With the inevitable Greek breakdown now postponed again, and other international events relatively benign, the best course would seem to be holding again in August. Chinese equity market volatility is quite divorced from their real economy and should not cause concern, though other indicators from China do suggest ongoing challenges in that economy. At longer horizons unreasonably low rates ought to start to rise unless international events conspire against the RBA raising rates in late 2015 or early 2016.

Outcome: August 2015

Continued Strong Case for Holding Rates Steady

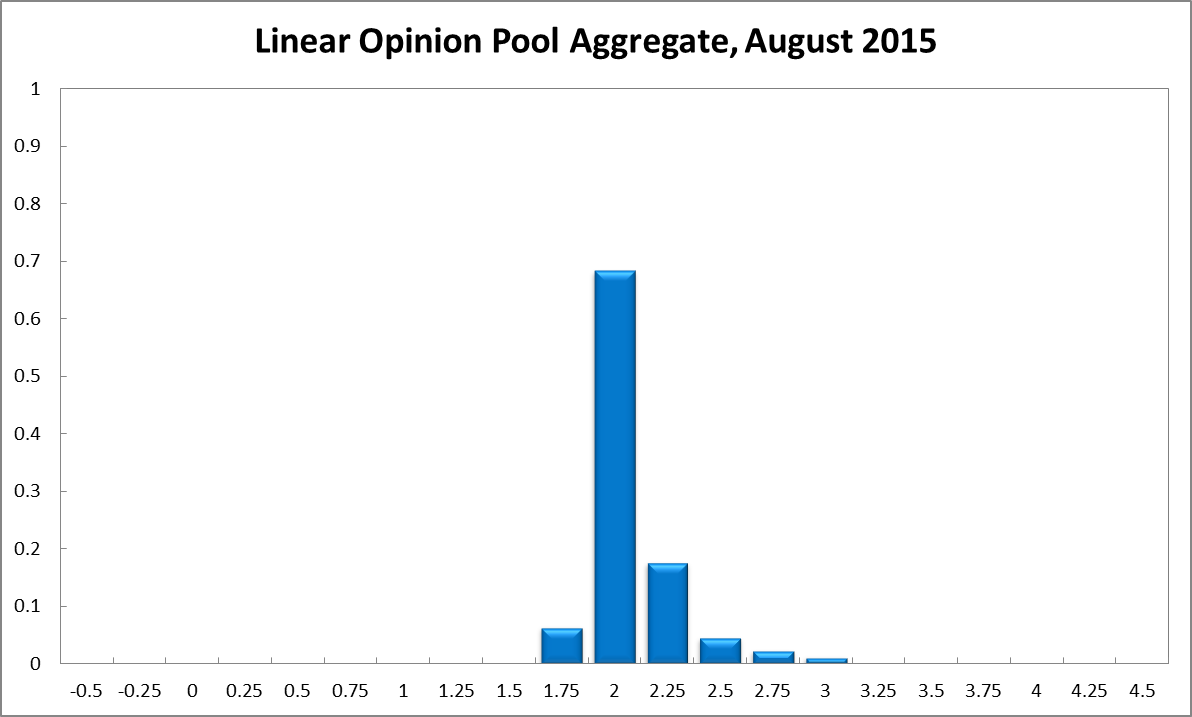

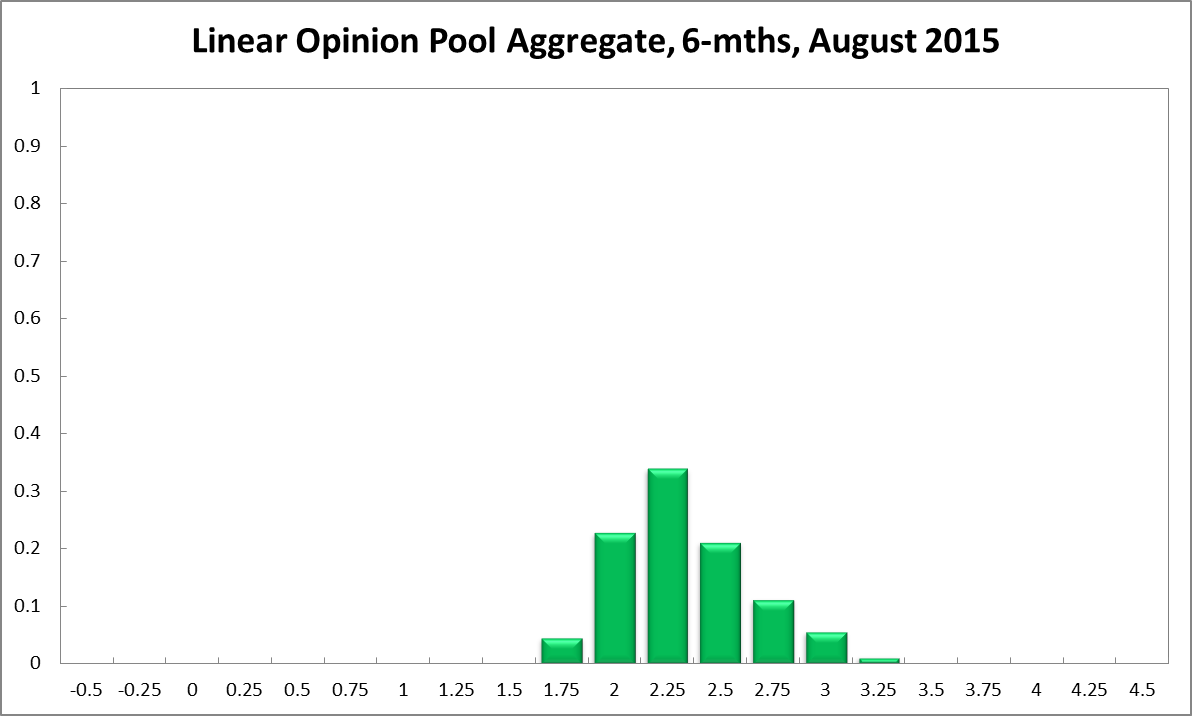

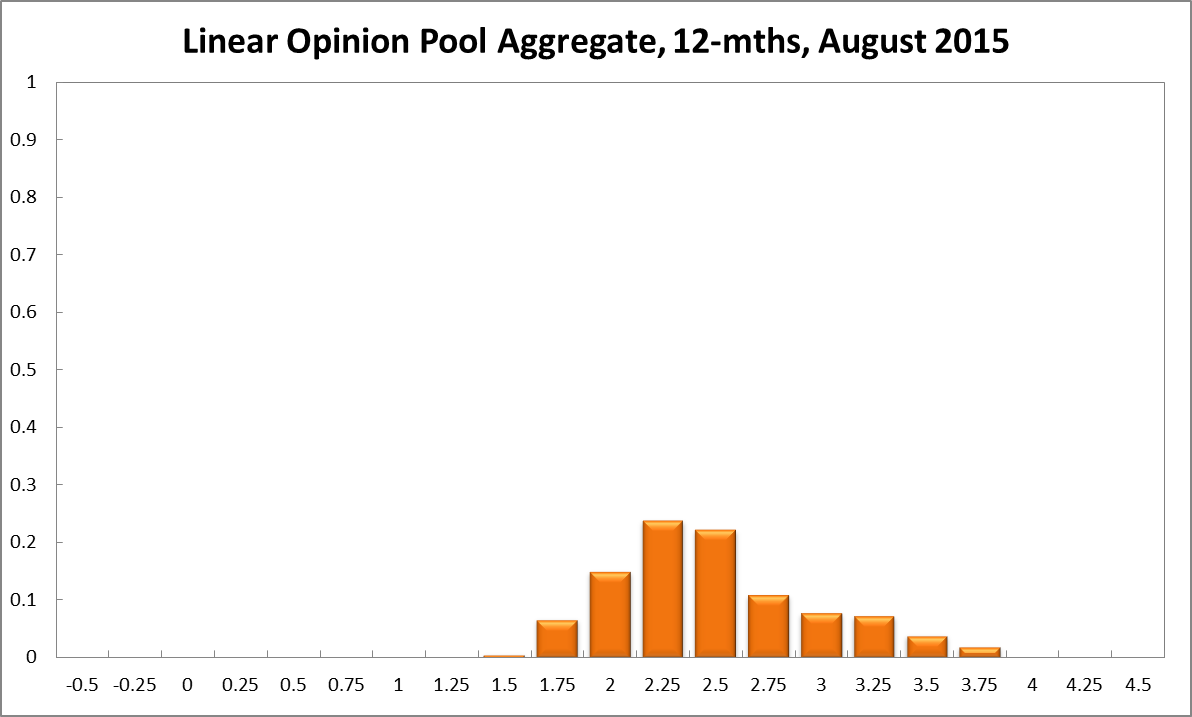

A Greek debt default and exit from the Euro have been averted, while the rout of the Chinese stock market continues. There exist little new domestic data to guide the Reserve Bank this month. Official inflation equals 1.5%, well below the RBA’s target band. The CAMA RBA Shadow Board on balance prefers to hold firm. It attaches only a small probability to the need for a rate cut. In particular, the Shadow Board recommends the cash rate be held at its current level of 2%; it attaches a 68% probability to this being the appropriate policy setting. The confidence attached to a required rate cut equals 6%, down 2% from the previous month, while the confidence in a required rate hike has fallen to 25%. Australia’s jobless rate, according to the Australian Bureau of Statistics, remains at 6%. No new data has been released on wage growth, which recently has been at a record low of 2.3% per quarter. After hovering around the 76 US¢ mark, the Aussie dollar has fallen some 3 US¢. Yields on Australian 10-year government bonds have fallen slightly from the previous month, to under 3%. The number of home loan approvals, excluding refinancing, fell by 8.2% in May, its largest monthly decline in 15 years. Along with a fall in the value of investor activity of 3.2% in the same month, these numbers point to a possible cooling of the Australian property market. The S&P/ASX 200 stock market index rebounded slightly from its recent decline. High real estate prices remain a concern for many Shadow Board members and are often cited for a reason not to cut the cash rate any further. Overseas, debt default and Greek exit from the Euro have been averted at the eleventh hour, while the Chinese stock market experienced a major correction from its lofty heights. The uncertainties surrounding the Chinese economy pose the biggest immediate threat to Australia’s export markets and thus to Australia’s GDP. In a recent speech, Federal Reserve Bank Board Governor Janet Yellen has indicated that an increase in the federal funds rate is imminent, reflecting the solid expansion underway of the US economy. Commodity prices, in particular crude oil, have fallen to new lows. The Westpac/Melbourne Institute Consumer Sentiment Index fell yet again from 95.3 in June to 92.3 in July. No other new data on consumer and producer confidence has been released since the last round. The Shadow Board’s confidence that the cash rate should remain at its current level of 2% equals 68% (up from 57% in July). The confidence that a rate cut is appropriate has fallen slightly, from 8% in July to 6%; conversely, the confidence that a rate increase, to 2.25% or higher, is called for has decreased for the second time in a row, from 35% in July to 25%. The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 2% equals 23% (24% in July). The estimated need for an interest rate increase lies at 73% (69% in July), while the need for a rate decrease is estimated at 4% (6% in July). A year out, the Shadow Board members’ confidence in a required cash rate increase equals 78% (one percentage point up from July), in a required cash rate decrease 7% (4% in July) and in a required hold of the cash rate 15% (down from 19% in July).

Aggregate

Current

6-Months

12-Months

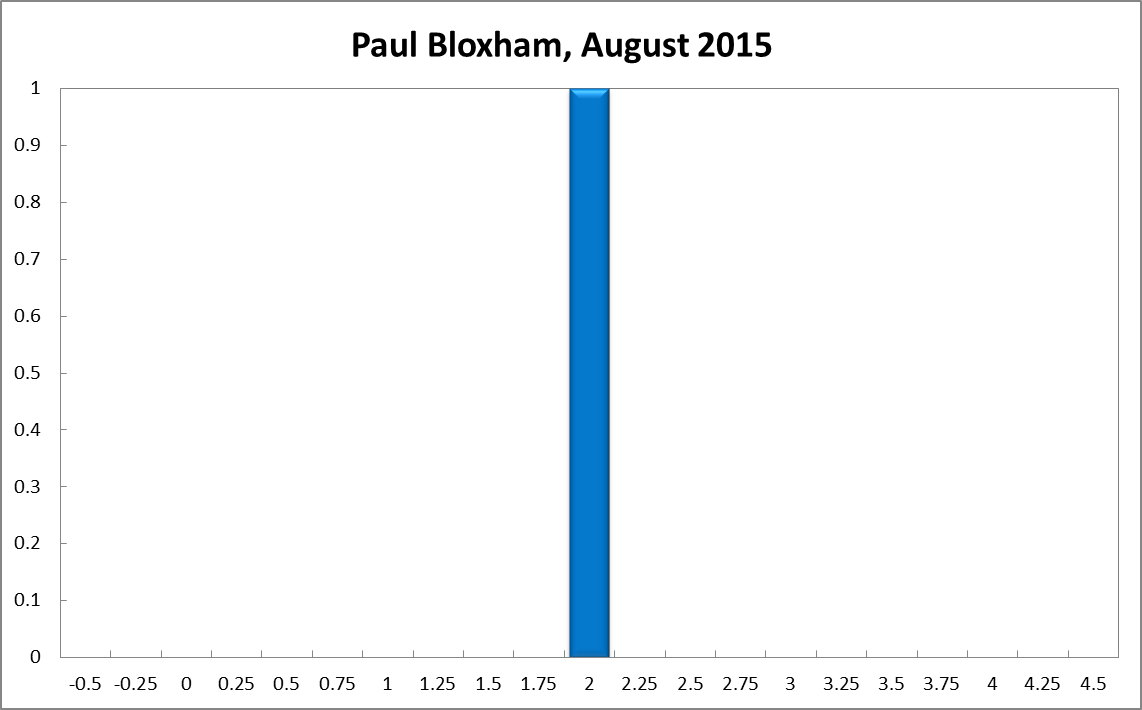

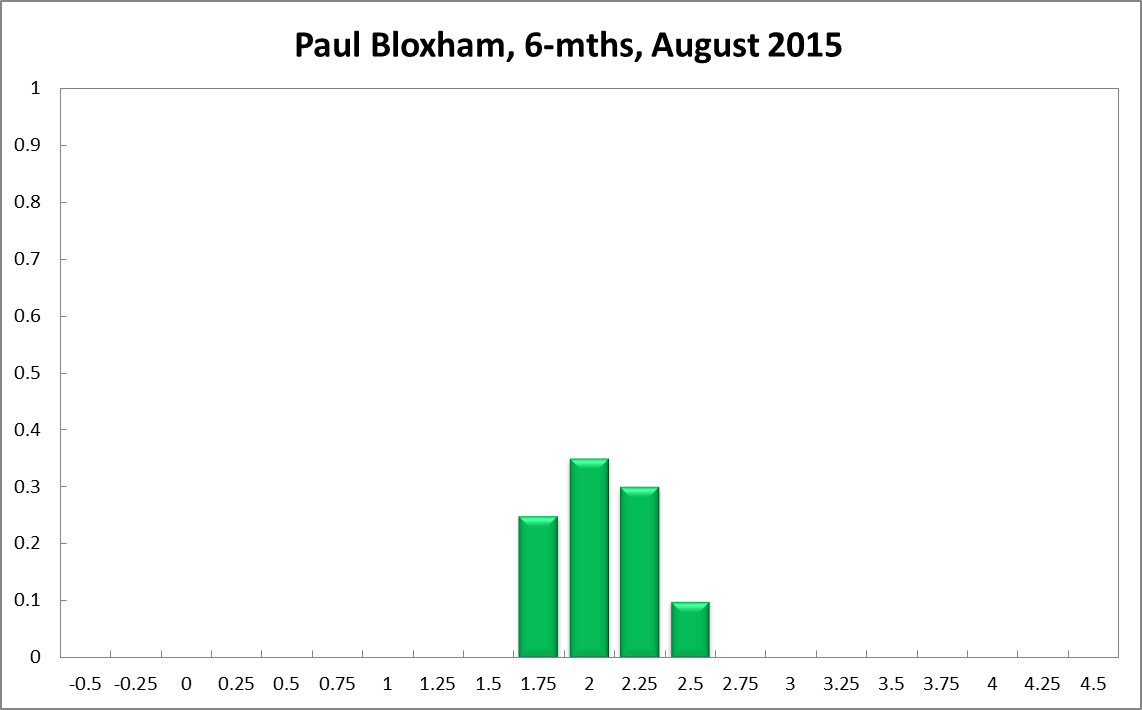

Paul Bloxham

Current

6-Months

12-Months

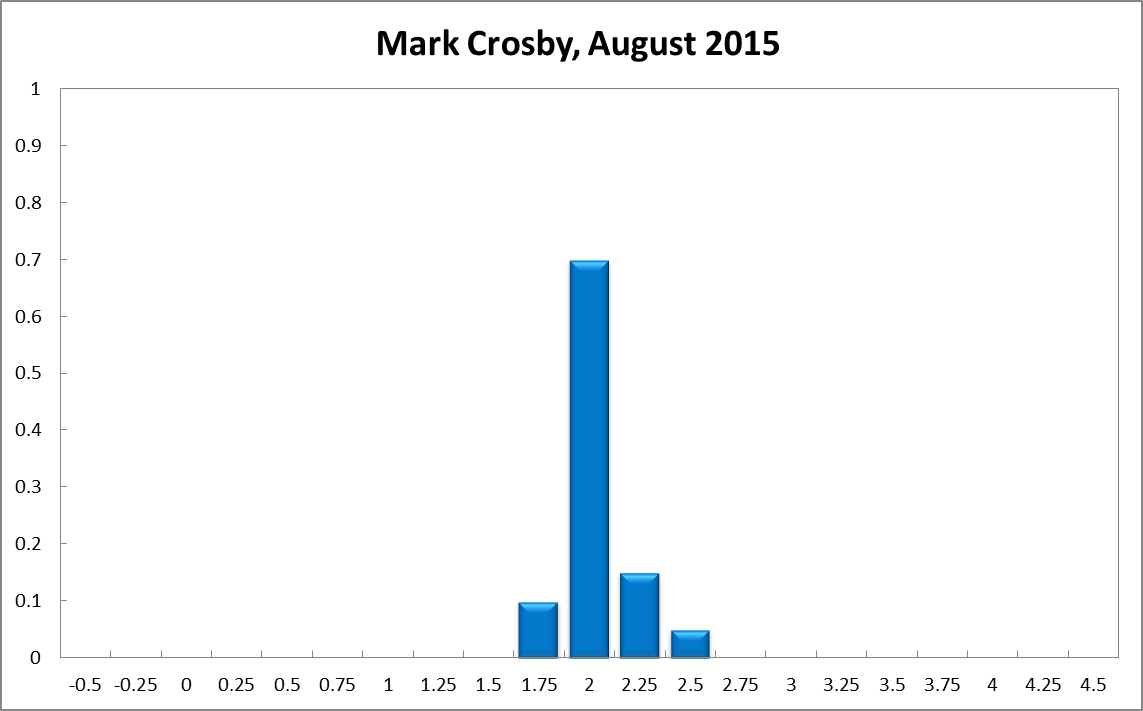

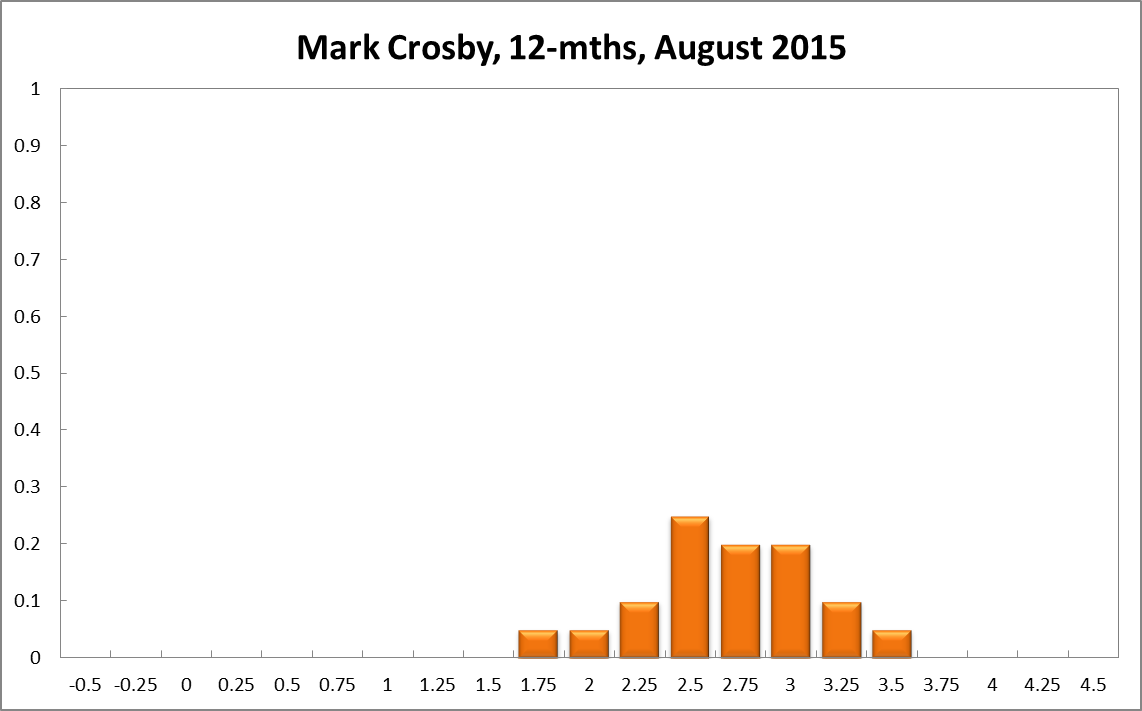

Mark Crosby

Current

6-Months

12-Months

Comments

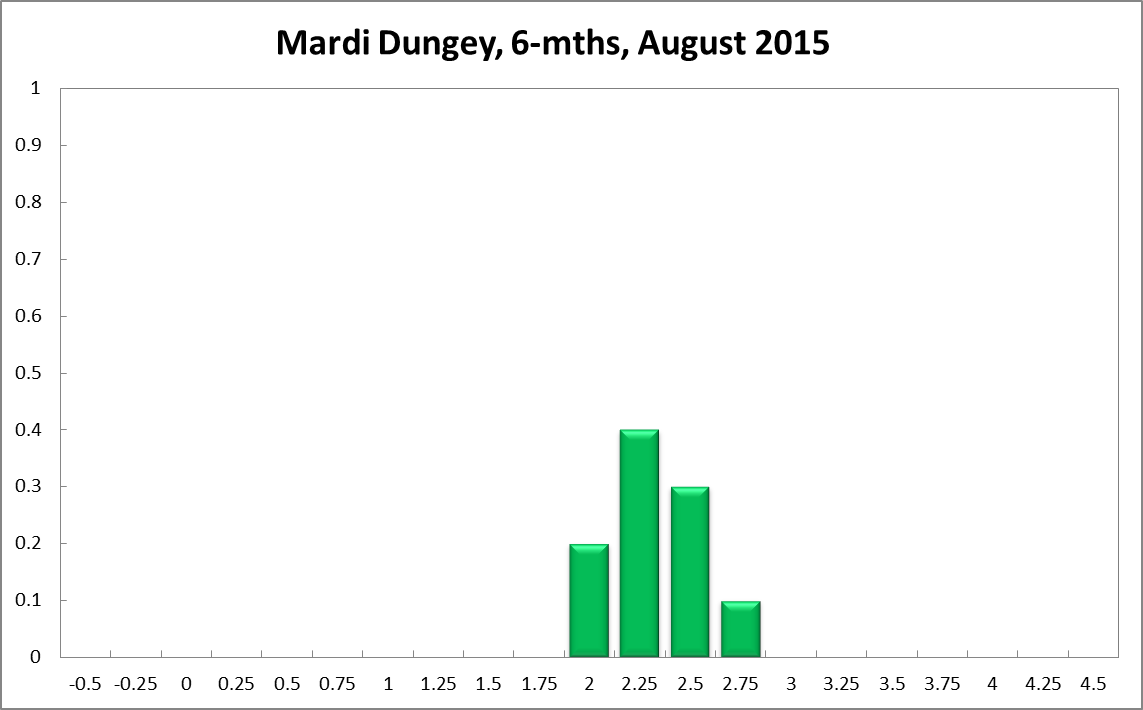

Mardi Dungey

Current

6-Months

12-Months

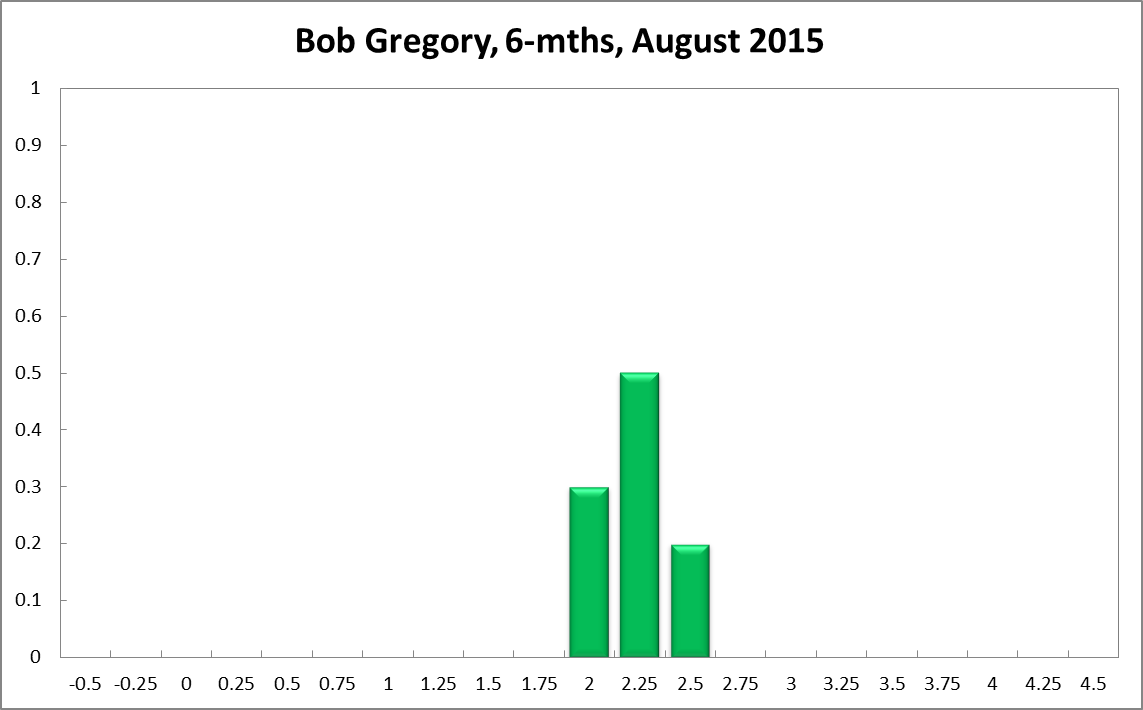

Bob Gregory

Current

6-Months

12-Months

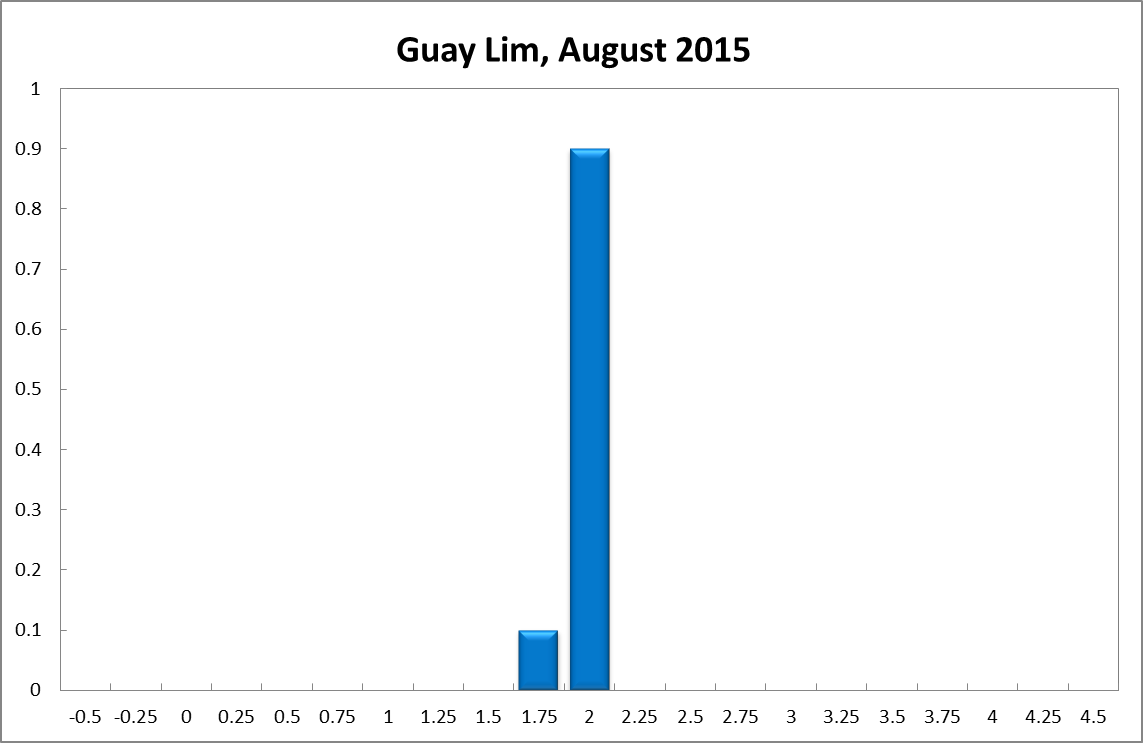

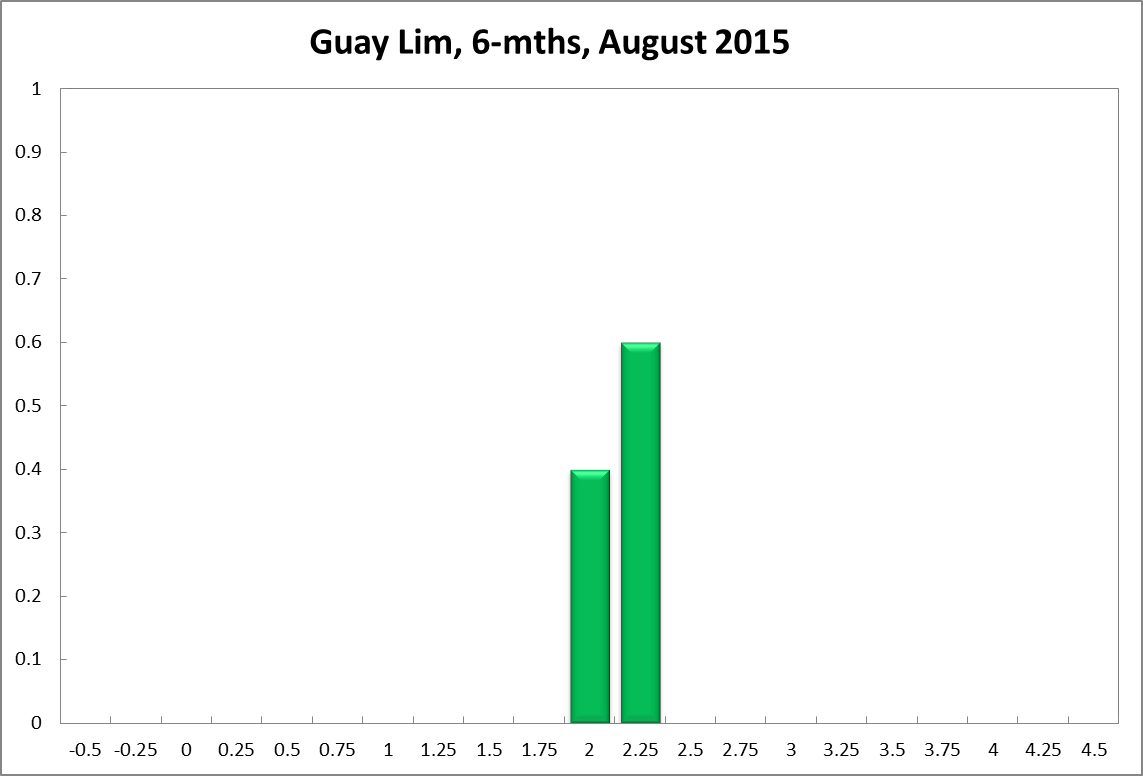

Guay Lim

Current

6-Months

12-Months

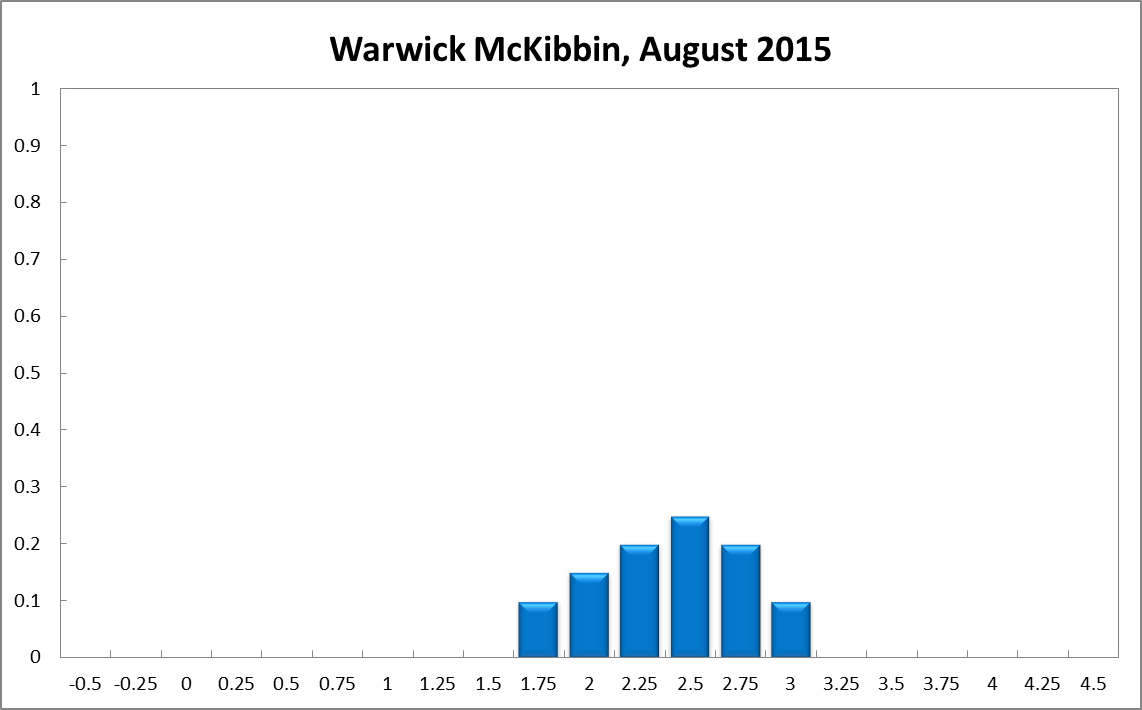

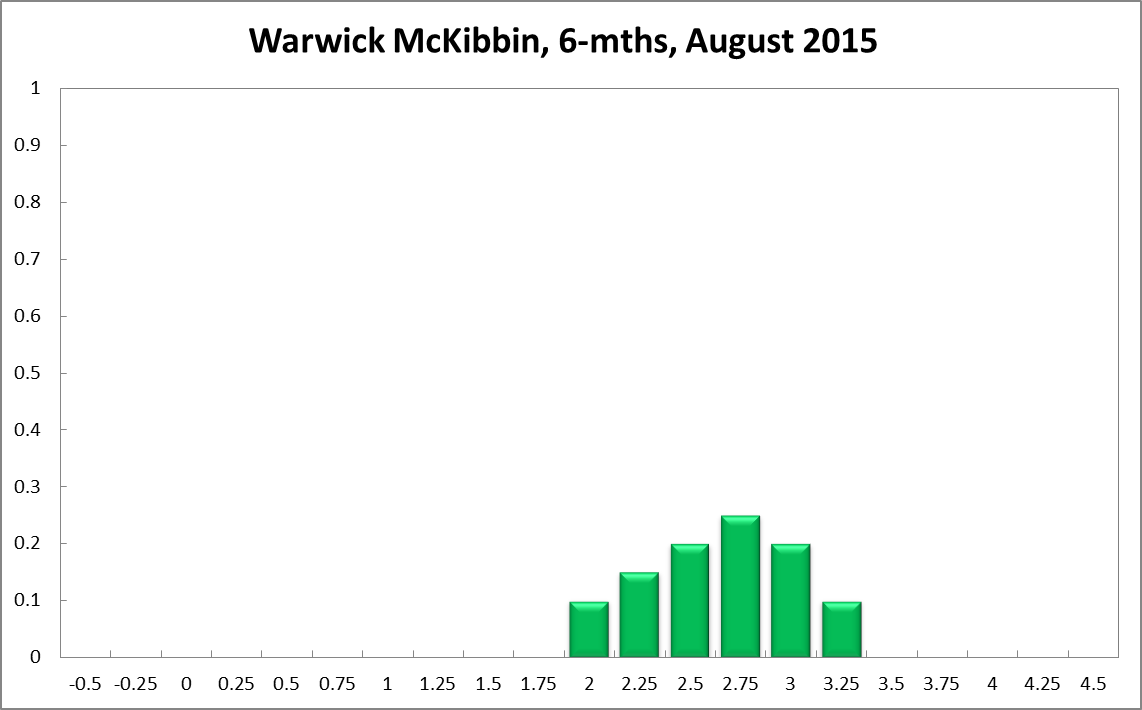

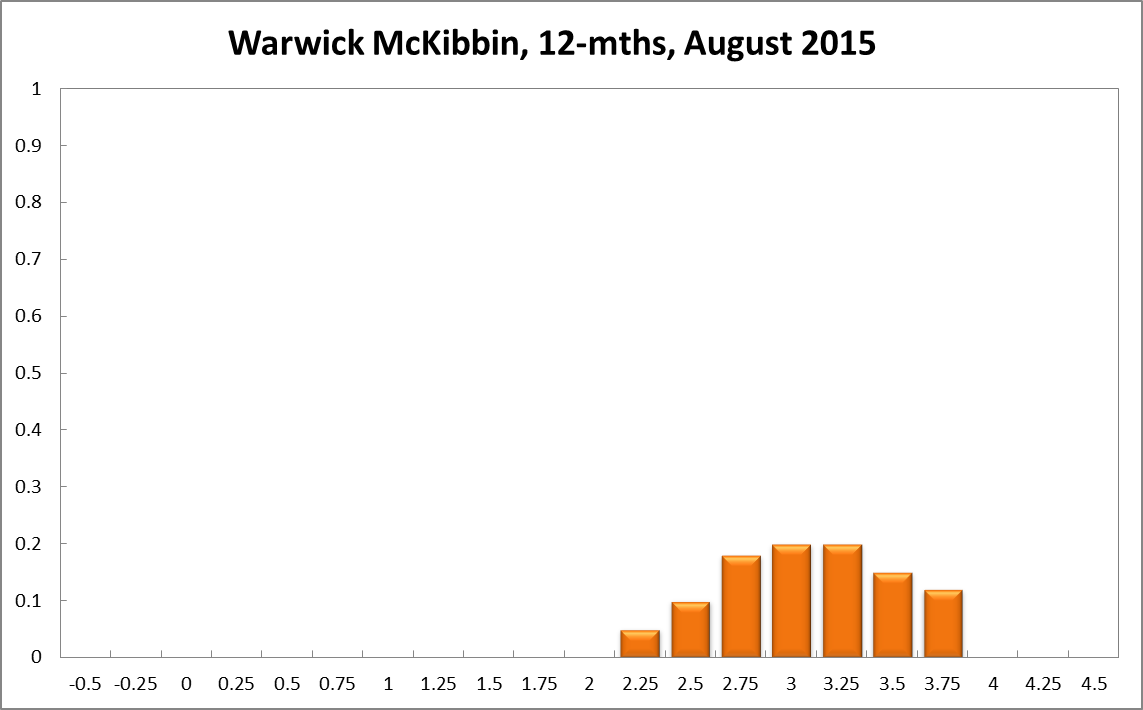

Warwick McKibbin

Current

6-Months

12-Months

James Morley

Current

6-Months

12-Months

Comments

The RBA should hold its policy rate steady, with a bias towards raising it soon in order to address the continued overheating in the housing market. However, they will want to see some indication of inflationary pressures before starting the raising cycle.

The current low level of the Australian dollar gives scope for holding steady or starting the raising cycle. Contributing to this is a clear strengthening of the US economy and imminent “lift-off” for the Federal Funds Rate in September. Developments in the United States are likely to be the bigger external force for the Australian economy over the next year than the ongoing weakness in China or any further developments with Greece.

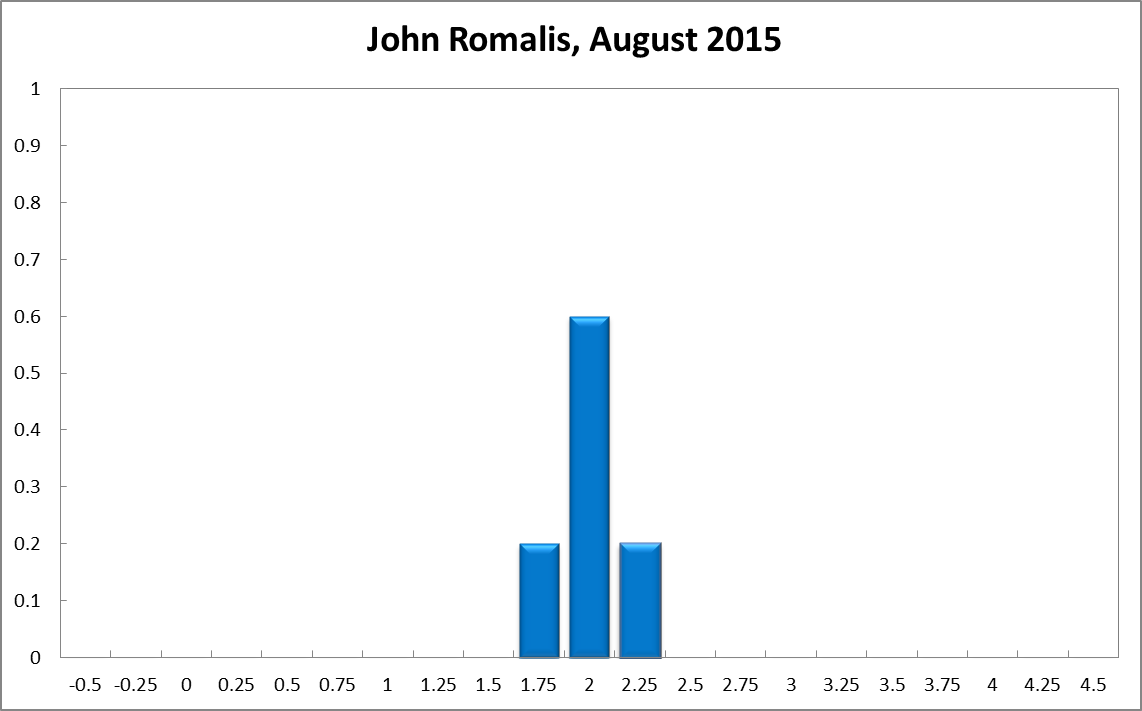

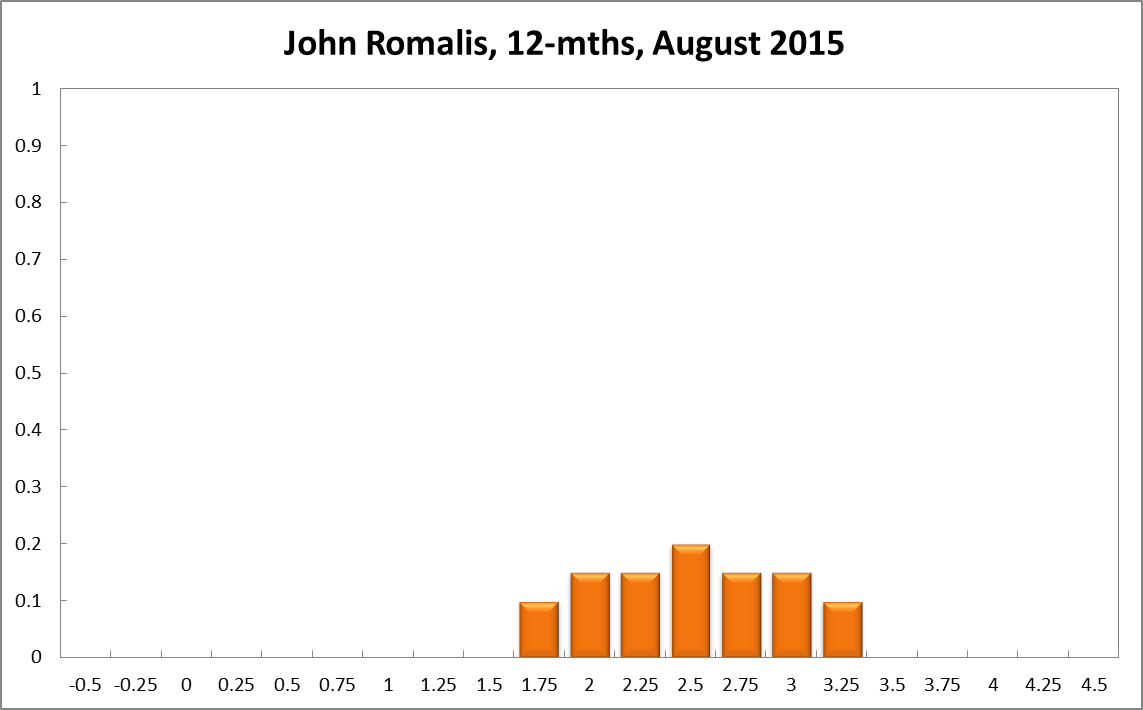

John Romalis

Current

6-Months

12-Months

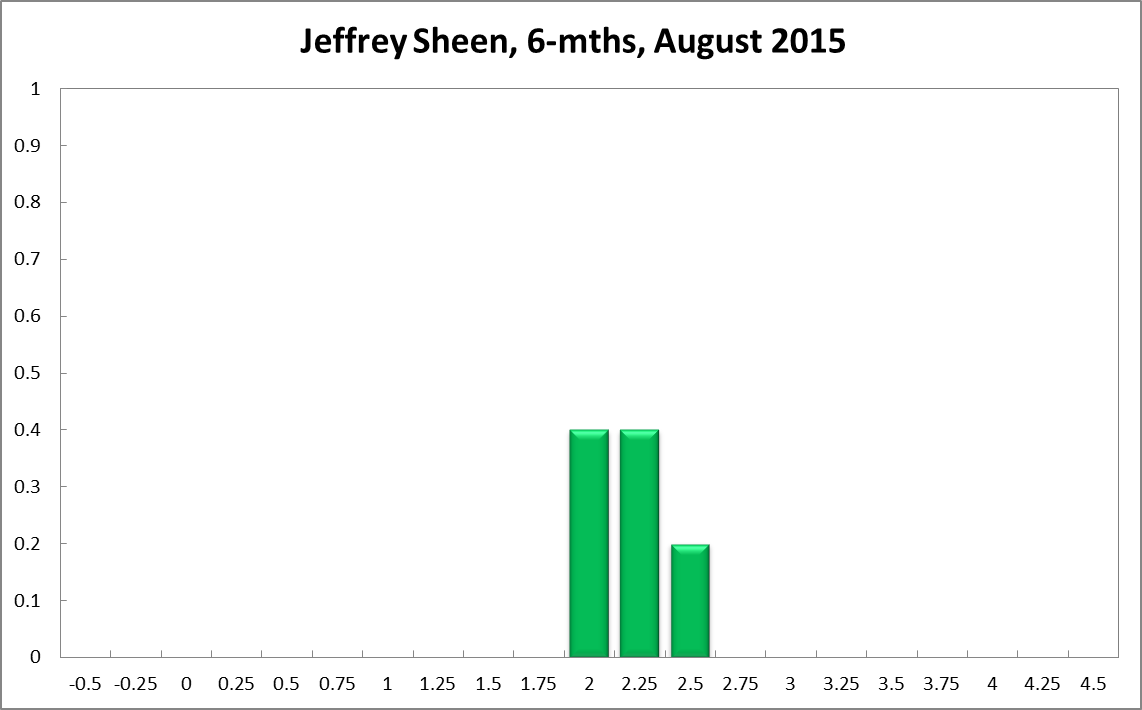

Jeffrey Sheen

Current

6-Months

12-Months