The significant depreciation of the AUD over the past month should be both supportive of growth and shifts the balance of inflation risk to the upside. The looser financial conditions implied by the lower currency means that a further cash rate cut should be unnecessary at this stage. I recommend the cash rate is left unchanged at 2.75% this month.

Outcome: June 2013

Whither the Aussie Dollar?

Since the RBA dropped the cash rate to 2.75 percent last month the Australian dollar has fallen to below 96 US cents, a depreciation of more than 7 percent against the US dollar. With weaker data coming from China, India and Europe and mixed data coming from the US, the rapid fall in the Aussie dollar highlights the downside risks to the Australian economy, as perceived by the markets. Will the dollar slide further in anticipation of mounting downside risks, or will the current level suffice to boost Australian exports and breathe new life into the Australian economy?

The tug-of-war between the need to lower the cash rate due to sustained weakness in the Australian economy and the need to raise the cash rate in response to the expansionary stimulus emanating from the historically low cash rate and the weakened Aussie dollar, is clearly on the minds of the shadow board members.

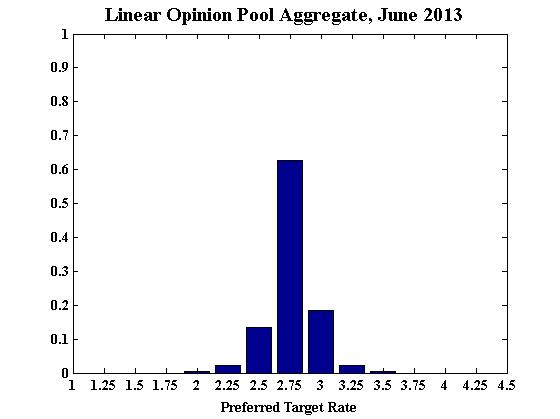

The strong consensus of the nine members is that the Reserve Bank of Australia should leave interest rates unchanged from May at 2.75 percent.

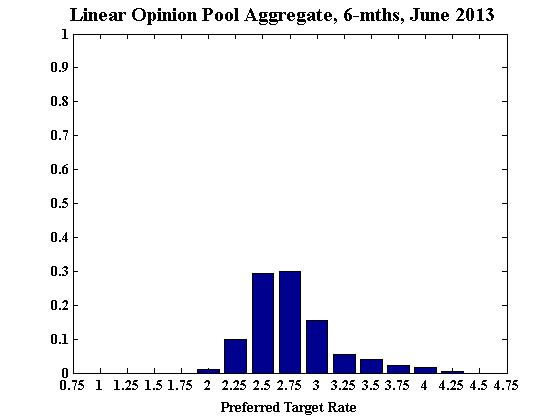

The probability that rates should rise in the next six months equals approx. 1/3, somewhat less than the risk that rates should be lower.

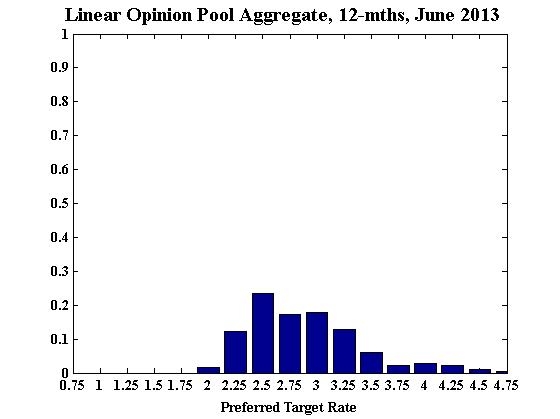

Over the longer term, in the next twelve months, the Shadow Board members anticipate that the probability of a rate increase is around 40 percent, slightly more than the probability of a fall. Overall, compared to previous months, there has been a small shift in favour of lower interest rates at the 6-month and 12-month horizon, reflecting concerns about muted consumption, weaker global demand, falling commodity prices and tighter fiscal policy following a likely change of government later this year.

Aggregate

Current

6-Months

12-Months

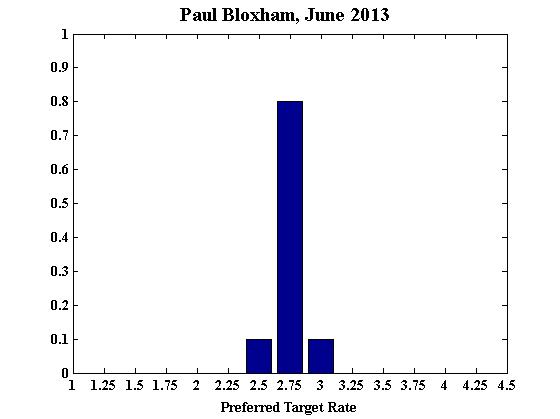

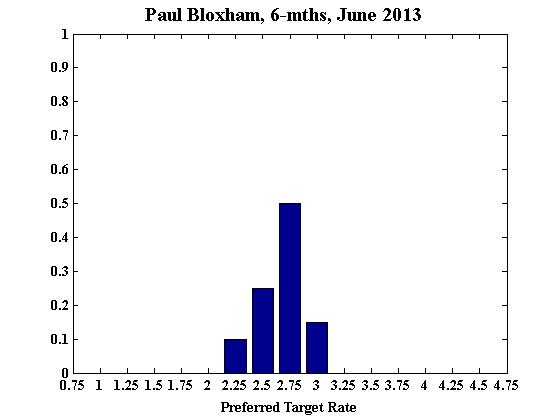

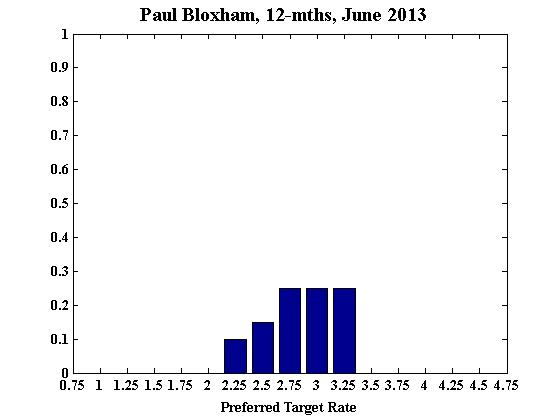

Paul Bloxham

Current

6-Months

12-Months

Comments

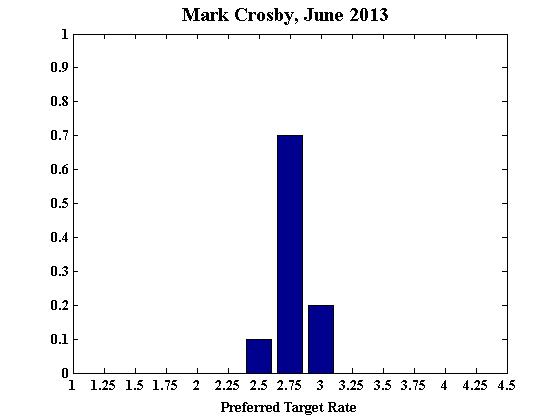

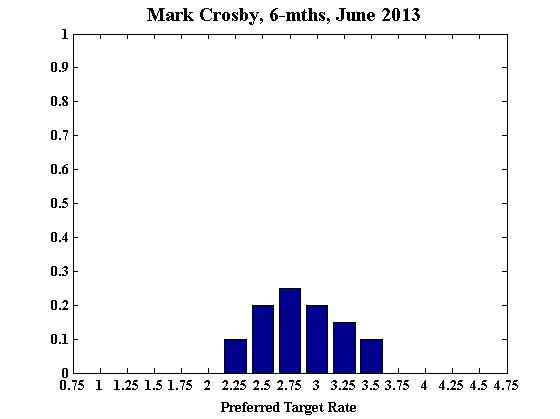

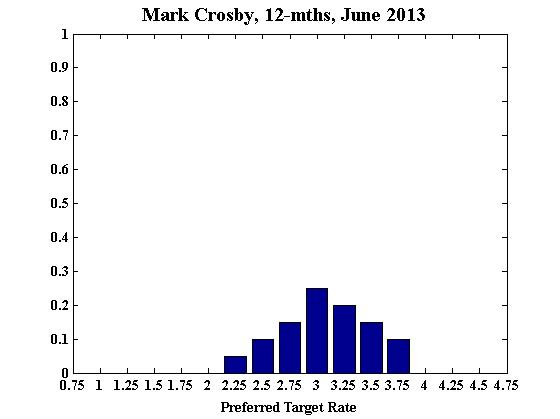

Mark Crosby

Current

6-Months

12-Months

Comments

Recent weakness in the AUD would suggest a pause in rate cuts. International data signals are mixed and market reactions complicating policymaking. Weakness in US GDP interpreted as reducing the likelihood of an earlier end to QE and thus strengthening asset markets being a case in point. One would suggest that in some QE countries asset price bubbles are becoming a serious issue - though the Fed has of course ignored these dangers in the past.

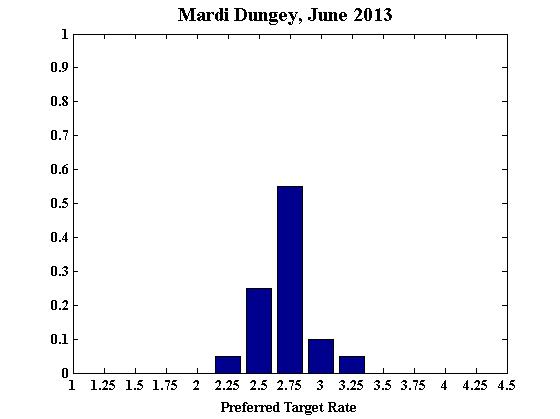

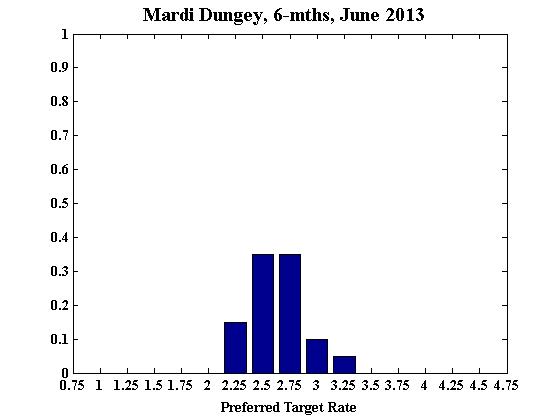

Mardi Dungey

Current

6-Months

12-Months

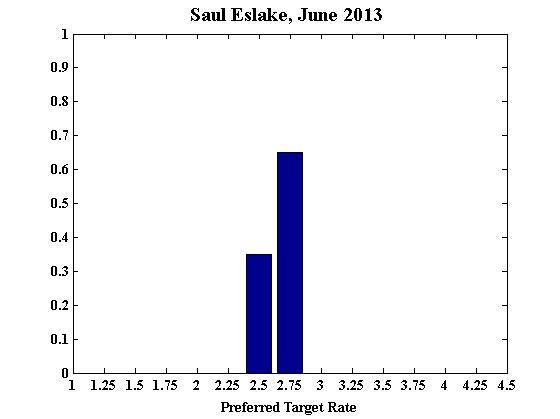

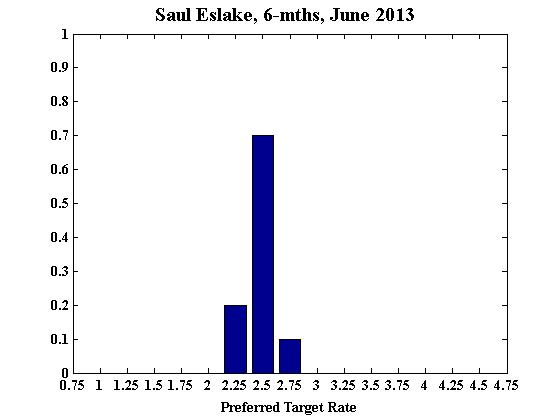

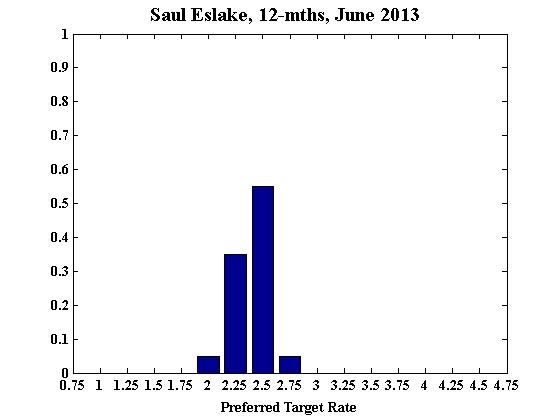

Saul Eslake

Current

6-Months

12-Months

Comments

The decline in the exchange rate since the last Board meeting reduces the pressure on the RBA to implement a second successive rate cut, while the data flow over the past month hasn't presented any compelling rationale for a further rate cut.

The currency may not fall a lot further, while the economy is likely to remain sluggish and the incoming government will probably seek to tighten fiscal policy more than is currently planned.

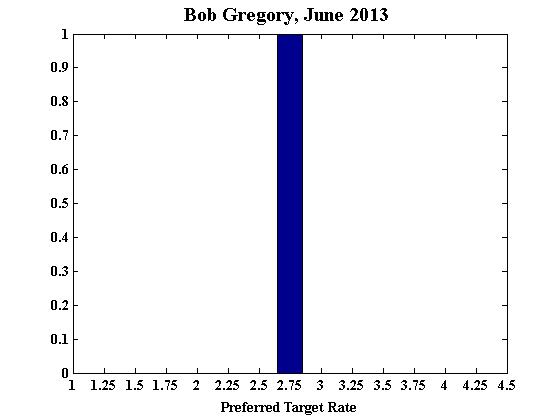

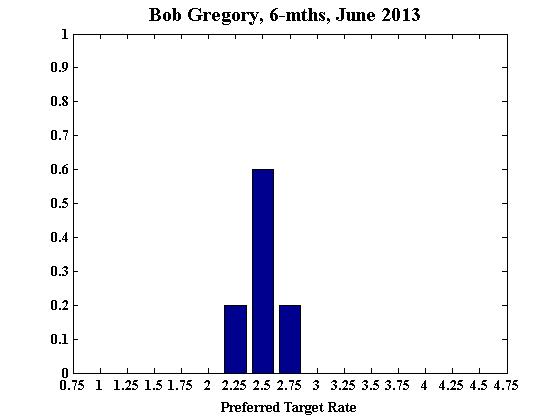

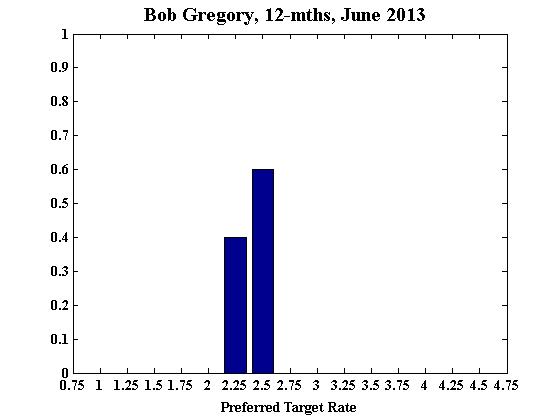

Bob Gregory

Current

6-Months

12-Months

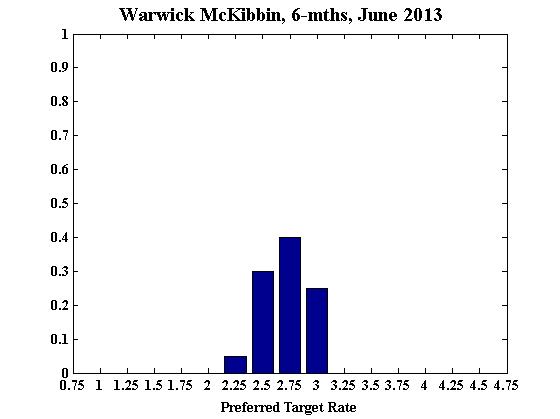

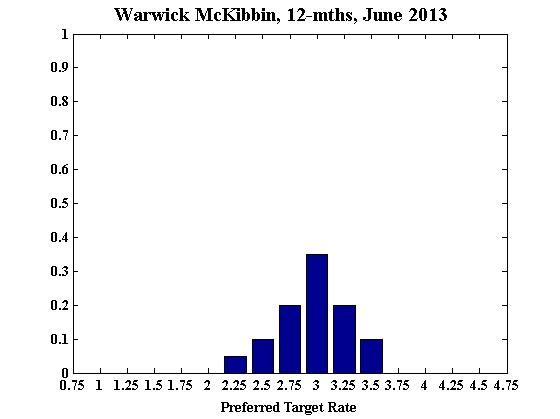

Warwick McKibbin

Current

6-Months

12-Months

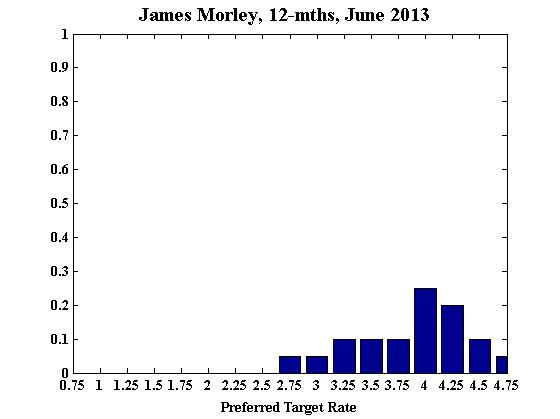

James Morley

Current

6-Months

12-Months

Comments

Monetary Policy Too Loose:

With inflation at 2.5% and expected to remain within the target range of 2-3%, the real cost of borrowing is far below its neutral level. This risks propping up a housing-market bubble, a collapse in which will become more difficult to address with monetary policy alone the longer it persists. Policy should focus on aggregate conditions and adjust back towards a more neutral stance over the medium term.

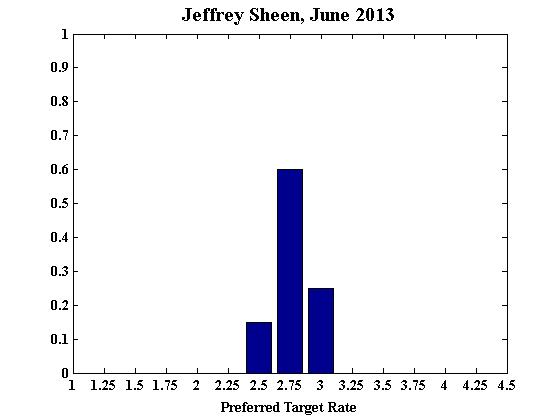

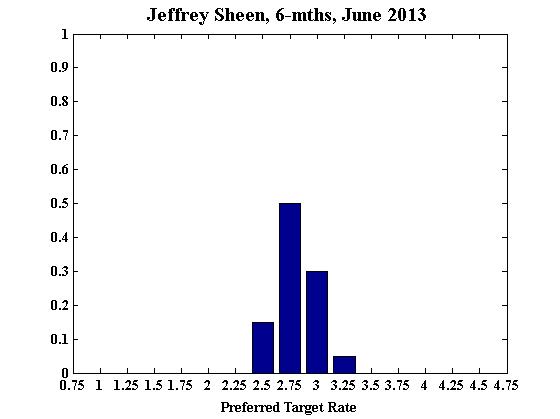

Jeffrey Sheen

Current

6-Months

12-Months

Comments

The recent weakening in private sector investment (across all sectors) in Australia is not matched yet by demand increases elsewhere in the economy including the government sector. The trade-weighted exchange rate has depreciated 8% since mid-April, and alongside the positive outlook in Japan plus the gradually recovering global economy, Australian net exports should eventually improve. However there is a fair risk that the likely change in the Australian government will lead to even tighter fiscal policy. Thus I consider the current accommodative stance appropriate, and expect minor tightening to be required in 6 to 12 months, depending on the election outcome.

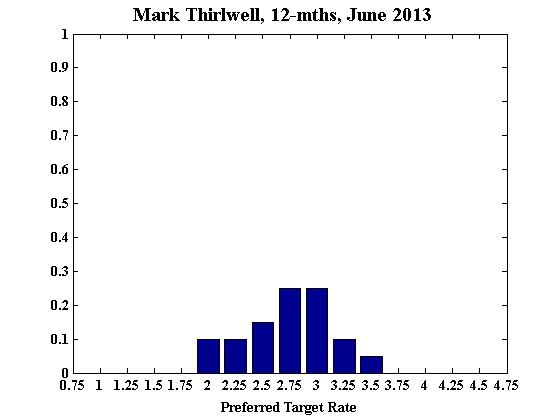

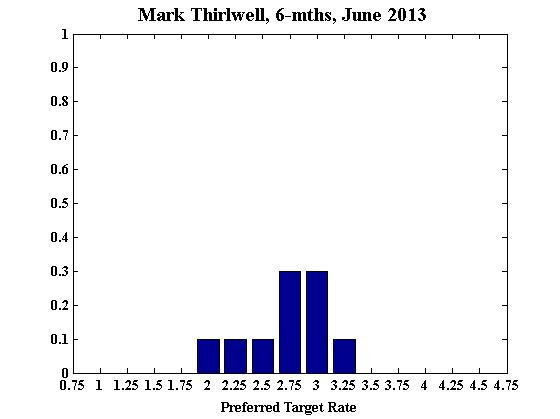

Mark Thirlwell

Current

6-Months

12-Months