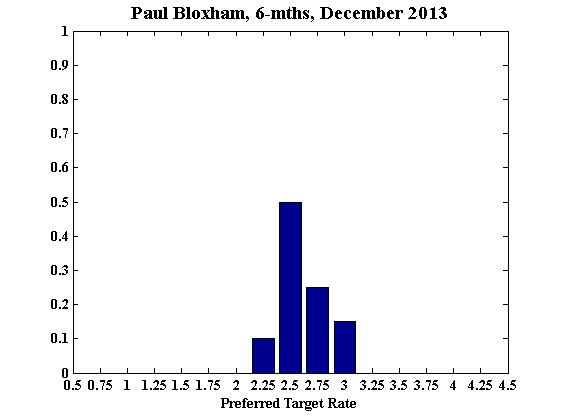

The interest rate sensitive sectors of the economy continue to pick up, in response to the current cash rate setting, with the housing market leading the way. There are also tentative signs that conditions are starting to improve across a broader range of industries, including the manufacturing and services sectors. As monetary policy is already getting significant traction, there would be little purpose in cutting the cash rate further, with lower rates likely to increase the risk of asset price misalignments. However, the case for lifting rates any time soon is also fairly weak at this stage, as inflation remains contained, the labour market remains loose and the AUD is still high. I recommend that the cash rate is left unchanged and see it as more likely than not that the cash rate will need to be higher than its current level in 12 months time.

Outcome: December 2013

The Waiting Game Continues

Yet again, there is little news about the domestic and international economies to incite the members of CAMA’s RBA Shadow Board to change their views. The consensus to keep the cash rate at its current level of 2.5% remains strong.

The overarching view is that the interest rate sensitive sectors of the Australian economy, in particular the housing market, are reacting to the historically low cash rate, with signs of the export sector benefiting from an Aussie dollar below parity with the US dollar. At the same time inflation is comfortably within the RBA’s target range, there remains some slack in the labour market and the Aussie dollar is relatively high. On balance the RBA can afford to maintain its accommodative policy in the near term.

The Shadow Board’s confidence in keeping the cash rate steady equals 63% (down from 66% in November). The probability attached to a required rate cut now equals 7% while the probability of a required rate hike equals 30%.

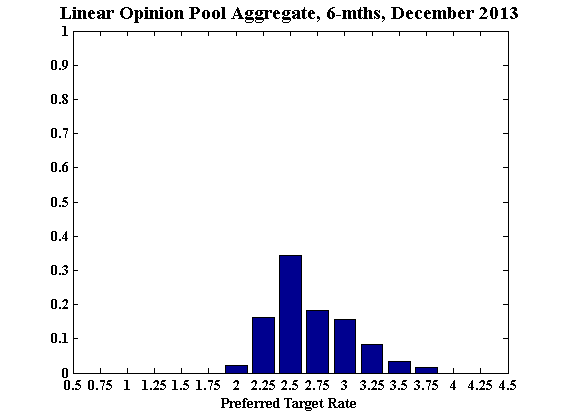

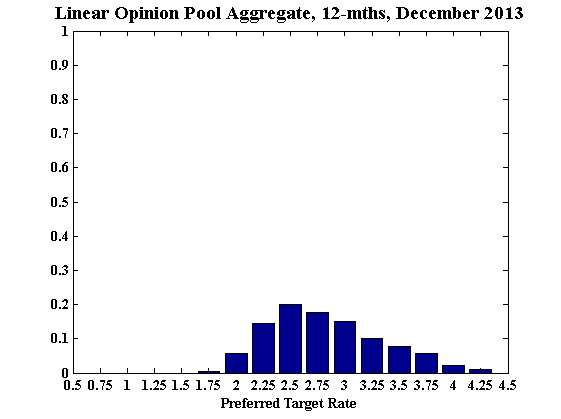

At longer horizons the following picture emerges: 6 months out, the probability that the cash rate should remain at 2.5% is unchanged at 34%. The estimated need for an interest rate increase has edged up to 47% (46% in November), while the need for a decrease has fallen to 18% (20% in October). A year out, the Shadow Board members’ confidence in a required cash rate increase has strengthened to 59% (up from 56% in November); the need for a decrease is now estimated at 21% (down from 23% in November).

The RBA board will not meet in January, nor will the CAMA RBA Shadow Board. Before the next meeting in February 2014 there should be considerably more information about the state of the economy, revealing whether the downside risks remain substantive or whether the Australian economy is exiting the current trough.

Aggregate

Current

6-Months

12-Months

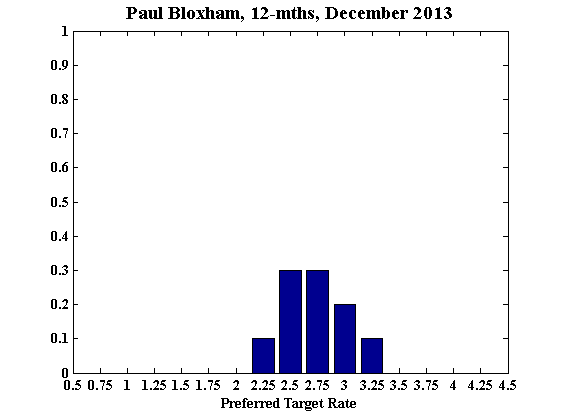

Paul Bloxham

Current

6-Months

12-Months

Comments

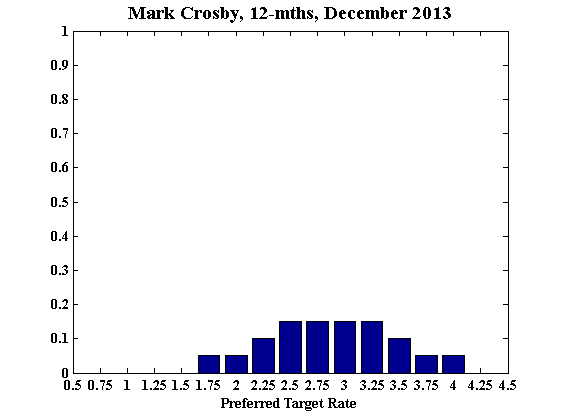

Mark Crosby

Current

6-Months

12-Months

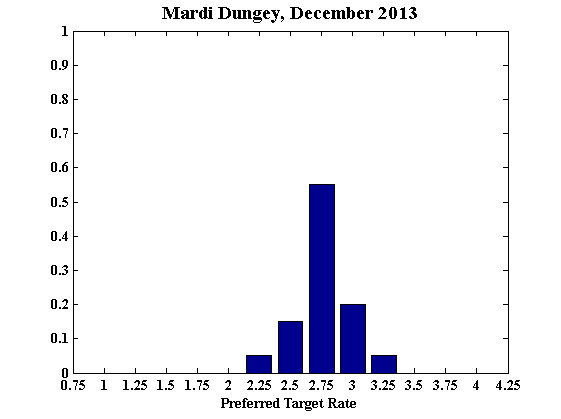

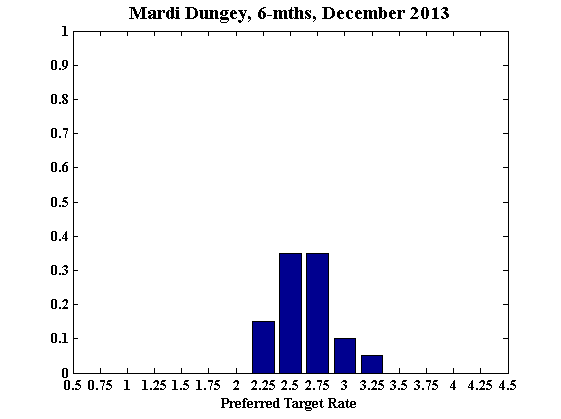

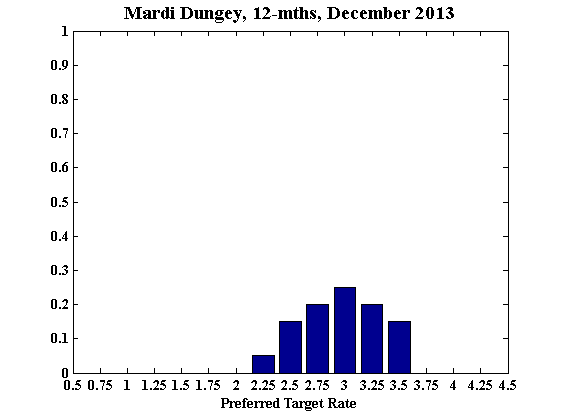

Mardi Dungey

Current

6-Months

12-Months

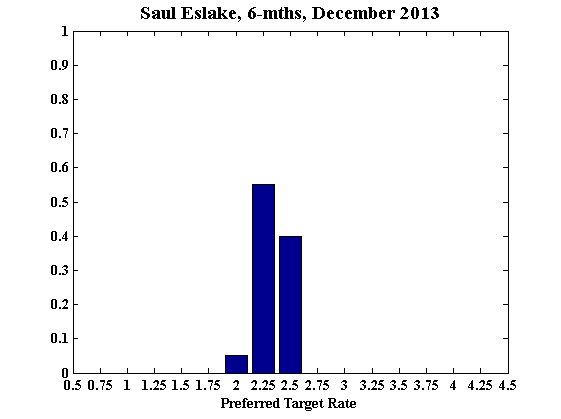

Saul Eslake

Current

6-Months

12-Months

Comments

Current: The RBA’s made it pretty clear it is reluctant to cut rates again, and would prefer that further easing in financial conditions come via a depreciation of the exchange rate. Yesterday’s capex numbers didn’t provide any reason for them to change that view.

6 month: Notwithstanding the RBA’s preference as noted above for further easing in financial conditions to come via exchange rate depreciation, unless the A$ reacts sharply to the likely start to ‘tapering’ of the US Federal Reserve’s QE program within this 6-month time frame, the A$ is likely still to be uncomfortably high, signs of a tangible revival in non-mining investment hard to detect, consumer spending still soft, and unemployment still trending upwards – making a much stronger case for a further cut in rates.

12 month: As for the six month view, just a bit more so.

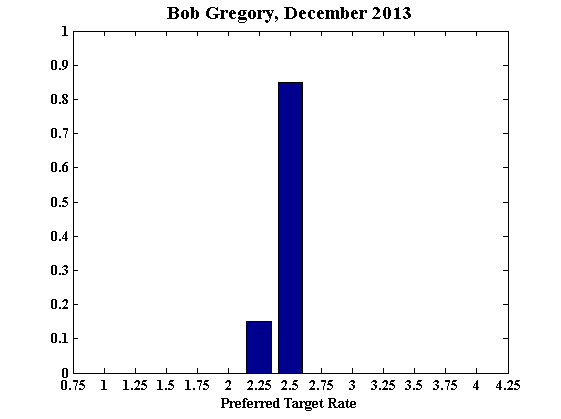

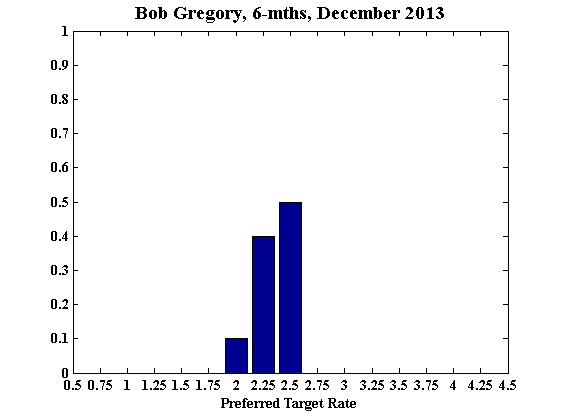

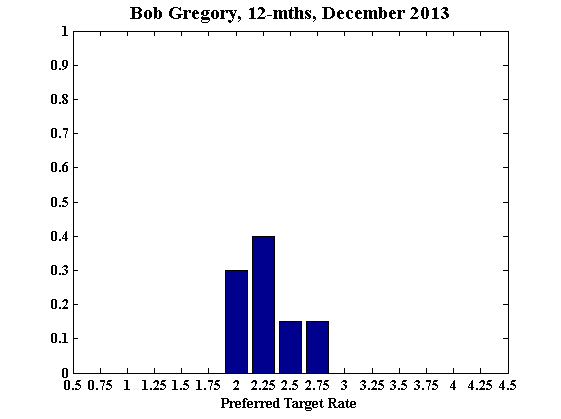

Bob Gregory

Current

6-Months

12-Months

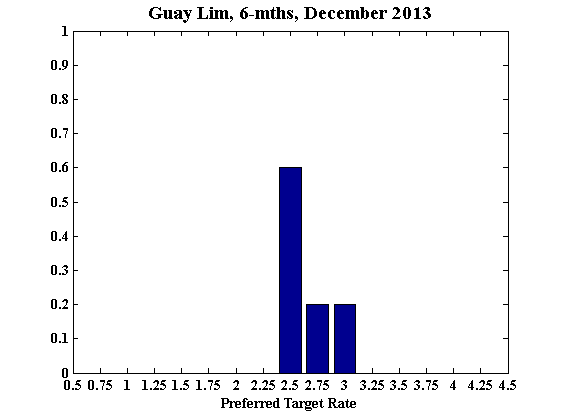

Guay Lim

Current

6-Months

12-Months

Comments

Keeping the cash rate at 2.5 percent seems appropriate for now, and the RBA has already signaled that it is monitoring house prices and the exchange rate. Both the TD-MI monthly inflation gauge and the MI consumer expected inflation rate are within the target band of 2-3 percent. There is, moreover, no clear evidence that the economy has changed gear recently, although there are encouraging signs of a pick-up in private capital expenditure.

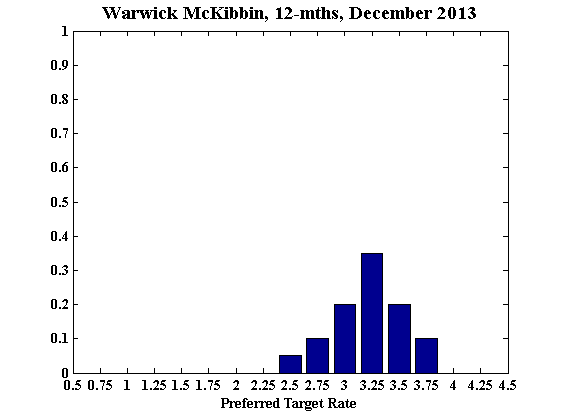

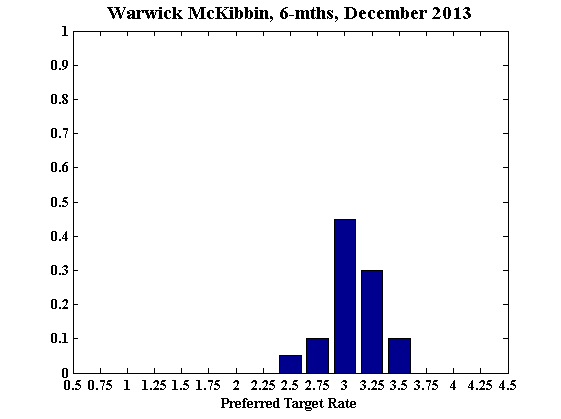

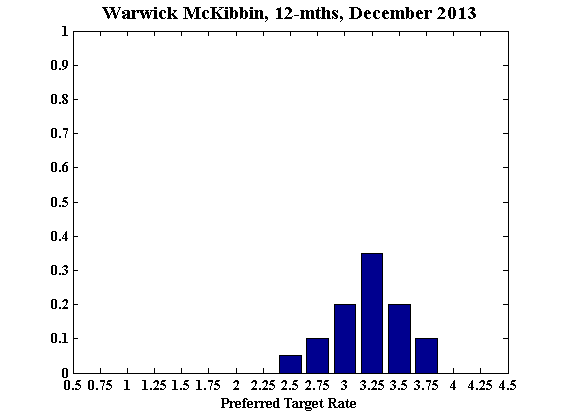

Warwick McKibbin

Current

6-Months

12-Months

James Morley

Current

6-Months

12-Months

Comments

The policy rate should be returned to its neutral level over the medium term. However, the current benign conditions for inflation combined with a mixed outlook for economic activity across different sectors suggests that the RBA can continue a “wait and see” approach before embarking on a tightening cycle.

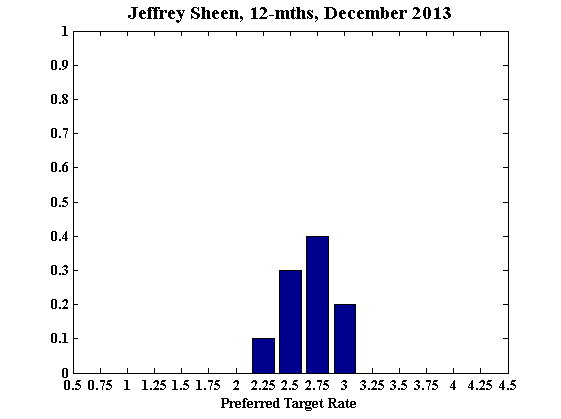

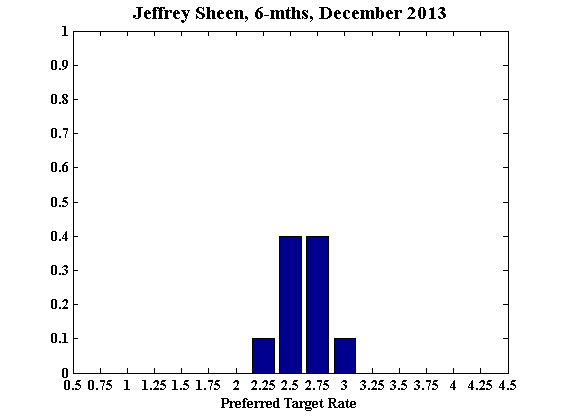

Jeffrey Sheen

Current

6-Months

12-Months