Disinflation Persists: Shadow Board Tilts More Decisively Toward Easing

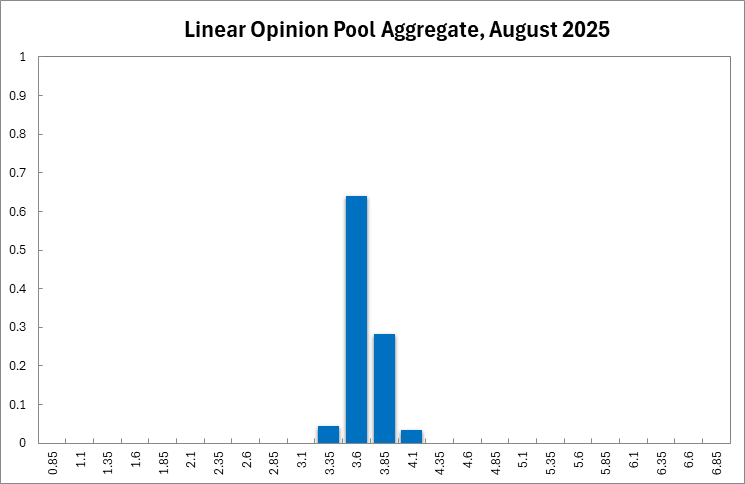

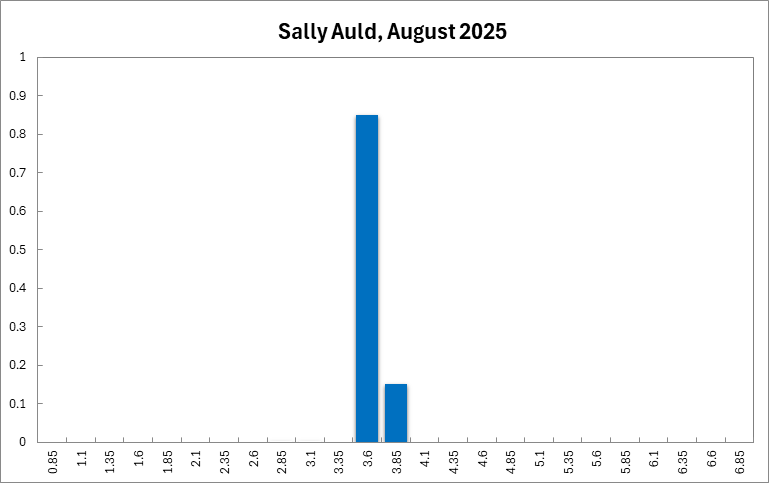

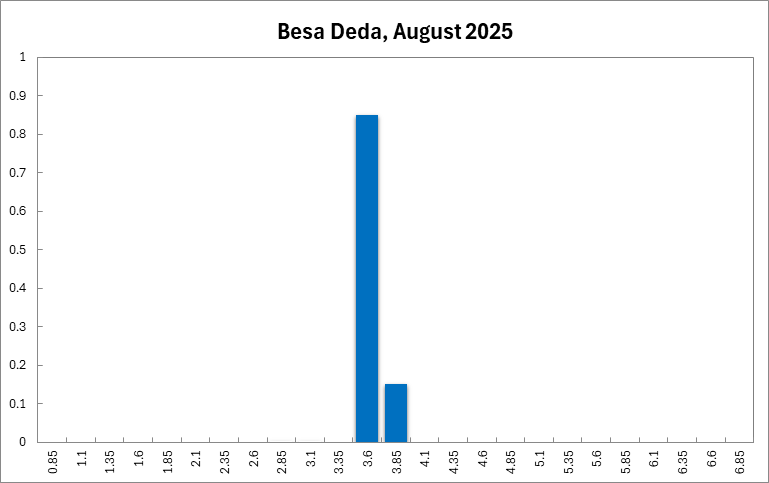

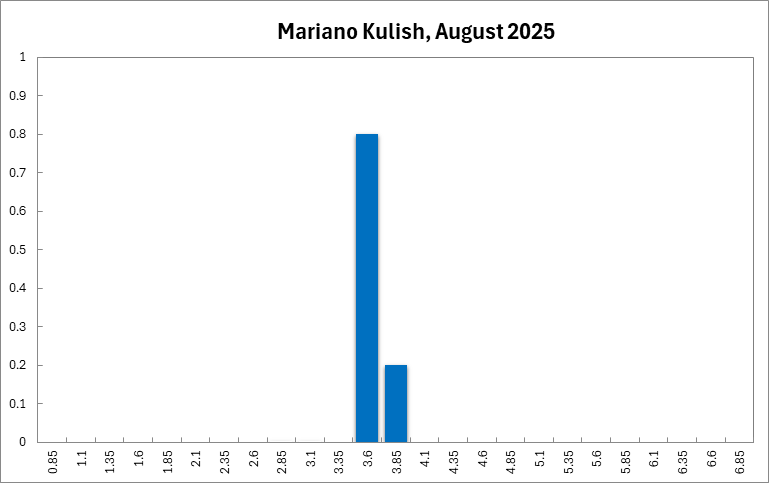

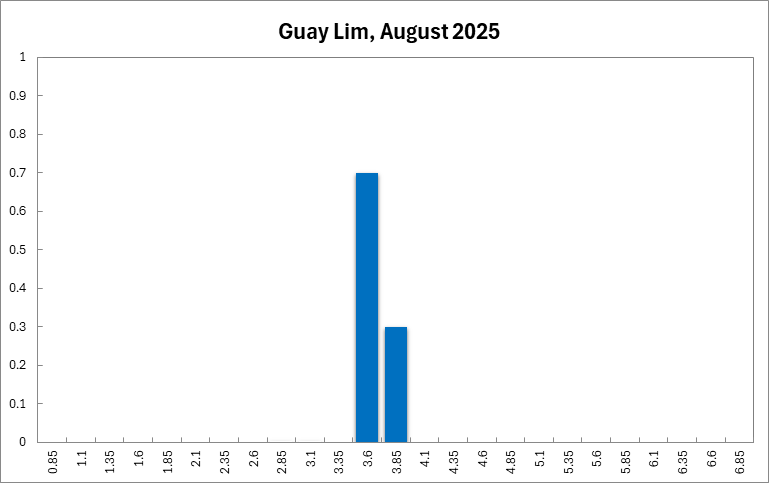

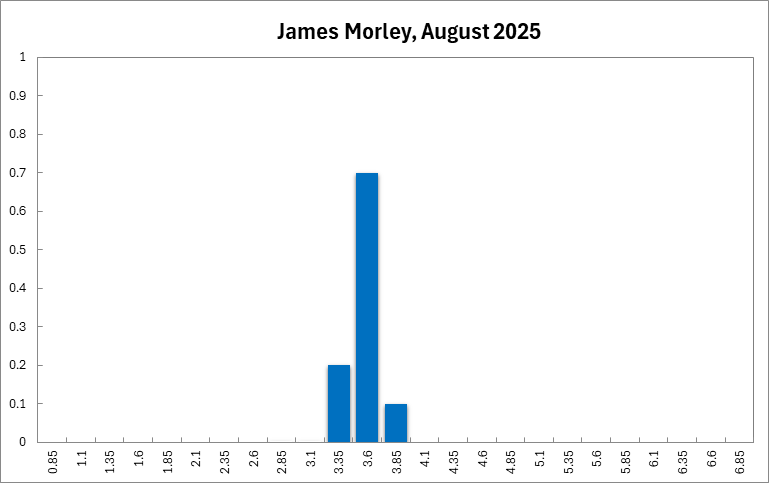

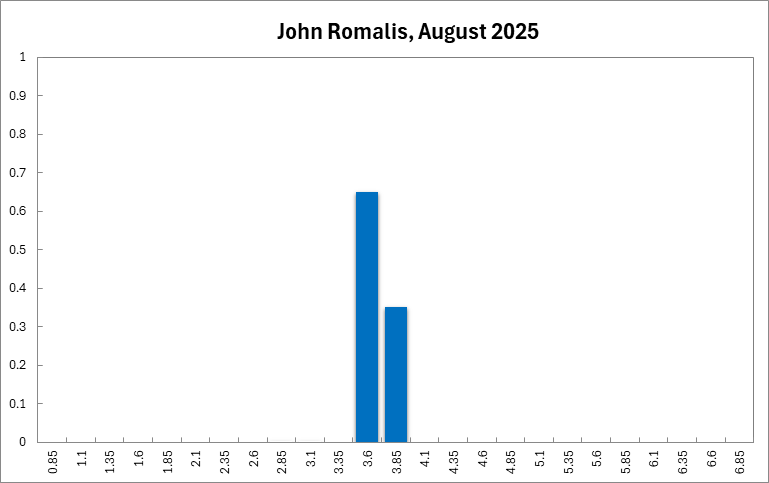

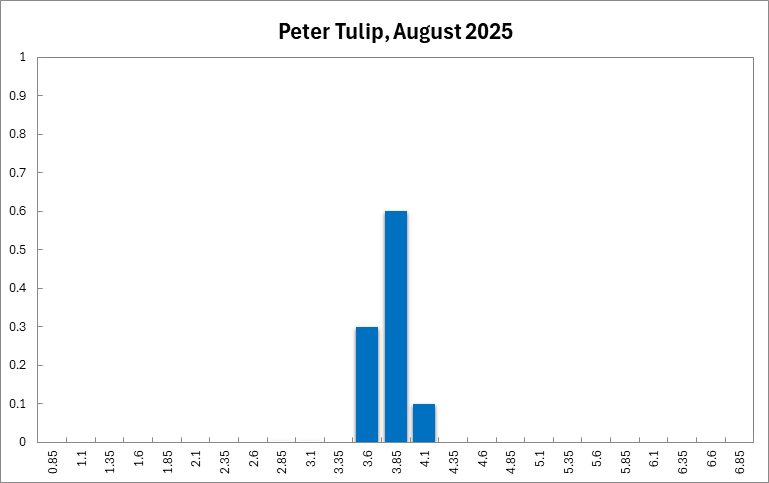

Australia’s annual CPI inflation eased to 2.1% in Q2 2025, the lowest since Q1 2021 and comfortably within the RBA’s 2–3% target band. Disinflation was broadening: services inflation slowed to a three-year low (3.3% vs 3.7%), goods inflation edged down (1.1% vs 1.3%). Inflation in housing (2.0%), health (4.1%), and recreation (1.7%) was unchanged, while transport costs fell further (-2.6% vs -1.0%). The trimmed mean inflation rate grew 2.7% y/y, its weakest pace since Q4 2021. Against this backdrop—and with unemployment rising to 4.3%, the AUD steady around US$0.65, the 10-year yield at 4.26%, and the ASX 200 at record highs—the Shadow Board favours lowering the overnight rate. It is 64% confident that 3.6% is the optimal setting this round; it assigns a 28% probability to holding at 3.85% and a 3% probability to a rate above 3.85%.

Labour-market conditions have softened at the margin. The unemployment rate rose to 4.3% in June (highest since November 2021) alongside higher participation (67.1%). Youth unemployment increased to 10.4%, underemployment lifted to 6.0%, and monthly hours worked fell to 1,974 million, a combination suggestive of easing labour demand. Forward indicators were mixed: ANZ-Indeed job ads declined 1.0% m/m in July yet reported job vacancies increased to 339.4k in Q2. With wage data due on Wednesday, 13 August, the trajectory of unit labour costs remains a key uncertainty for the inflation outlook.

Financial markets point to an economy navigating disinflation with supportive financial conditions. The Australian dollar has been range-bound between US$0.64 and US$0.66, recently near US$0.65. The 10-year Commonwealth yield sits around 4.26%. The curve is modestly inverted at the very short end (2y–1y: -5.7 bps) but exhibits normal convexity further out (5y–2y: +21.5 bps; 10y–2y: +90.3 bps), consistent with expectations of gradual policy easing as inflation converges to target. Equities rallied strongly, with the S&P/ASX 200 pushing above 8,800 to a new all-time high after rebounding from April’s trough near 7,350.

Household indicators have firmed, albeit from subdued levels. The Westpac-MI consumer sentiment index ticked up to 93.1 in July (still below neutral). Retail sales rose 1.2% m/m in June, beating expectations, while ABS household spending accelerated to 4.8% y/y—the fastest since January 2024—driven by services (+6.6% y/y) and a pick-up in goods (+3.4% y/y). These data suggest resilience but not exuberance, and are consistent with disinflation and a gently cooling jobs market.

Business conditions are improving unevenly. NAB business confidence climbed to +5 in June, its highest since January and now in line with the long-run average. PMIs point to a broader upturn: manufacturing remained in modest expansion (51.3) despite weak demand and reduced staffing, services activity strengthened (54.1), and the composite index rose to 53.8, the strongest since April 2022. Capacity utilisation eased to 77.6% (from 77.9%), the Westpac leading index was flat in June, small-business sentiment improved to -8, and the Ai Group indices showed construction near stabilisation (-1.3) while manufacturing remained in deep contraction (-23.9). Overall, momentum is improving but spare capacity persists.

Globally, the IMF describes a backdrop of “tenuous resilience amid persistent uncertainty.” Following a partial reversal of recently announced US tariff increases and some de-escalation of trade tensions with China, the IMF nudged up its global growth projections to 3.0% in 2025 and 3.1% in 2026, though growth remains below pre-pandemic norms and risks are skewed to the downside. The Fund highlights elevated policy uncertainty, still-high tariffs, a projected decline in trade’s share of global output, and the importance of safeguarding central-bank independence as inflation recedes. For Australia, this points to near-term external support alongside medium-term downside risks, especially via trade and investment channels.

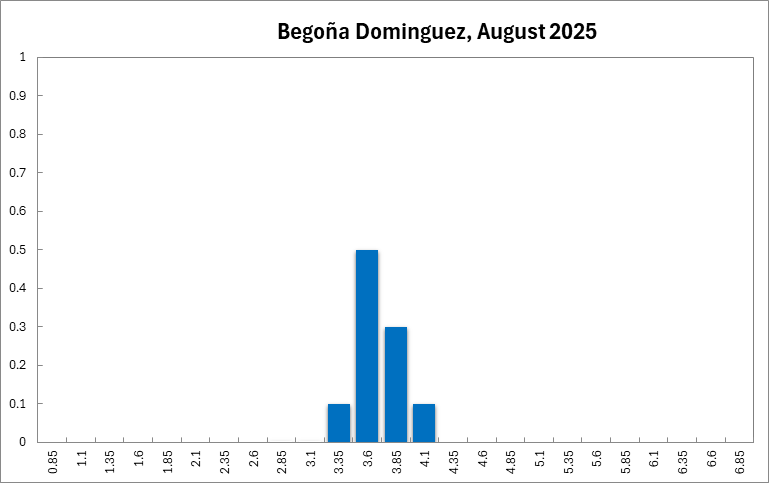

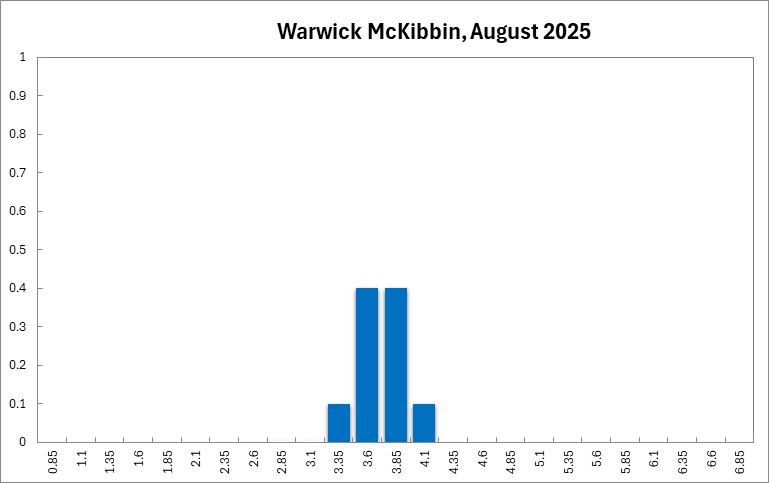

With inflation now solidly within target and labour-market slack building, the Shadow Board’s conviction has shifted more decisively toward easing. It assigns a 64% probability that reducing the overnight rate to 3.6% is optimal, a 28% probability that holding at 3.85% is appropriate, and a 3% probability that a higher rate is warranted. Compared with last month’s round—when a cut was judged optimal with a 44% probability—the tilt toward easing has clearly strengthened.

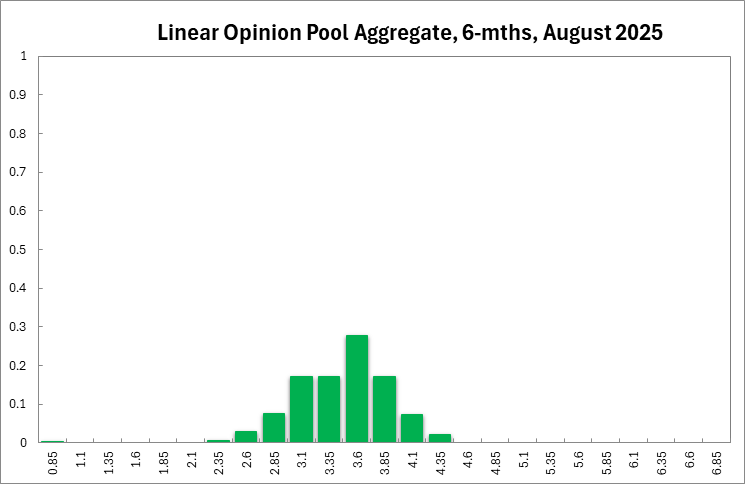

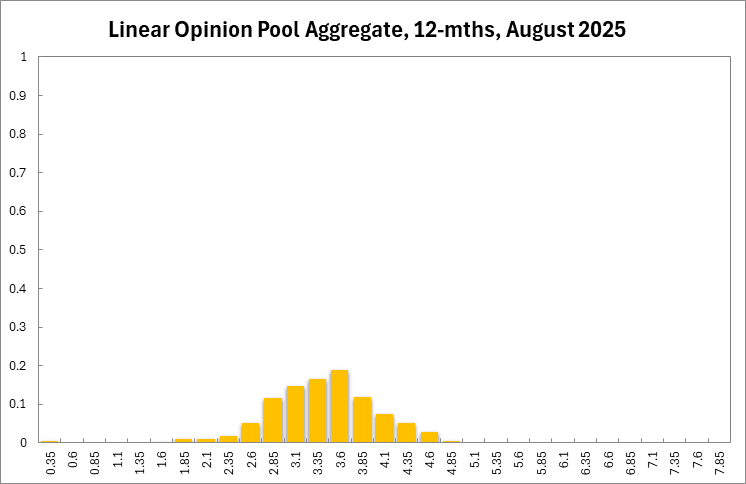

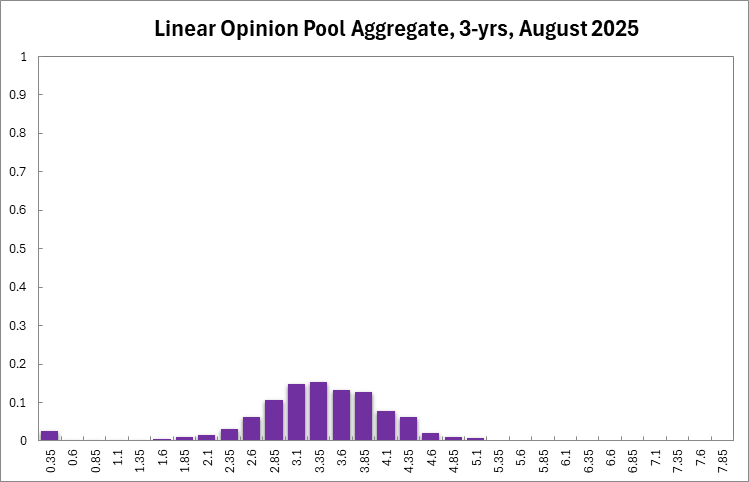

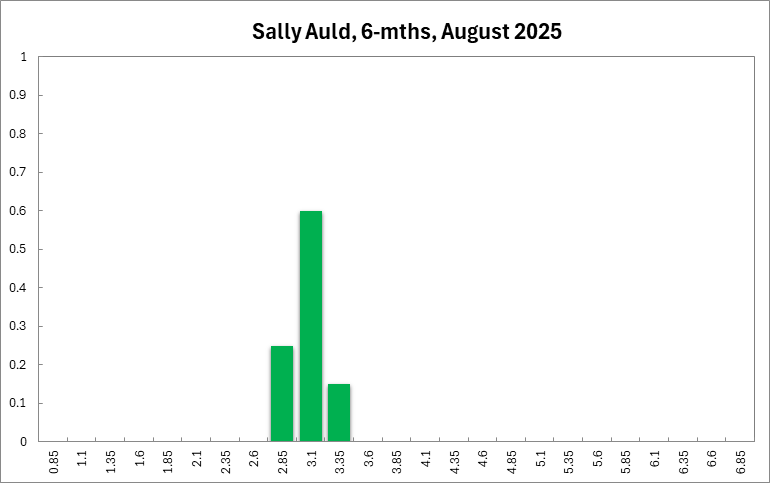

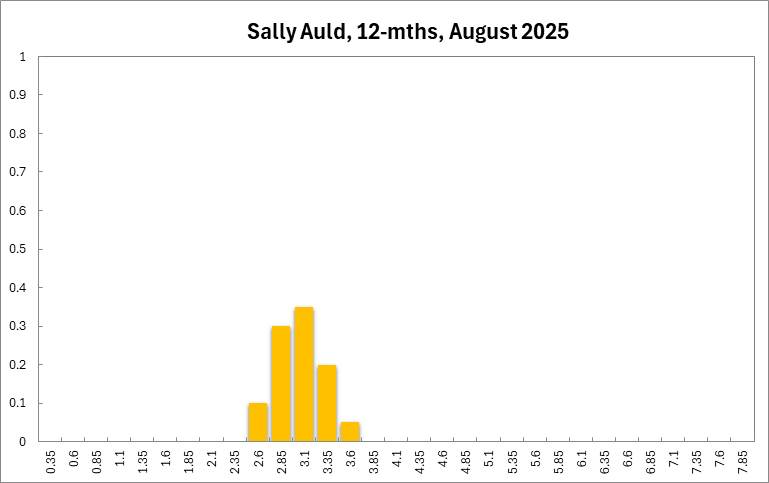

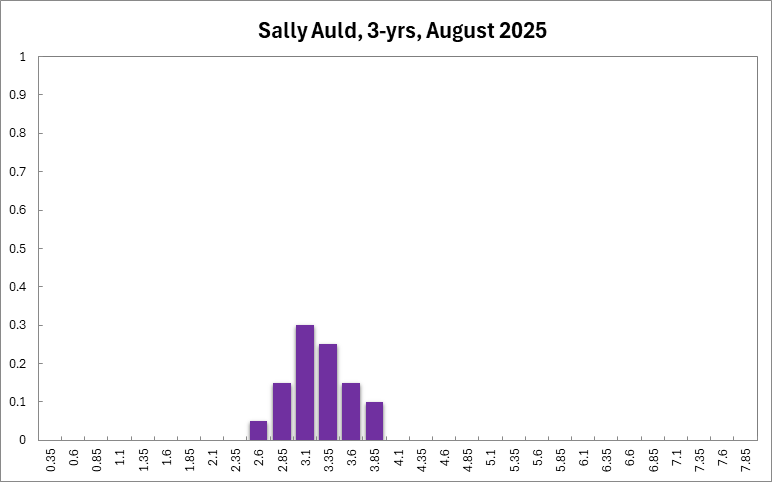

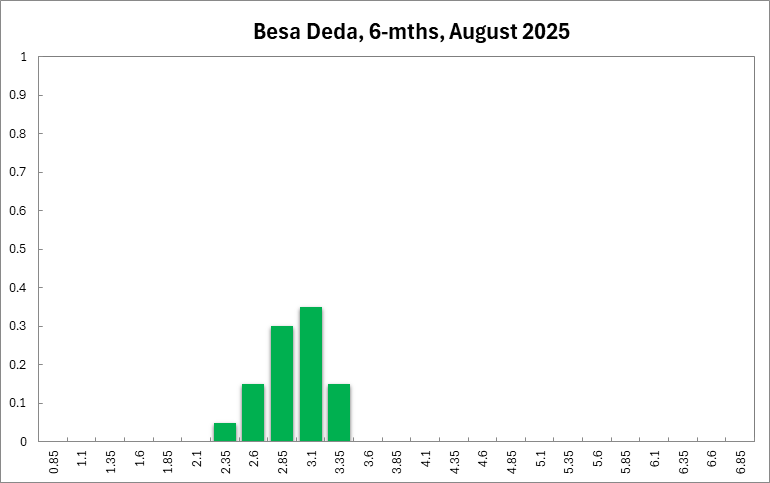

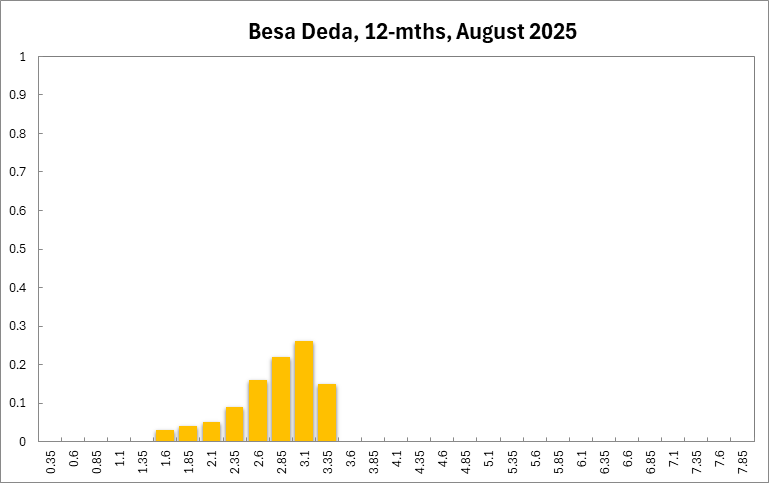

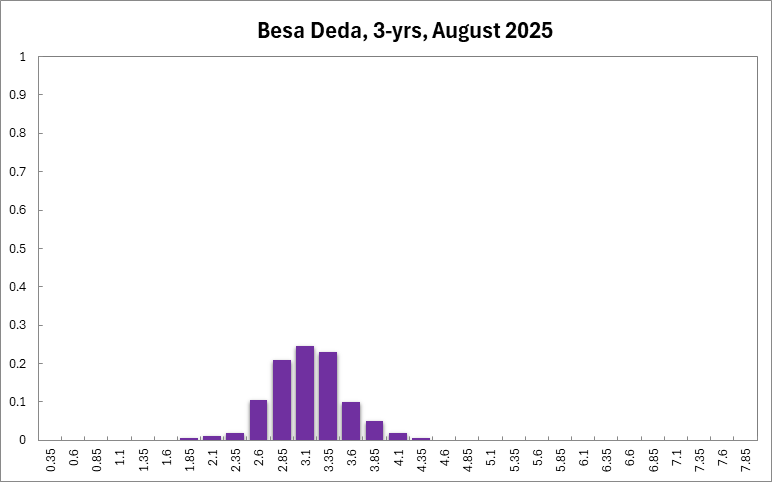

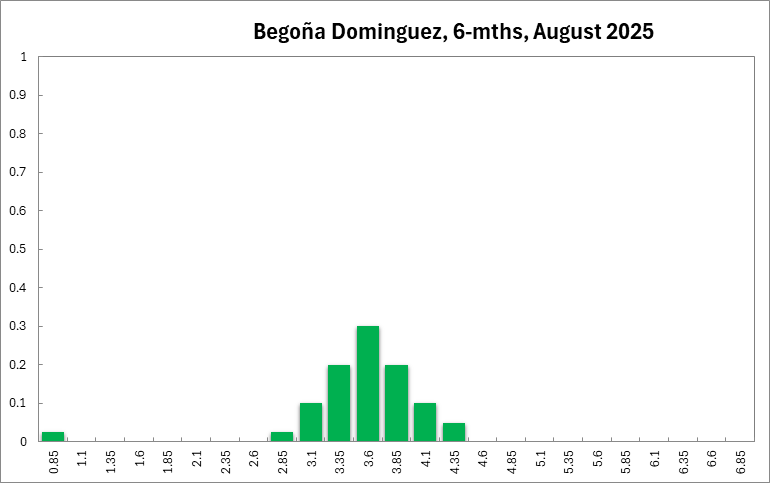

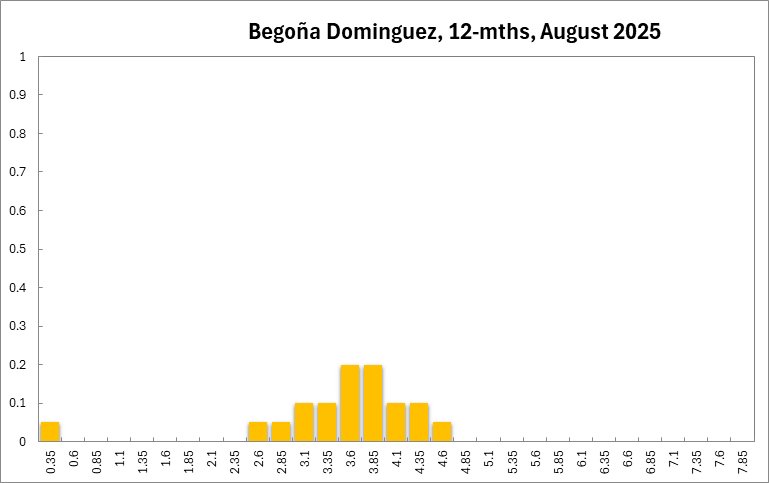

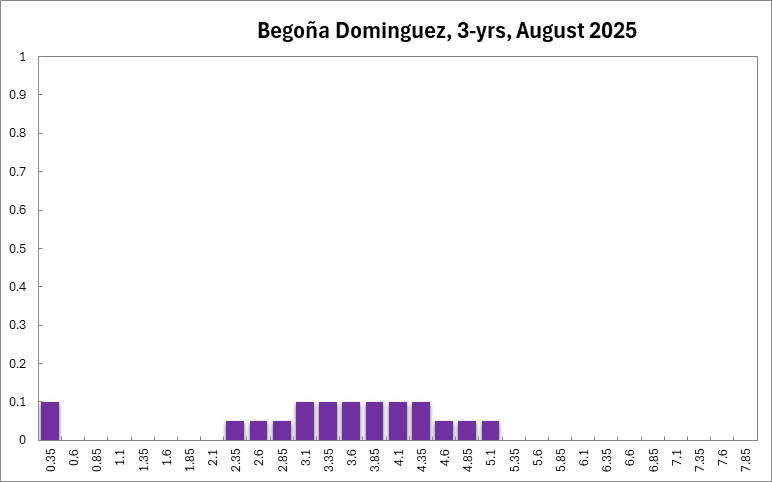

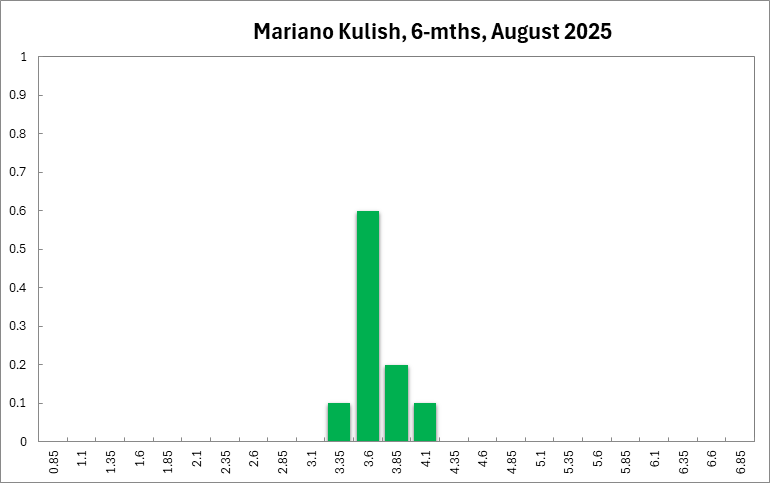

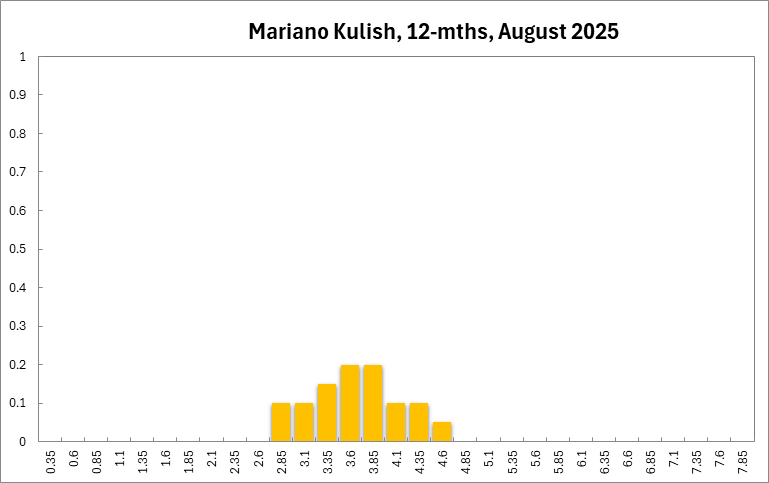

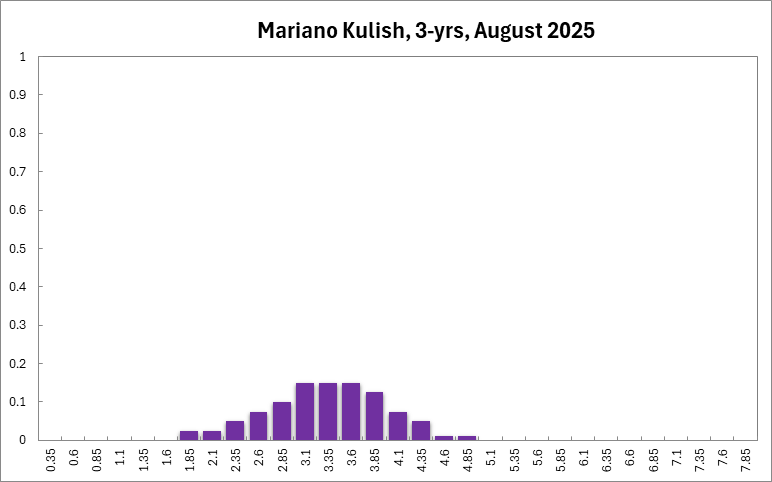

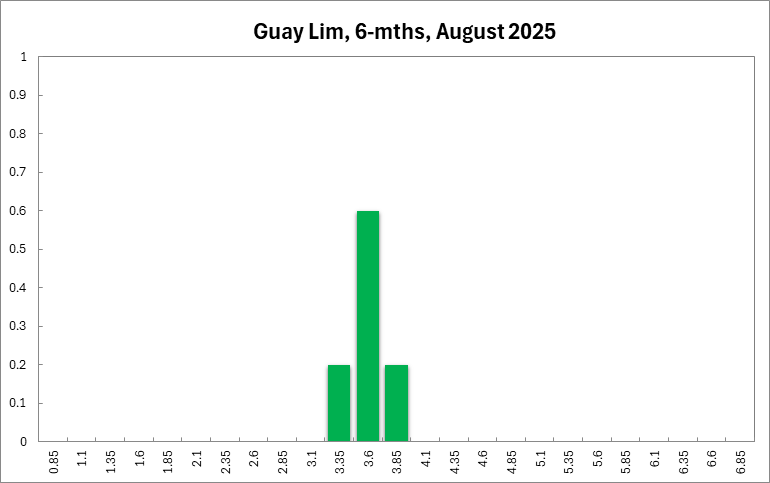

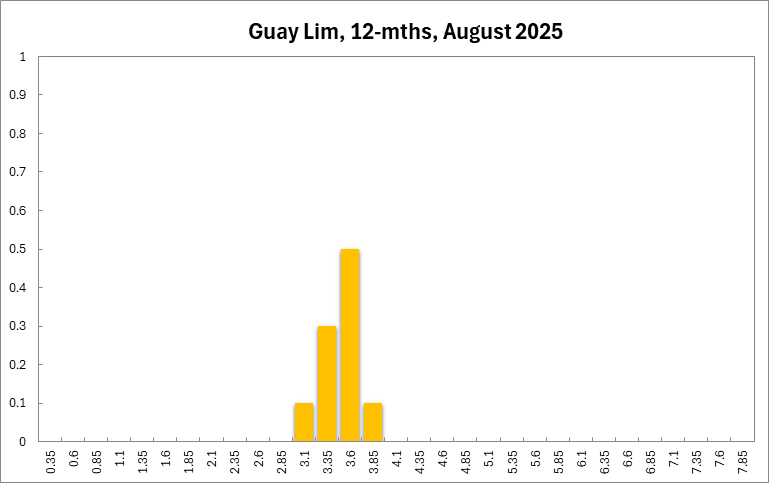

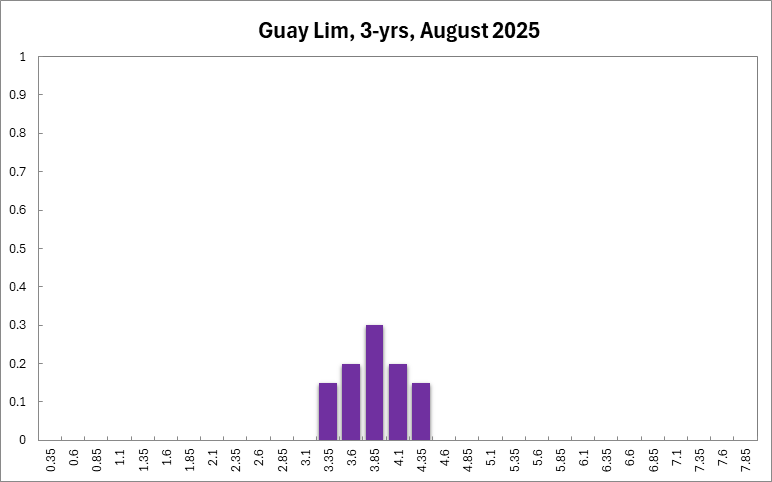

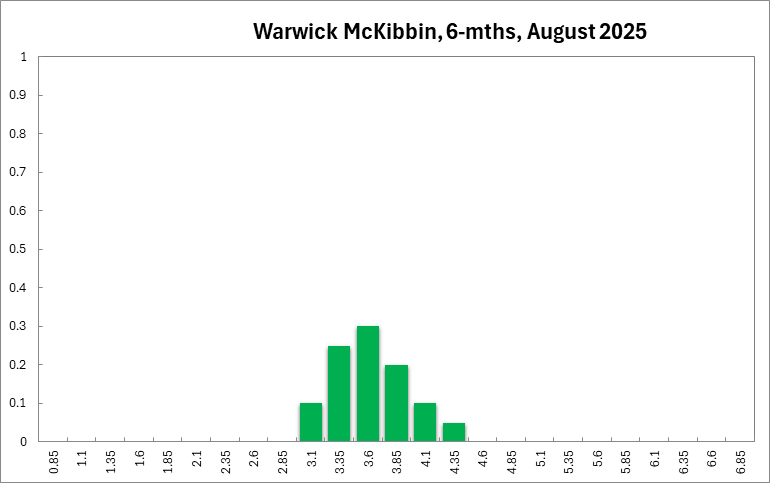

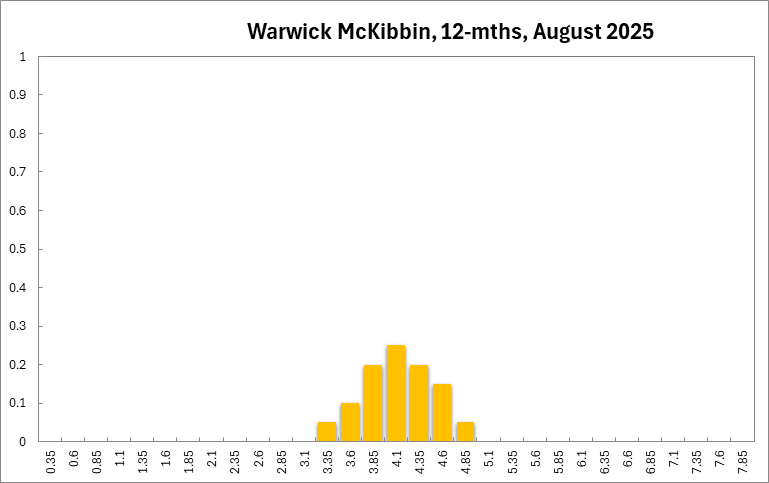

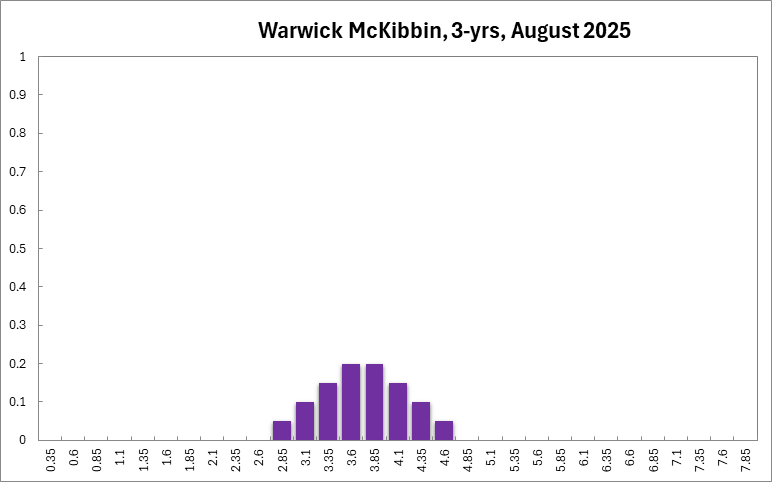

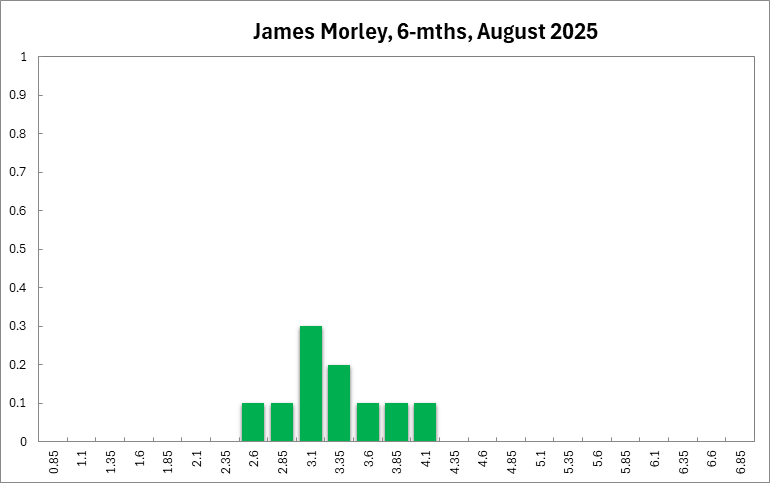

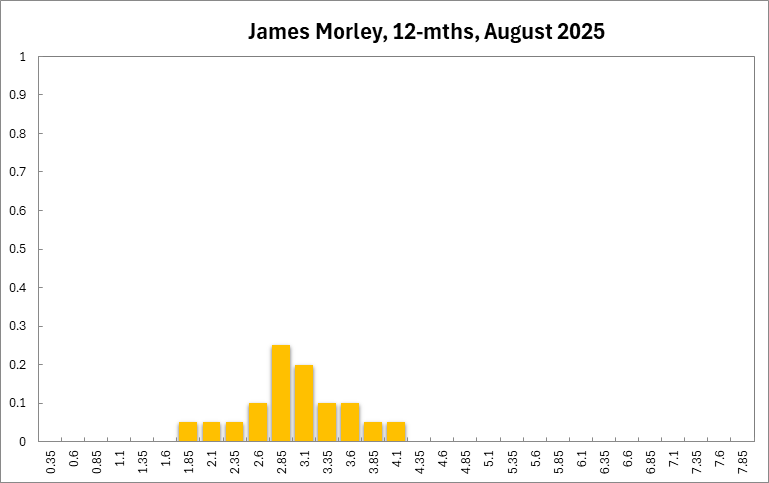

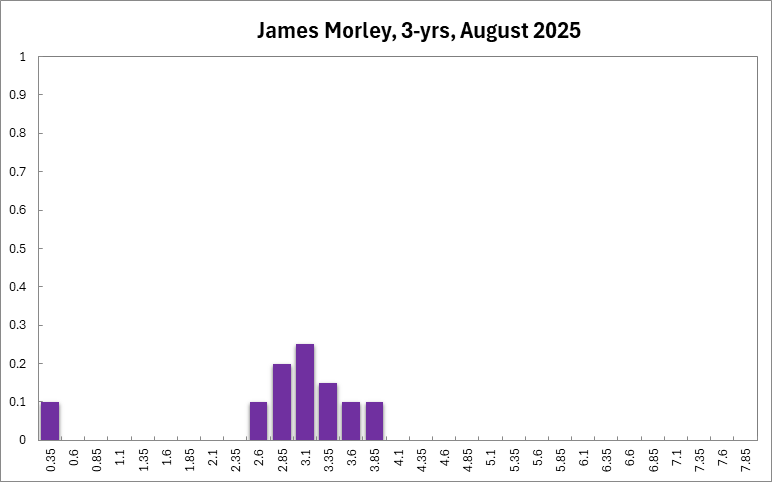

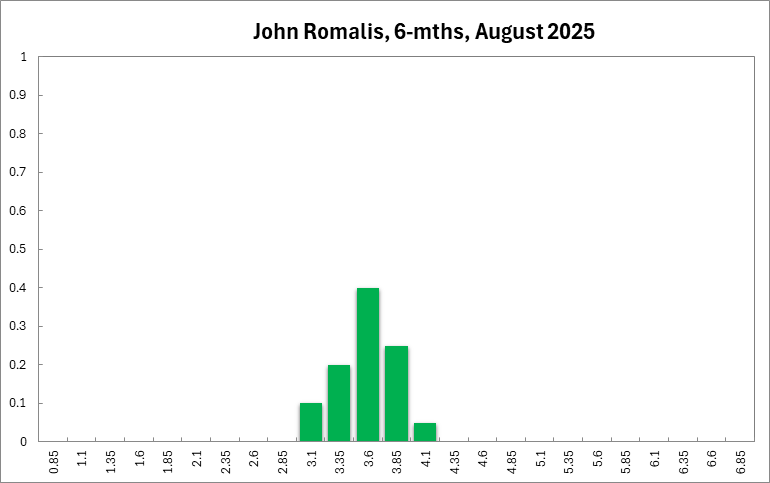

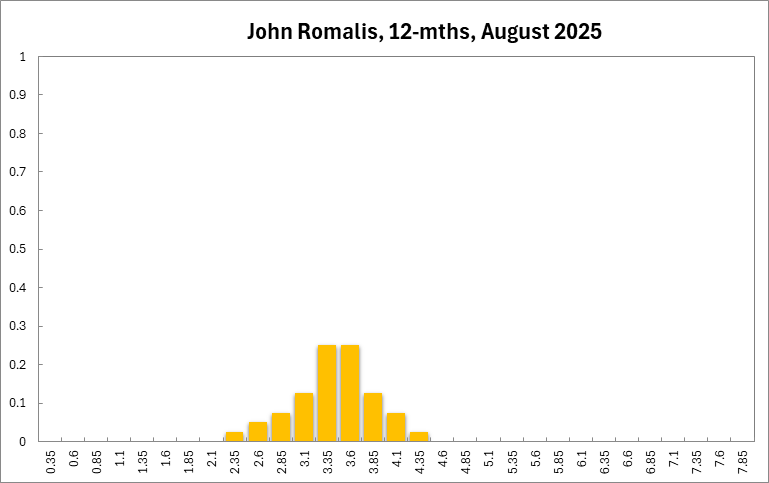

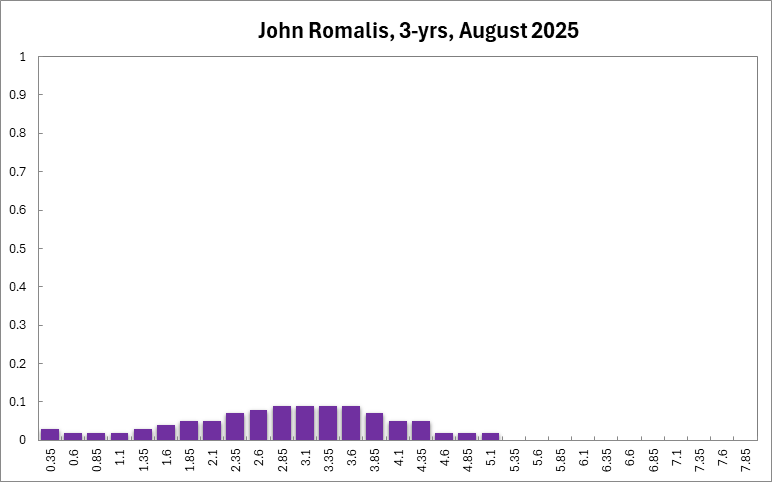

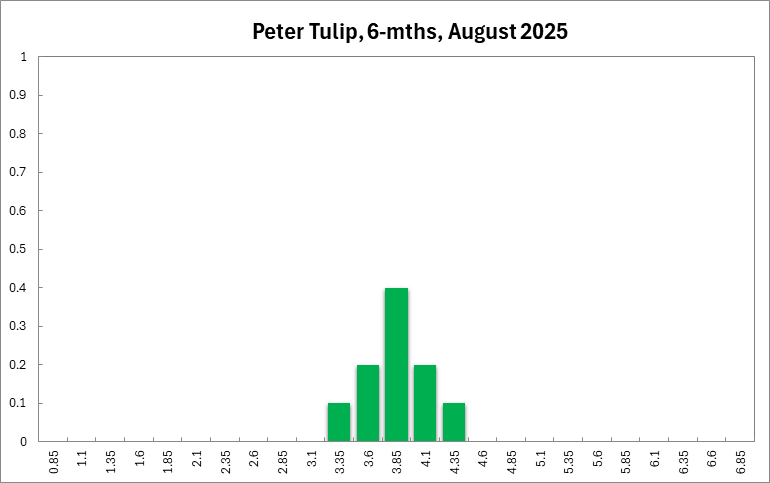

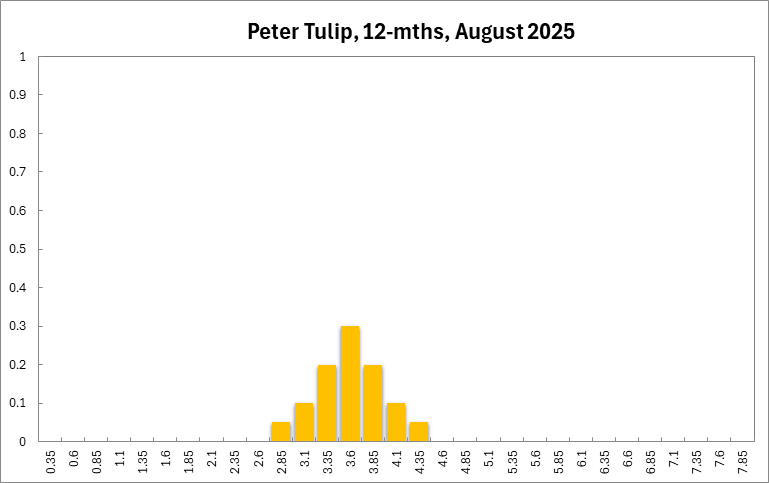

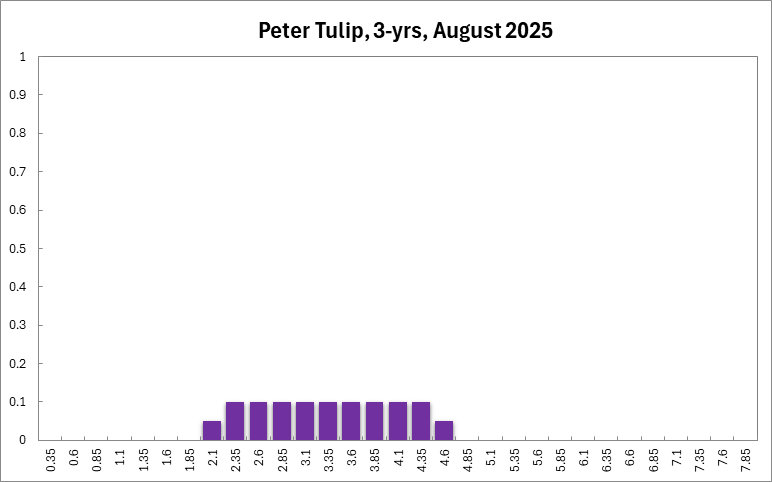

Six months out, the Board attaches a 73% probability to a lower cash rate, 17% to the current setting (3.85%), and 9% to a higher rate. At the 12-month horizon, probabilities are 72% (lower), 12% (unchanged), and 16% (higher). Three years out, the Board attaches a 70% probability to a lower rate being optimal, 13% to the current setting, and 18% to a higher rate.

The distribution for the current recommendation has narrowed to a 3.35%–4.10% band. At longer horizons, the implied ranges are 0.85%–4.35% (six months), 0.35%–4.85% (twelve months), and 0.35%–5.10% (three years), reflecting both the near-term progress on inflation and residual uncertainty about the global and domestic outlook.

The range of the probability distribution for the current interest rate recommendation widened marginally, extending from 3.35% to 4.60% (from 3.60% to 4.60% in the previous round). At longer horizons the ranges have also changed only slightly: they extend from 2.60% to 4.60% (previously 2.60% to 4.85%) for the 6-month horizon, from 1.60% to 5.10% (1.85% to 5.35%) for the 12-month horizon, and from 0.60%-5.35% (unchanged) for the 3-year horizon.