The recent lower than expected underlying inflation prints as well as the lift in mortgage rates by the major banks mean that the RBA ought to consider that it may need to cut further in order to maintain inflation on target. The underlying inflation measures - the trimmed mean and the weighted median -- both rose by only 0.3% in Q3 to average 2.2% over the past year. Over the past six months the underlying inflation numbers have been below the bottom of the RBA's target band. These numbers suggest there is now greater risk of the RBA undershooting its inflation target, with very little risk of an overshoot. At the same time, the independent tightening of financial conditions by the major banks should be expected to weigh on activity, albeit only modestly. Although the economy does appear to be on an improving growth track, the momentum has, so far, been insufficient to push the unemployment rate lower. While the RBA could afford to sit still this month to assess the impact of the higher mortgage rates on the economy, it is increasingly likely that the cash rate will need to be trimmed further to keep inflation on target, so cutting this month would help the central bank to stay ahead of the curve. I recommend a 25bp cut.

Outcome: November 2015

No Need for Rate Cut on Melbourne Cut Day

Australian headline inflation, benefiting from exceptionally low energy prices, equals 1.5% (year-on-year) for a second quarter in a row, well below the RBA’s target band of 2-3%, while economic growth and the unemployment rate continue to underwhelm. The global economy looks weak and financial markets are nervous. The RBA Board lowered the official cash rate from 2.25 per cent to 2.0 per cent in May. However, Australia’s four major banks have all increased interest rates in the past month due to tougher prudential standards, prompting markets to factor in a 60 per cent chance of another official rate cut as early as this week.

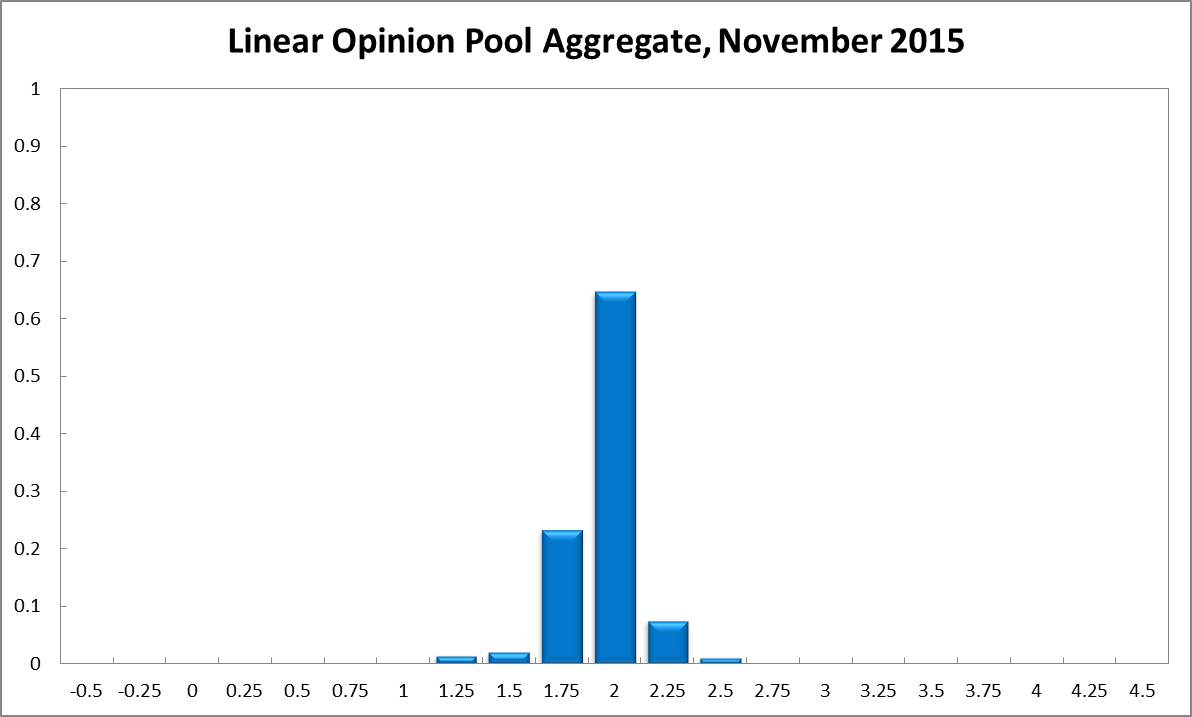

The CAMA RBA Shadow Board on balance prefers to keep the cash rate on hold, attaching a 65% probability to this being the appropriate policy setting. The confidence attached to a required rate cut equals 26%, up twelve percentage points from the previous month, while the confidence in a required rate hike has fallen to 9%. So, while the overall sentiment is one of holding rates steady, the balance of risks has shifted down.

Australia’s unemployment rate remains at 6.2%, according to the Australian Bureau of Statistics. Worryingly, employment has fallen, in particular full time employment (-13,900 in September), and the participation rate, now equal to 64.86%, continues to decline.

The Aussie dollar appears to have found a floor at the 70 US¢ mark, with the currency trading as high 72.5 US¢ in recent days. This likely reflects a reaction to the US Federal Reserve’s continued delay of lifting its federal funds rate target. This year’s depreciation of the Aussie dollar has not led to an improvement in the balance of trade. On the contrary, in August the balance of trade was $-3.095 billion, compared to $-1.277 billion at the beginning of this year, suggestive of a J-curve effect, whereby supply and demand elasticities respond to a currency depreciation with a delay. Yields on Australian 10-year government bonds have edged down further to 2.58%.

The Australian property market looks like weakening, with the construction PMI, building permits and new home sales falling. The S&P/ASX200 has rebounded from last month’s lows below 5000. With heightened uncertainty about the Australian and global economic outlook, the stock index may well trade sideways for some time.

Considerable attention is given to the US Federal Reserve Bank’s global outlook and its policy decisions. An increase in the federal funds rate was highly anticipated until the middle of this year but then delayed in light of weak global economic data. This week’s Fed statement sounds more bullish again even though the latest US economic data is not as strong as expected. There remain divisions within the Federal Reserve Bank Board about when to lift rates. Europe’s problems are not lessening: the refugee crisis will strain government budgets while the Greek debt crisis is only enjoying a brief hiatus. China’s economy still looks shaky and growth is likely to be remain relatively soft, with most economists expecting a target growth rate of 6.5% for the newly adopted five-year economic plan.

Consumer and producer sentiment measures continue to yoyo around without a clear trend. After successive drops, the Westpac/Melbourne Institute Consumer Sentiment Index rose to 97.8 in October from 93.9 in September. Business confidence, according to the NAB business survey slid further, rebounded from 1 to 5. The AIG manufacturing and services indices, both leading economic indicators, contradict each other.

The Shadow Board’s confidence that the cash rate should remain at its current level dropped from 72% in October to 65%. The confidence that a rate cut is appropriate has increased substantially to 26%, from 14% in the previous month; conversely, the confidence that a rate increase, to 2.25% or higher, is necessary has fallen to 9% (14% in October).

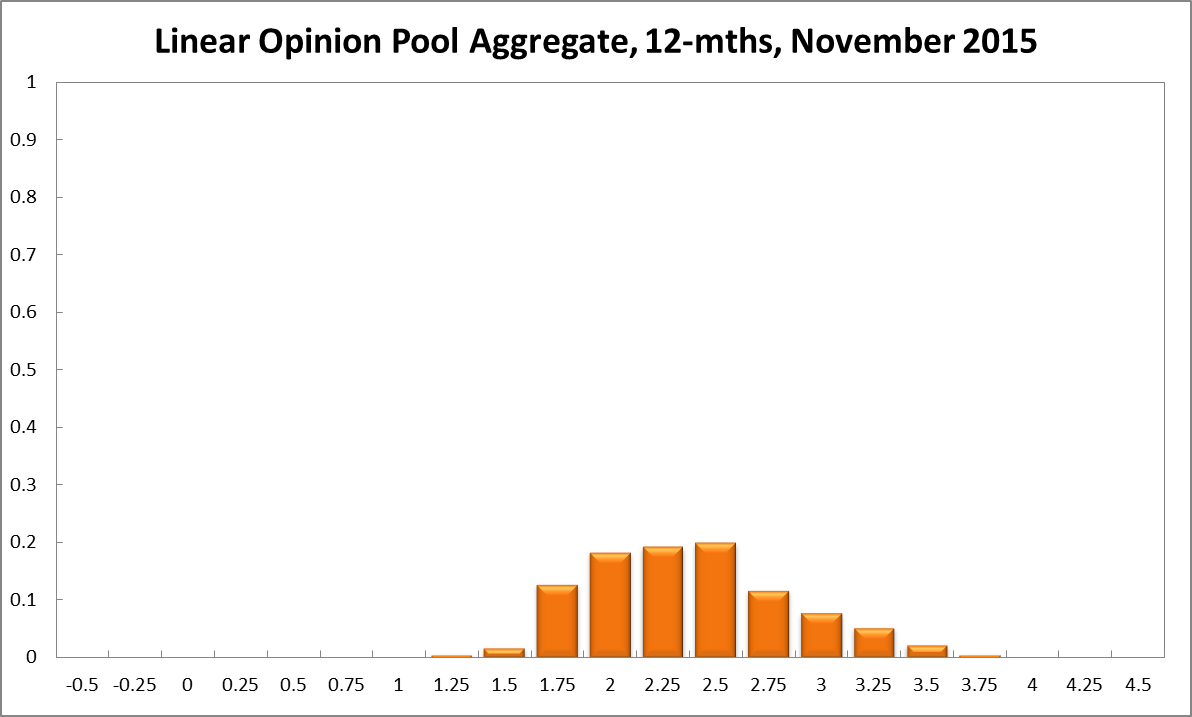

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 2% is nearly unchanged at 24% (25% in October). The estimated need for an interest rate increase has dropped further, to 58% (62% in October), while the need for a rate decrease has risen to 19% (13% in October). A year out, the Shadow Board members’ confidence that the cash rate should be held steady is unchanged at 18%, while the confidence in a required cash rate increase equals 67% (68% in October) and in a required cash rate decrease 15% (14% in October).

Aggregate

Current

6-Months

12-Months

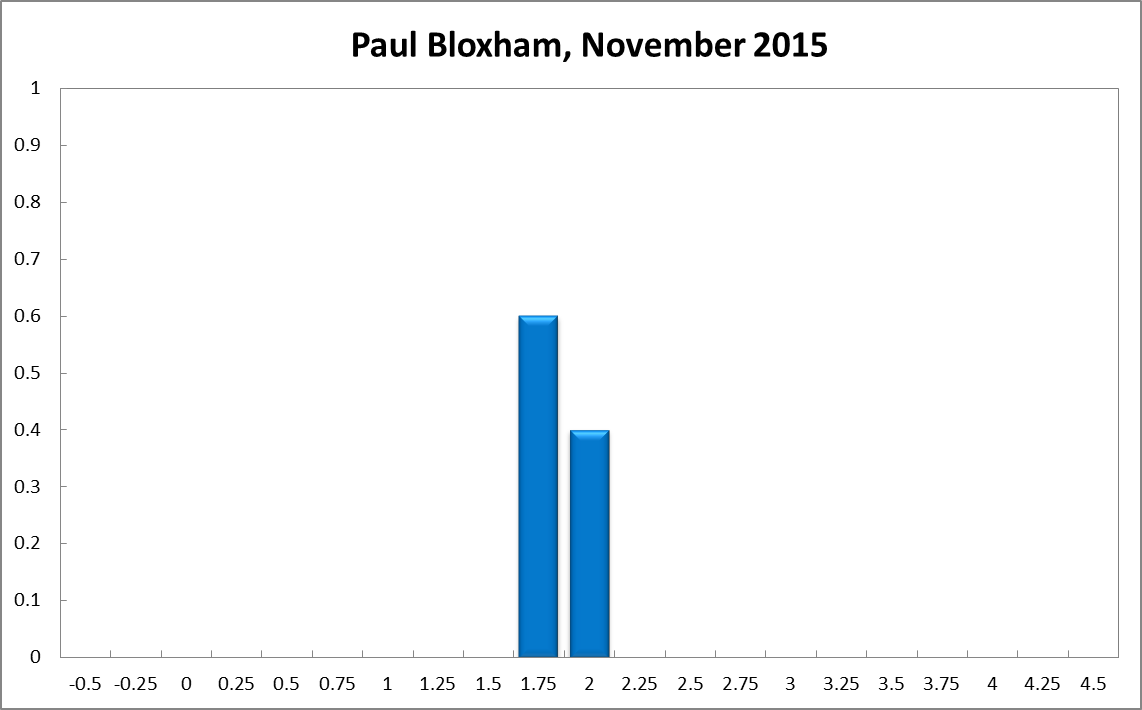

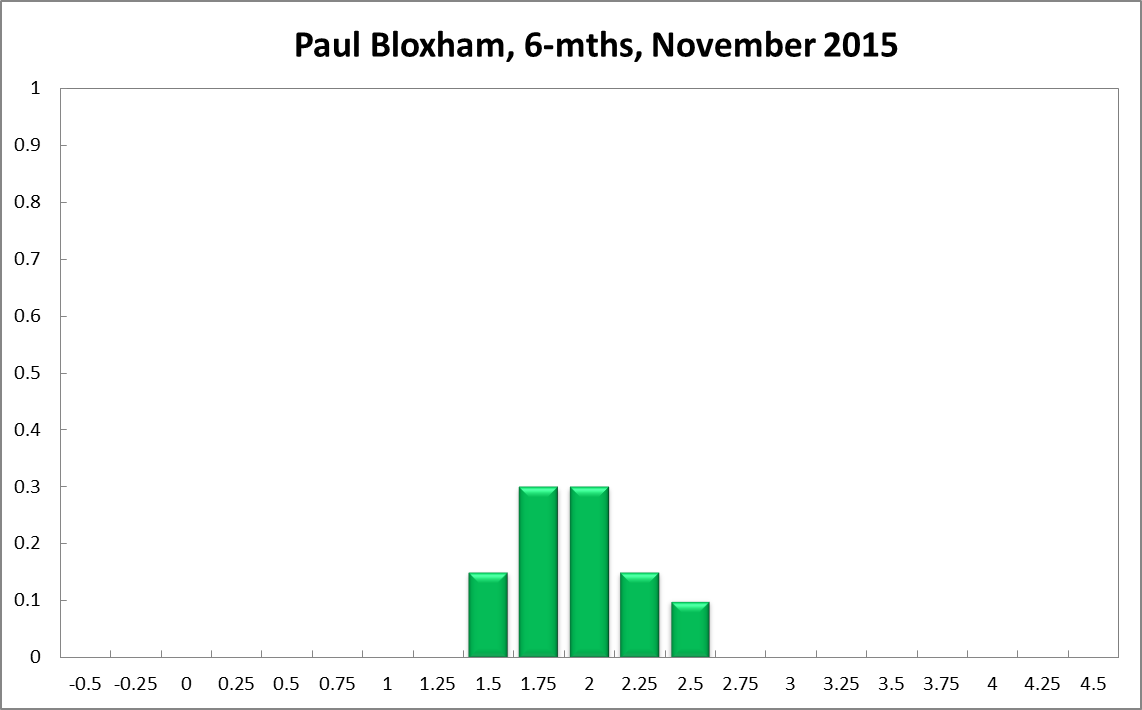

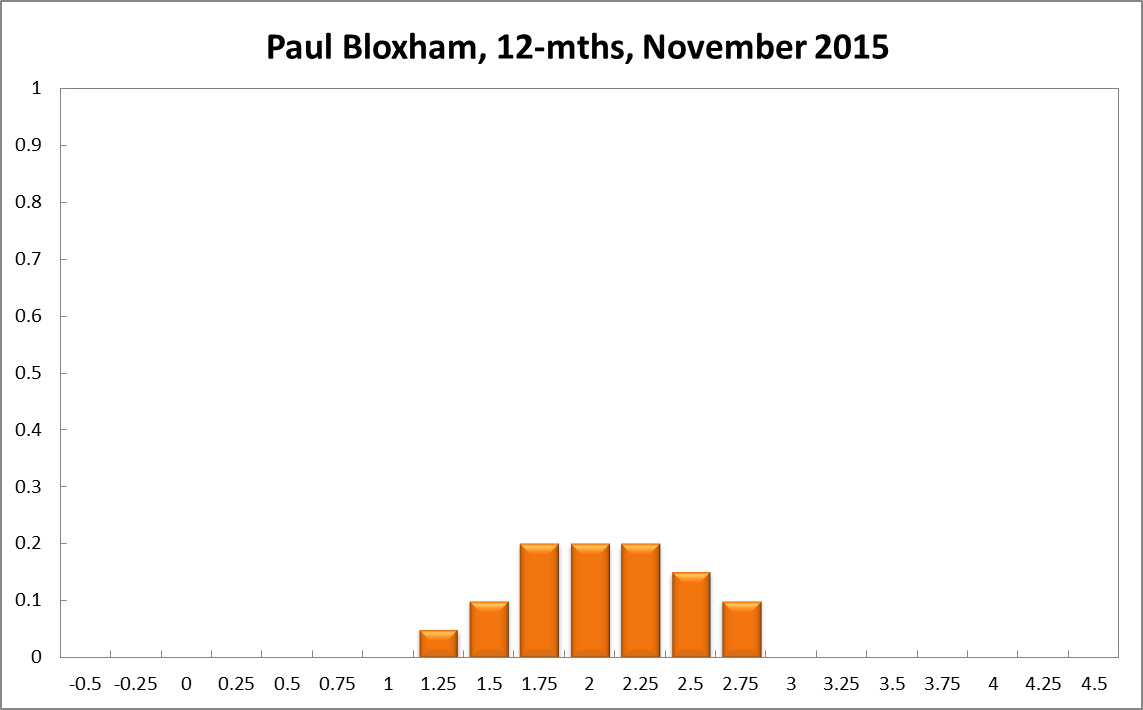

Paul Bloxham

Current

6-Months

12-Months

Comments

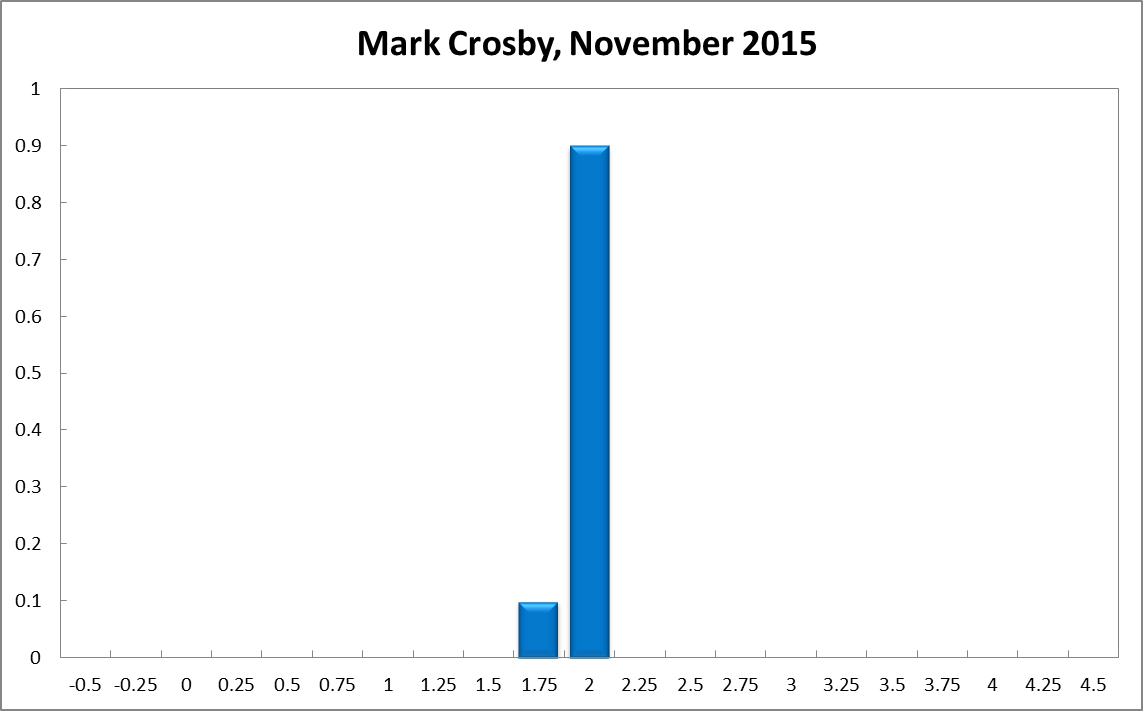

Mark Crosby

Current

6-Months

12-Months

Comments

Despite recent increases in bank mortgage rates, there is little reason for the RBA to cut. The Fed have signalled that they see the global risks as dissipating, and they are looking to raise rates sooner rather than later. Underlying inflation is in the low end of the RBAs band, which gives room to cut, but the question has to be asked as to whether that is really necessary in an environment where rates are already ultra low and household credit growth is strong. If Australia’s economy is weak given current monetary conditions it is surely the fault of other structural factors, rather than monetary policy. It is these structural issues that are in urgent need of repair, rather than monetary policy that is at fault for current weakness.

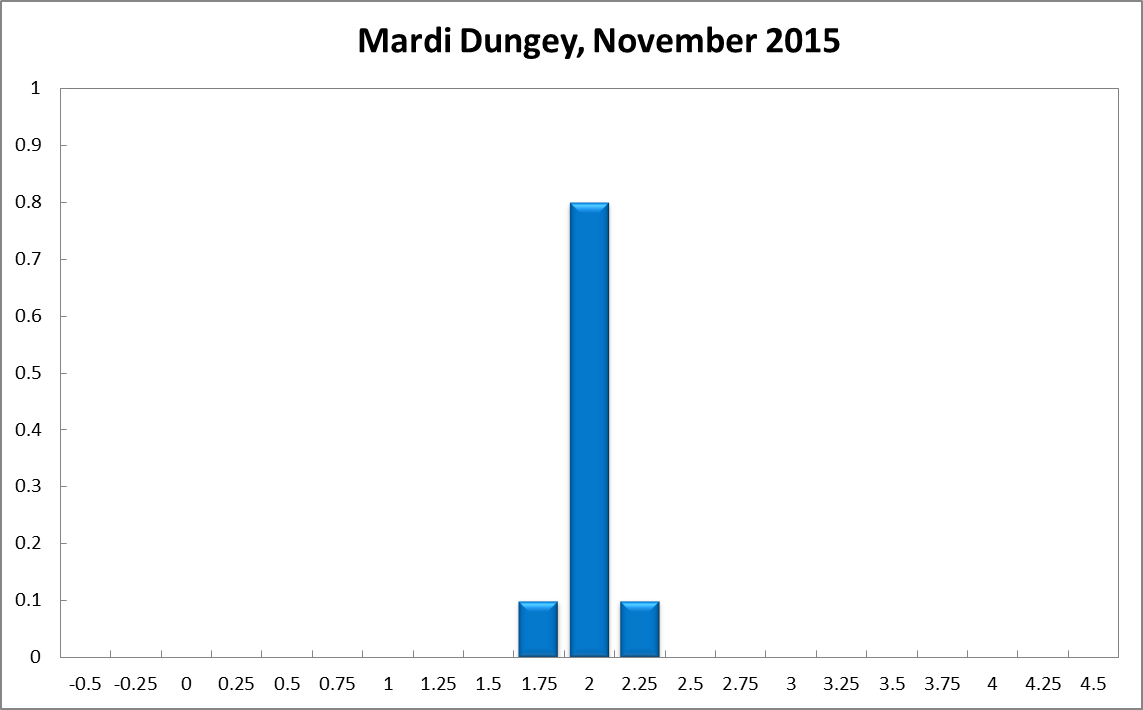

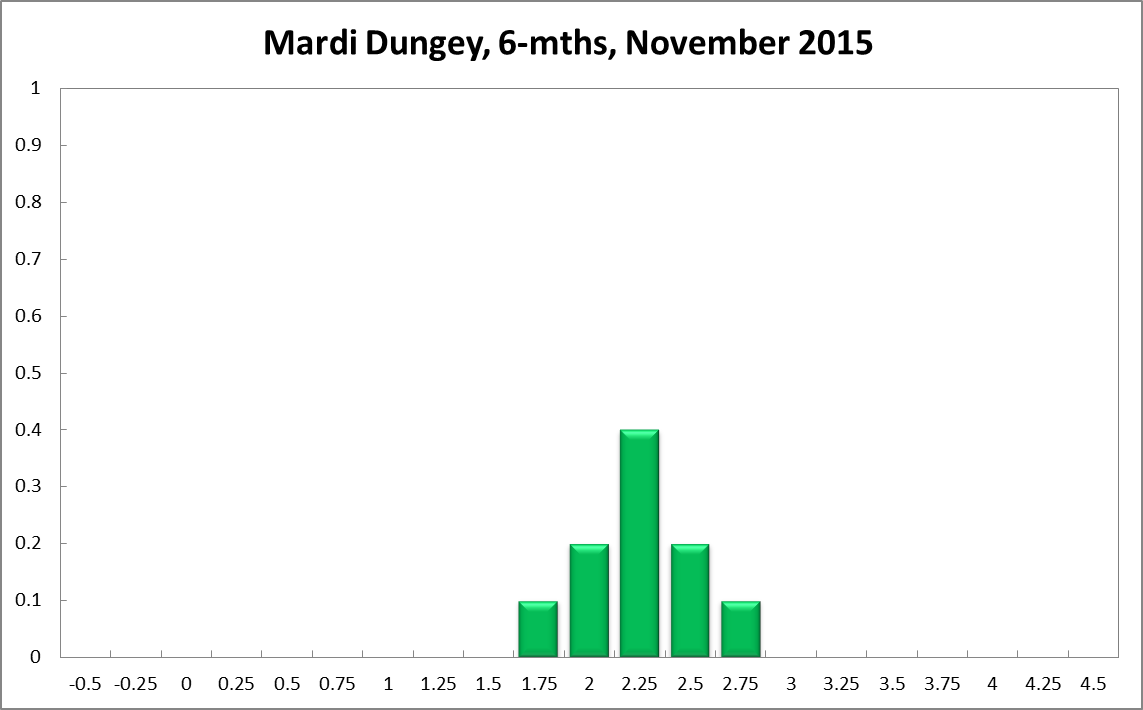

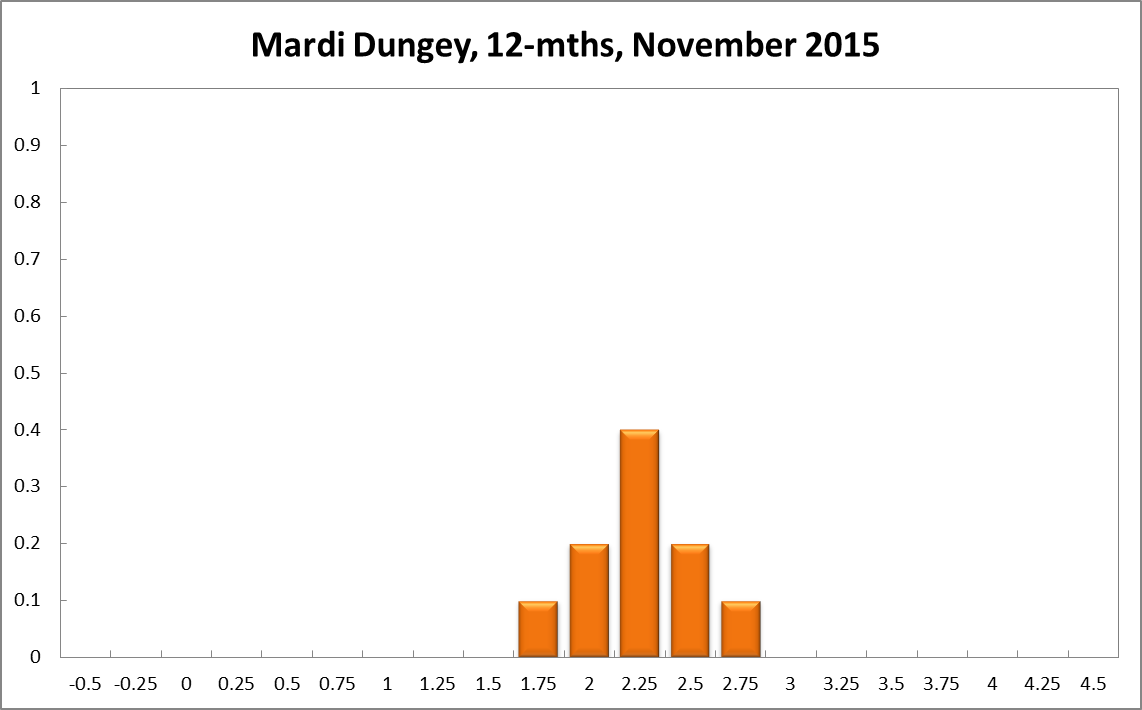

Mardi Dungey

Current

6-Months

12-Months

Comments

With inflation relatively benign and lack of movement from the US for this month there is no compelling reason for rates to be moved in the very near term.

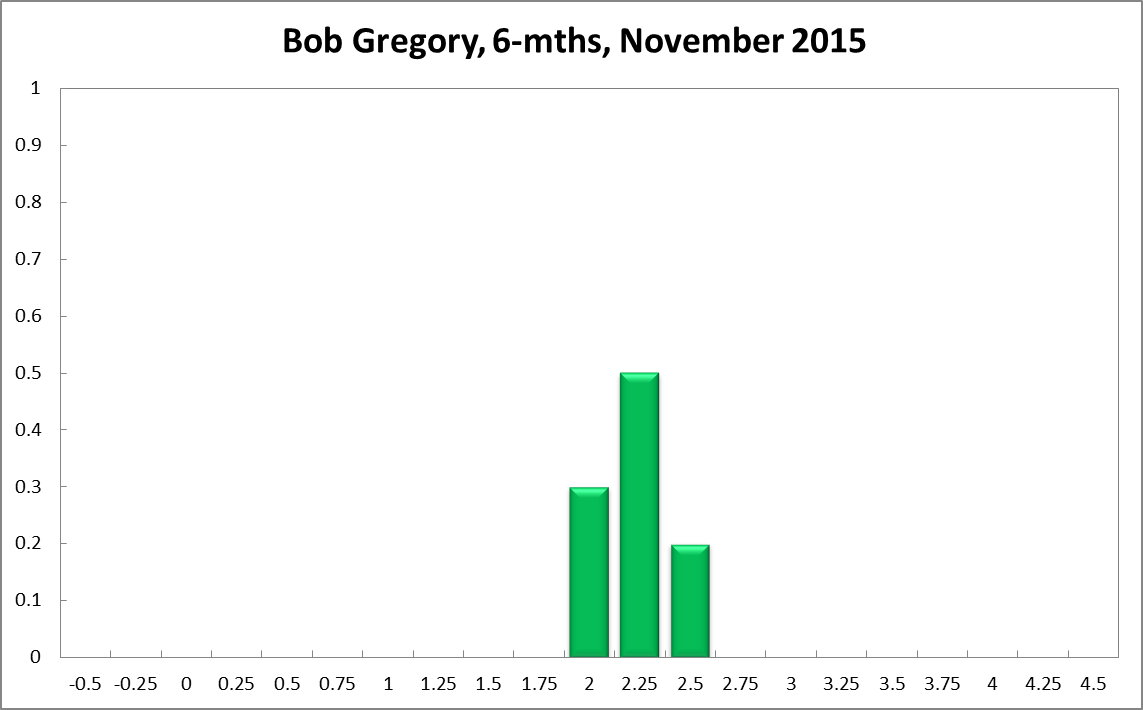

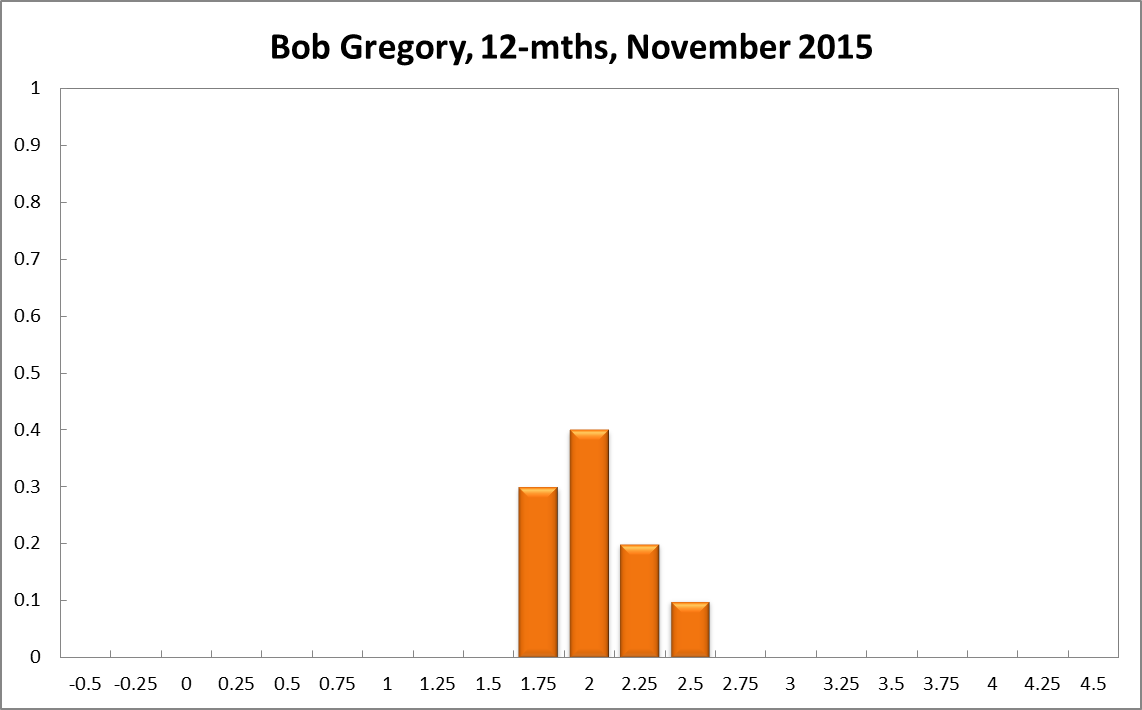

Bob Gregory

Current

6-Months

12-Months

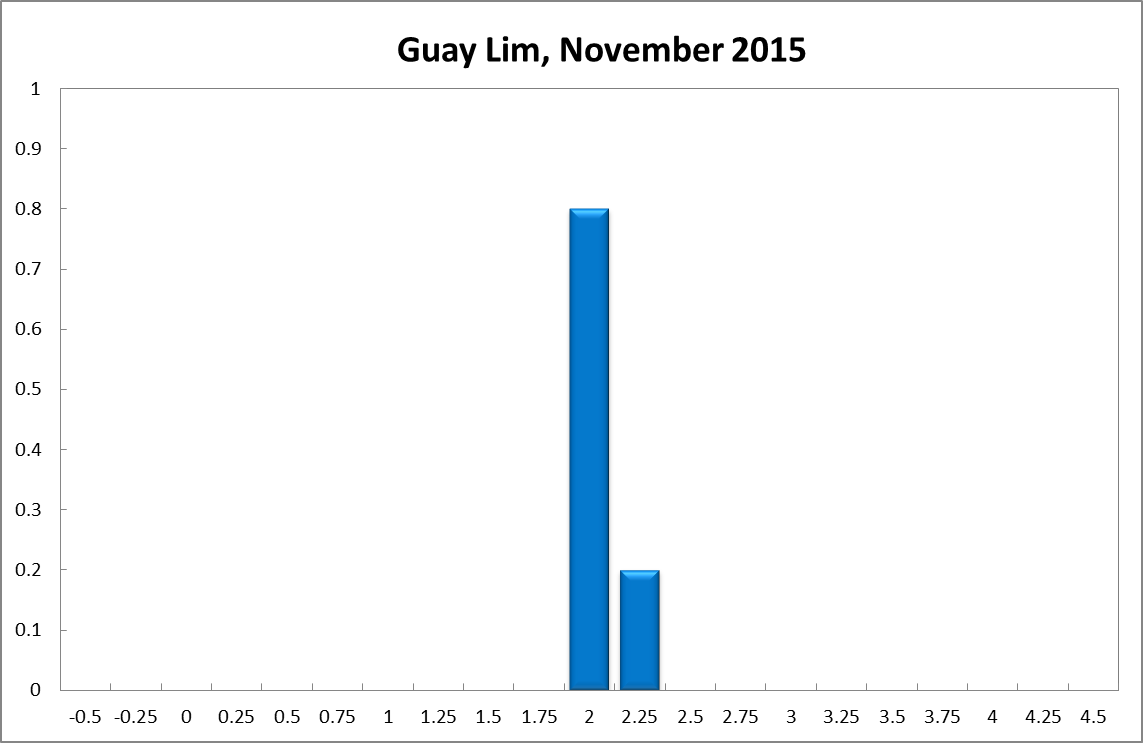

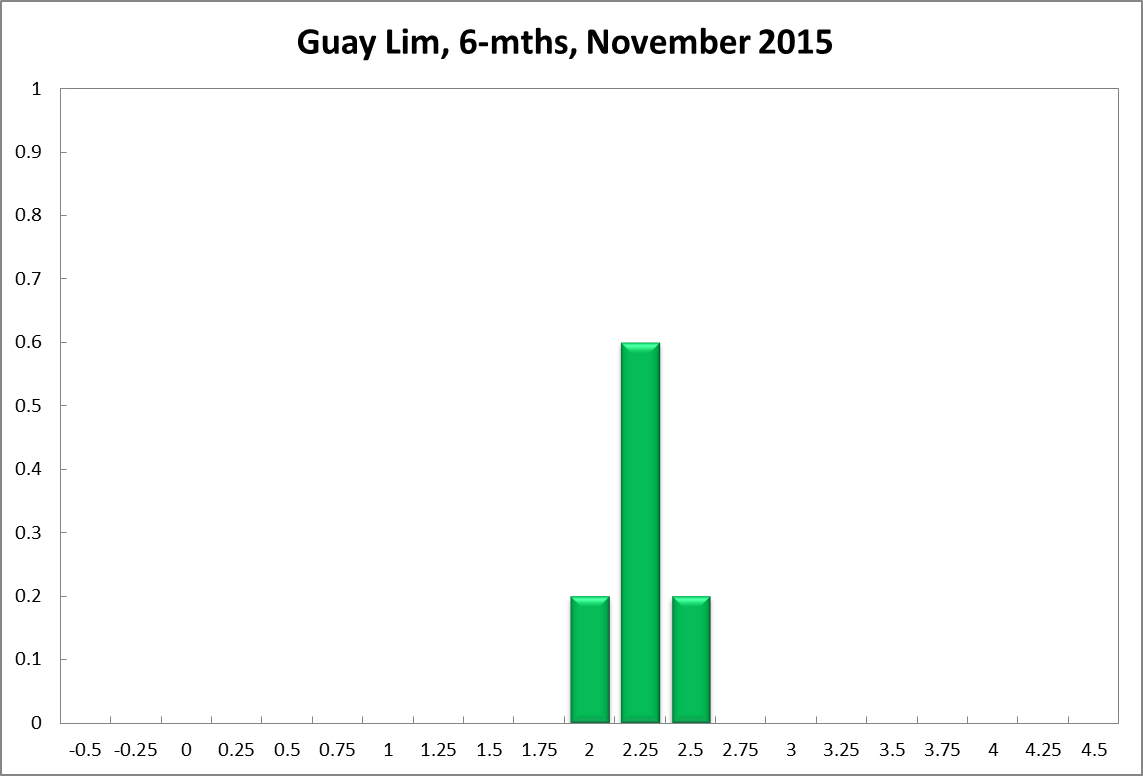

Guay Lim

Current

6-Months

12-Months

Comments

It seems untimely to cut the official cash rate now when rates in the US may be lifted soon. Holding our rates steady will help keep the AUD low as well as help check potential rise in house prices. There are also signs of improvements in business and consumer confidence and the stance of fiscal policy will be clearer soon. It’s time for some monetary-fiscal policy coordination.

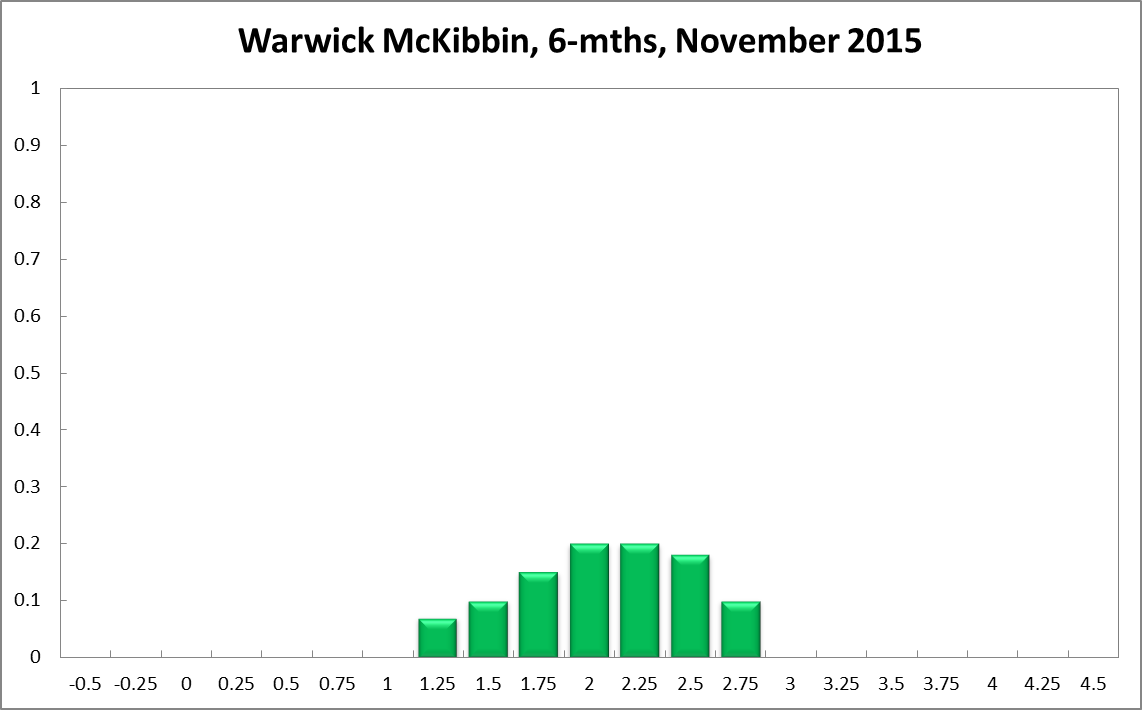

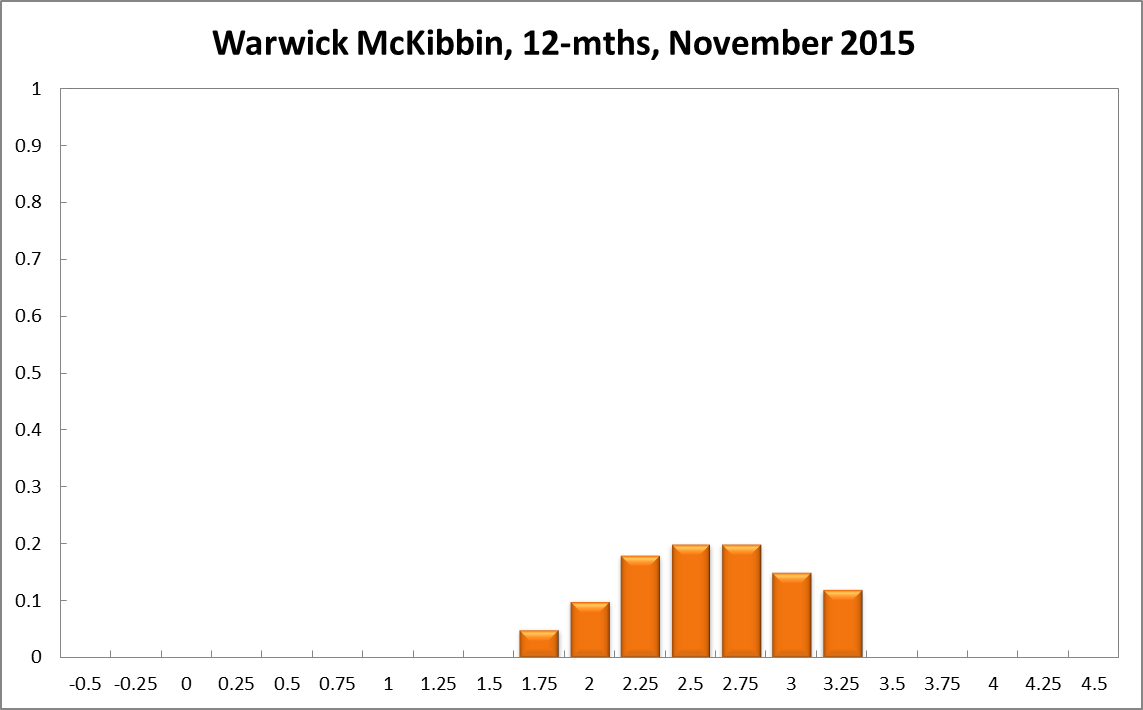

Warwick McKibbin

Current

6-Months

12-Months

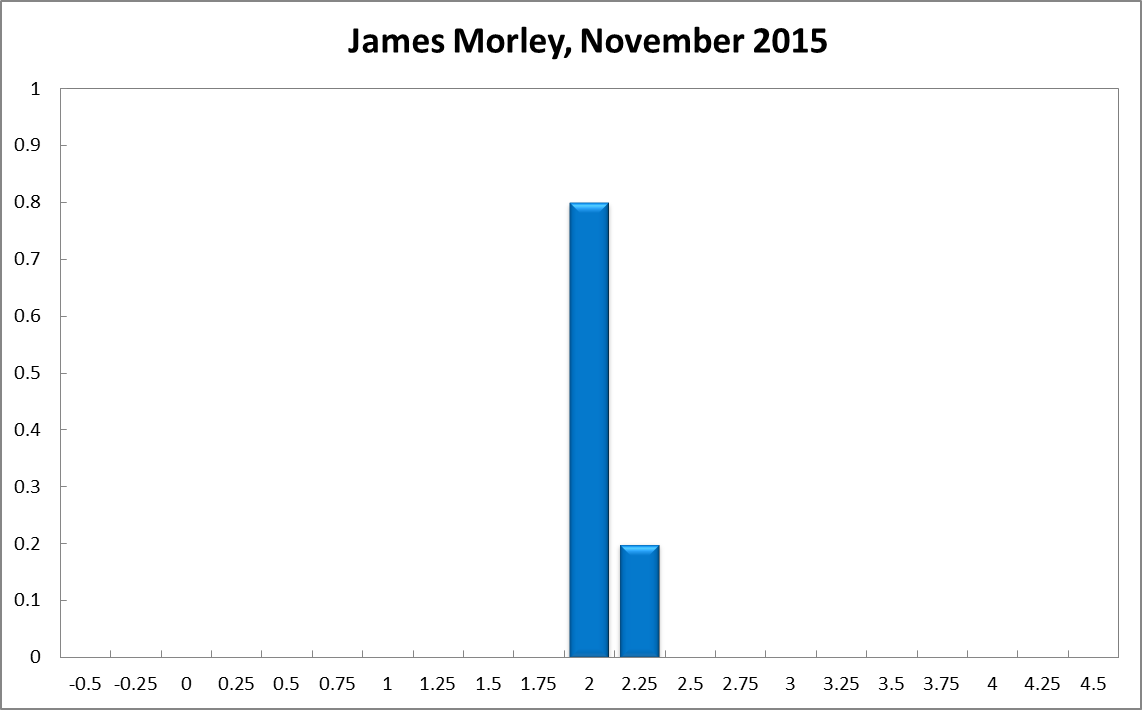

James Morley

Current

6-Months

12-Months

Comments

Headline inflation is low primarily because of a dramatic fall in energy prices in late 2014. Some of this has leaked into underlying inflation, with nontradables inflation running lower this year than it has been for a decade, currently around 2.5% vs. 4% of so over the past 12 years. But the large decline in volatile energy prices should have only a one-time effect on year-on-year inflation that will dissipate in 2016. Also, the lower Australian dollar should offset some of these disinflationary pressures by raising tradables inflation. The bottom line is that inflation expectations remain well anchored, with the 10-year break-even inflation rate at 2.2% being well within the RBA’s 2-3% target range, albeit a bit below the middle of the band.

A cash rate of 2.0% is low enough given a 6.2% unemployment rate and current inflation expectations. If the neutral rate is lower than previously believed due to secular stagnation and related forces, the RBA should plan less of an increase over the medium term. But there hasn't been enough new information over the past month to justify cutting the cash rate further on the basis of a lower neutral rate. Meanwhile, the RBA should always avoid setting the cash rate to offset interest rate movements by the banks. The central bank dictates the course of monetary policy, not the banks.

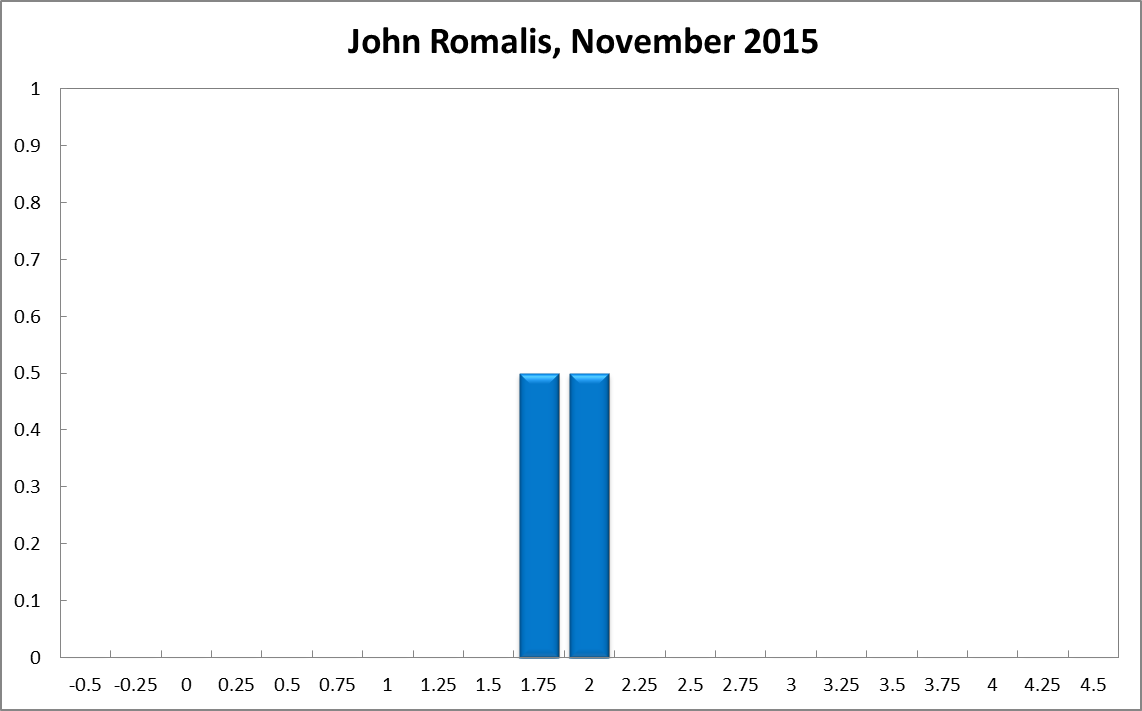

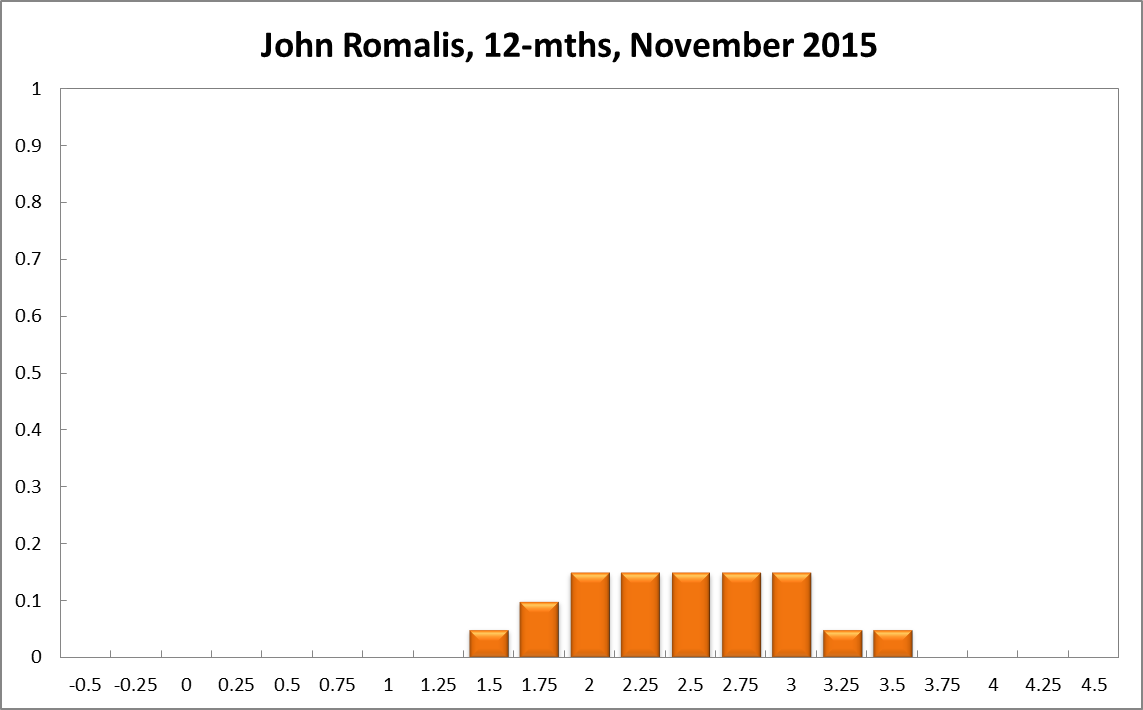

John Romalis

Current

6-Months

12-Months

Jeffrey Sheen

Current

6-Months

12-Months

Comments

The major banks have raised their mortgage rates this month by about 25 basis points in response to APRA's intervention requiring higher capital reserves. At this relatively weak stage of the Australian business cycle, these actions may have an undesirable adverse impact on household and business confidence. Therefore my recommendation is for a higher probability of a rate cut in November and in the next year.