Little has changed since last month, despite the election of Donald Trump in the United States. Uncertainty around the international environment is now greater than a month ago, but key international economies continue to muddle through. In this environment there is little reason for the RBA to move in either direction, despite protestations by the Eurocentric OECD that countries like Australia should raise rates so as to strengthen our exchange rate and weaken our economy to the benefit of Europe.

Outcome: December 2016

No Need for Pre-Xmas Rate Change: Shadow RBA Board

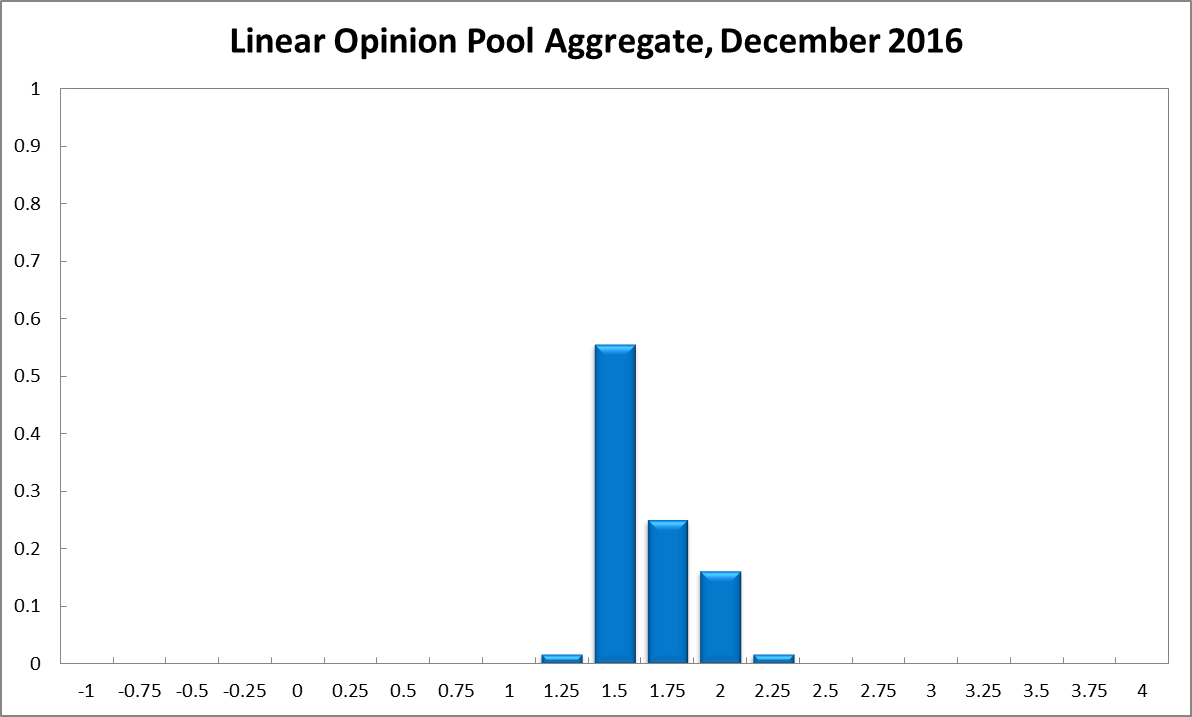

The course of the world’s largest economy has become less certain with Donald Trump unexpectedly triumphing in the US Presidential election. On the other side of the Atlantic, Europe is bracing itself for more trouble as it stands by watching Italy hold a referendum on a change to its constitution. Domestically, unemployment is flat, while consumer price inflation, at 1.0% year-on-year, remains well below the RBA’s 2-3% target band. The CAMA RBA Shadow Board continues to believe that the cash rate should remain at its current level but the probabilities for a required interest rate increase have strengthened on all horizons. The Shadow Board attaches a 56% probability to a rate hold being the appropriate policy setting. The confidence attached to a required rate cut equals 2%, while the confidence in a required rate hike equals 43%.

There is little inflationary pressure emanating from the Australian labour market, with Australia’s unemployment rate still estimated to be 5.6%, according to the Australian Bureau of Statistics. Part-time and full-time employment figures continue to yoyo around on a monthly basis, making these numbers difficult to interpret. New data indicates that nominal wages grew a modest 1.9%, year-on-year.

The Aussie dollar, relative to the US dollar, has depreciated since last month, temporarily trading as low as 73.1 US¢ on 21 November. Since then the dollar has rebounded and is now hovering around 74.5 US¢. Yields on Australian 10-year government bonds have continued their bounce from recent historical lows. They now equal 2.88%. Domestic share prices joined the global rally but are now consolidating, with the S&P/ASX 200 stock market index trading near 5,500.

Worldwide, more uncertainty enthrals financial markets and policy makers. After Donald Trump’s surprise win of the US Presidential election, financial markets rallied but this may be short-lived. Across the globe, people are trying to predict what a Trump Presidency will look like, whether Trump’s policies will match his campaign rhetoric and the the implications of his policies, many of which do not neatly fit into the traditional left-right spectrum. Europe is on edge about this Sunday’s Italian referendum to change the Italian constitution, with a banking crisis and further political turmoil looming on the horizon.

With the US Presidential election out of the way and the US economy holding up for the time, the Federal Reserve Bank in the US may start in earnest to lift the federal funds rate. The Organization of the Petroleum Exporting Countries (OPEC) met again in Vienna to agree on production cuts, with pundits estimating that the world price for crude oil could settle around US$ 60 a barrel. These developments, along with recent data pointing to an uptick in global inflation, suggest slight upward pressure for global prices. Eventually, this pressure is likely to spill into the domestic economy; hence the Shadow Board’s slight revision of preferred interest rates to the upside.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, is virtually unchanged from the previous month. The manufacturing and services PMI, which measure the performances of the manufacturing and services sectors, have strengthened again, from 50.9 to 54.2 and from 48.9 to 50.5, respectively. The AIG Performance of Construction Index (PCI), after its recent blip up, fell again, from 51.4 in September to 45.9 in October. Building permits declined for the third month in a row, this time by 12.6%, which points to an overall weakening of the housing market.

The Shadow Board’s preference for the optimal interest rate has shifted a little. It now attaches a 56% probability (64% last month) that “no change” is the appropriate policy, a 2% probability (4% last month) that a rate cut is appropriate and a 43% probability (32% in the previous month) that a rate rise, to 1.75% or higher, is appropriate.

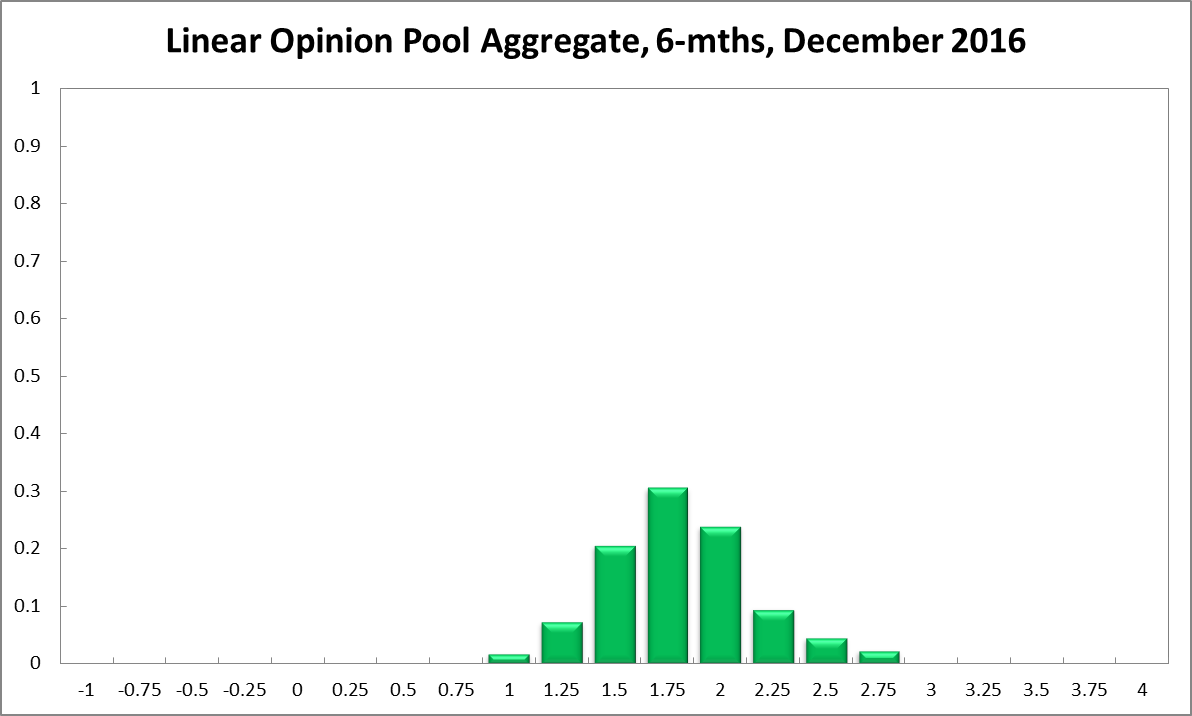

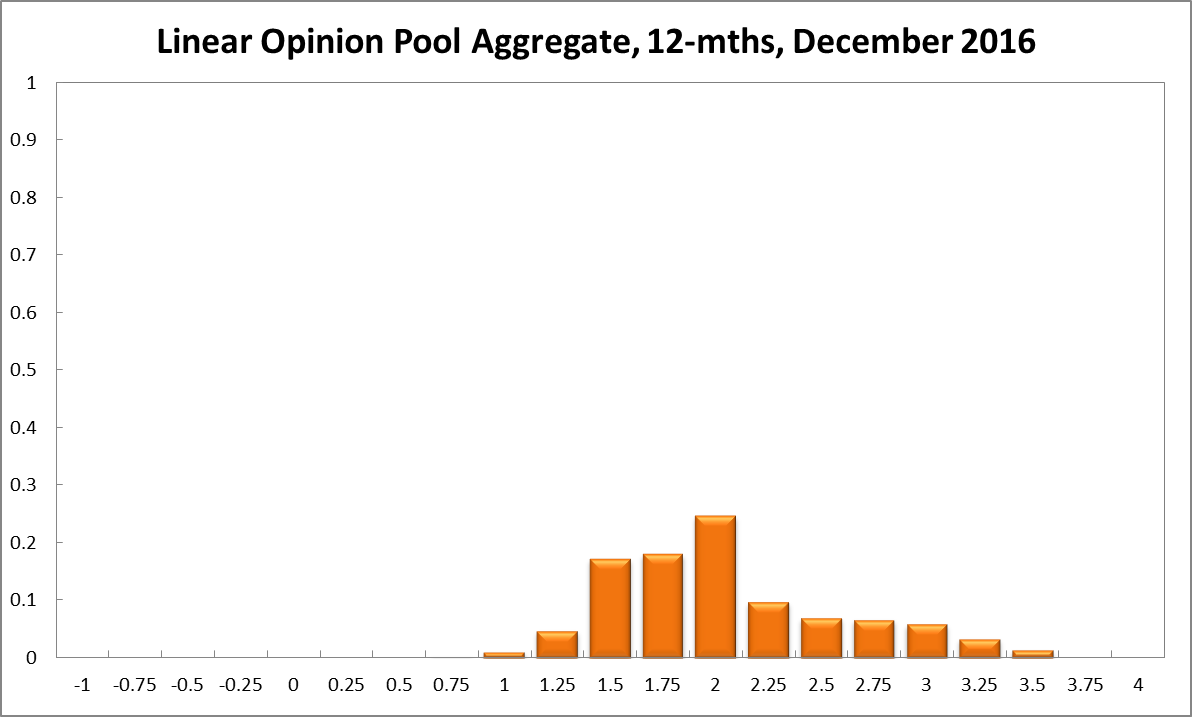

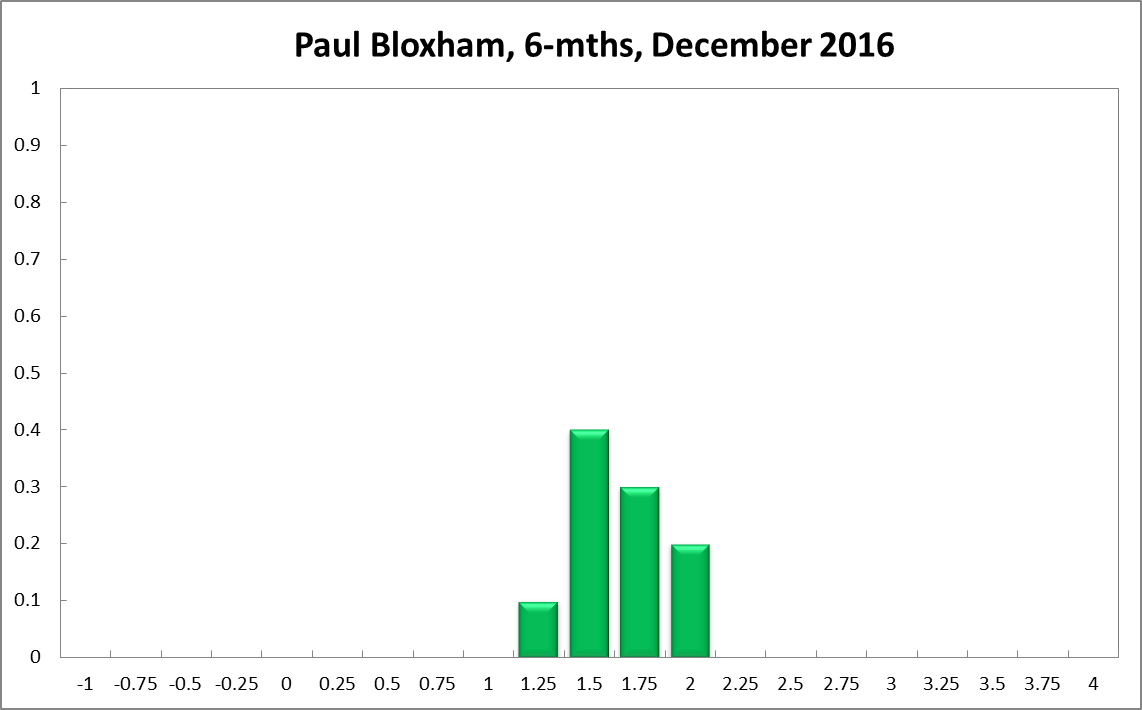

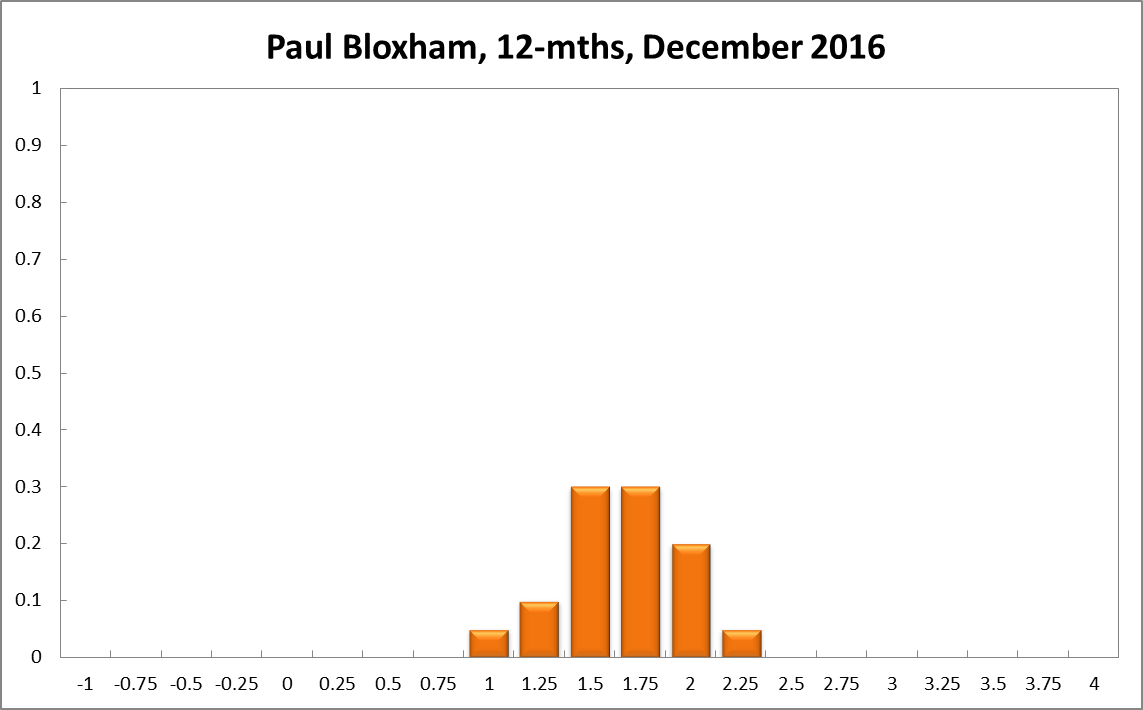

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.50% equals 21%, three percentage points down from the previous month. The estimated need for an interest rate decrease has fallen to 9% (down from 13% in November), while the need for a rate increase equals 71% (63% in November). A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 17% (18% in November), while the confidence in a required cash rate decrease fell four percentage points to 6% and the confidence in a required cash rate increase equals 77% (72% in November).

Aggregate

Current

6-Months

12-Months

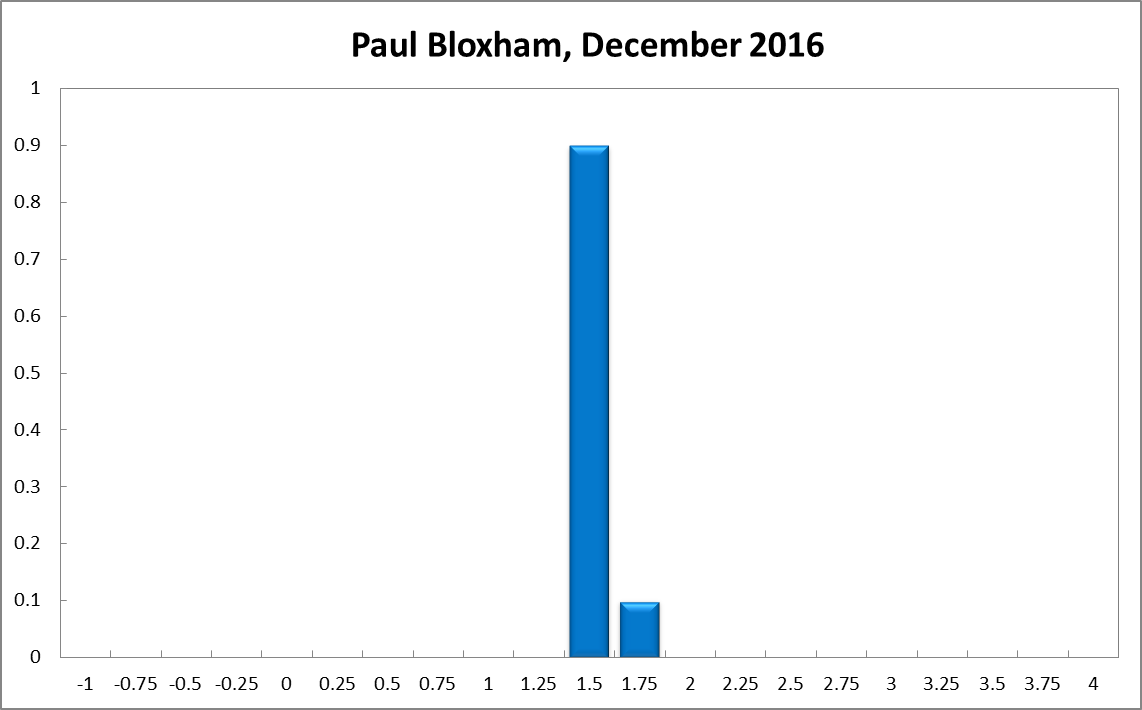

Paul Bloxham

Current

6-Months

12-Months

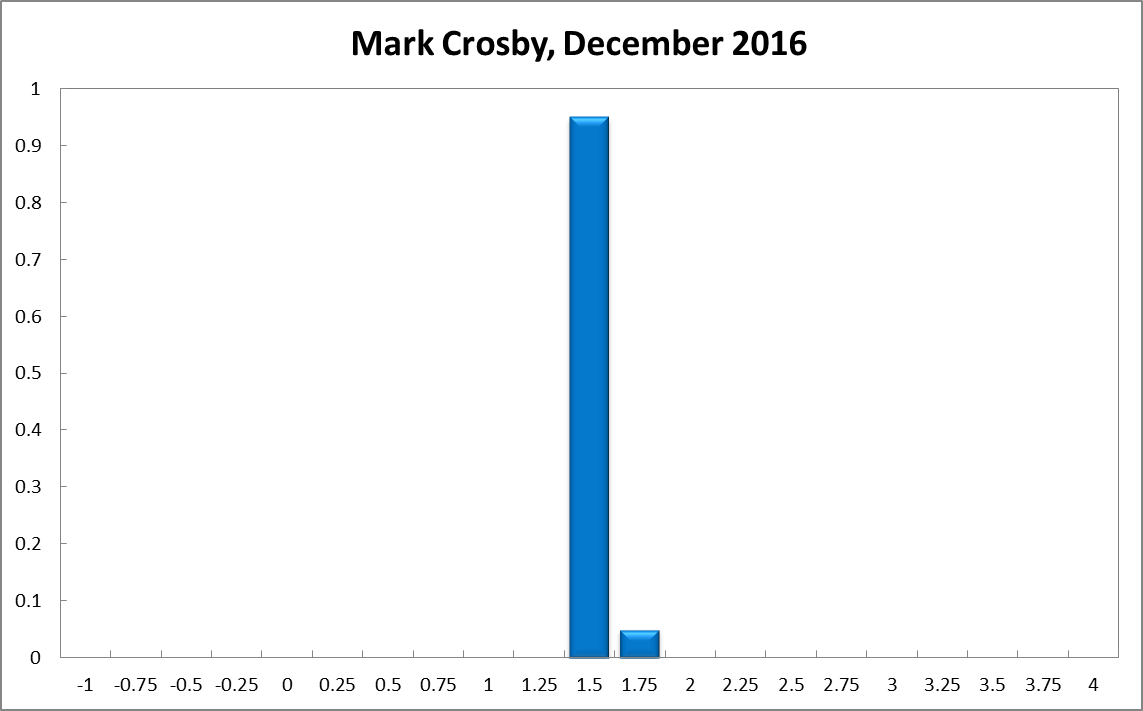

Mark Crosby

Current

6-Months

12-Months

Comments

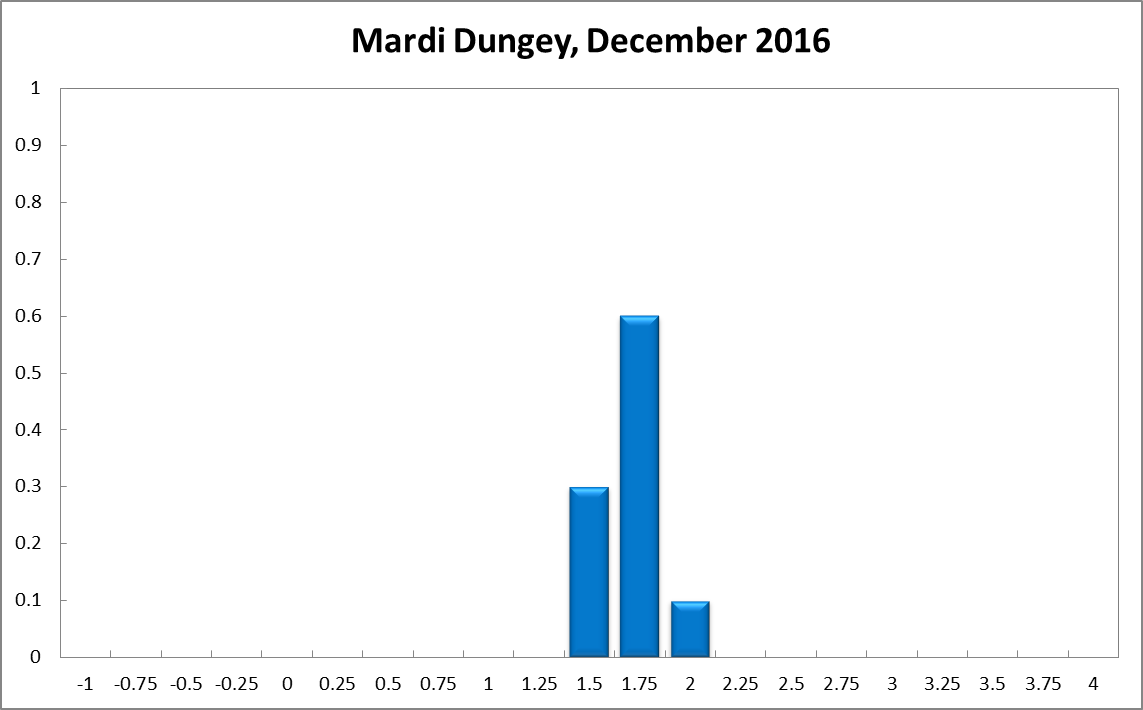

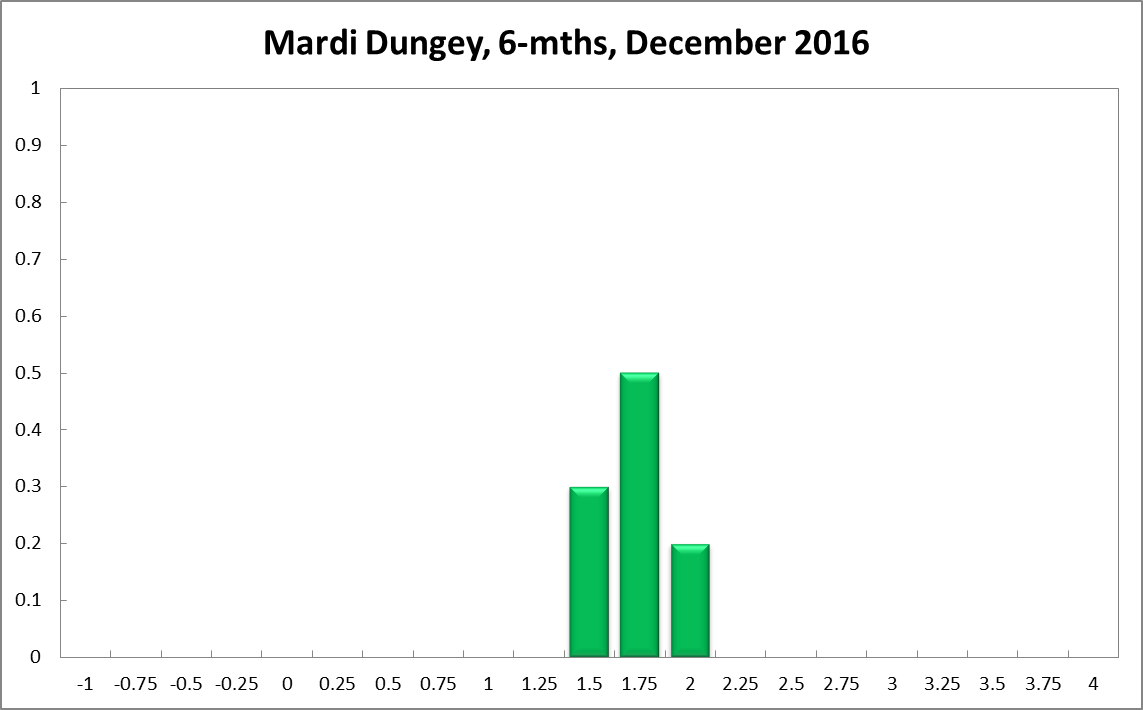

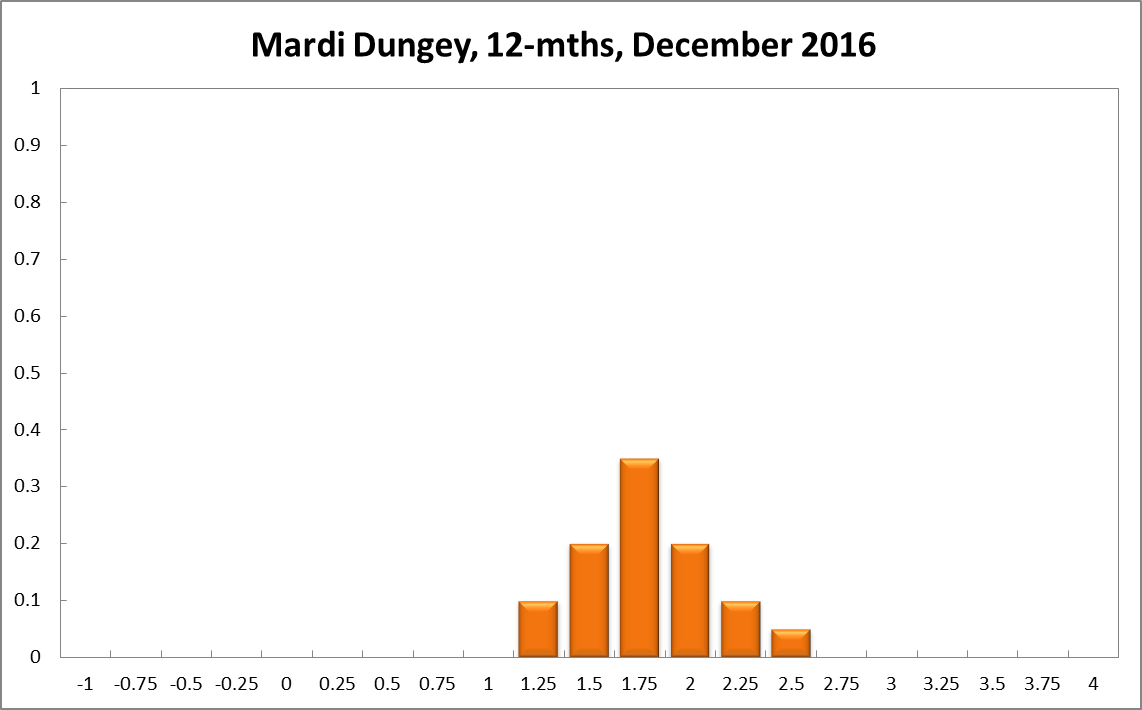

Mardi Dungey

Current

6-Months

12-Months

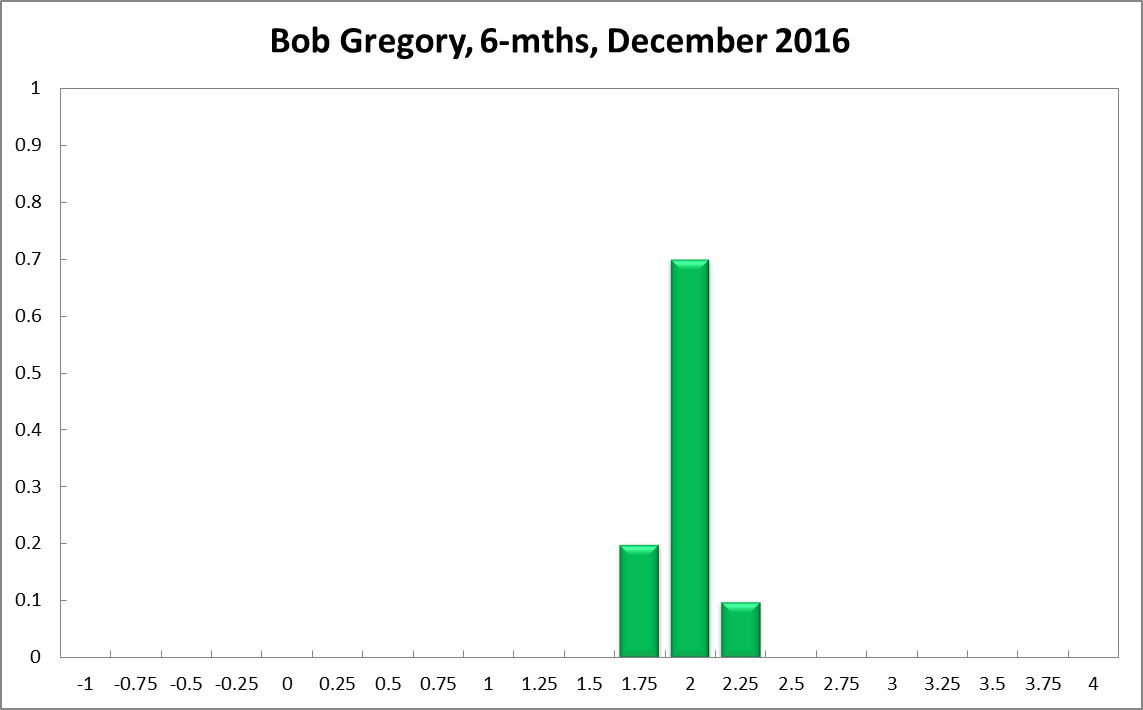

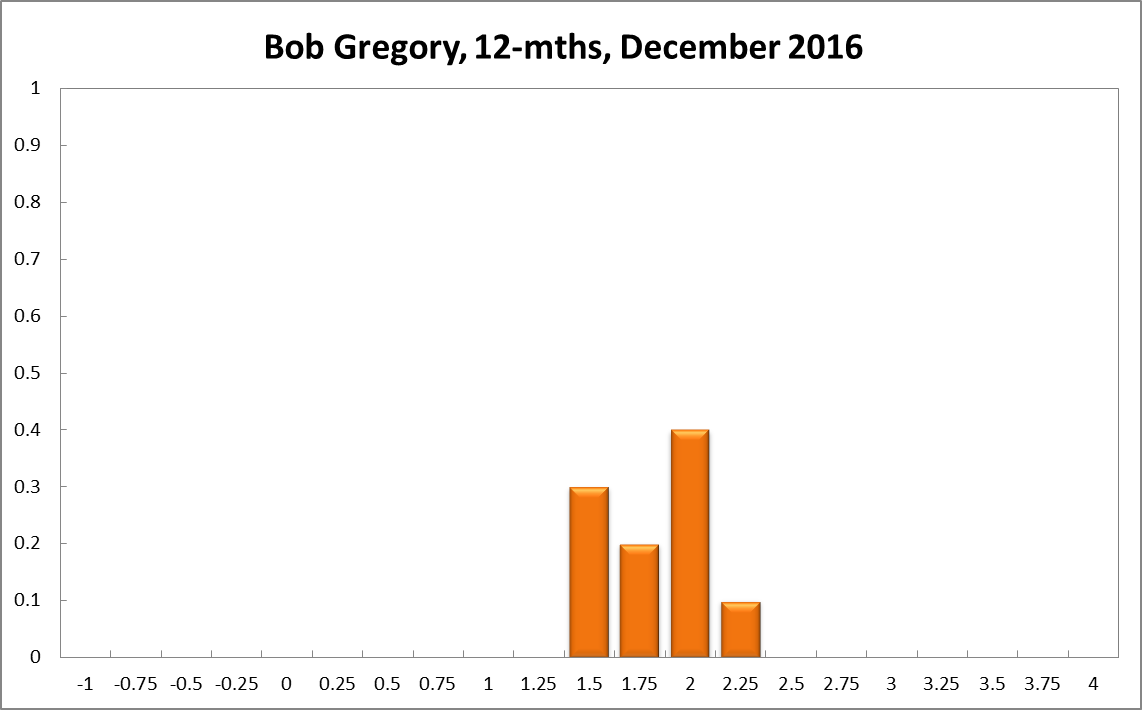

Bob Gregory

Current

6-Months

12-Months

Comments

I agree with the sentiments of Mark so I am just sitting tight with what I said last time. It is interesting though in that I have heard that there is some pressure around Canberra to encourage the RBA to do a little more stimulus as there is a view that the economy is beginning to weaken.

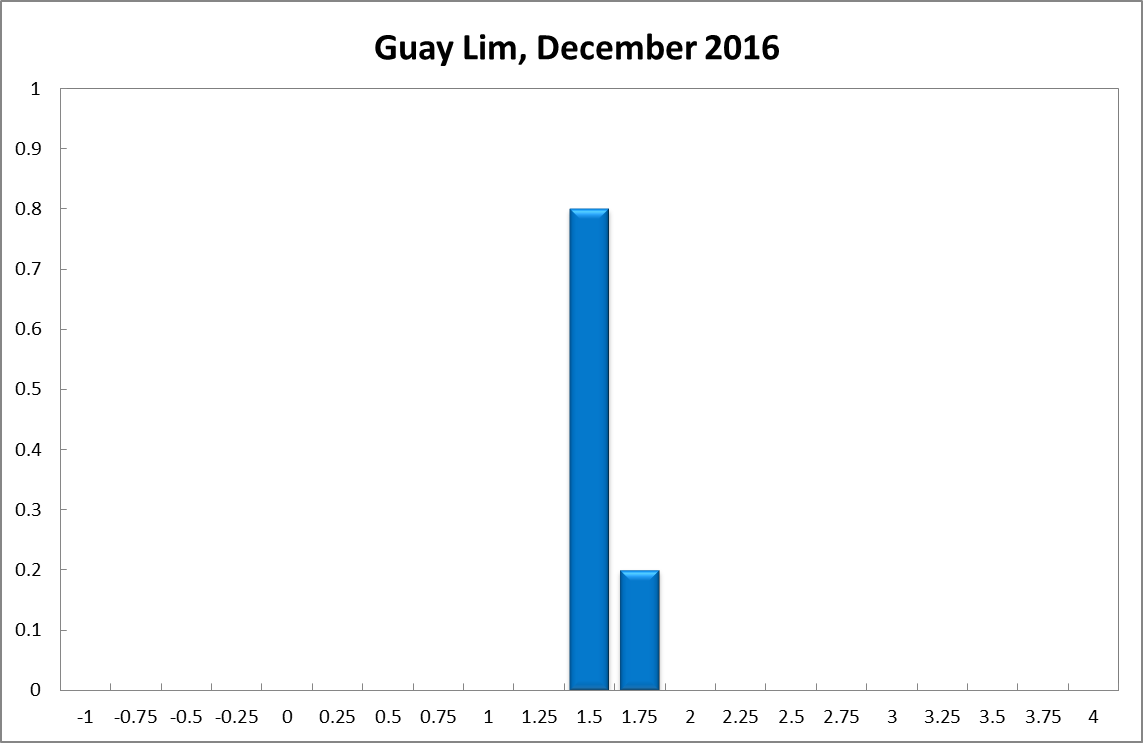

Guay Lim

Current

6-Months

12-Months

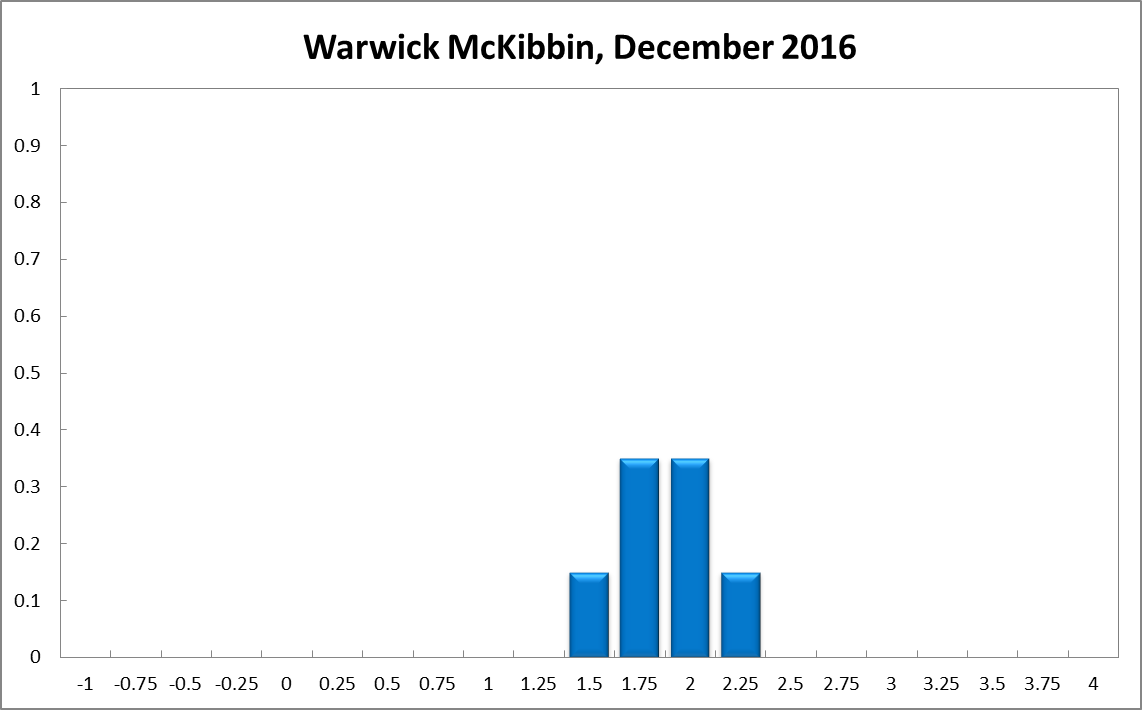

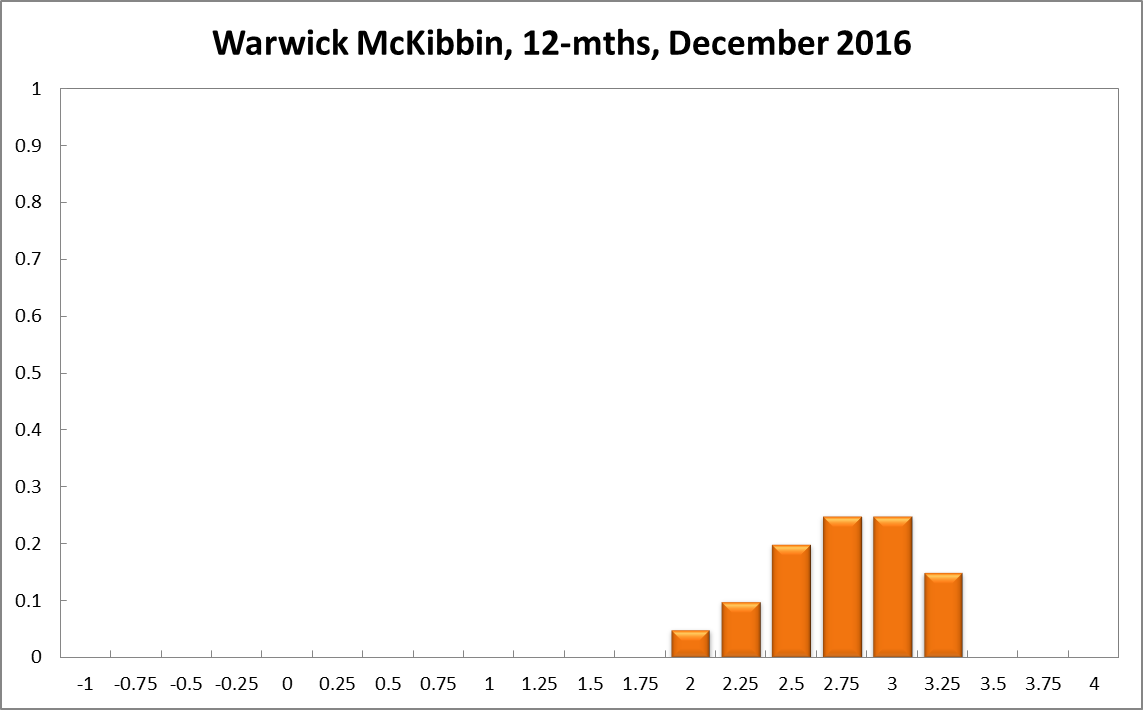

Warwick McKibbin

Current

6-Months

12-Months

Comments

The election of Donald Trump as US President has changed the term structure of global interest rates. As the US embarks on a tightening of monetary policy and loosening of fiscal policy global interest rates will likely rise. It is difficult to see how Australia will be able to follow a very different path of domestic interest rates under these circumstances.

James Morley

Current

6-Months

12-Months

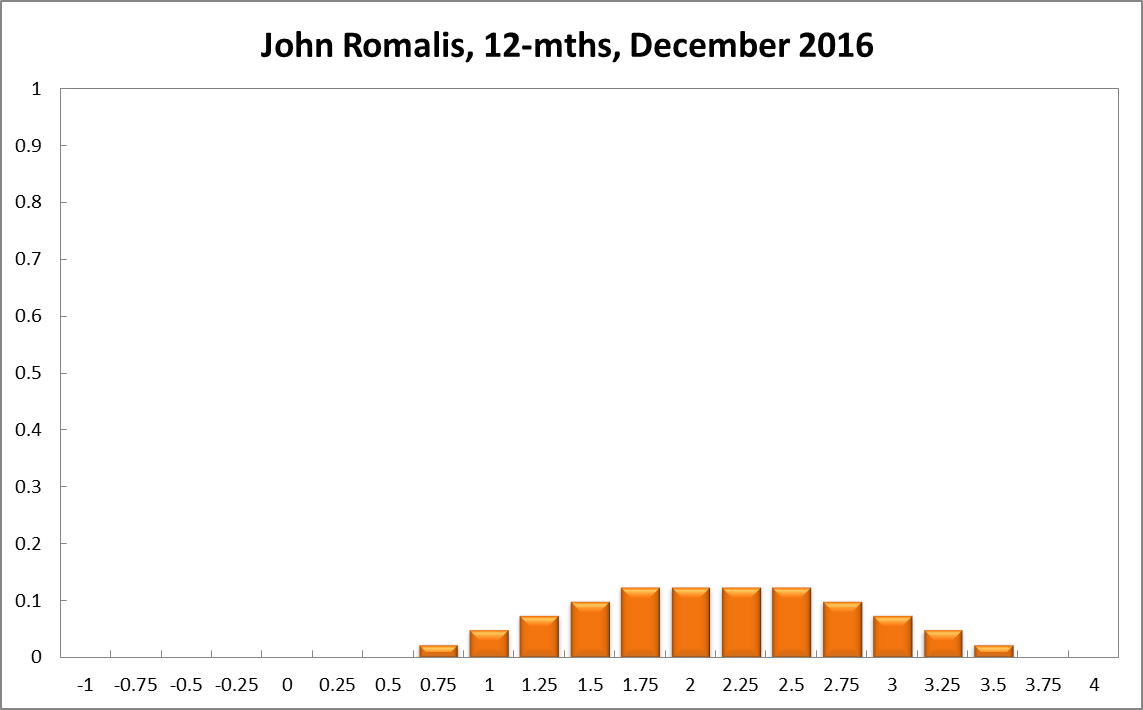

John Romalis

Current

6-Months

12-Months

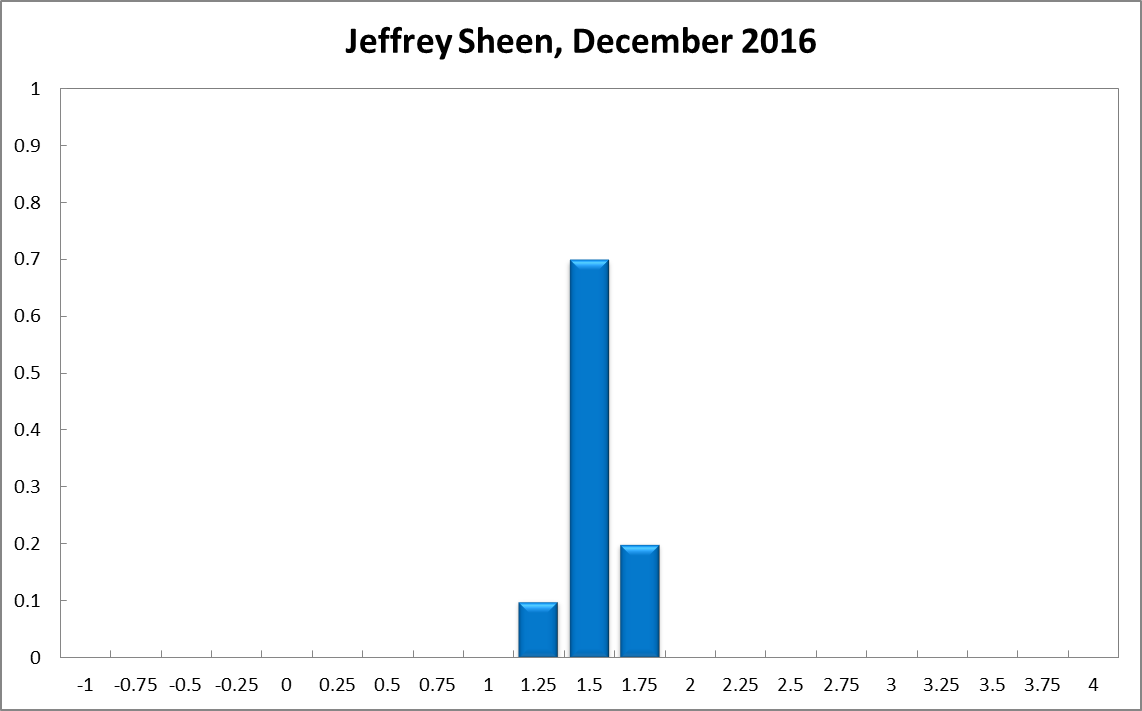

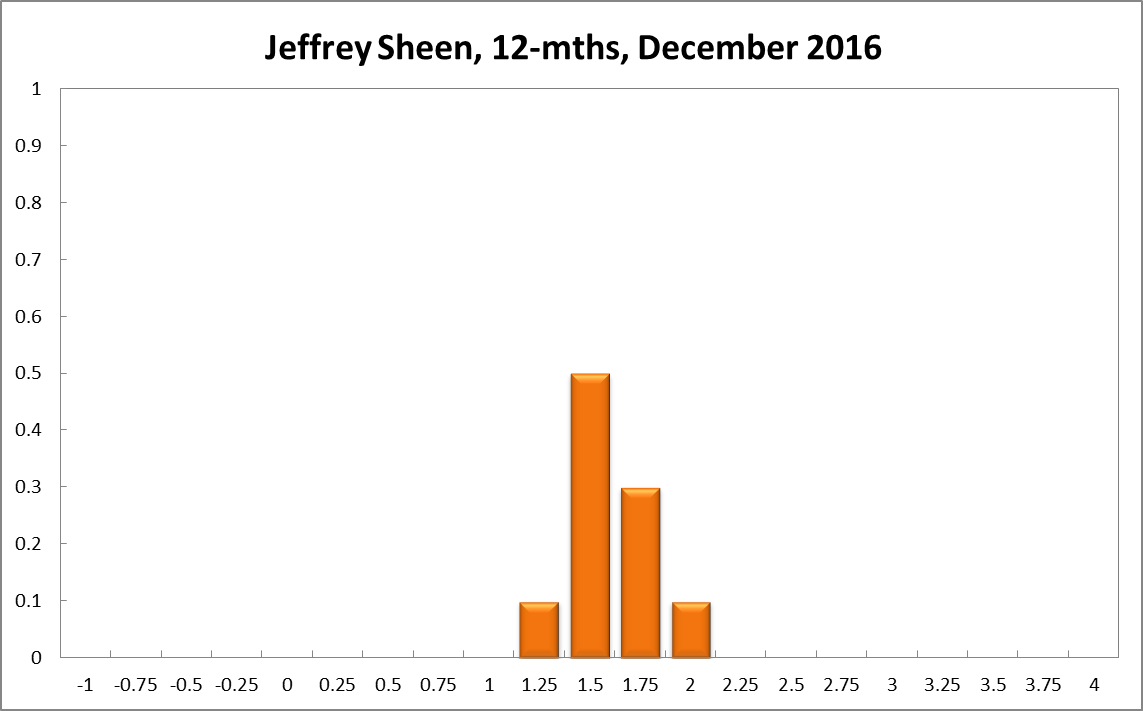

Jeffrey Sheen

Current

6-Months

12-Months

Comments

The Trump election appears to have changed sentiment in financial markets. Long term bond yields (as well as bank and construction stocks) have risen in anticipation of a large fiscal stimulus in the US. This stimulus is likely to come from tax cuts initially, and infrastructure investment later. However, there remains much uncertainty about the net macroeconomic effects of the Trump presidency---for example, because of the negative global impact of any heightened protection measures that may be introduced. One cannot be very confident about significantly higher expectations of future inflation and nominal and real interest rates in the US. The likely impacts of the new presidency on the Australian economy are even more uncertain at this stage.

The Australian economy is growing just above normal thanks to government and household expenditure and net exports, and despite negative private real investment growth. Dwelling investment approvals have also been shrinking, which is also a concern. Low interest rates are needed until non-mining investment turns around, and so the RBA should not raise the cash rate now. However my outlook for the future has shifted very marginally towards a tightening because of the possible Trump effect.