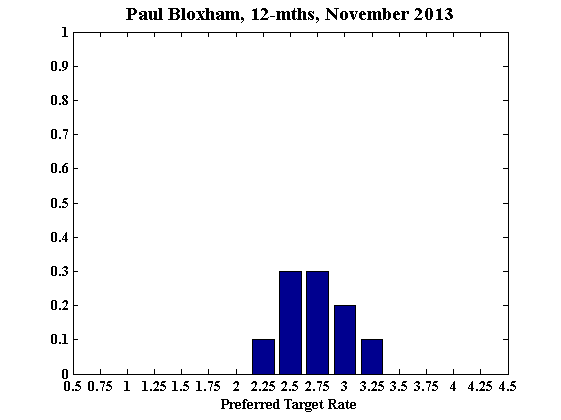

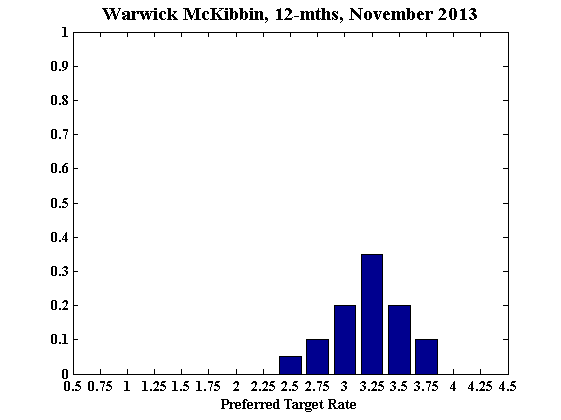

Confidence continues to pick up and asset prices are rising strongly, partly reflecting Australia's current very loose setting of local monetary policy. These improvements have come despite the Australian dollar remaining high. With the currency having remained high for many years, the shape of the economy appears to be adjusting to deal with a higher currency. With the interest rate sensitive sectors of the economy picking up strongly, in response to the current cash rate setting, there would be little purpose in cutting the cash rate further. Indeed, cutting rates further could create other problems by increasing the risk of asset price misalignments. On the other hand, the case for lifting rates any time soon is also fairly weak at this stage, as inflation remains contained, the labour market remains loose and the AUD is still high. If the Federal Reserve does, however, begin to taper its quantitative easing program in coming months this should be expected to put some downward pressure on the AUD at which point rate hikes may need to be considered to offset the upward pressure on inflation from a lower currency. I now see it as more likely than not that the cash rate will need to be higher than its current level in 12 months time.

Outcome: November 2013

Has the Australian Economy Turned the Corner?

The balance of risks to Australia’s economy has barely shifted from last month, so that the consensus to keep the cash rate at its current level of 2.5% remains strong, according to Reserve Bank Shadow Board members.

The new coalition government has yet to announce any big policy surprises, the US government budget crisis has been deferred for a further four months (as widely expected), European economic growth remains subdued, and Asian economies are only slowing slightly.

Domestically, the signals are mixed. The Australian dollar remains relatively high while the real estate markets in the major cities appear to be responding to the low interest rates.

Inflation is well within the target range, the unemployment rate fairly stable around 5.6%, consumer and business confidence continue to improve, if only marginally. While a debt crisis in the US has been averted at the eleventh hour, the political problems leading to the stand-off remain.

Uncertainty about the US budget position is thus likely to resurface early next year. Germany’s economy is picking up slightly and there are green shoots in Spain and the UK. However, there is continued concern about the health of Europe’s banks. A stress test of 130 key European credit institutions, recently announced by the ECB, may reveal some unpleasant truths.

Asia is slowing slightly but not dramatically, as pointed out in the World Bank’s recent East Asia Pacific Economic Update, with China expected to hit the official growth target of 7.5% in 2013 and the rest of the region slowing to 5.2% before accelerating in 2014 and beyond.

The World Bank identifies an abrupt slowdown of investment in China as one of the immediate risks to the region’s economic prospects. The Shadow Board’s confidence in keeping the cash rate steady has strengthened a little, equalling 66% (up from 62% in October). The probability attached to a required rate cut now equals 5% while the probability of a required rate hike equals 29%.

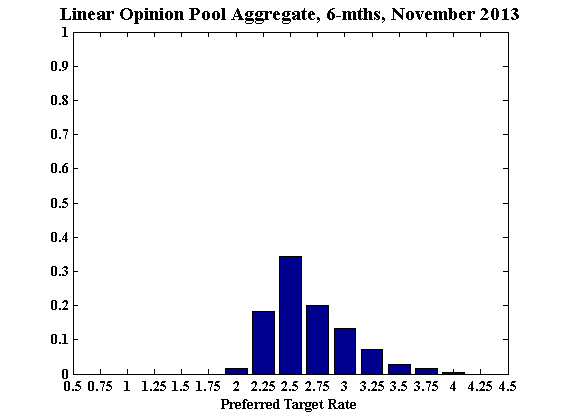

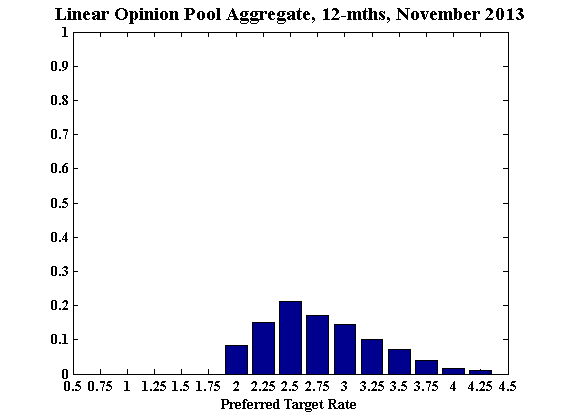

At longer horizons the following picture emerges: the probability that the cash rate should remain at 2.5% is 34%. The need for an interest rate increase is estimated at 46% (47% in October), for an interest rate cut at 20% (23% in October). A year out, the Shadow Board members attach a 56% probability to the need for an increase in the cash rate (down from 58% in October) and a 23% probability to the need for a decrease in the cash rate (down from 25% in October).

Aggregate

Current

6-Months

12-Months

Paul Bloxham

Current

6-Months

12-Months

Comments

Mark Crosby

Current

6-Months

12-Months

Comments

Currently the monetary policy dilemma is between exchange rate overvaluation versus asset price appreciation brought on by easy money. With housing prices continuing to increase in the US and issues with negative equity receding, the end of QE is hopefully nearer rather than further – however, with a dove as the likely new Fed Chair, that remains to be seen. All of which suggests a greater need to tighten rather than loosen within 12 months, though more than likely towards the end of that time frame rather than sooner.

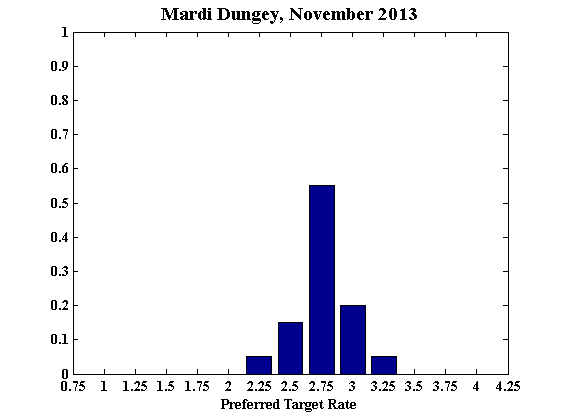

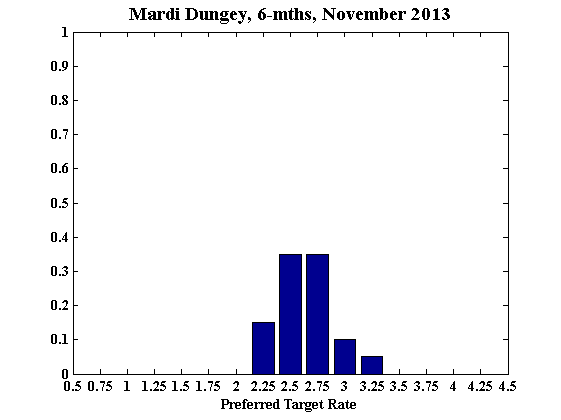

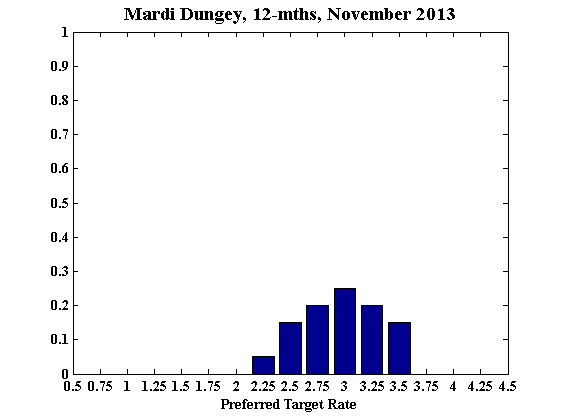

Mardi Dungey

Current

6-Months

12-Months

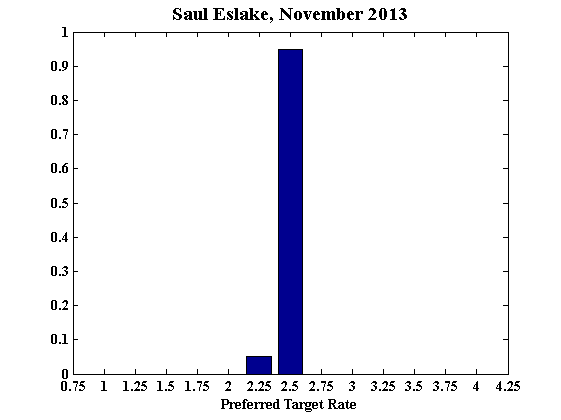

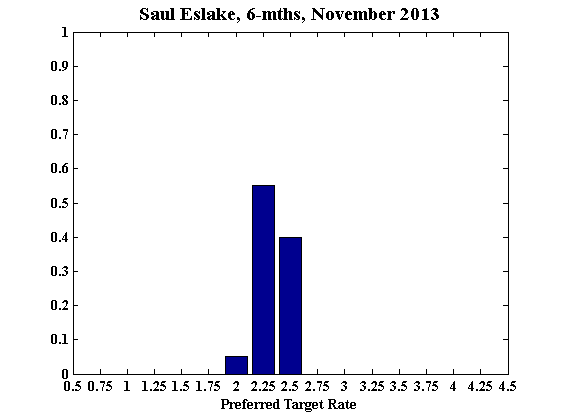

Saul Eslake

Current

6-Months

12-Months

Comments

Current: RBA still assessing sustainability of post-election bounce in business confidence, and in particular whether it translates into higher non-mining business investment expectations – recent remarks by Phil Lowe & Glenn Stevens suggest they haven’t detected any signs of the latter as year, but they won’t really know for sure until the release of the Q3 capex intentions survey at the end of this month. The RBA doesn’t appear to be especially concerned as yet about rising house prices; while they seem now to be resigned to being unable to influence the value of the A$ either through policy actions or ‘jawboning’.

6 month: On the assumption that non-mining business investment intentions remain sluggish, unemployment continuing to rise (close to 6% by January or February) and the currency remains at elevated levels (likely if the Fed hasn’t started ‘tapering’ QE by its late January meeting), the RBA may cut rates again at its February or possibly March meeting.

12 month: As for six months, except (with regard to unemployment) more so.

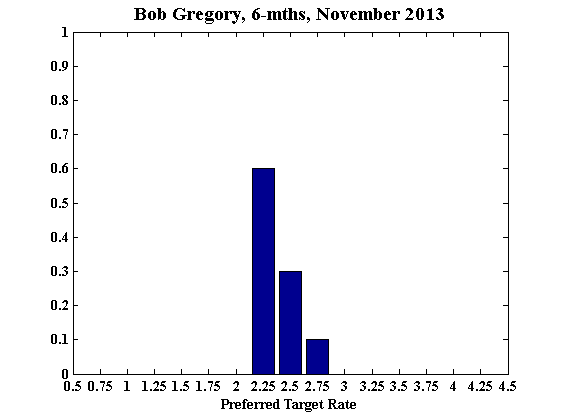

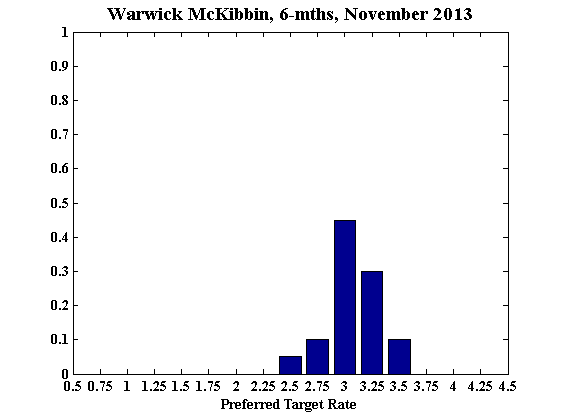

Bob Gregory

6-Months

12-Months

3-Years

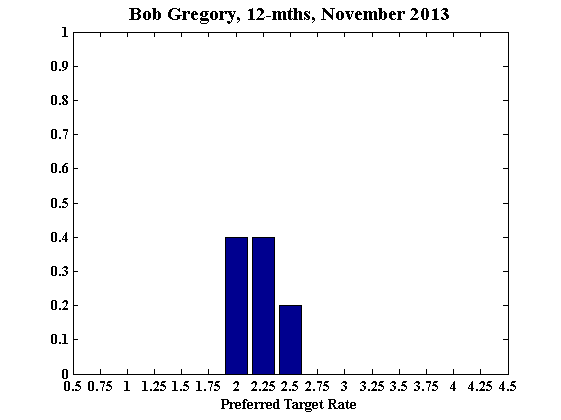

Guay Lim

Current

6-Months

12-Months

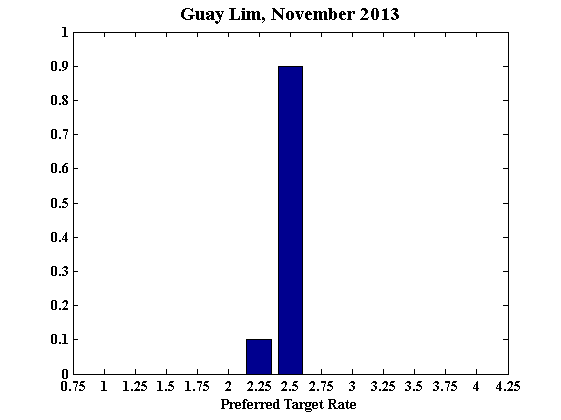

Warwick McKibbin

Current

6-Months

12-Months

James Morley

Current

6-Months

12-Months

Comments

Headline inflation remained within the target range at 2.2 percent in Q3, while the unemployment rate dropped a bit to 5.6 percent in September. So there is no compelling case for further cuts to an already low policy rate.

In terms of the timing of any increase in the policy rate, the current balanced economic conditions allow for further monitoring of property markets before taking action to dissipate the rising froth. However, if domestic and international economic conditions were to show more consistent signs of improvement, the policy rate should be returned to neutral in reasonably short order.

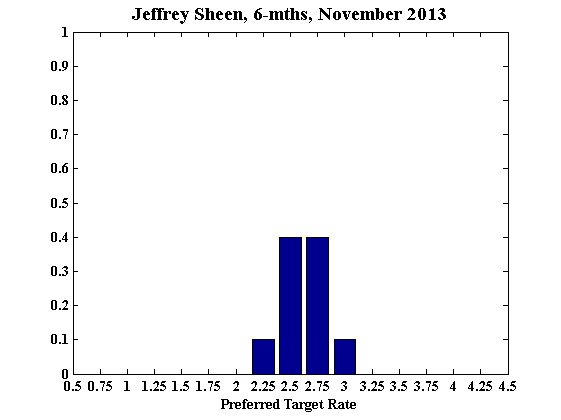

Jeffrey Sheen

Current

6-Months

12-Months

Comments

Key macro variables in the Australian economy are remarkably stable - for example, 1. the trend in the unemployment rate is flattening at 5.7%, 2. participation at 65%, 3. the full-time to part-time employment ratio at 1.5, 4. trimmed CPI inflation at 2.3%, 5. the RBA's real trade-weighted exchange rate at around 160 (though declining a little recently, this will not stimulate non-mining net exports much), 6. household saving rate at 11%, 7. the terms of trade at 91, and 8. the ABS's real unit labour cost at 101. Real GDP growth is slowing marginally, and this is mainly due to the decline in public sector investment.

Domestic forward-looking indicators are looking positive – for example, 1. stock and housing prices are rising well in response to protracted easy monetary policy, and 2. both business and consumer confidence have improved significantly in 2013. Though unnecessary fiscal policy consolidation by the new Coalition government still remains a risk, I recommend making no change in the cash rate in November and giving a clear signal of gradually increasing rates in the next 12 months. This signal should be represented as less pressure on the accelerator, not as a braking of momentum.