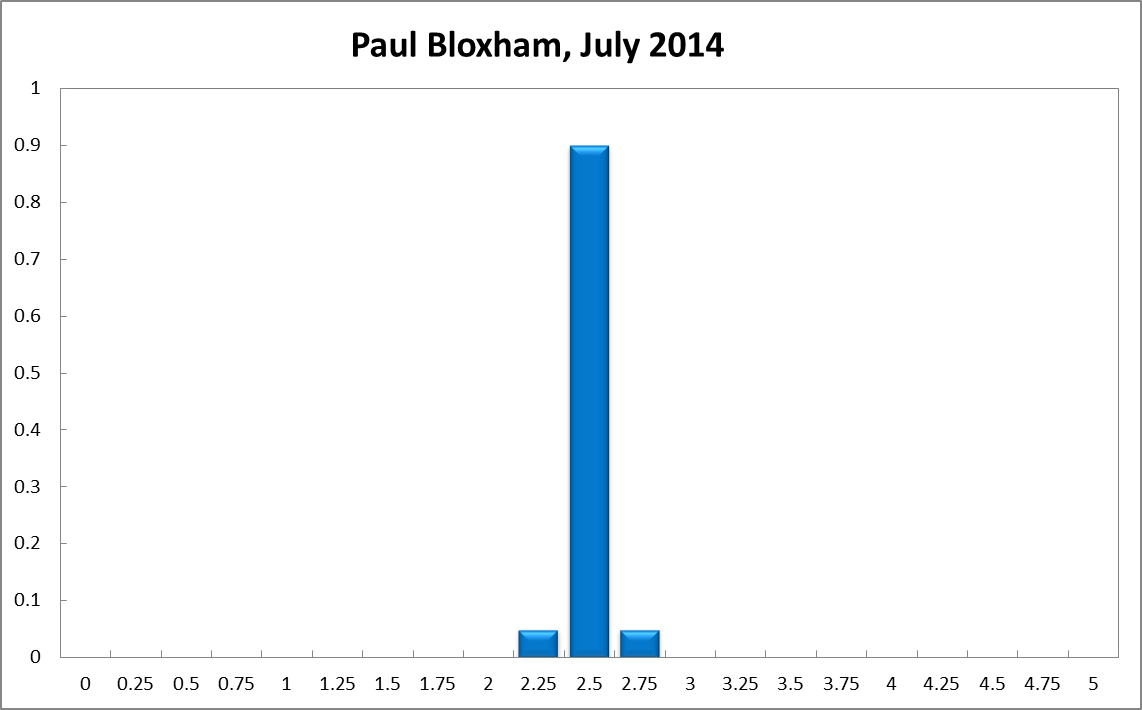

Australia's GDP growth was strong in the first quarter, although more timely indicators suggest some loss of momentum recently. New building approvals have fallen while growth in retail sales and housing prices has slowed. Consumer sentiment has remained weak following cuts announced in the Federal budget. Local incomes are also being squeezed by the combination of falling commodity prices and a rising AUD in recent months. With inflation well contained and activity and income growth appearing to have softened in the past couple of months, there is little evidence to suggest that local interest rates will need to rise anytime soon. At the same time, there are still signs that the domestic economy is being supported by low interest rates. Business surveys continue to suggest higher levels of confidence than last year and the labour market is showing signs of gradual improvement. I recommend that the cash rate is left unchanged this month.

Outcome: July 2014

Australian Economy Consolidating Slowly

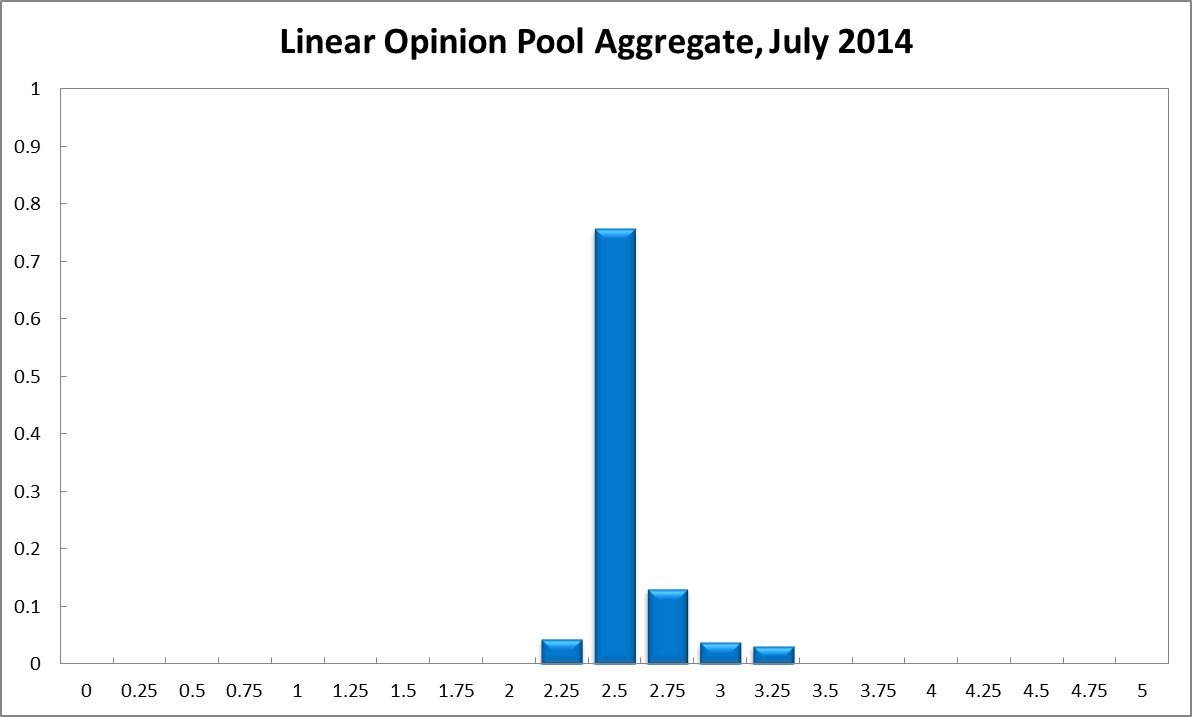

The Australian economy is continuing down its path of slow and steady consolidation. The labour market is holding up and GDP growth remains solid. Consumer confidence, depressed after the government’s May budget, has improved slightly, as have several indicators of business sentiment. The CAMA RBA Shadow Board’s conviction that the cash rate ought to remain steady at 2.5% remains unshaken; it continues to attach a 76% probability that this is the appropriate setting. The probability attached to a required rate cut has fallen two percentage points to 4%, while the probability of a required rate hike has risen slightly to 20%.

The unemployment rate again clocked in at 5.8%. Employment fell in May and fewer vacancies were posted, compared to the previous month. Labour costs have fallen slightly.

There is no new information about inflation until the release of second quarter inflation measures. The Australian dollar, now worth approximately 94 US cents, is strengthening slightly. Asset prices remain high, although there are possible signs that the housing market’s run is slowing, with new building approvals falling and price growth slowing. Some shadow board members, notably Prof. Warwick McKibbin, remain concerned about the distortionary effects on asset prices of prolonged low interest rates.

The global economy’s recovery remains shaky. US first quarter GDP growth was weak, with recent revisions to healthcare spending and a harsh winter indicating the world’s largest economy contracted by 2.9%. The Federal Reserve is continuing with its announced policy of phasing out monthly purchases but more weak economic data will presumably make the US central bank more doveish. European data is again mixed although tensions in the Ukraine appear to be waning which should reduce pressure on energy markets. Japan’s economy is improving, while China’s is steadying.

Promising signs for the Australian economy come from the rebound in the AIG’s manufacturing index, which in May climbed 4.5 points to 49.22, half a point shy of its 15-year average. With a slight improvement in consumer confidence as well as the AIG’s services index, we may just be seeing the fruits of sustained low interest rates. Should these indicators continue to improve over the next few months, the call for a tightening of monetary policy will likely grow louder.

The consensus to keep the cash rate at its current level of 2.5% remains unchanged at 76%. The probability attached to a required rate cut has edged down to 4% (6% in June) while the probability of a required rate hike has risen to 20% (18% in June).

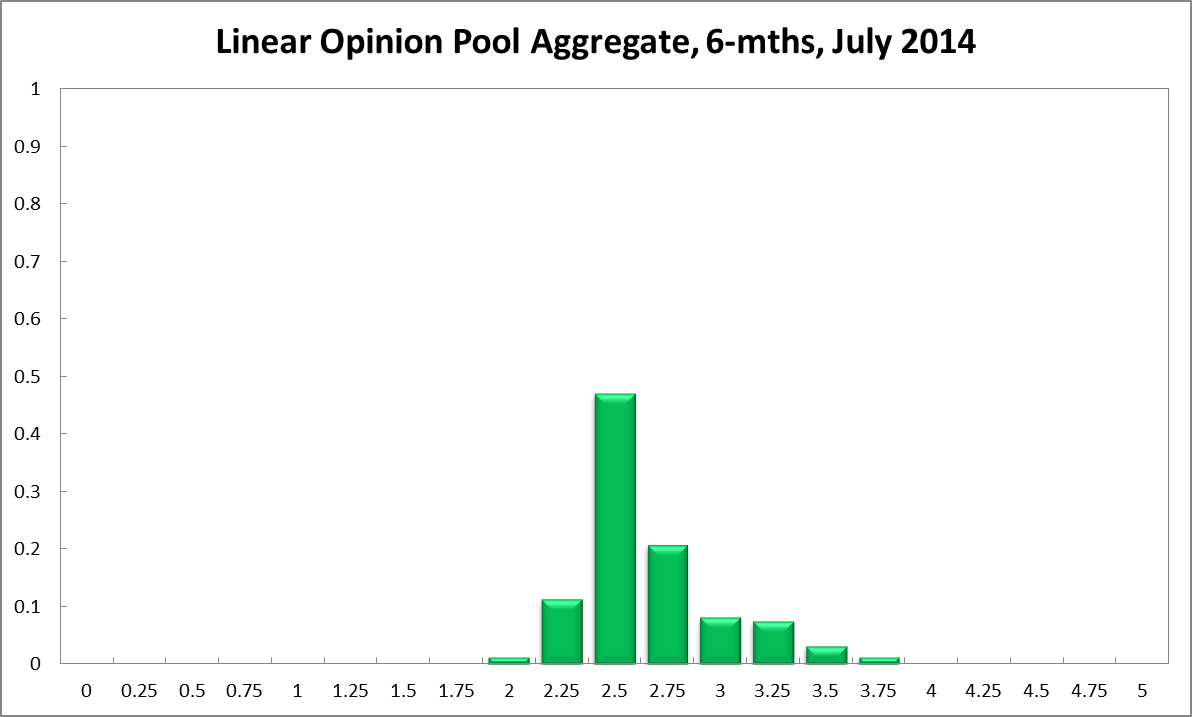

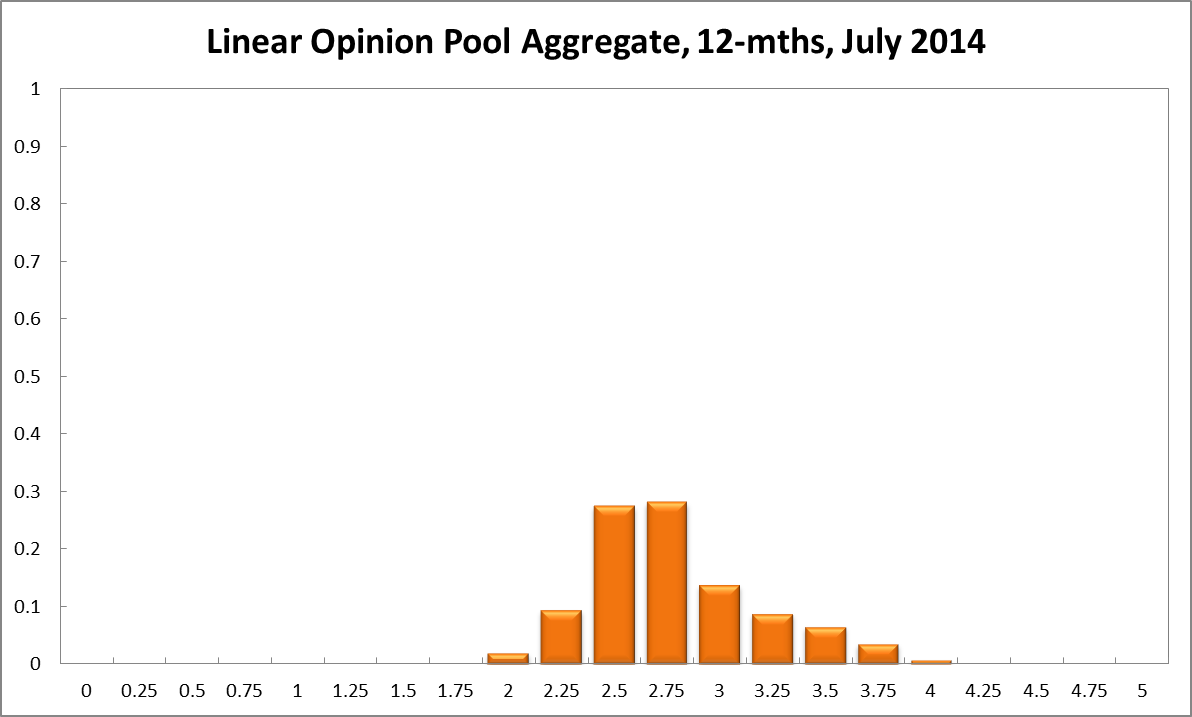

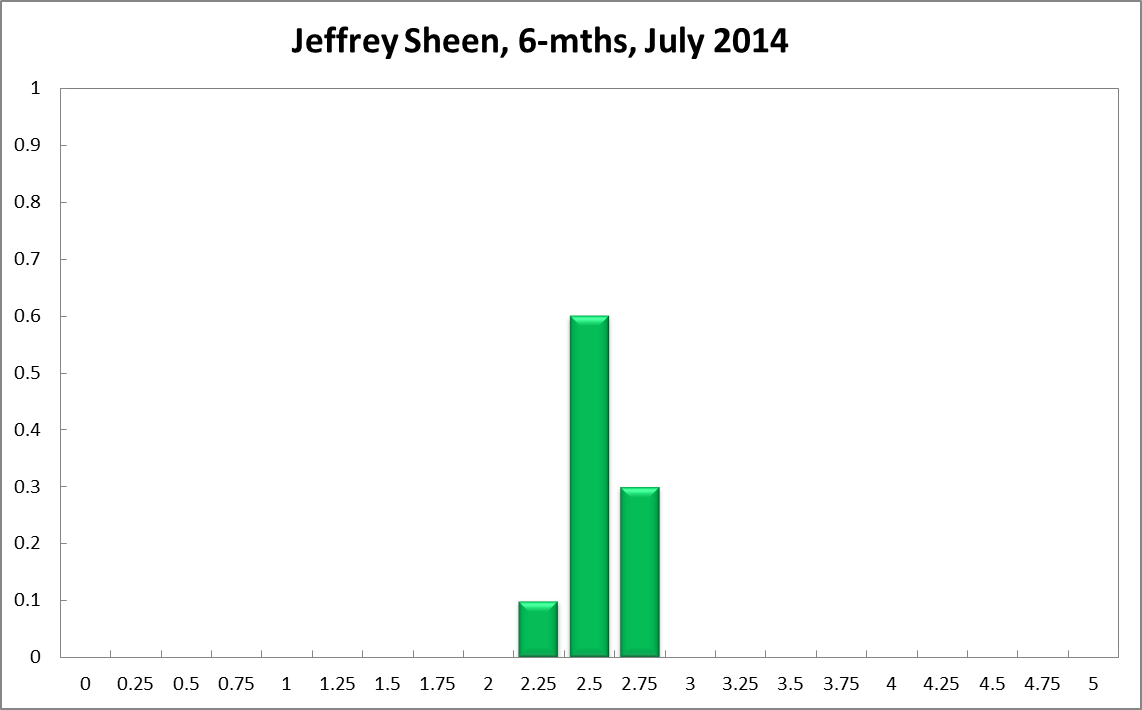

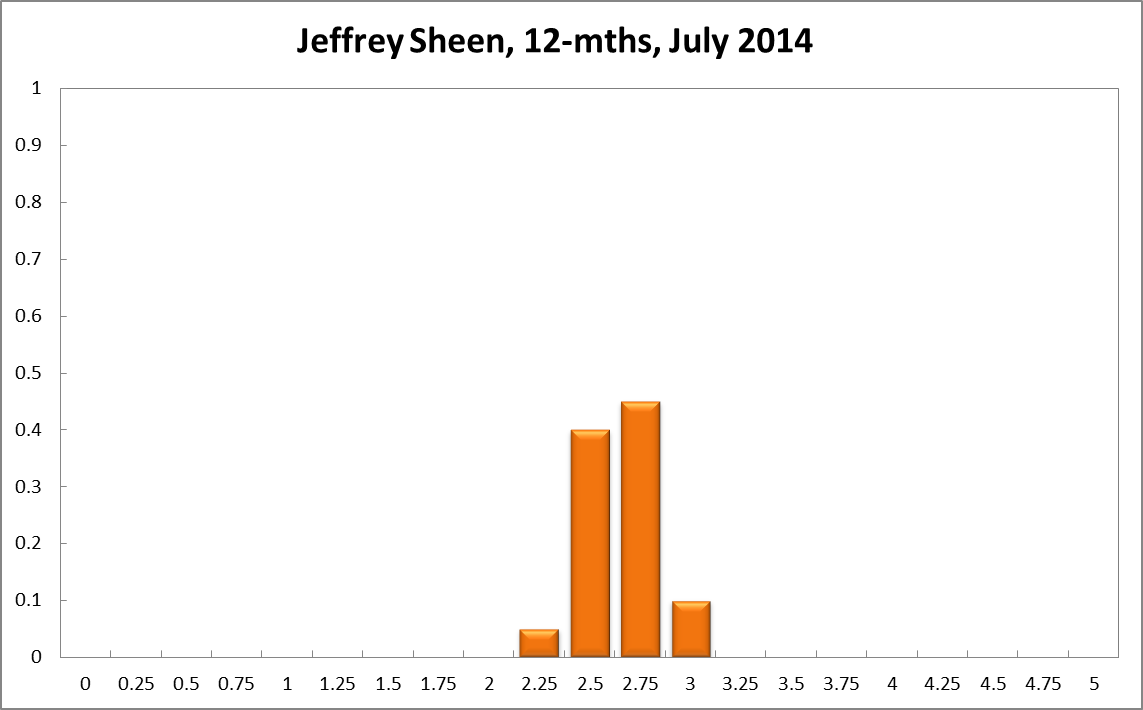

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% equals 47% (46% in June). The estimated need for an interest rate increase is 41% (40% in June), while the need for a decrease has fallen to 12%. A year out, the Shadow Board members’ confidence in a required cash rate increase has risen to 61% (59% in June), the need for a decrease fell to 11% (13% in June), while the probability for a rate hold has remains at 28%.

Aggregate

Current

6-Months

12-Months

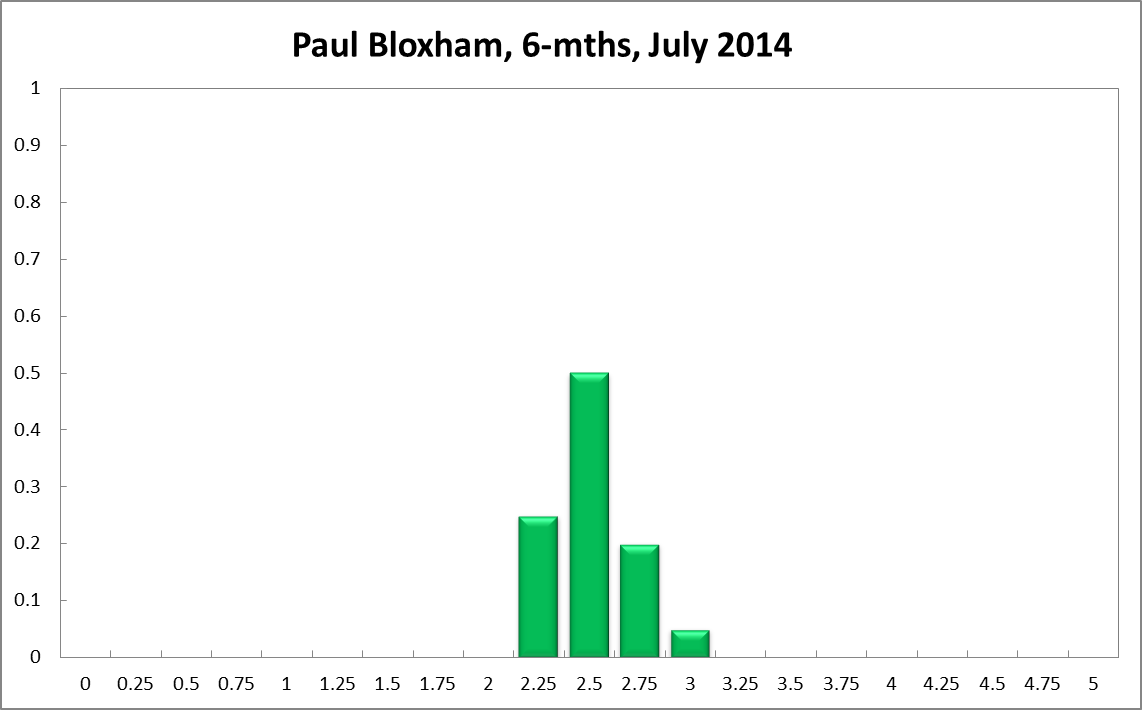

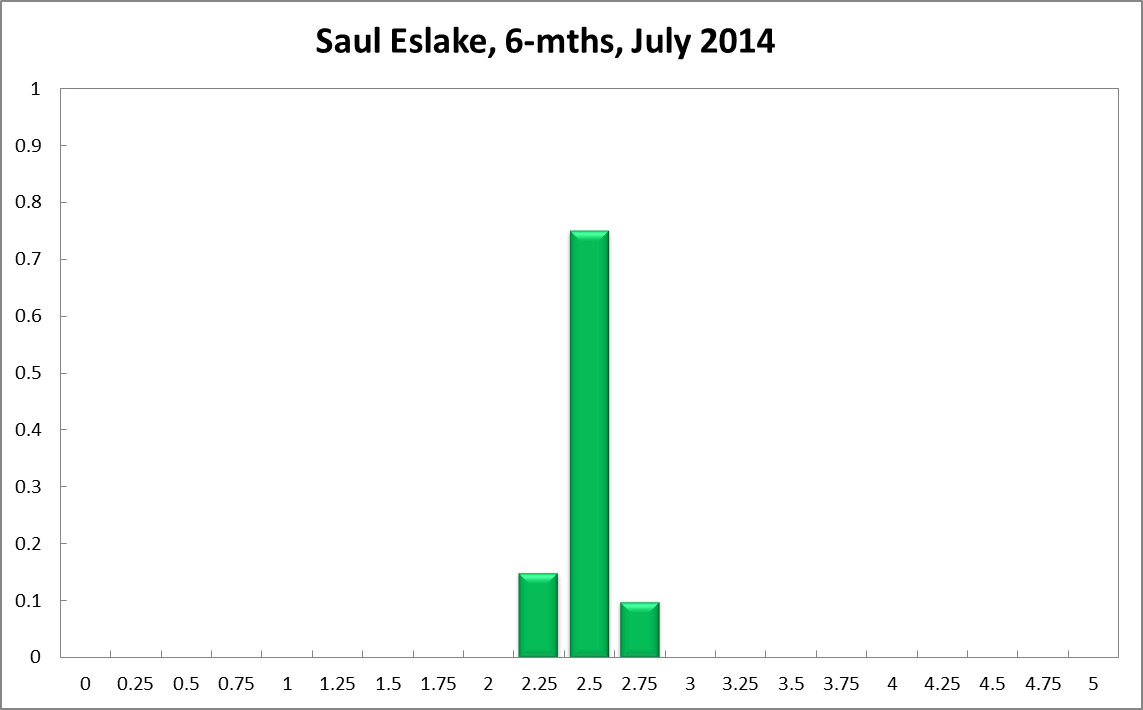

Paul Bloxham

Current

6-Months

12-Months

Comments

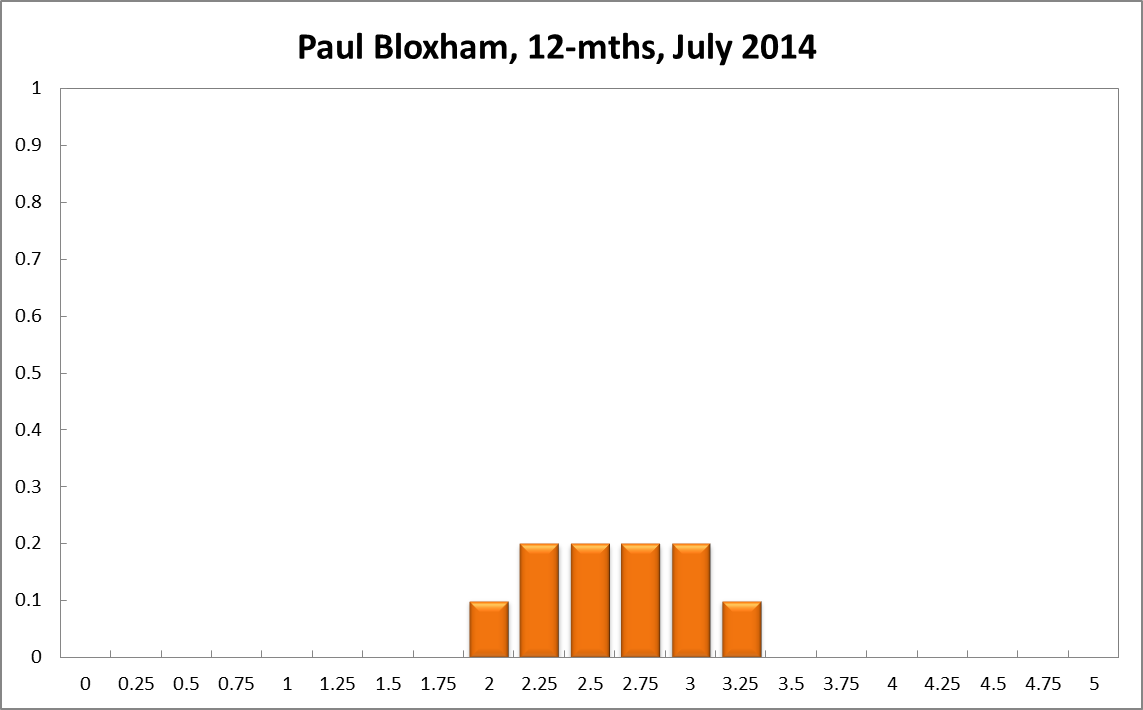

Mardi Dungey

Current

6-Months

12-Months

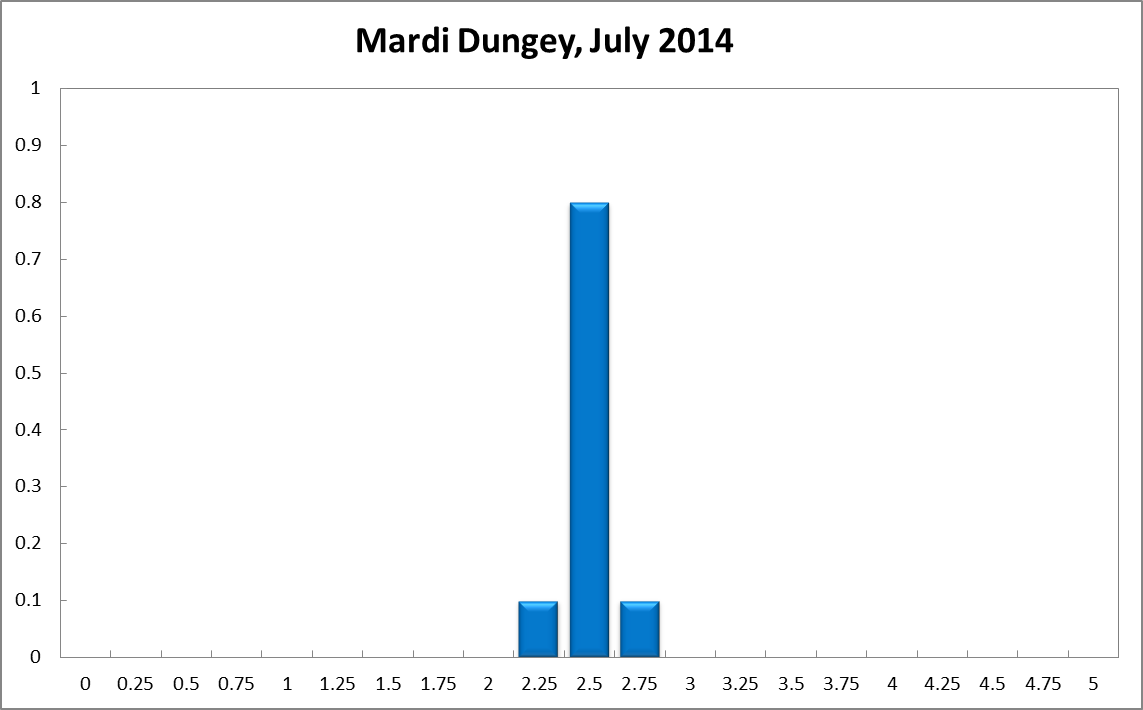

Saul Eslake

Current

6-Months

12-Months

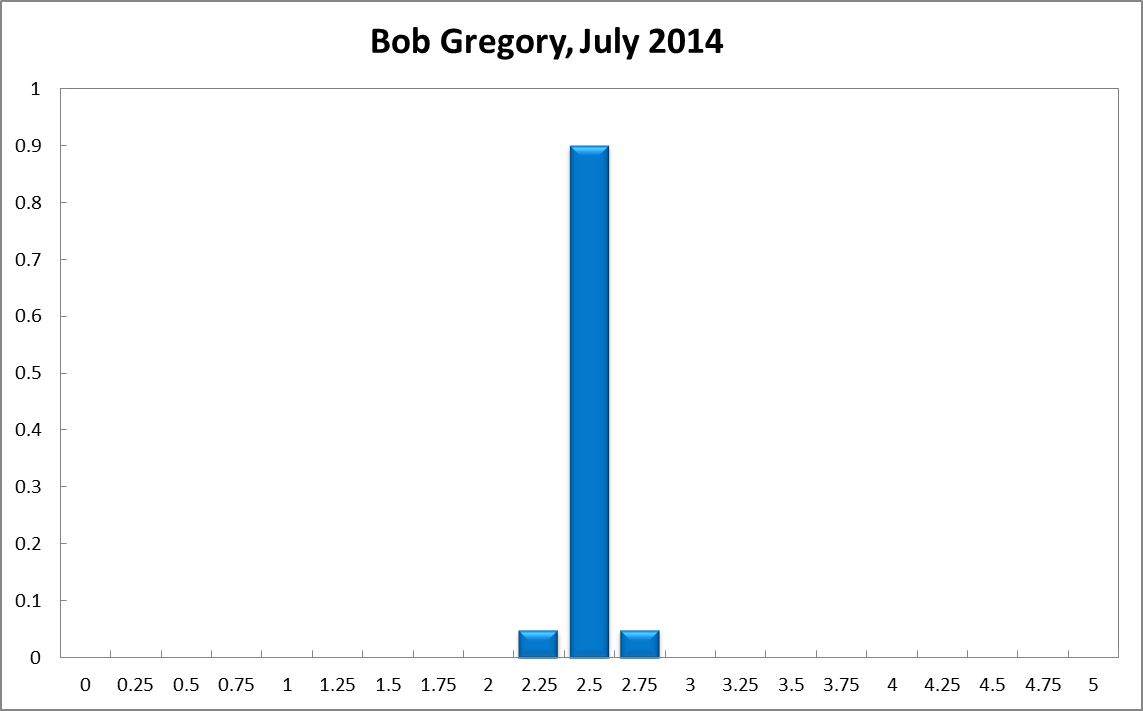

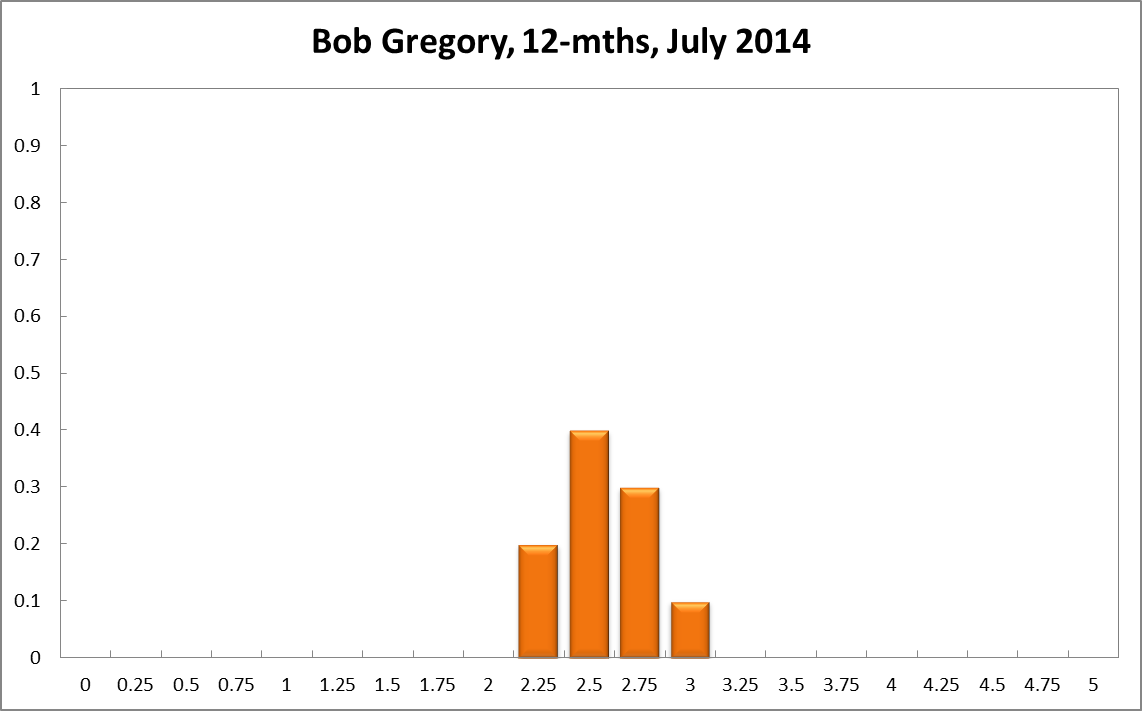

Bob Gregory

Current

6-Months

12-Months

Comments

No radical change either up or down in the economic outcomes just a slow movement. Have been worried about house price increases spreading but this prospect seems to have eased.

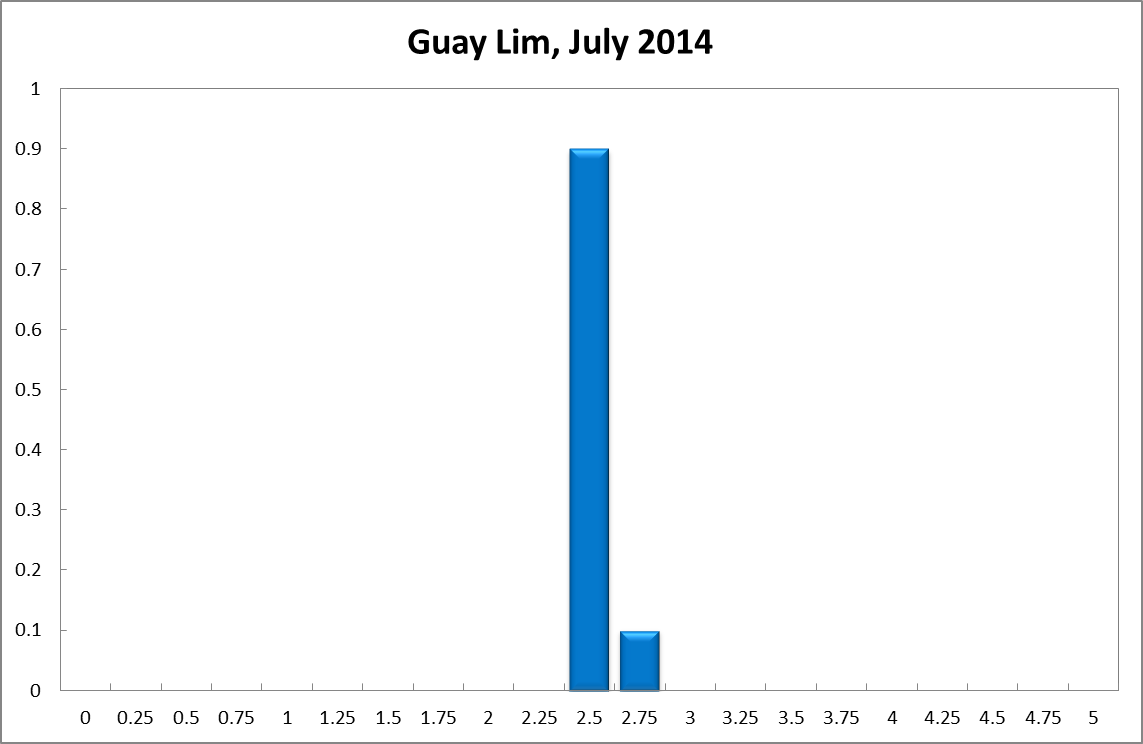

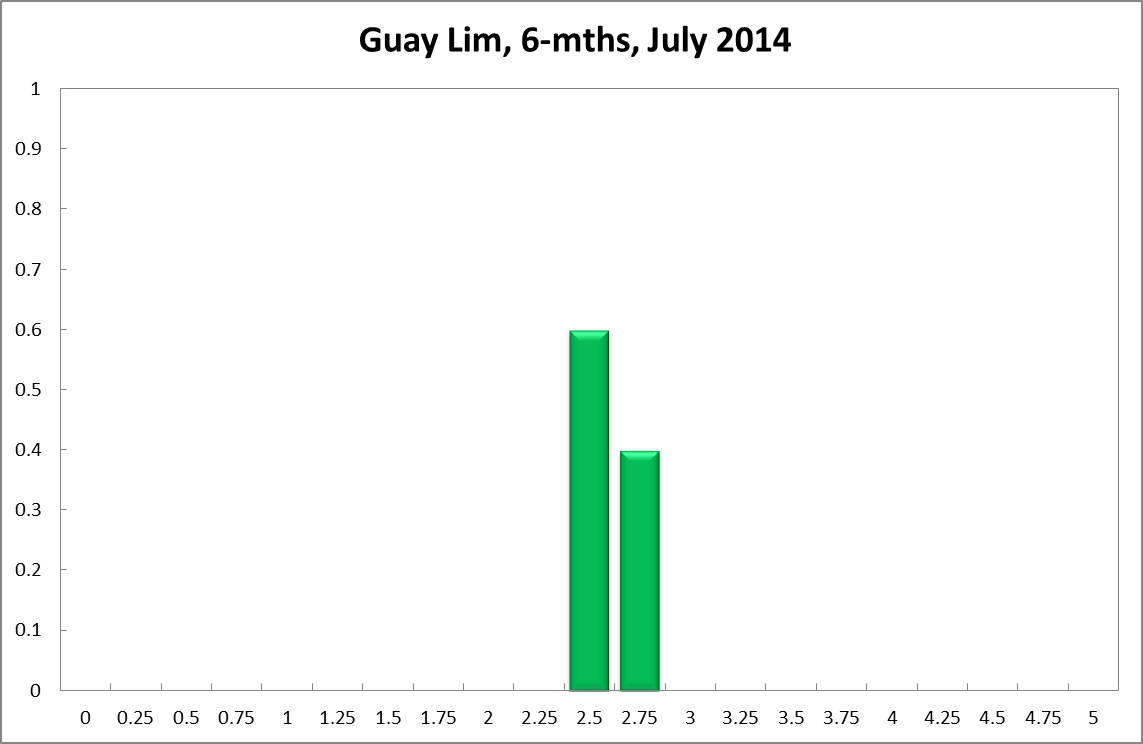

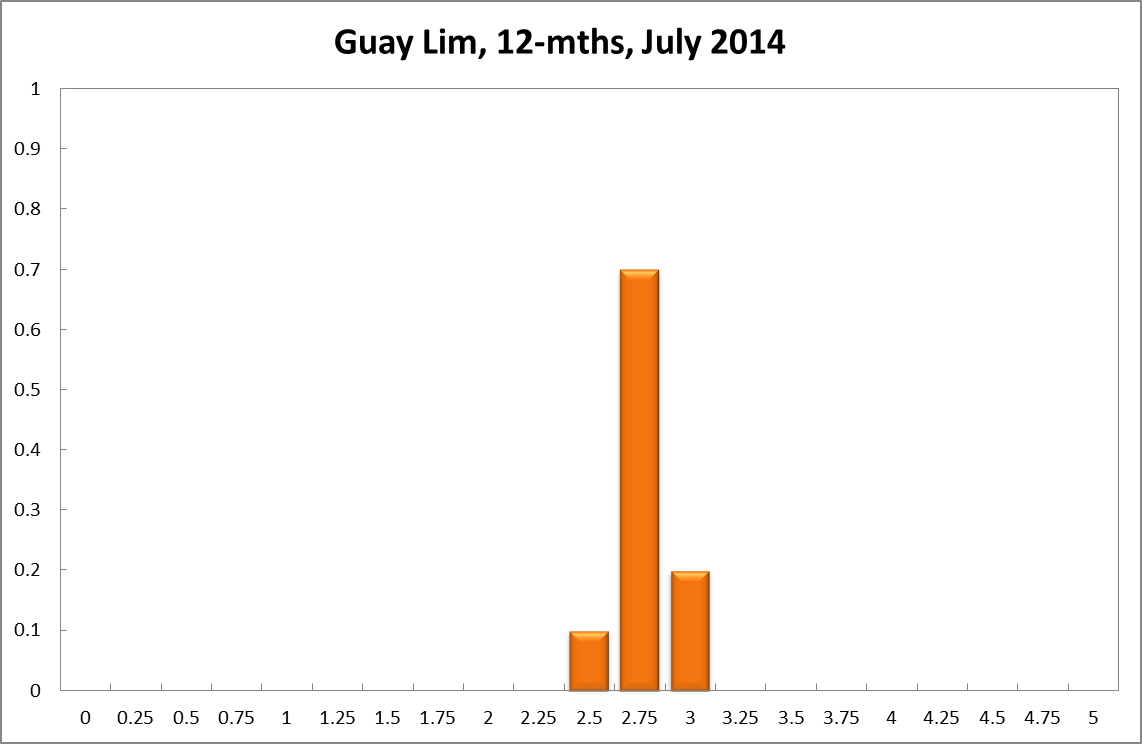

Guay Lim

Current

6-Months

12-Months

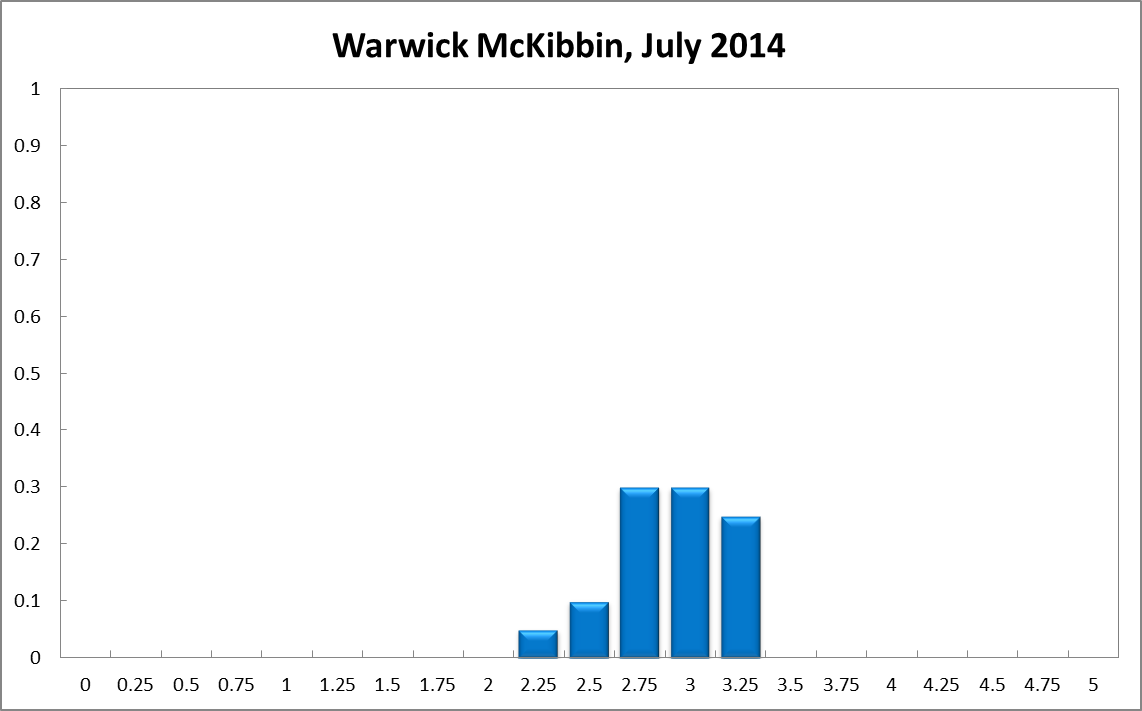

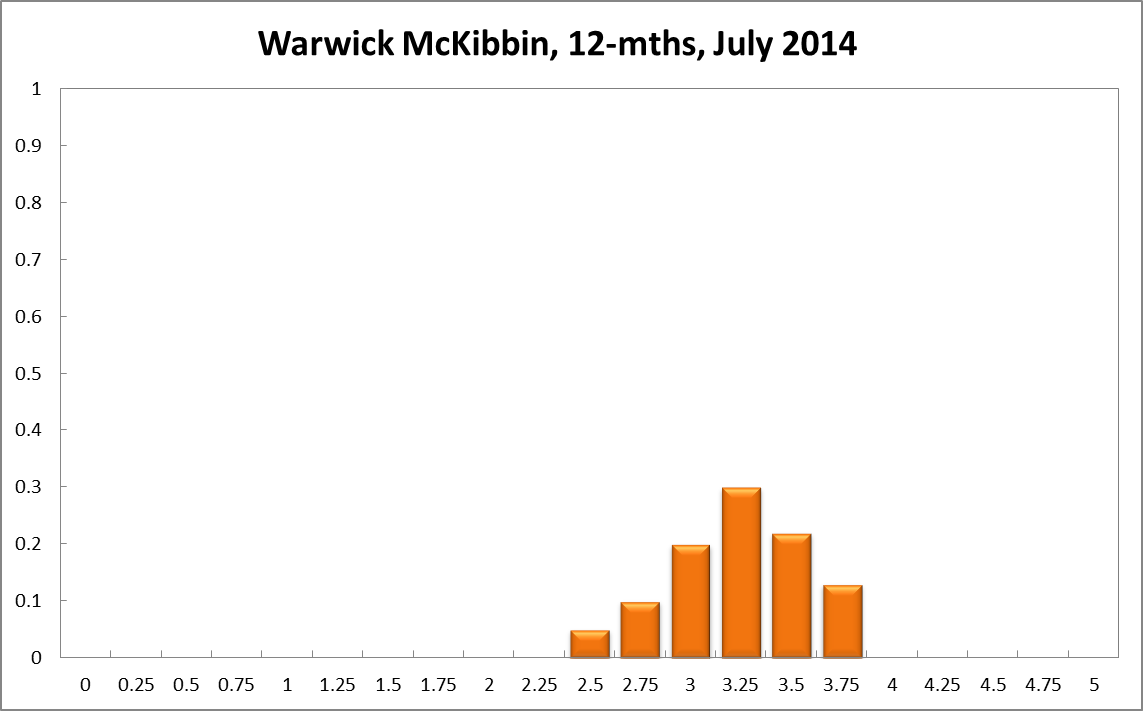

Warwick McKibbin

Current

6-Months

12-Months

Comments

In my view current Australian interest rates are too low. The problem is that monetary policy is aimed at stimulating non-mining parts of the economy particularly housing construction. Monetary policy should focus on the growth rate of nominal GDP as a benchmark to guide interest rates. Given the current growth rate of nominal GDP of around 4-5 percent per year, a neutral monetary policy would be a risk adjusted interest rate of at least 4.5 per cent. Allowing for risk adjustment, this suggests the Australian policy rate should be closer to 3 per cent and possibly even 3.5 per cent. The current stance of monetary policy is at risk of increasing demand for assets, which will drive up the price of those assets. Unless there is a supply response, that will lead to pure capital gain and ultimately a bubble which will be costly to clean up. Australia faces a shift in global portfolio preferences towards Australian assets as well ultra-loose monetary policy in major countries that experiences a financial crisis causing a search for robust currencies. This means the usual channel of loose monetary policy through weakening the $A is no longer viable even if it was the goal. The focus on generating economic growth should be on the supply side of the economy through cost reductions (productivity improvements) improving competitiveness. There is not much a central bank can do about this except intellectual leadership in the debate.

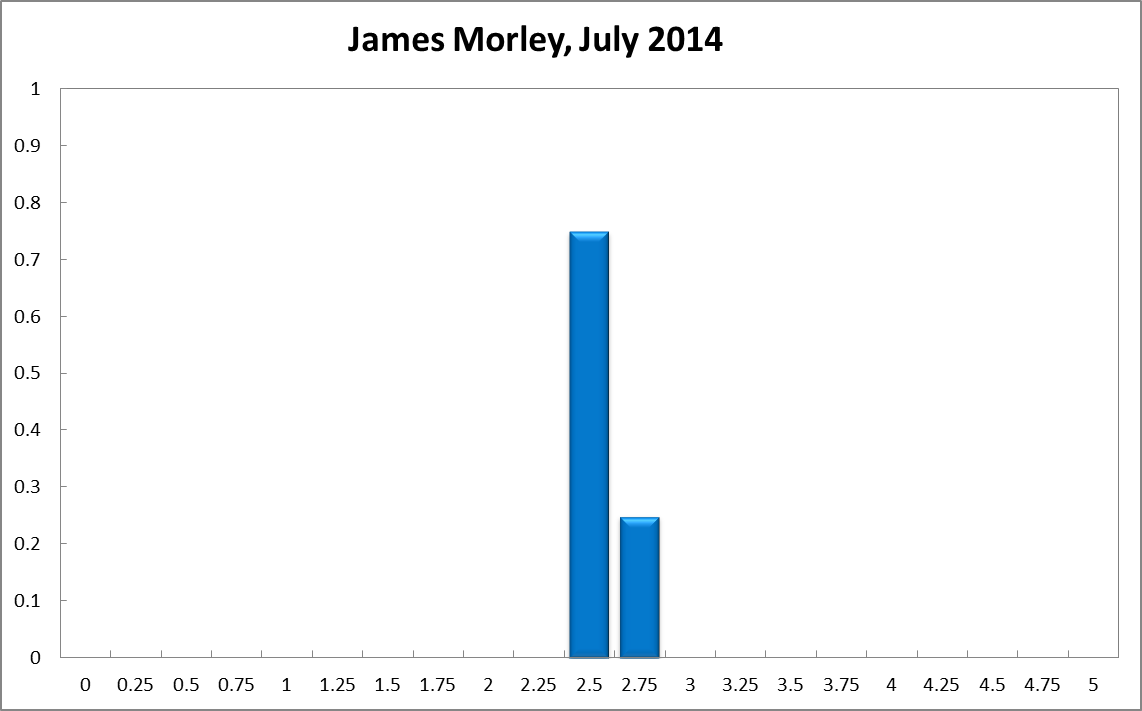

James Morley

Current

6-Months

12-Months

Comments

Inflation expectations remain well anchored, providing scope for the RBA to focus on real and financial conditions.

In light of fragile consumer confidence and fiscal policy uncertainty, the RBA should hold steady until there are clearer indications of improvements in the labour market or there are broad and abnormal increases in credit growth.

Jeffrey Sheen

Current

6-Months

12-Months

Comments

Australian output growth is slightly above normal at 3.5%, mostly driven by export volumes in resources. The labour market is showing improvement, with unemployment ticking down to 5.8%, wages growth a modest 2.5%, and labour productivity (in mining and non-mining) back to the pre-crisis average of about 2%. The structural divide between the mining industry and the rest is beginning to dissipate. The real export-weighted index is depreciating a little, largely because relative unit labour costs are falling. Inflation remains benign. The tough fiscal budget proposed by the government is likely to be softened by the Senate, which will reduce its negative short run impact. Confidence as exhibited in asset market prices is strong. Changes in the global economy, as they apply to Australia, are mixed. China’s growth rate is slowing marginally, but its demand for our exports remains substantial. Oil prices are rising due to the escalation of hostilities in Iraq, and if these worsen, there could be negative implications for Australian economic activity. This all suggests that, at the margin, the probability of an increase in the cash rate is now higher and the time to wait before that happens is shrinking.