Shadow Board’s Confidence in Holding Cash Rate Steady Waning

in Face of Rising Inflation

Australia’s latest inflation data suggest that the disinflation phase has stalled, leaving price pressures still uncomfortably above the Reserve Bank’s 2–3% target band. According to the Australian Bureau of Statistics, having completed the transition from the quarterly Consumer Price Index (CPI) to the complete monthly CPI as Australia’s primary measure of headline inflation, the CPI rose 3.8% in the 12 months to October 2025, up from 3.6% in the 12 months to September 2025. The largest contributors to annual inflation were housing (+5.9%), food and non-alcoholic beverages (+3.2%) and recreation and culture (+3.2%). Trimmed mean inflation was 3.3% in the same period. At the same time, real GDP grew 0.4% in the September quarter and 2.1% over the year, driven by private investment—particularly data-centre and infrastructure projects—and a modest recovery in household consumption, although GDP per capita was flat. Against this backdrop of above-target inflation, steady but unspectacular growth and only gradually easing capacity pressures, the RBA Shadow Board continues to advocate holding the cash rate on hold at 3.60% but sees upside inflation risks rising.

Labour-market indicators reinforce the picture of an economy that is no longer running hot but where slack is emerging only slowly. In October, the unemployment rate rose to 4.3% (seasonally adjusted) from 4.2%, even as total employment increased by 42,000 persons and monthly hours worked grew by 0.5%; the participation rate was steady at 67.0%. The increase in unemployment reflects ongoing strength in labour-force growth and some cooling in labour demand rather than an abrupt deterioration in conditions. Wage growth, meanwhile, has levelled out: the Wage Price Index rose 0.8% in the September quarter and 3.4% over the year, unchanged from the June quarter. With underlying consumer price inflation running at roughly 3–3¼%, real wage gains have turned slightly positive but remain modest. Overall, the labour market still looks tight by historical standards but is clearly moving away from the extremes of 2022–23, a configuration that is broadly consistent with the RBA’s goal of bringing inflation back to target without a sharp rise in unemployment. For the Shadow Board this offers little justification for early policy easing while inflation surprises on the upside.

Financial markets continue to price a prolonged period of restrictive policy rather than an imminent easing cycle. The Australian dollar has traded in a relatively narrow range in recent weeks, buying around US$0.66 in early December, close to its recent highs, with the trade-weighted index near 62. Government bond yields have moved higher across the curve following the October inflation and national accounts data: the 2-year bond yield is around 3.9–4.0%, while the 10-year yield is near 4.7%, leaving the yield curve only modestly upward sloping after a period of near-flatness. These levels are consistent with markets expecting the cash rate to remain at its current setting well into 2026, with some probability attached to further tightening if inflation proves more persistent than the RBA’s central scenario. Equity markets, by contrast, are more upbeat: the S&P/ASX 200 is trading close to record highs, around 8,600, supported by resilient domestic demand, strong corporate earnings in some sectors and optimism about AI-related and data-centre investment. Credit spreads remain contained, and there are no obvious signs of acute financial stress, though higher risk-free rates continue to weigh on more interest-sensitive parts of the housing and commercial property markets.

Household-sector indicators have improved from the very weak levels recorded earlier in the year, but the underlying message is still one of caution. The Westpac–Melbourne Institute Consumer Sentiment Index jumped 12.8% in November to 103.8, up from 92.1 in October and back into “optimistic” territory for the first time in several years, with broad-based gains across views on family finances, the economic outlook and spending plans; survey detail shows just over one-third of respondents still intend to spend less on Christmas gifts than last year, but the share planning to spend more has risen to around 15%. The latest ABS Monthly Household Spending Indicator shows nominal household spending rising 1.3% in October and 5.6% over the year, the strongest monthly increase since early 2024, with all nine spending categories recording gains and particularly strong growth in discretionary items such as clothing, household goods and hospitality; non-discretionary spending rose a more modest 0.8%. However, Westpac and ABS analysis suggests that real, per-capita spending is roughly flat, and the household saving ratio rose from 6.0% to 6.4% of income in the September quarter as households rebuilt buffers. For monetary policy, the combination of slightly firmer sentiment, modest real spending growth and high but easing cost-of-living pressures suggests that households are coping with higher interest rates, but that further shocks—whether from rates, prices or the labour market—would be felt quickly.

Business sentiment and activity appear somewhat more resilient than household indicators, though the picture remains uneven across sectors. According to the NAB Monthly Business Survey, business confidence eased slightly in October, with the confidence index slipping from +7 to +6, but remained just above its long-run average; business conditions improved to +9, supported by stronger sales and profitability; capacity utilisation edged up to around 83.4%, about 2 percentage points above its long-run average. Forward orders have returned to slightly positive territory and are now at their highest level since April 2023, consistent with moderate near-term growth and only limited spare capacity. Survey and high-frequency indicators of production tell a similar story: the Judo Bank/S&P Global manufacturing PMI rose back into expansionary territory in November, increasing to 51.6 from 49.7 in October, and the composite PMI edged up to 52.6, signalling modest output growth across both manufacturing and services. Smaller firms remain more cautious, and pockets of weakness are evident in construction and parts of services, but there is little sign of an imminent collapse in business investment. For the RBA, firm business conditions and healthy investment intentions underscore the risk that domestic demand—and hence inflation—could prove more persistent than earlier assumed, even as headline growth slows.

The international backdrop, as set out in the OECD’s December 2025 Economic Outlook, is one of “resilient but fragile” growth. The OECD projects global GDP growth of 3.2% in 2025, slowing to 2.9% in 2026 before edging up to 3.1% in 2027, with inflation gradually converging towards central bank targets over the next two years. Growth in the United States is expected to moderate from 2.0% in 2025 to around 1.7–1.9% in 2026–27, while the euro area is forecast to grow by roughly 1¼% per year and China’s expansion to slow from 5.0% to about 4½% over the same horizon. The Outlook highlights several downside risks: renewed trade tensions and higher tariffs, especially between the United States and China; high public- and private-sector debt; stretched valuations in AI-related equity sectors; and the ongoing adjustment in China’s property market. For Australia, the OECD expects GDP growth to strengthen from 1.8% in 2025 to 2.3% in 2026 and 2027, with unemployment remaining low and inflation staying close to target as the small negative output gap gradually closes. This baseline would be broadly supportive of Australian exports and national income, but the concentration of Australia’s trade links with China and other Asian economies means that any sharper-than-expected global slowdown, or a correction in commodity and AI-related investment, could transmit quickly to domestic activity and, by extension, to the RBA’s policy calculus.

The Shadow Board assigns a 56% probability that holding the overnight rate at 3.6% is optimal (77% in the previous round), a 3% probability that reducing the overnight rate to 3.6% is appropriate (9% in previous round), and a 41% probability that raising the rate above 3.60% is warranted (14% in the previous round). Hence, the Shadow Board’s perceived inflation risks are noticeably shifting to the upside.

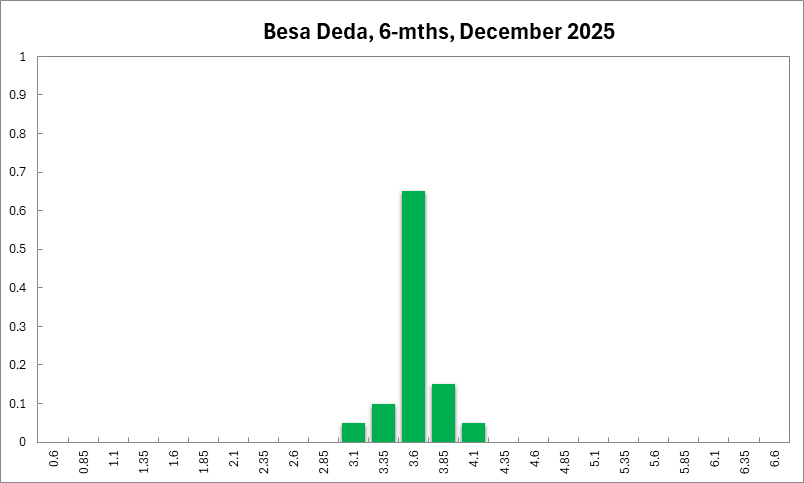

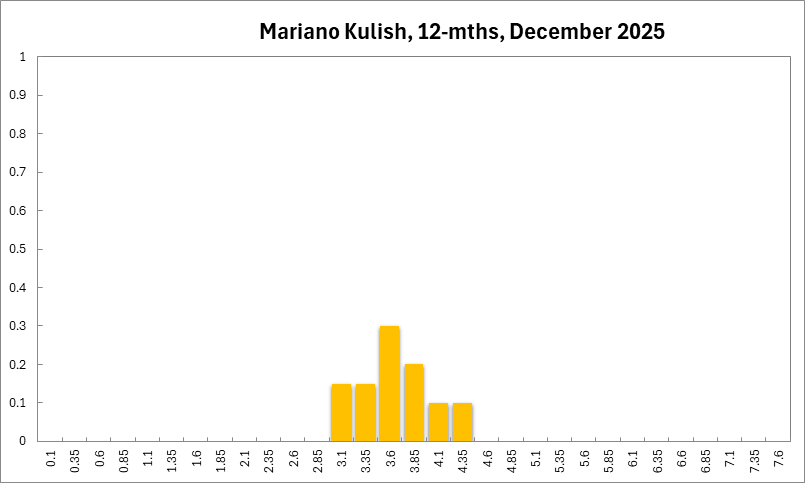

Six months out, the Board attaches a 20% probability that the cash rate should be lower than the current setting of 3.60% (40% in previous round), 38% that the current setting is optimal (37%), and 42% that a higher rate is required (23%). At the 12-month horizon, probabilities are 35% for a lower interest rate (57%), 29% for a rate hold (20%), and 37% for a higher rate (23%). Three years out, the Board attaches a 62% probability of a lower rate being optimal, 12% to the current setting, and 26% to a higher rate.

The distribution for the current recommendation shifted up slightly, to 3.35%–4.60%. For the 6-month horizon, the distribution extended at the upper bound, to 2.85%–4.85%. The same applies at longer horizons, with ranges at 0.10%–4.85% (twelve months) and 0.10%–5.10% (three years).