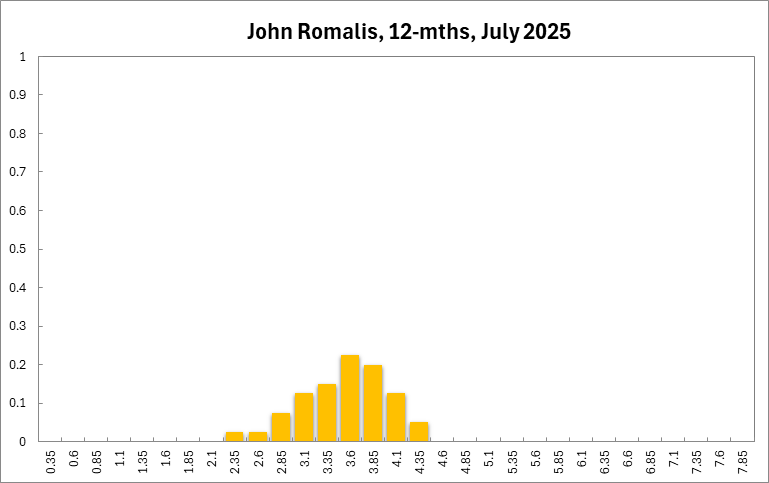

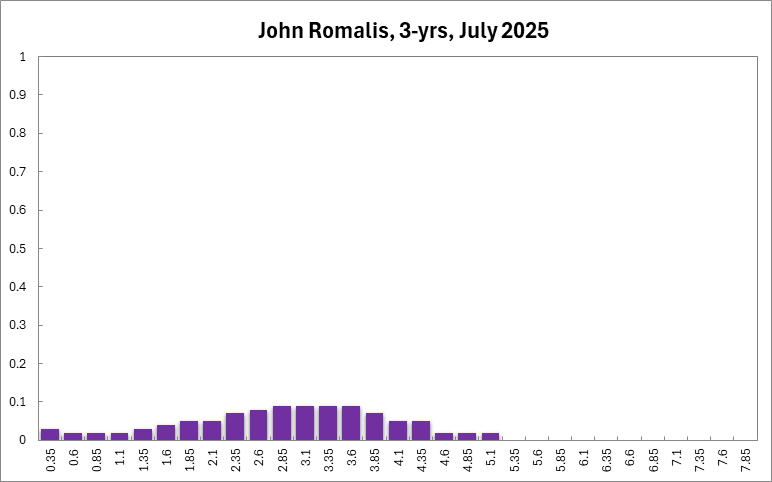

John Romalis

Current

6-Months

12-Months

3-Years

Comments

No comment.

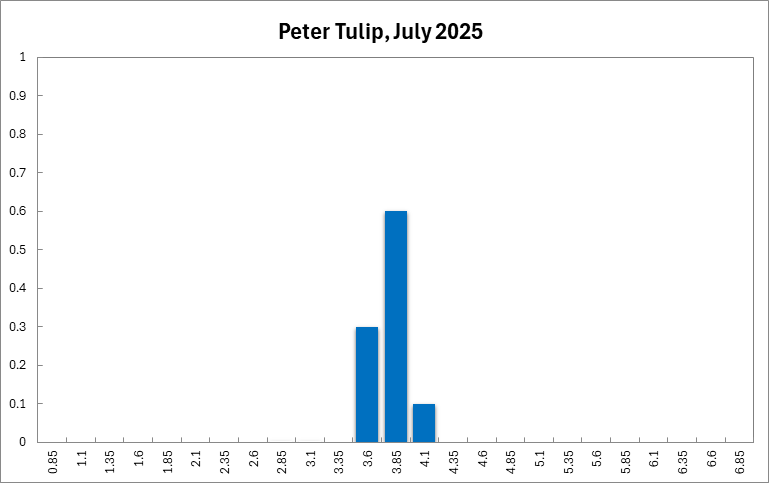

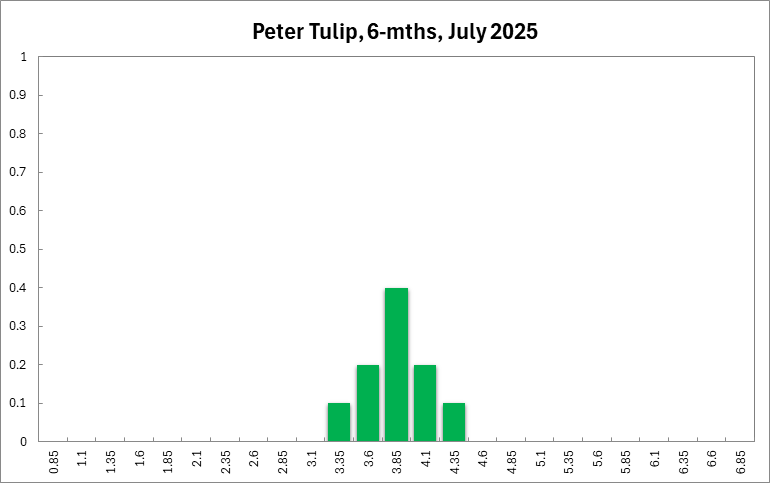

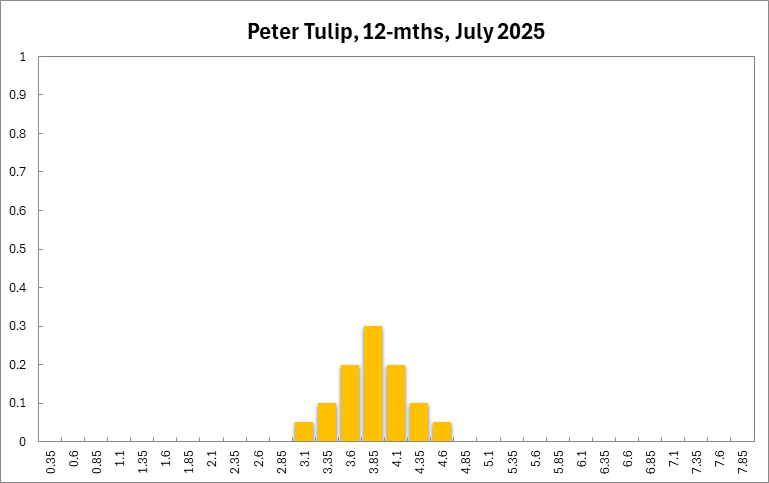

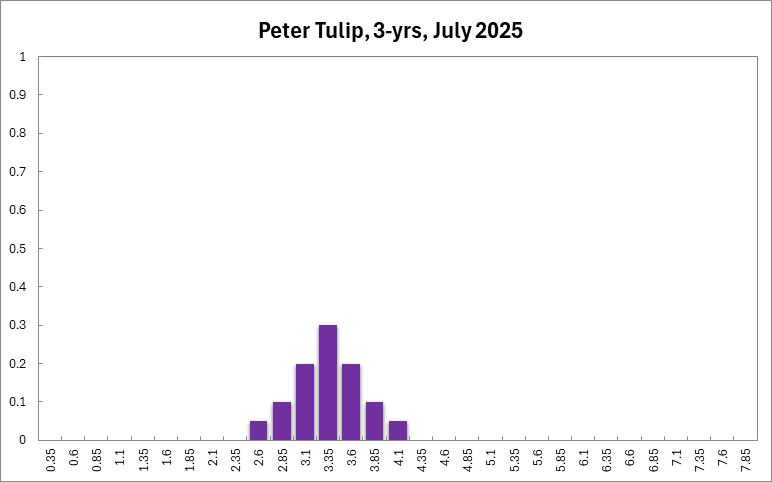

Peter Tulip

Current

6-Months

12-Months

3-Years

Comments

The trimmed mean CPI has come in below expectations. By a bit, relative to RBA and market forecasts; by more relative to what I was expecting; especially as unemployment is also lower.

Some of this looks like lower persistent pressure, so the inflation outlook is lower also, justifying a downward revision to the path of the cash rate.

Partially offsetting this, unemployment has also come in lower.

And the market and RBA are greatly overstating the effect of Trump’s tariffs on Australian monetary policy. A trade war will weaken our terms of trade, putting downward pressure on the $A, increasing inflation. The RBA’s reliance on “confidence effects” (on which they have been wrong in the past) suggests the forecasts are being fudged.