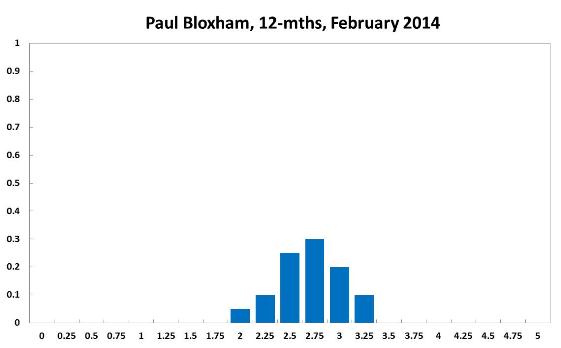

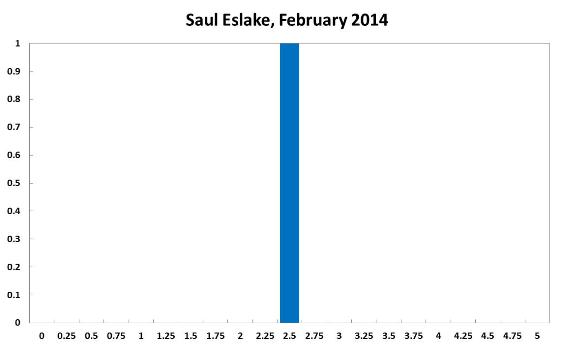

Timely demand indicators for the local economy have generally lifted since the last board meeting. Retail sales, building approvals and measures of local business conditions have all shown improvement over the past couple of months. The housing market has also continued to pick up strongly. Together, these indicators suggest that monetary policy is continuing to get traction in the economy. The recent fall in the Australian dollar has also helped to loosen financial conditions further. The recent lift in inflation suggests that there is unlikely to be much scope to cut interest rates any further during this easing phase, barring an unforeseen negative shock. I recommend that the cash rate is left unchanged at 2.50% and see it as more likely than not that the cash rate will need to be higher than its current level in 12 months time.

Outcome: February 2014

Divergence Between Financial Markets and the Real Economy Widens

Two months have passed since the CAMA RBA Shadow Board’s last interest rate setting and the uncertainties surrounding the domestic and foreign economies are not abating. Globally, asset markets are performing well but GDP growth remains subdued, pointing to a disparity that must be resolved eventually.

The picture for the Australian economy has not changed much since December. Inflation is well within the 2-3% target range, investment and consumption remain tepid. The economy is supported by historically low interest rates and an Aussie dollar that is now hovering around 87 US cents, a 21% fall from its recent peak. This expansionary policy setting is generating early signs of improvements in retail sales, building approvals and local business conditions.

Overseas, the picture continues to be characterized by uncertainty. While growth in US output has accelerated to an annualized rate of 3.2%, underscoring the Federal Reserve’s decision to scale down its asset purchases, the rest of the World is looking less promising. Europe will probably continue to show tepid growth as long as the debt overhang and structural problems are not fully addressed and China will likely settle on a lower growth trajectory, with the possibility of a more damaging credit crisis persisting.

Surprisingly, asset markets, domestically and overseas, have experienced double digit gains in 2013, fuelled by cheap credit and possibly excessive optimism. This divergence between the real economies and asset prices will ultimately need to narrow, either because global economic growth picks up significantly, validating the large increases in asset prices, or because asset prices will fall to more realistic levels.

Without a clear direction of where the Australian economy is heading, the consensus to keep the cash rate at its current level of 2.5% remains strong. The Shadow Board’s confidence in keeping the cash rate steady rose to 68% (up from 63% in December 2013). The probability attached to a required rate cut now equals 3% (7% in December) while the probability of a required rate hike equals 28% (30% in December).

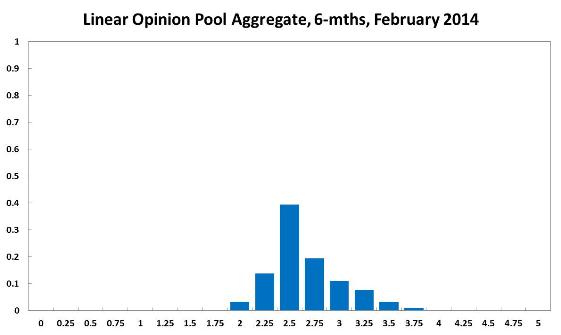

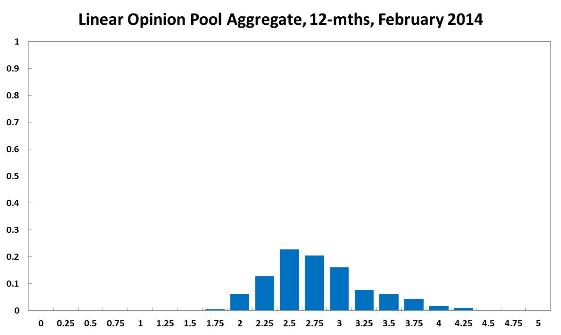

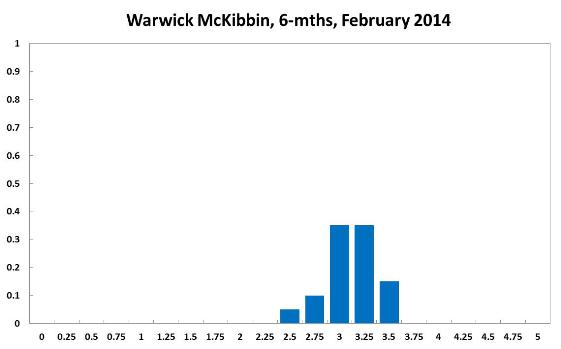

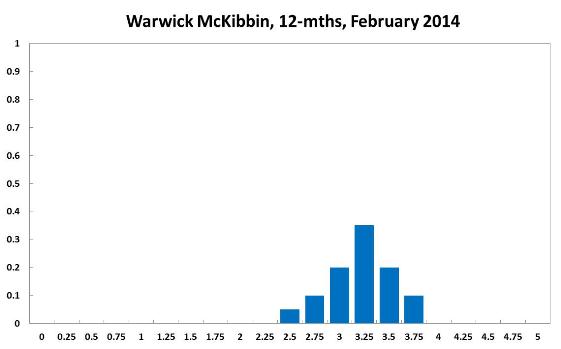

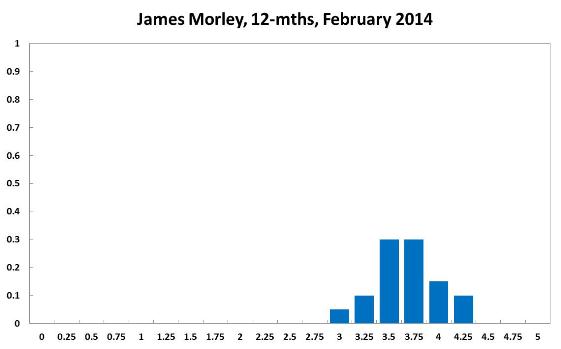

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% has increased to 39% (up from 34% in December 2013). The estimated need for an interest rate increase fell three percentage points to 44%, while the need for a decrease has nudged down to 17% (18% in December). A year out, the Shadow Board members’ confidence in a required cash rate equals 58% (59% in November), the need for a decrease has fallen further to 19% (21% in December), while the probability for a rate hold is given by 23% (up from 20% in December).

Aggregate

Current

6-Months

12-Months

Paul Bloxham

Current

6-Months

12-Months

Comments

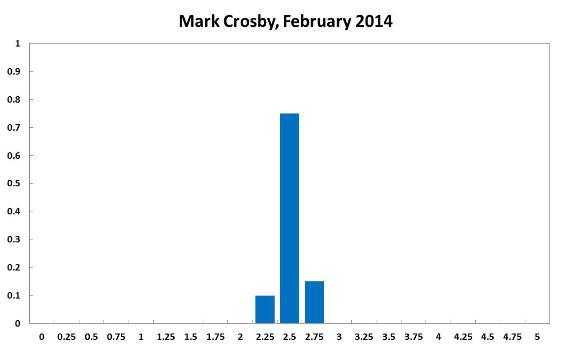

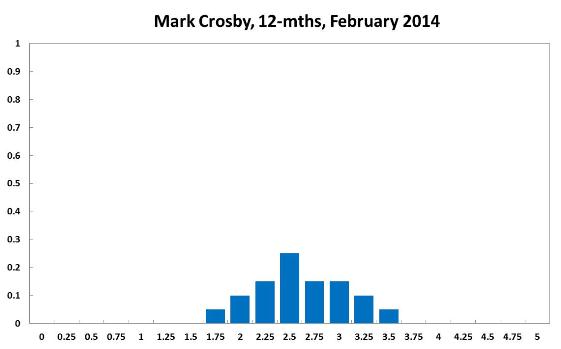

Mark Crosby

Current

6-Months

12-Months

Comments

Current: Continuing uncertainty about the speed and impact of tapering suggest adjustments to monetary policy in the short term ought to be made with caution.

6-12 month: At the 6 to 12 month horizon the RBA will have to juggle continued weakness in advanced economies, and some important emerging markets against the problems of inflation and asset price growth caused by continued low interest rates.

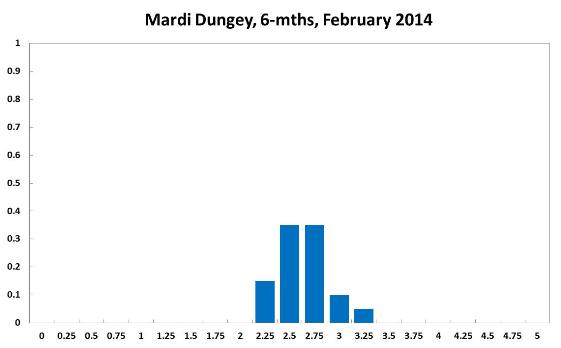

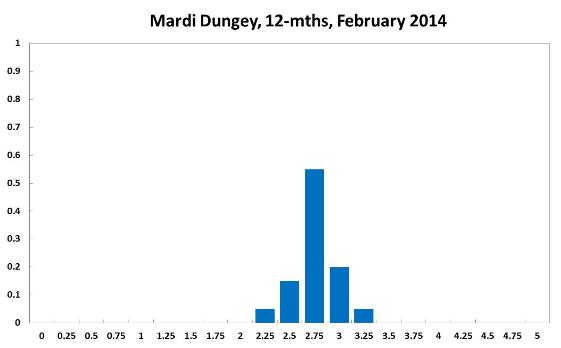

Mardi Dungey

Current

6-Months

12-Months

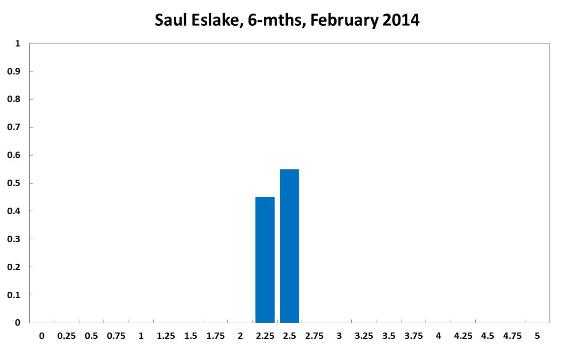

Saul Eslake

Current

6-Months

12-Months

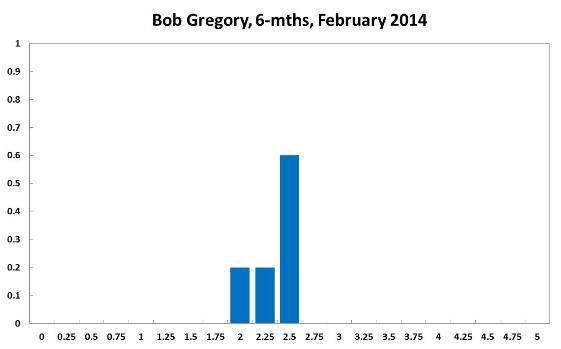

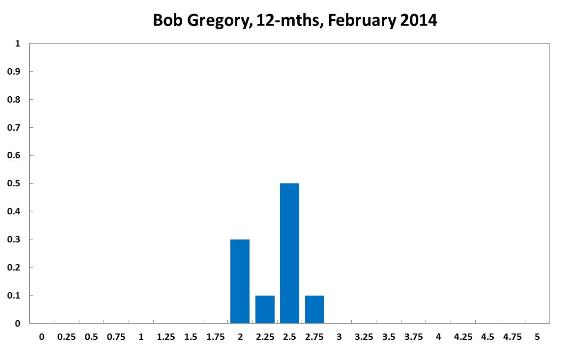

Bob Gregory

Current

6-Months

12-Months

Comments

I am becoming more uncertain, not about the range of possibilities, but what probability to attach to each one. Have a clear view on the economy - it is sliding down slowly. But interest rates have a high relative content - that is relative to overseas and I think overseas interest rates will begin to go up. So if we stand still it is like a cut, from the RBA view.

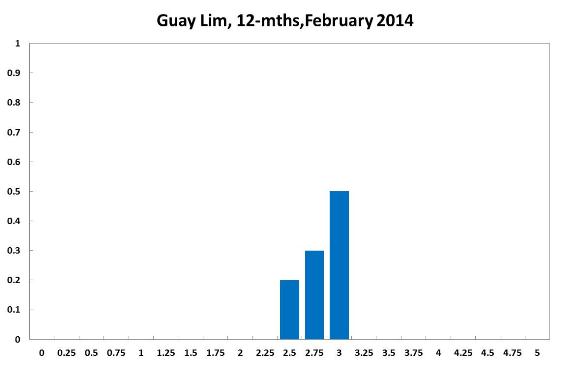

Guay Lim

Current

6-Months

12-Months

Warwick McKibbin

Current

6-Months

12-Months

James Morley

Current

6-Months

12-Months

Comments

Current: Inflation for 2013 was 2.7%, which is slightly above the mid-point of the 2-3% target range. However, this is likely due to one-time effects of the depreciation in the Australian dollar from its record highs against the US dollar. As a result, inflation can be expected to run at the lower end of the target range in 2014 unless the dollar depreciates a lot further.

12 month: The policy rate should be returned to its neutral level over the medium term (1-2 year horizon). However, the RBA can continue to monitor the effects of low real interest rates on asset and housing prices before embarking on a tightening cycle.

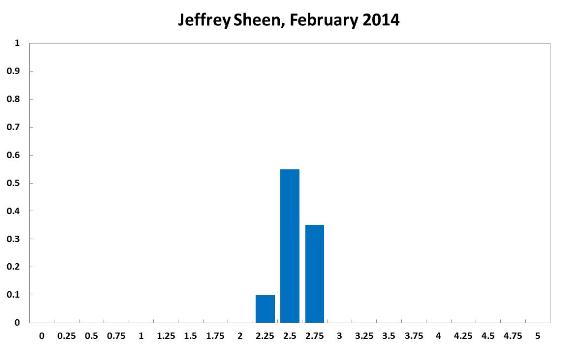

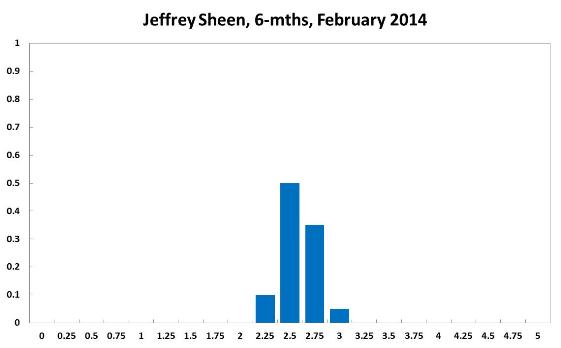

Jeffrey Sheen

Current

6-Months

12-Months

Comments

Since the last Board meeting, the Australian economy has continued to flatline. Its major trading partners improved their growth only modestly, and it seems now that this trend will persist for some time. The trade weighted index has depreciated only a little. On the other hand, housing and share prices in Australia have continued to rise significantly, in part reflecting investor confidence about the future. However, in the present, economic activity appears restrained and capacity utilization is falling slowly. While the impact of changes to fiscal policy settings by the new Abbott government remain unclear, consolidation in 2014 is quite likely. Therefore a zero real value for the cash rate seems appropriate for now.