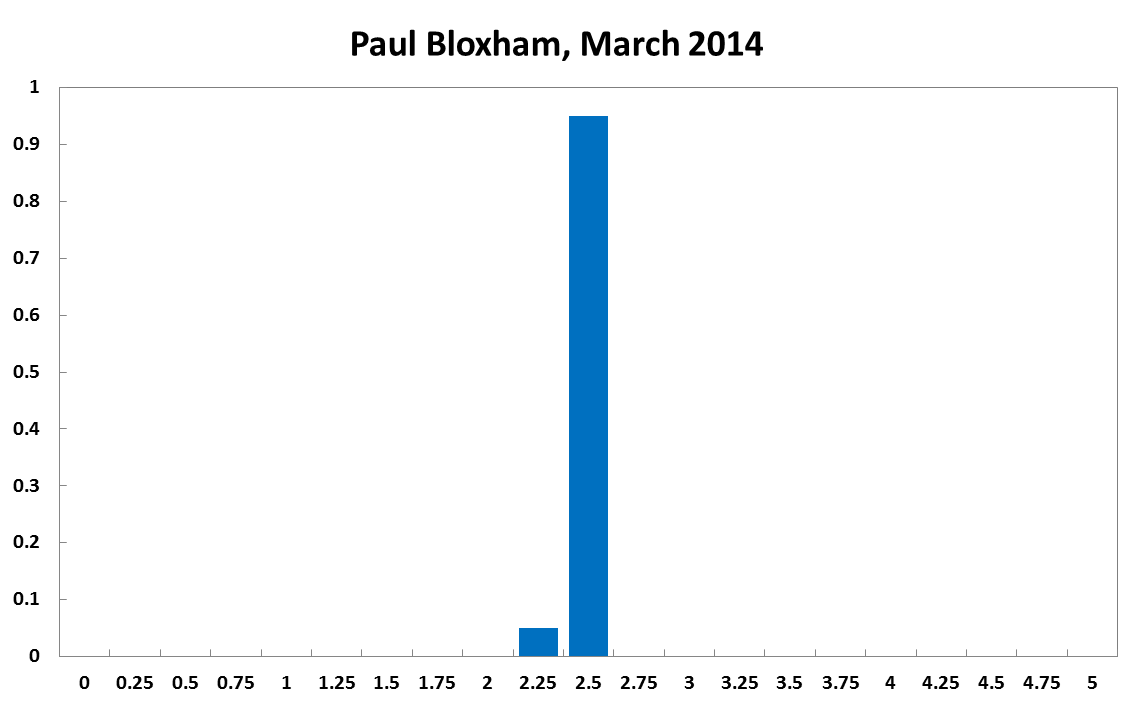

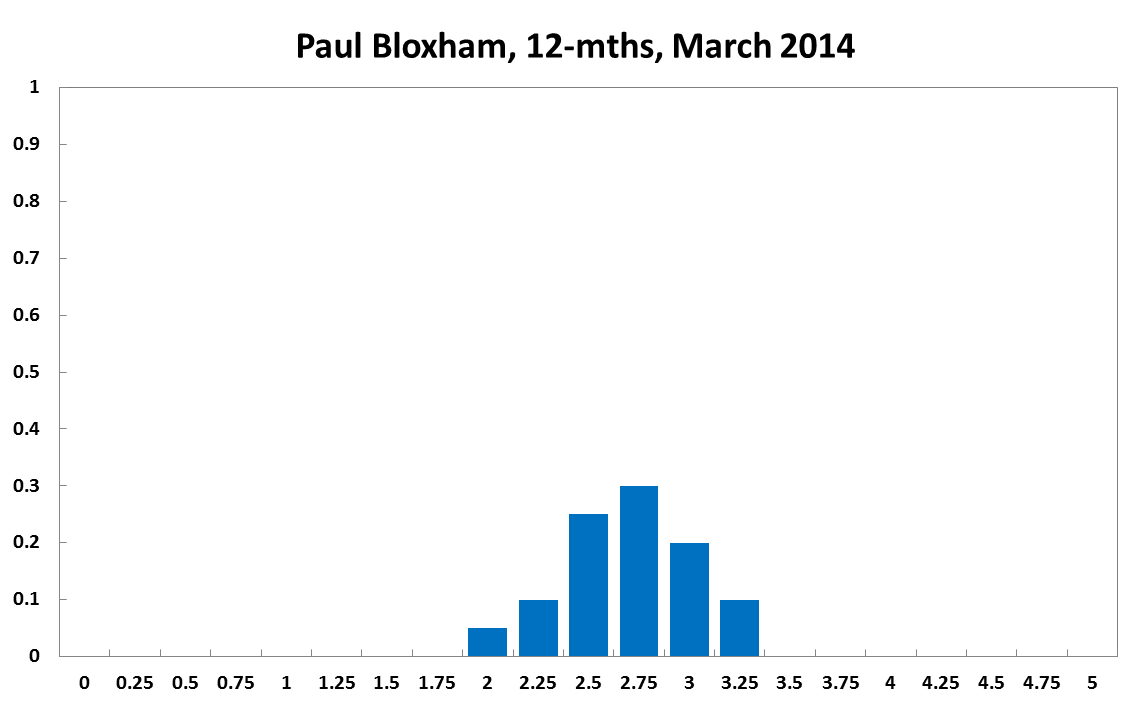

With inflation already in the upper half of the target band there is little scope to cut interest rates further. The recent data also suggest that low interest rates, and a now lower currency, are already having the desired effect of lifting domestic demand. One area of continued weakness is the labour market, although the timely indicators suggest that there may be some improvement in employment conditions afoot, consistent with the typical lag between a lift in activity and a rise in hiring. A weak labour market and slow wages growth should limit the need to lift interest rates any time soon, although if the labour market improves it may be necessary to start to consider moving interest rates back towards neutral. I recommend that the cash rate is left unchanged this month. Looking forward, I see it as more likely than not that the cash rate will need to be higher than its current level in 12 months time.

Outcome: March 2014

Labour Market Weakness Calls for Continued Monetary Accommodation

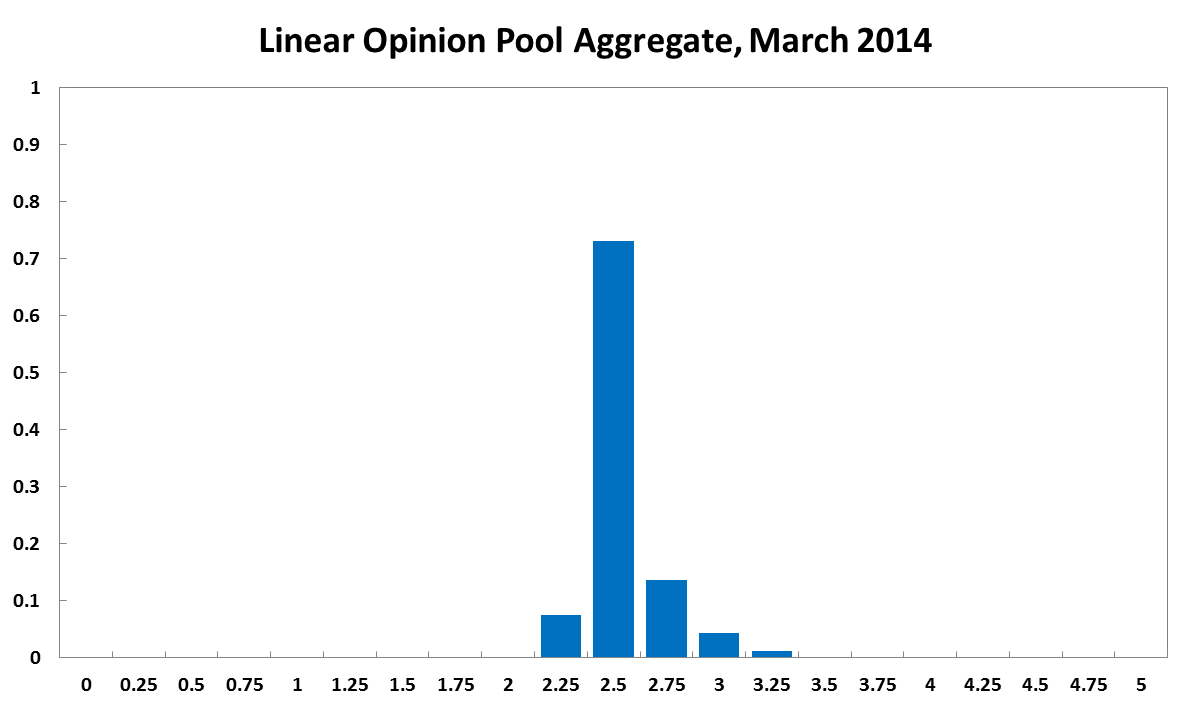

Weakness in the Australian labour market is making the CAMA RBA Shadow Board advocate continued monetary accommodation. The Shadow Board is 73% confident that the cash rate should remain steady at 2.5%. The probability attached to a required rate cut equals 8% while the probability of a required rate hike has fallen to 19%.

The Australian unemployment rate rose to 6% in January 2014, with underemployment and the median duration of unemployment also worsening. The key question is whether improvements in domestic demand will curb the increase in un- and underemployment or whether weakness in the labour market will persist.

Inflation has edged up but remains within the 2-3% target range. The Australian dollar has rebounded slightly from its recent lows to approx. 90 US cents. Asset markets, in particular housing, remain buoyant, bolstering the concern that it is cheap money, not sound fundamentals, that is driving asset prices.

Overseas, the picture is much the same as in the previous month. US economic data is still mixed but improving. Investors will closely scrutinize the new Federal Reserve Board governor’s rhetoric to identify any change in policy stance. The spectre of deflation is rearing its head in the Euro zone while major developing economies, especially the BRICS countries, continue to weaken. Global economic weakness may help to put a floor on the Australian dollar as international investors are looking for safe havens unless commodity prices plummet.

The consensus to keep the cash rate at its current level of 2.5% has increased further. The Shadow Board’s confidence in keeping the cash rate steady equals 73% (68% in February 2014). The probability attached to a required rate cut equals 8% (3% in February) while the probability of a required rate hike has fallen to 19% (28% in February).

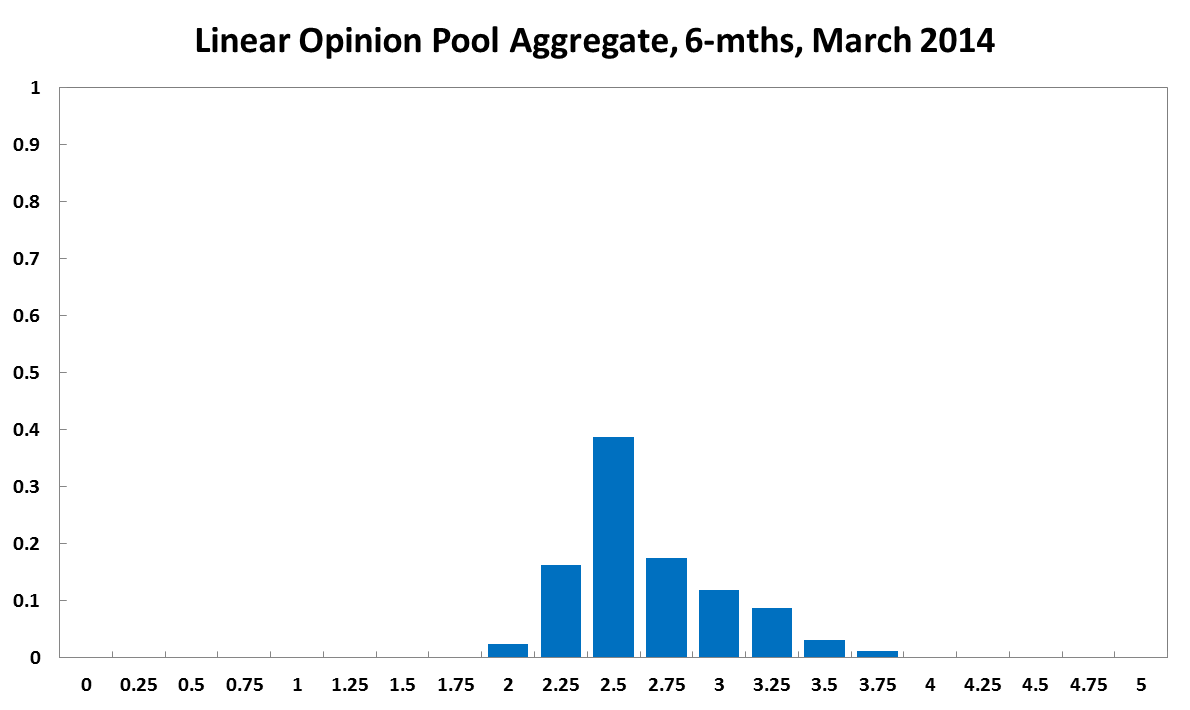

The probabilities at longer horizons are as follows: 6 months out, the probability that the cash rate should remain at 2.5% is unchanged at 39%. The estimated need for an interest rate increase is down a percentage point to 43%, while the need for a decrease has nudged up to 19% (17% in February). A year out, the Shadow Board members’ confidence in a required cash rate increase has fallen to 54% (58% in February), the need for a decrease remains unchanged at 19%, while the probability for a rate hold has risen to 26% (up from 23% in February).

Note: Prof. Mardi Dungey was unable to vote in this round, so the linear opinion pool aggregate is based on 8 members.

Aggregate

Current

6-Months

12-Months

Paul Bloxham

Current

6-Months

12-Months

Comments

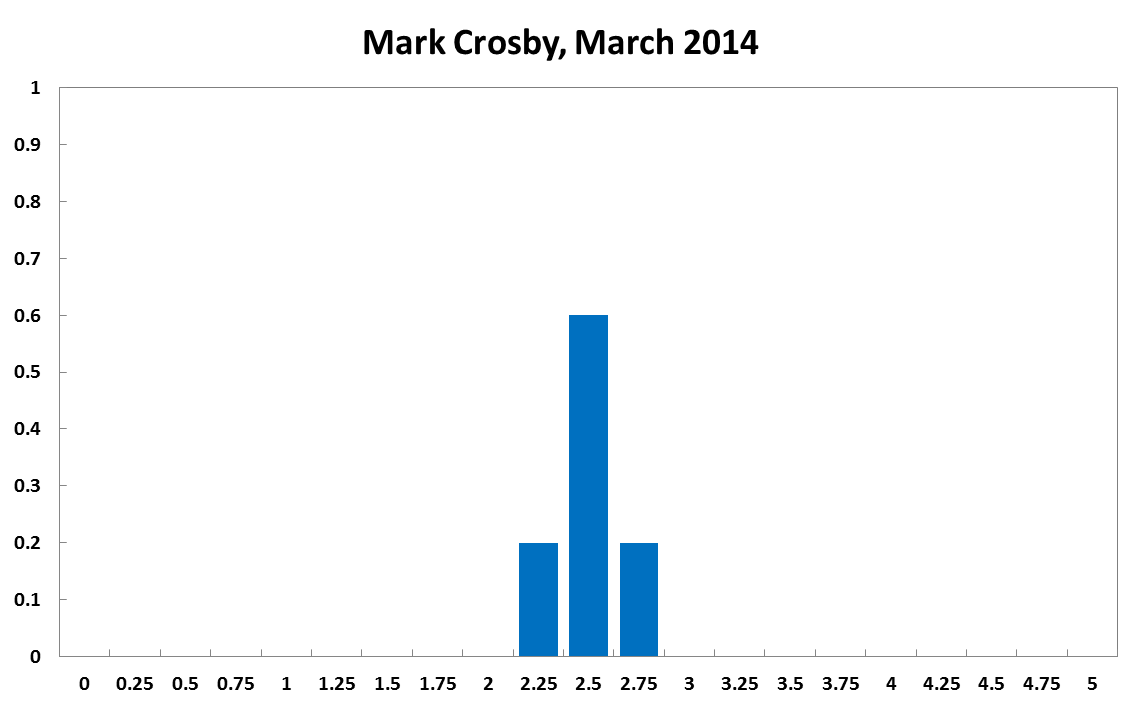

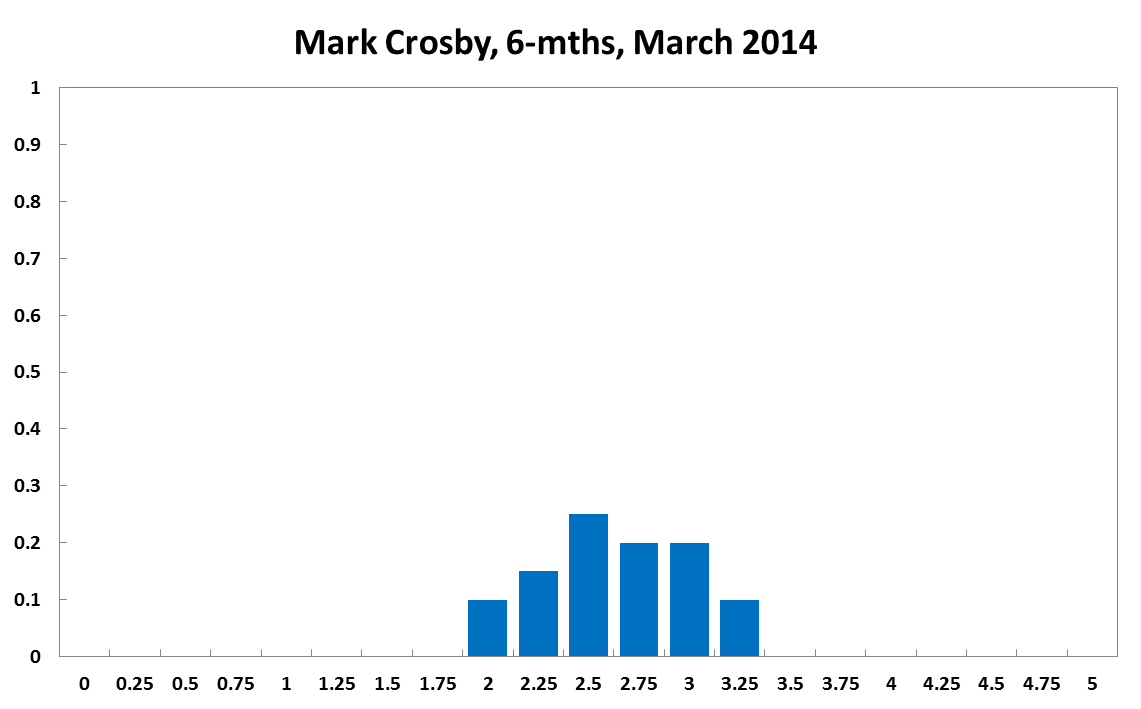

Mark Crosby

Current

6-Months

12-Months

Comments

With tapering continuing and signs consistent with ongoing recovery, albeit weak, in advanced economies the medium term outlook is likely to be for modest increases in rate settings.

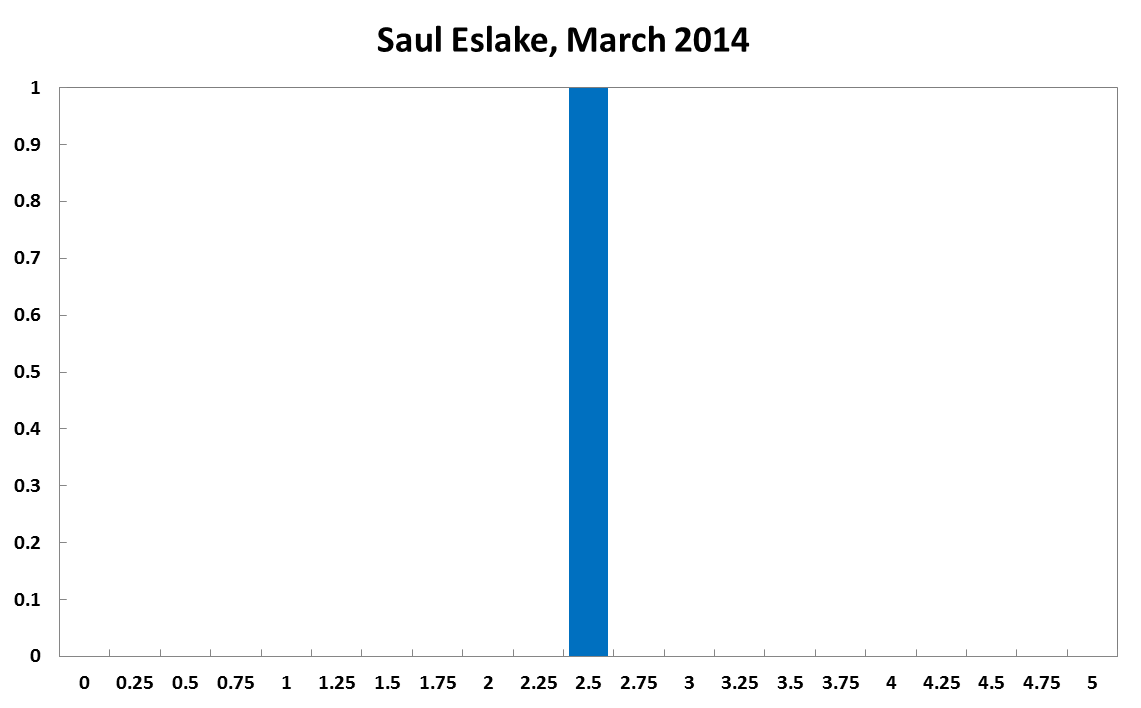

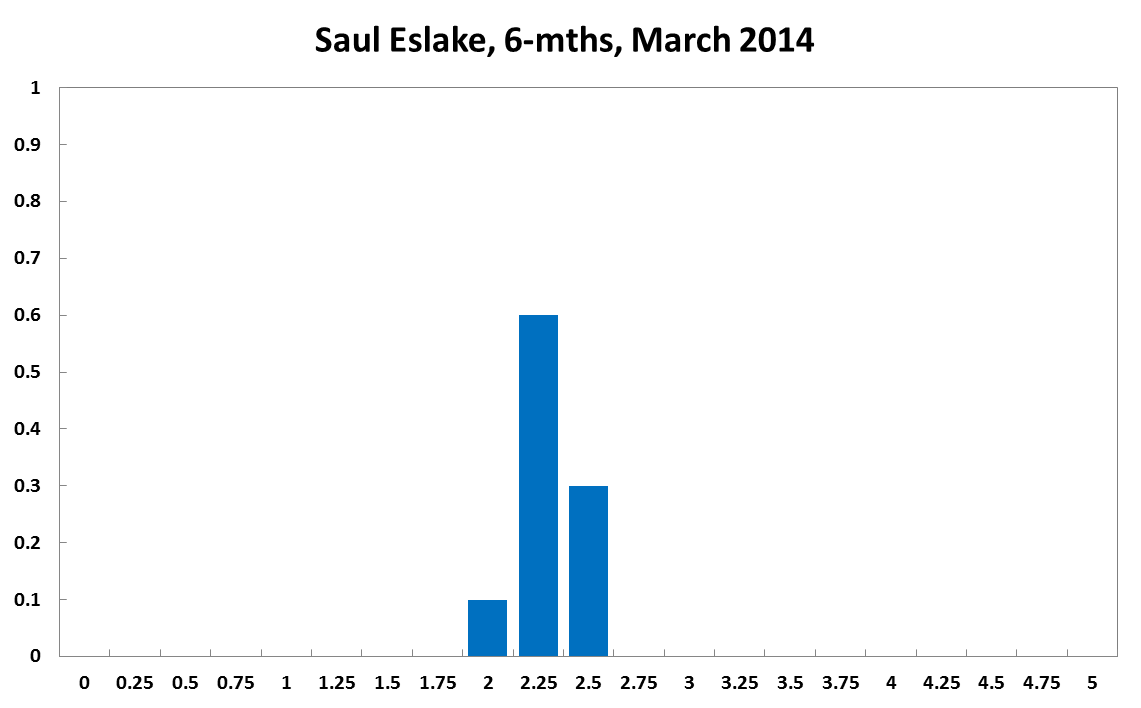

Saul Eslake

Current

6-Months

12-Months

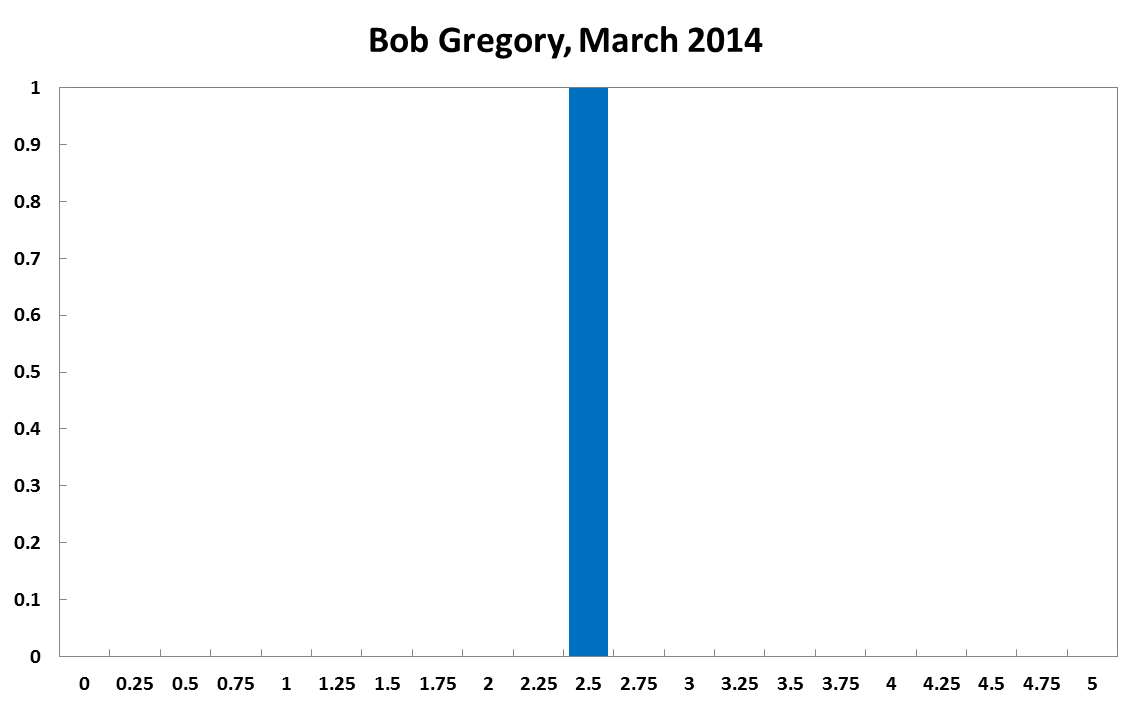

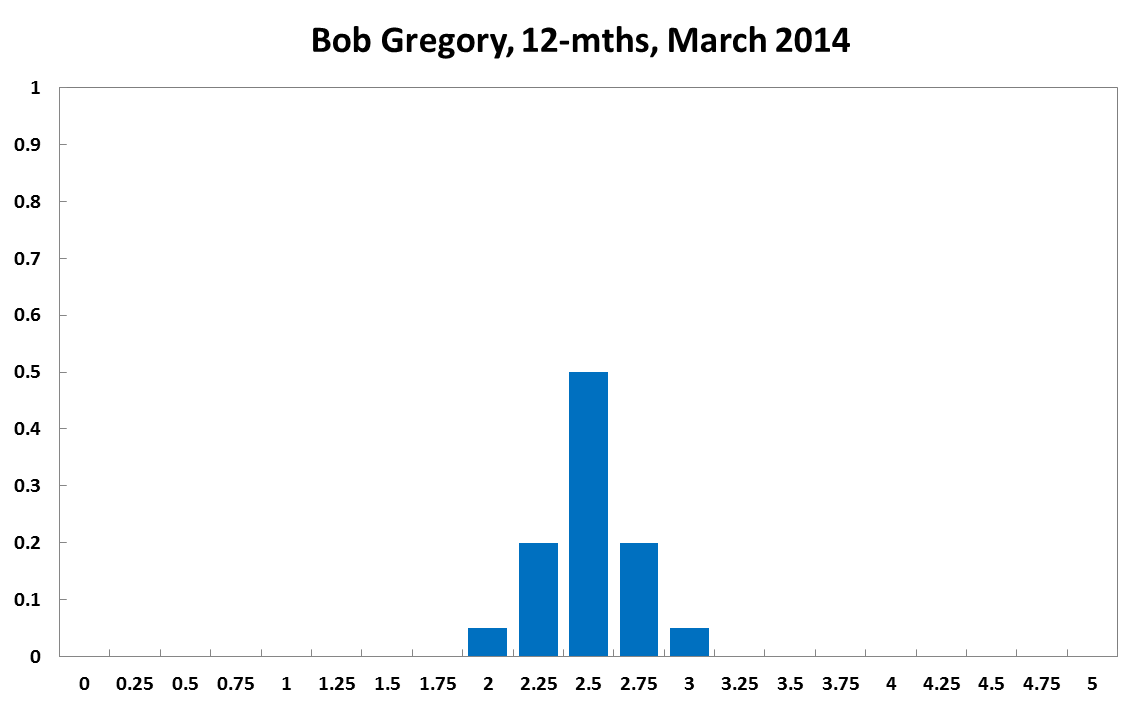

Bob Gregory

Current

6-Months

12-Months

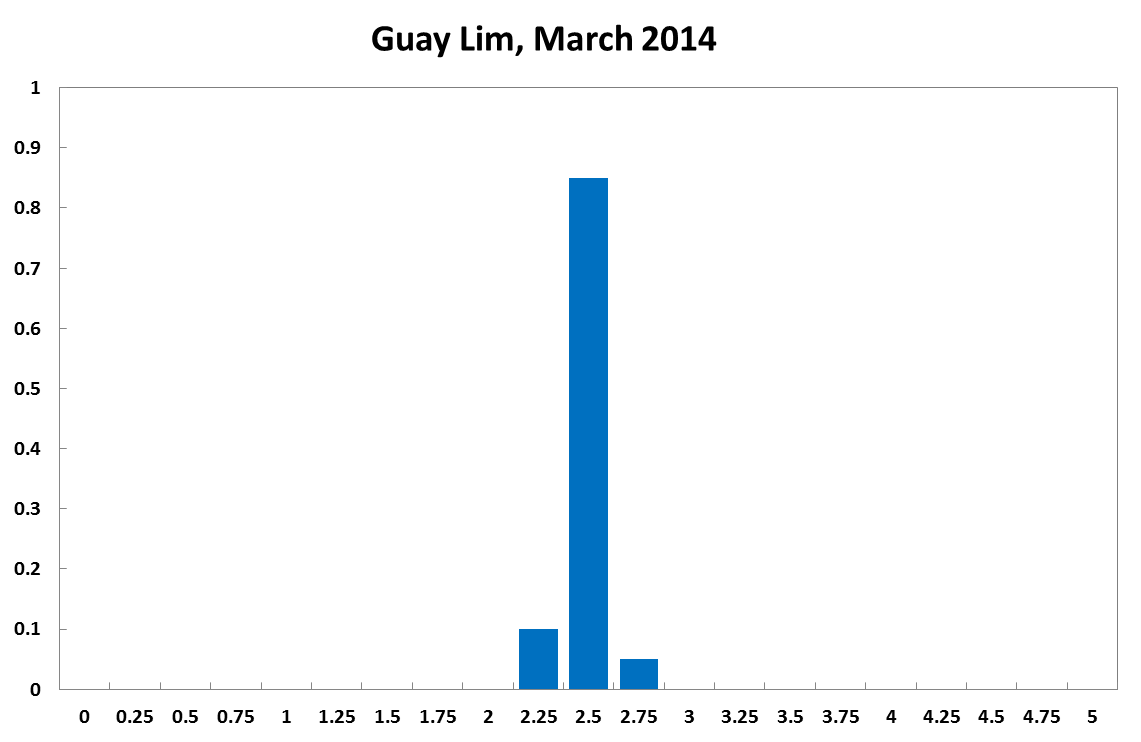

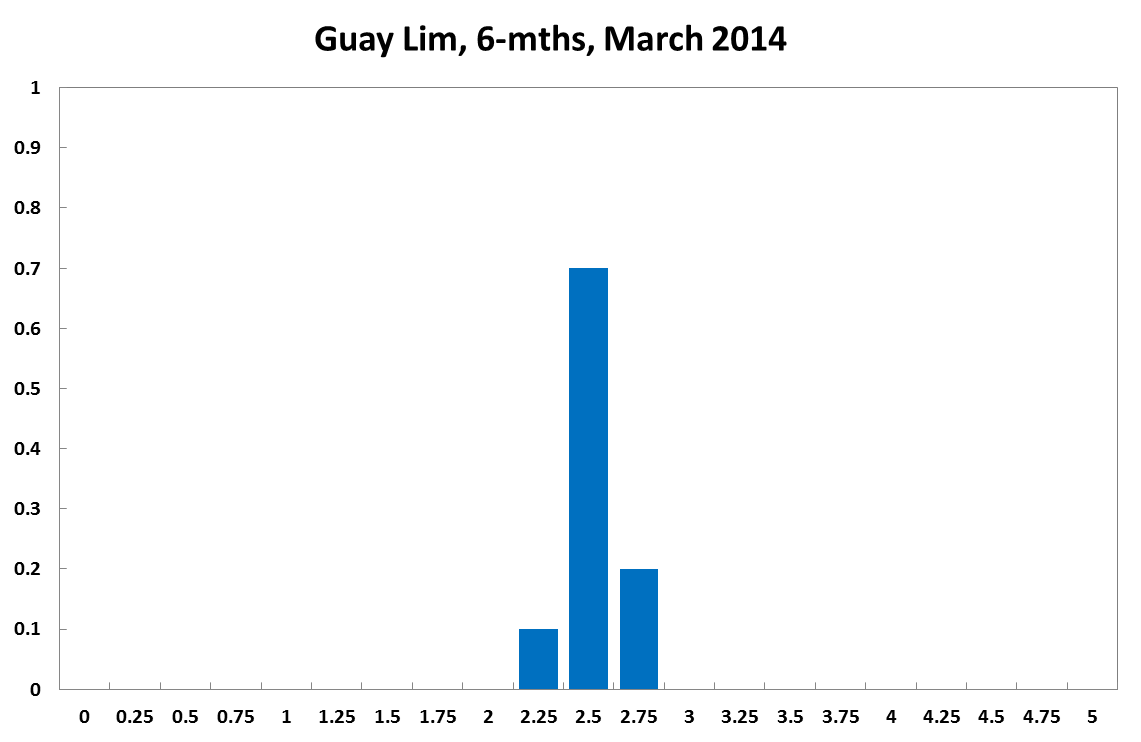

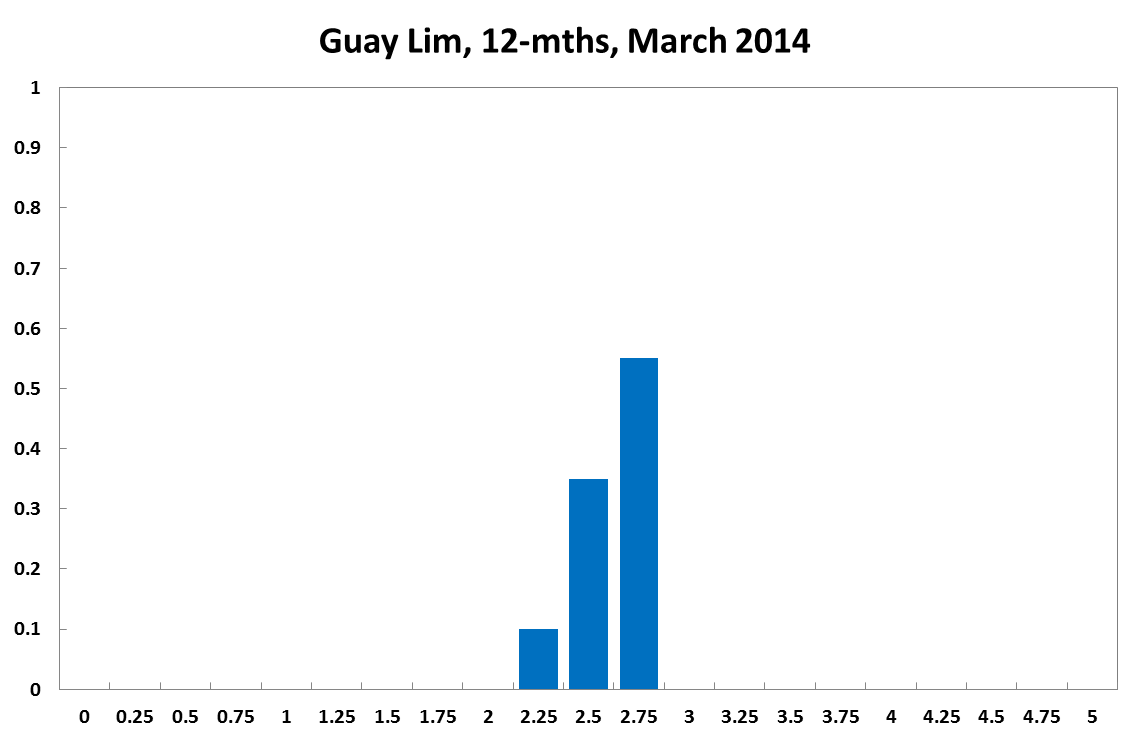

Guay Lim

Current

6-Months

12-Months

Comments

There are weak signs that the Australian economy will grow (albeit sluggishly), and inflationary pressures, if any, appear to be benign. But, the recent hike in the unemployment rate is cause for concern even though one should bear in the mind that many summary measures of labour market activity are lagging indicators. On balance, it would be prudent to hold the cash rate at 2.5 per cent – an increase might be pre-mature (given the state of the labour market), while a cut might fuel an asset (housing) bubble.

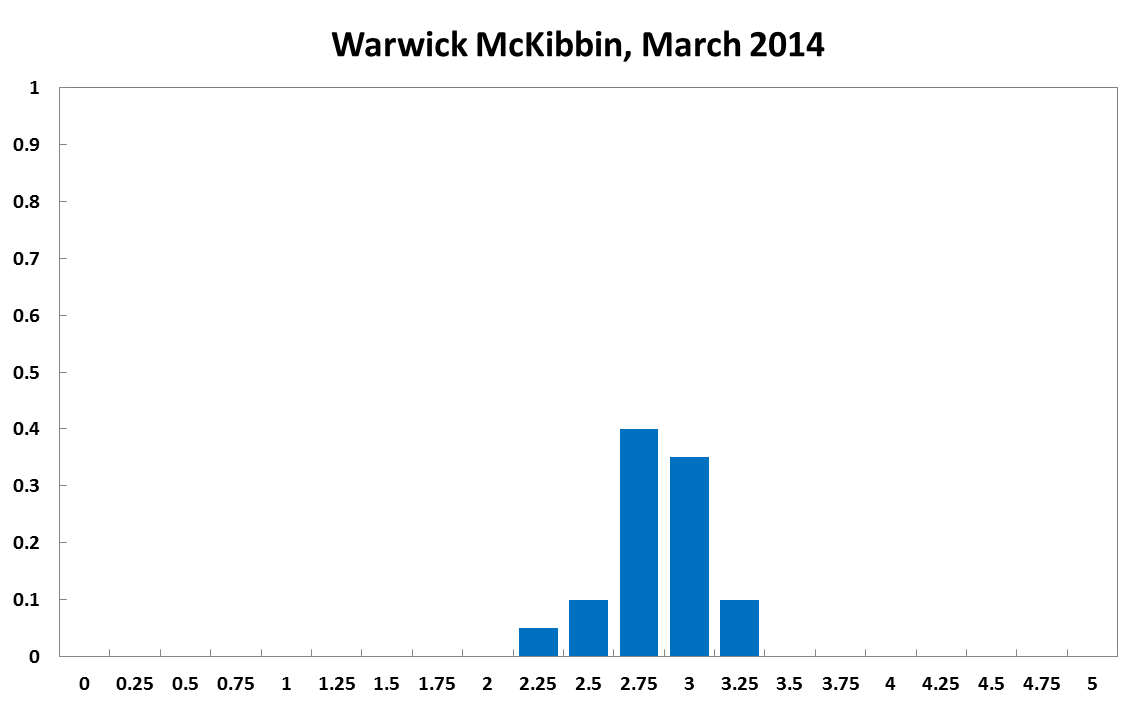

Warwick McKibbin

Current

6-Months

12-Months

Comments

Continued strong domestic non-traded goods inflation together with rising traded goods inflation is concerning especially at a time of labor market weakening. A greater concern is the rise in asset prices, particularly housing prices over the past year. This suggest that excess liquidity is driving market valuations above that would be expected with more normal interest rate settings. The major problem for growth prospects in Australia is on the supply side and particularly the continued high input cost structure. A stronger currency cannot be ruled out particularly given events outside Australia which make Australia an attractive place to hold assets relative to other countries who have severe economic and debt sustainability problems. Unfortunately there is not a great deal that monetary policy can do to solve Australia’s competitiveness problem which can only effectively be addressed by structural reform and a refocusing of fiscal policy.

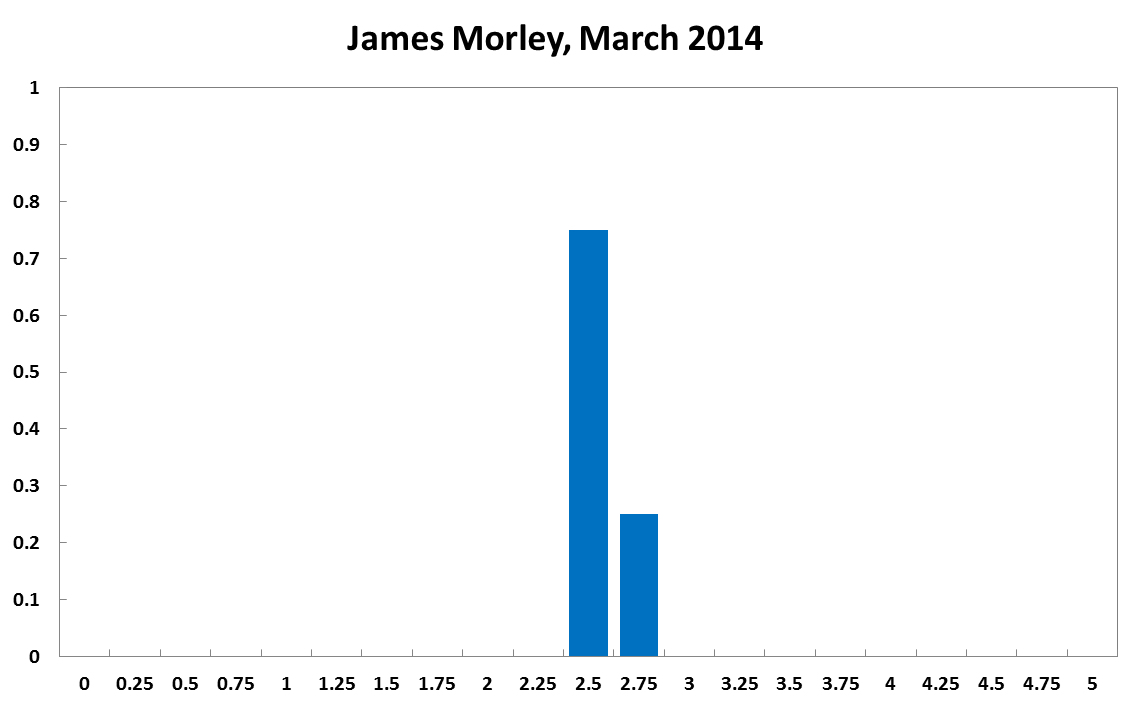

James Morley

Current

6-Months

12-Months

Comments

Continued weakness in the labour market, with the January unemployment rate hitting 6%, argues for further delay in raising rates back to their neutral level.

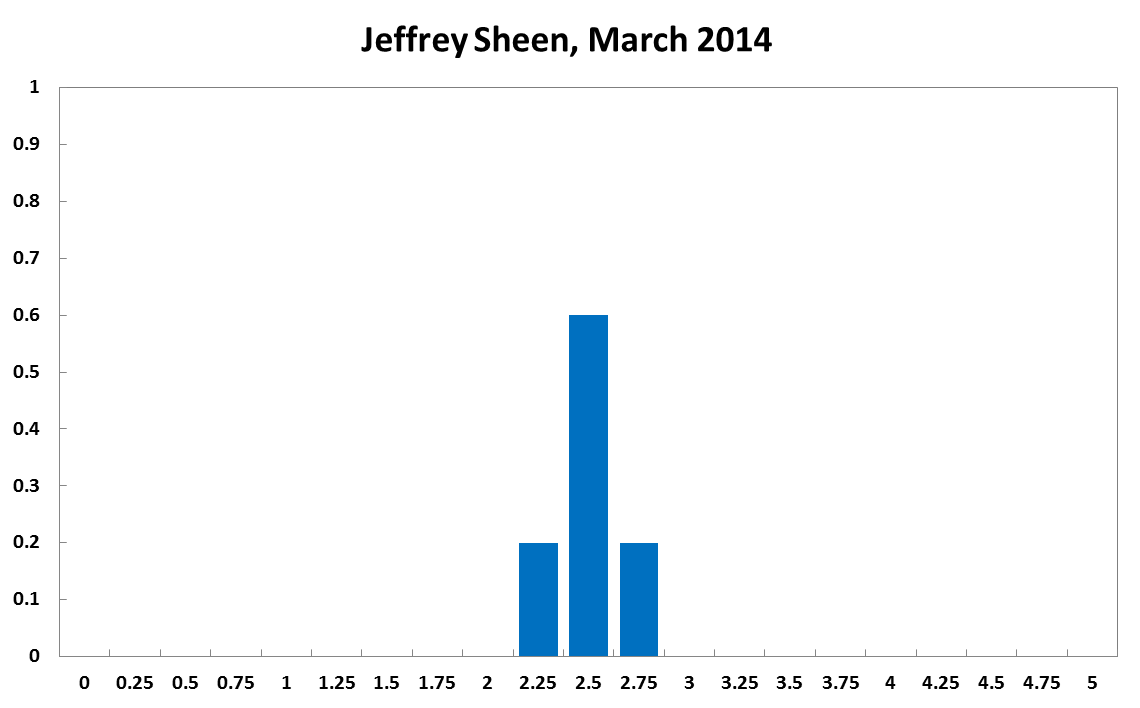

Jeffrey Sheen

Current

6-Months

12-Months

Comments

The labour market is showing weakness: the unemployment rate rose to 6% in January 2014, underemployment in September 2013 worsened with now more than a quarter of part-time workers wanting to work more, the median duration of underemployment rose to 30 weeks and wage growth has continued to slow. These are mostly the lagging effects of the persistently high real exchange rate that peaked in April 2013 and is still about 15% too high and likely to remain that way for some time. In addition, the world economy continued to recover only slowly, and the Australian government is seeming to prepare significant fiscal consolidation in its first few budgets. Though inflation has edged up within the RBA's target zone, these other factors indicate that monetary policy needs to remain accommodating for even longer going into next year.