The new US President has added considerably to global uncertainty regarding the 2017 economic outlook, but so far he has not done enough damage to warrant the RBA cutting rates. Medium term the outlook is still very unclear, with significant factors to look out for being Fed rate rises and movements in the AUD.

Outcome: February 2017

Rates On Hold as Trump Uncertainty Rises

Donald Trump’s assumption of the US presidency since the last RBA Shadow Board round two months ago raises important questions about the future health of the global economy. Domestically, consumer prices rose a little faster, by 1.5% year-on-year in the December 2016 quarter, but still well below the RBA’s 2-3% target band. The CAMA RBA Shadow Board’s conviction that the cash rate should remain at its current level is stronger than two months ago, reflecting the heightened uncertainty surrounding the Trump presidency. The Shadow Board attaches a 70% probability to a rate hold being the appropriate policy setting. The confidence attached to a required rate cut equals 5%, while the confidence in a required rate hike equals 25%.

There is little inflationary pressure emanating from the Australian labour market, with Australia’s official unemployment rate now standing at 5.8%. Since the participation rate has remained steady, the modest increase in unemployment is primarily due to a smaller increase in the creation of new jobs. There is no new data on wages growth.

The Aussie dollar, relative to the US dollar, has strengthened again, finding support above 75 US¢. Yields on Australian 10-year government bonds have slipped to 2.77%, once again nearing their historical low. Domestic share prices have retreated from their highs in early January, the S&P/ASX 200 stock market index now consolidating between 5,600 and 5,700.

The main global threat remains the uncertainty surrounding the Trump Presidency. On the one hand, Trump’s promise to drastically increase infrastructure and defence spending, coupled with tax cuts, will exert upward pressure on US, and hence world, interest rates. On the other hand, Trump’s protectionist and nationalist policies will dampen international trade and generate political uncertainty. This could further increase global interest rates if risk premia were to rise considerably, or lower interest rates if global demand falls. Making accurate predictions in such an environment is extremely ambitious; but the heightened uncertainty is damaging to financial markets and the overall economic outlook.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, has fallen slightly during the past two months. It now stands at 97.4 (down from 101.3 two months ago). The manufacturing and services PMI, which measure the performances of the manufacturing and services sectors, continue to bounce around without clear direction, now equaling 51.2 (down from 54.2 two months ago) and 54.5 (up from 50.5), respectively. The AIG Performance of Construction Index (PCI), after its recent blip up, fell again, edged up for the second month in a row, from 45.9 in October to 47 in December. Building permits declined again in December, by 1.2%, though November saw an interruption in this trend, with an increase of 7.5%.

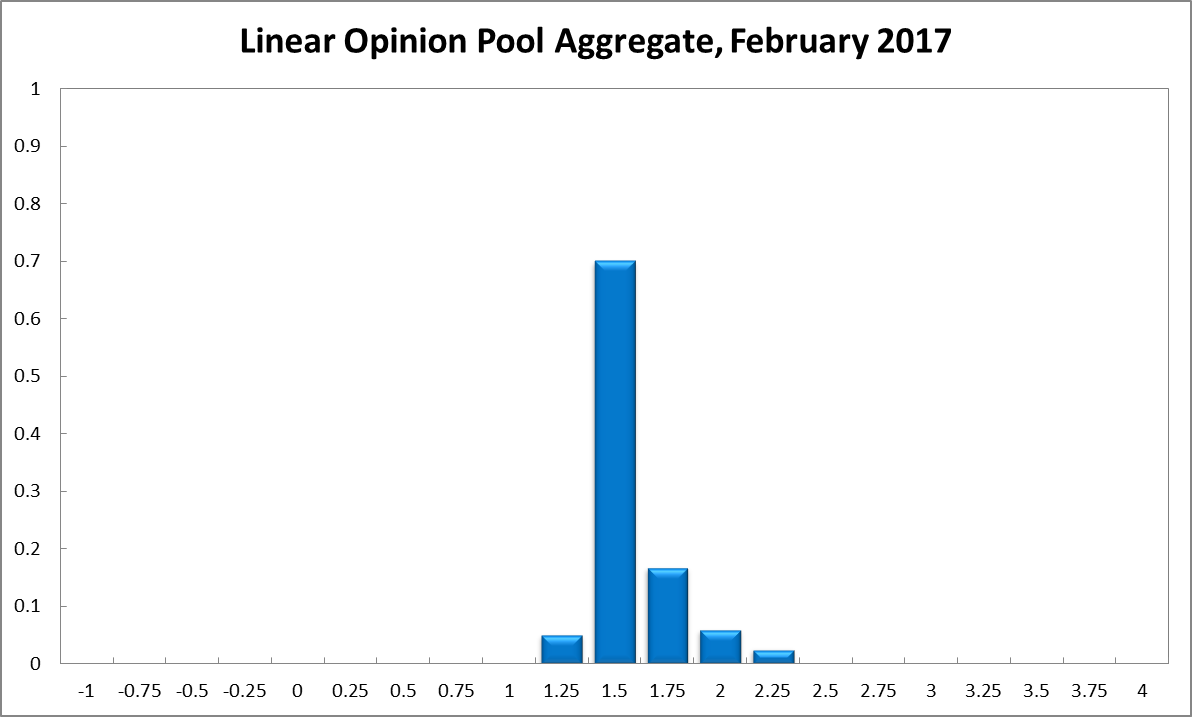

The Shadow Board’s preference for the optimal interest rate has strengthened. It now attaches a 70% probability (56% in December) that “no change” is the appropriate policy, a 5% probability (2% in December) that a rate cut is appropriate and a 25% probability (43% in December) that a rate rise, to 1.75% or higher, is appropriate.

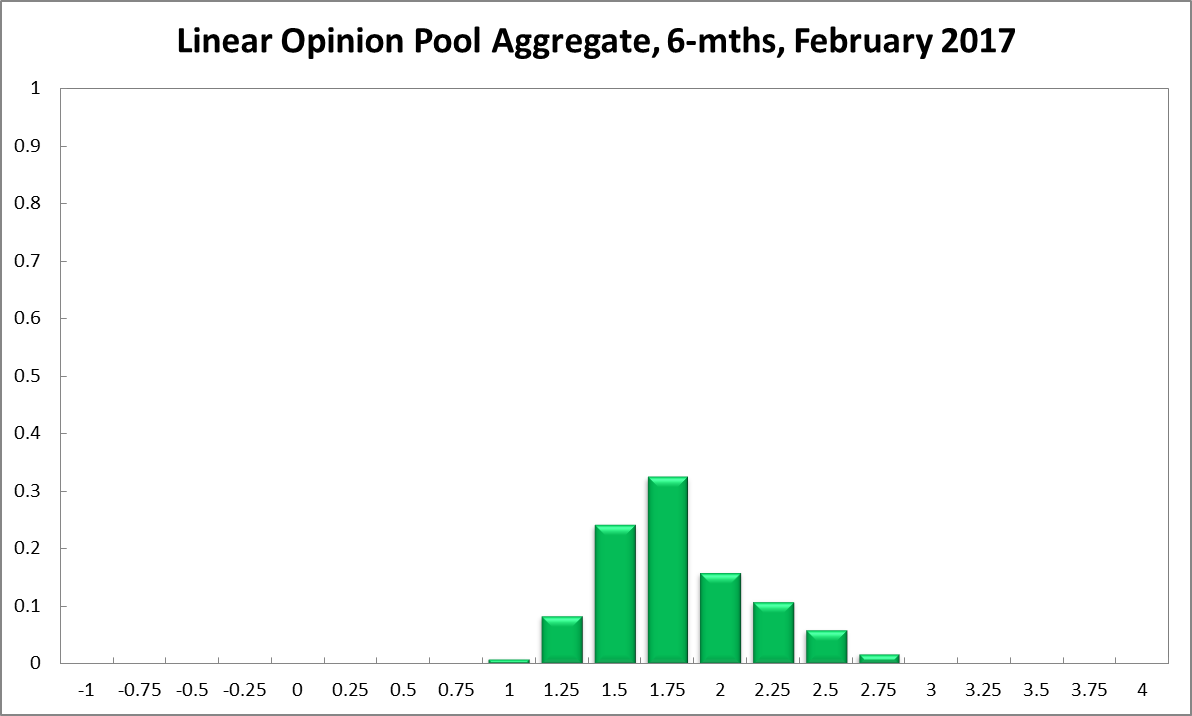

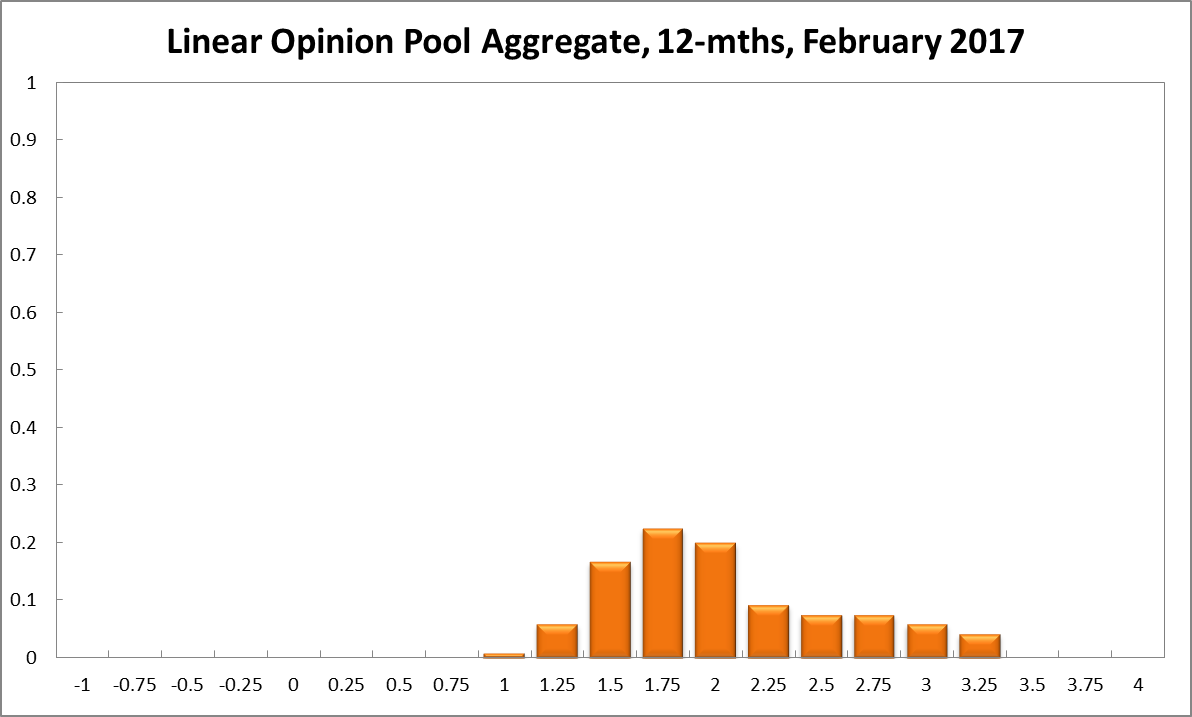

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.50% equals 24%, three percentage points up from the previous round. The estimated need for an interest rate decrease remains unchanged at 9%, while the need for a rate increase equals 67% (71% in December). A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 17% (unchanged from December), while the confidence in a required cash rate decrease (7%) and in a required cash rate increase (77%) are also virtually unchanged.

Aggregate

Current

6-Months

12-Months

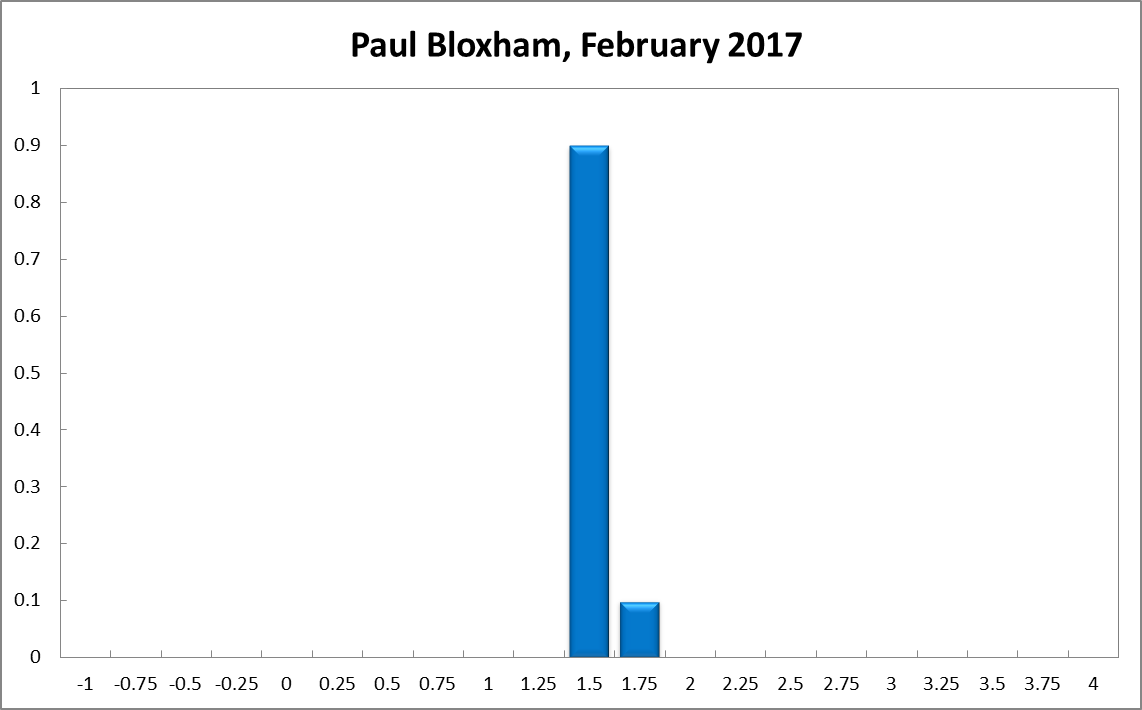

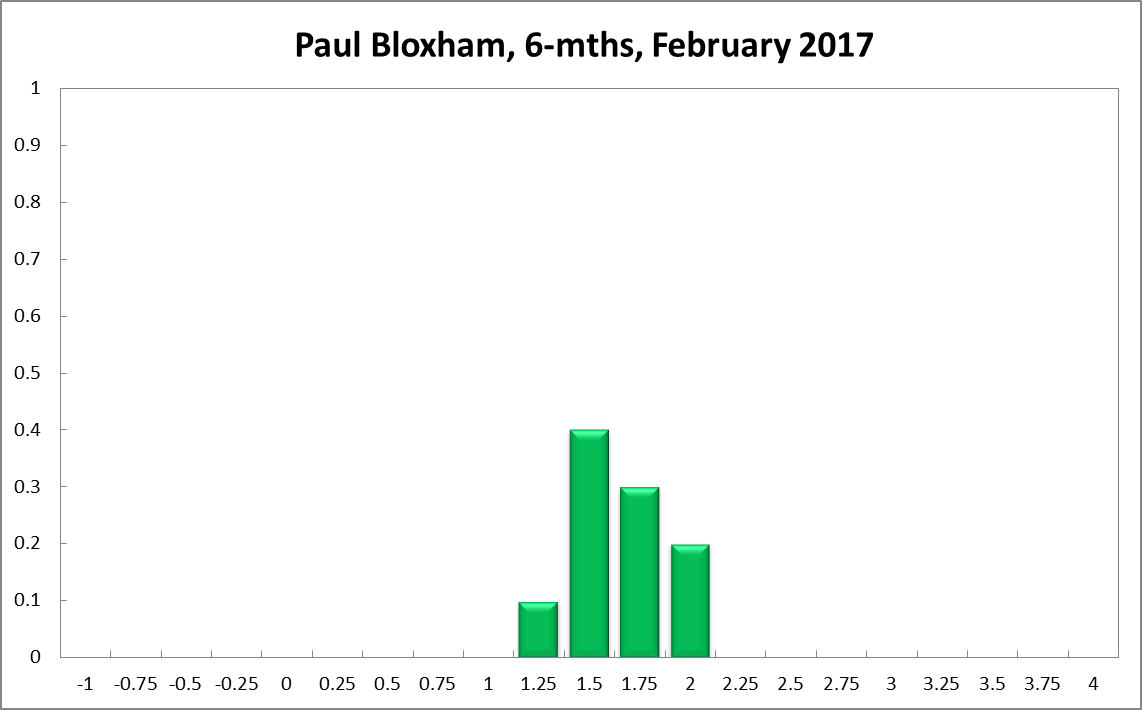

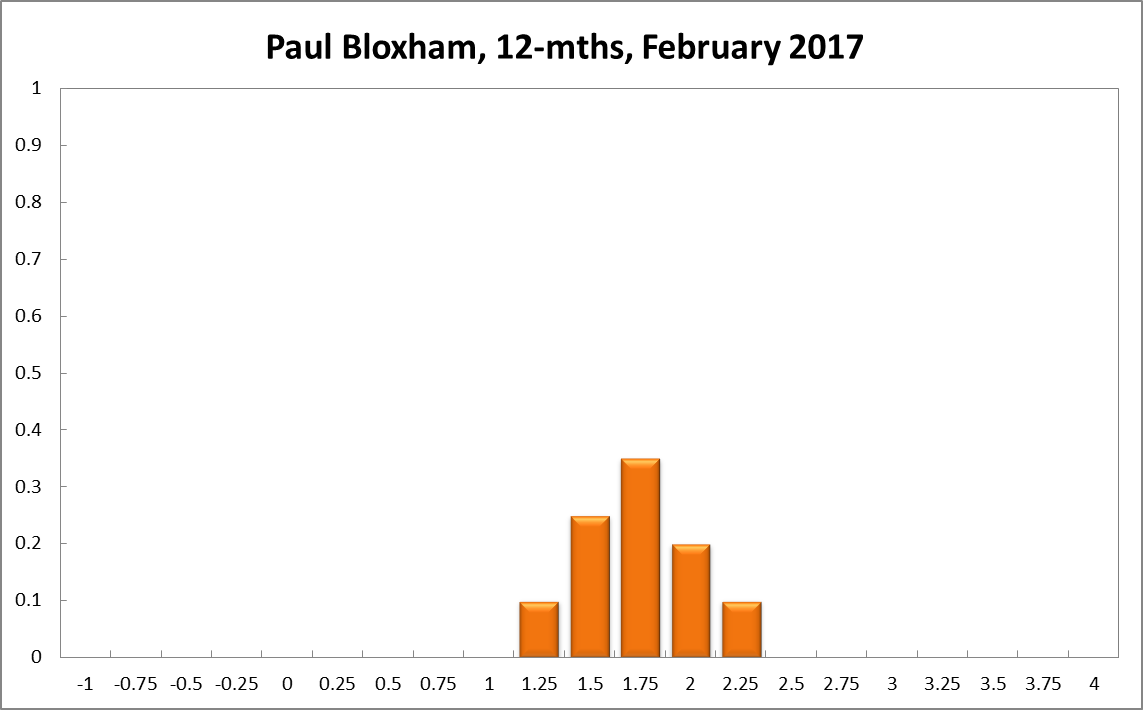

Paul Bloxham

Current

6-Months

12-Months

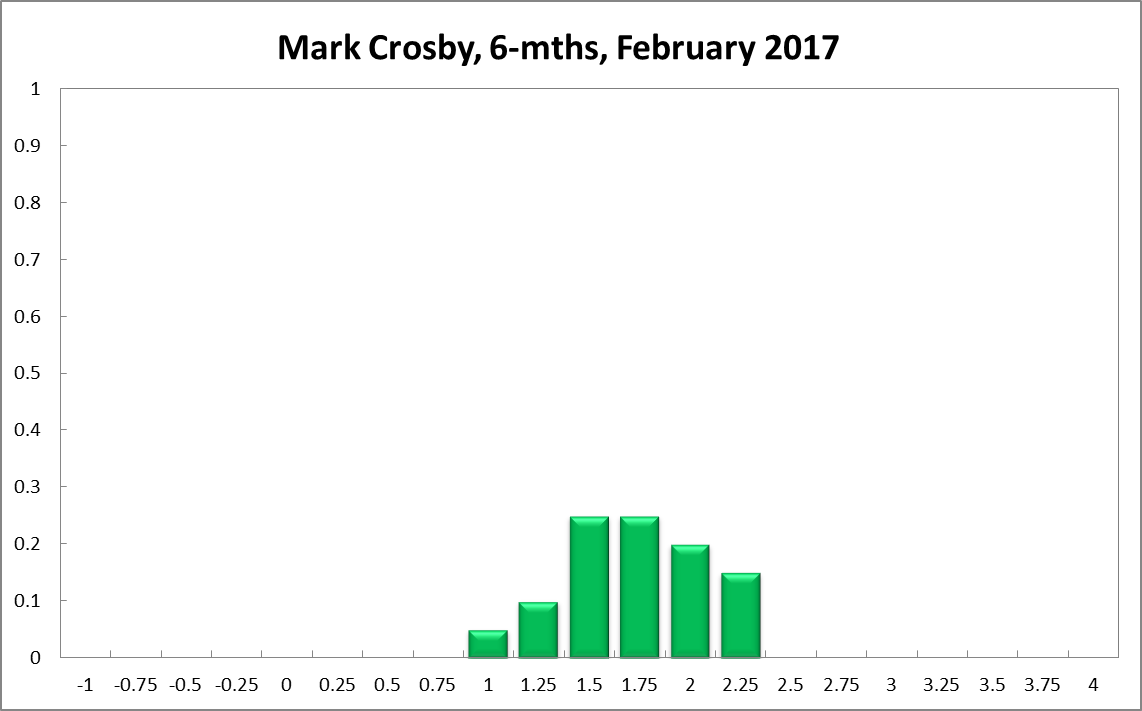

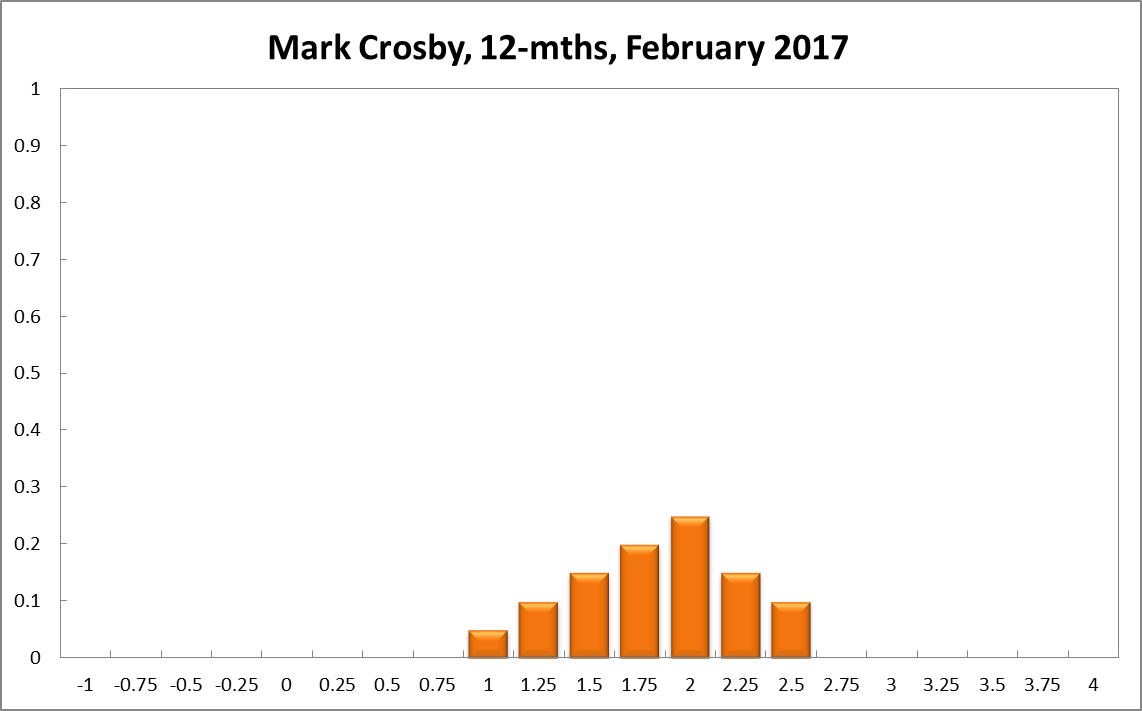

Mark Crosby

Current

6-Months

12-Months

Comments

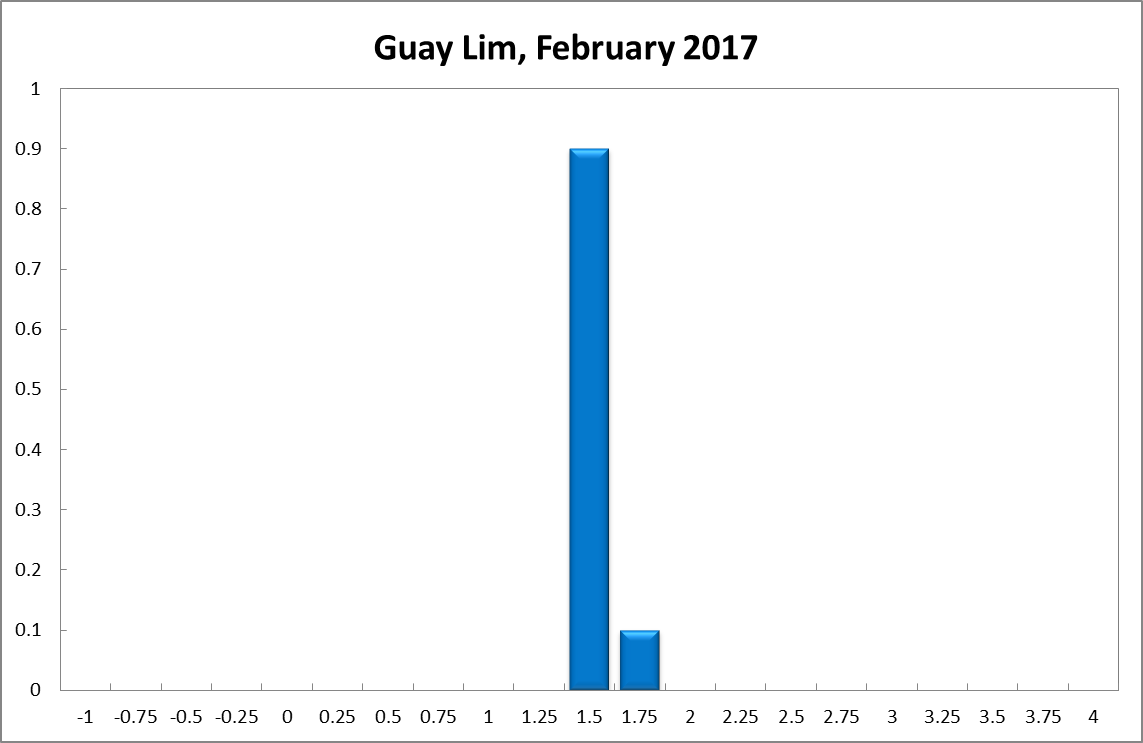

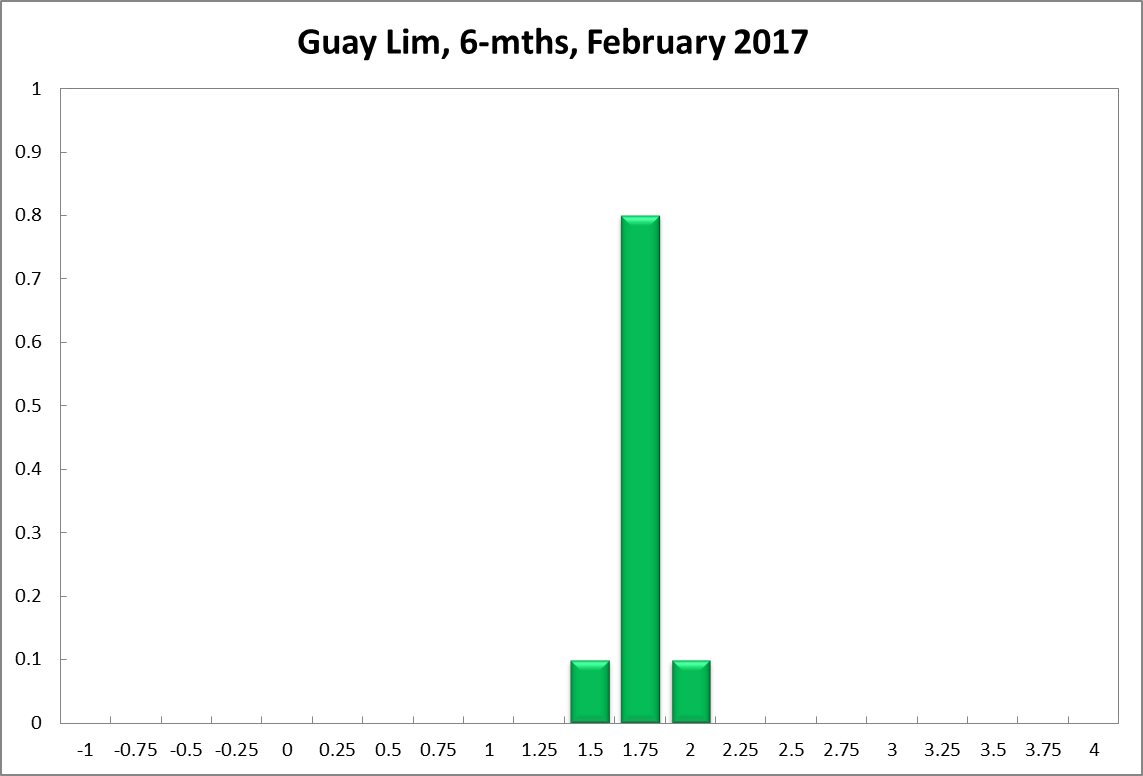

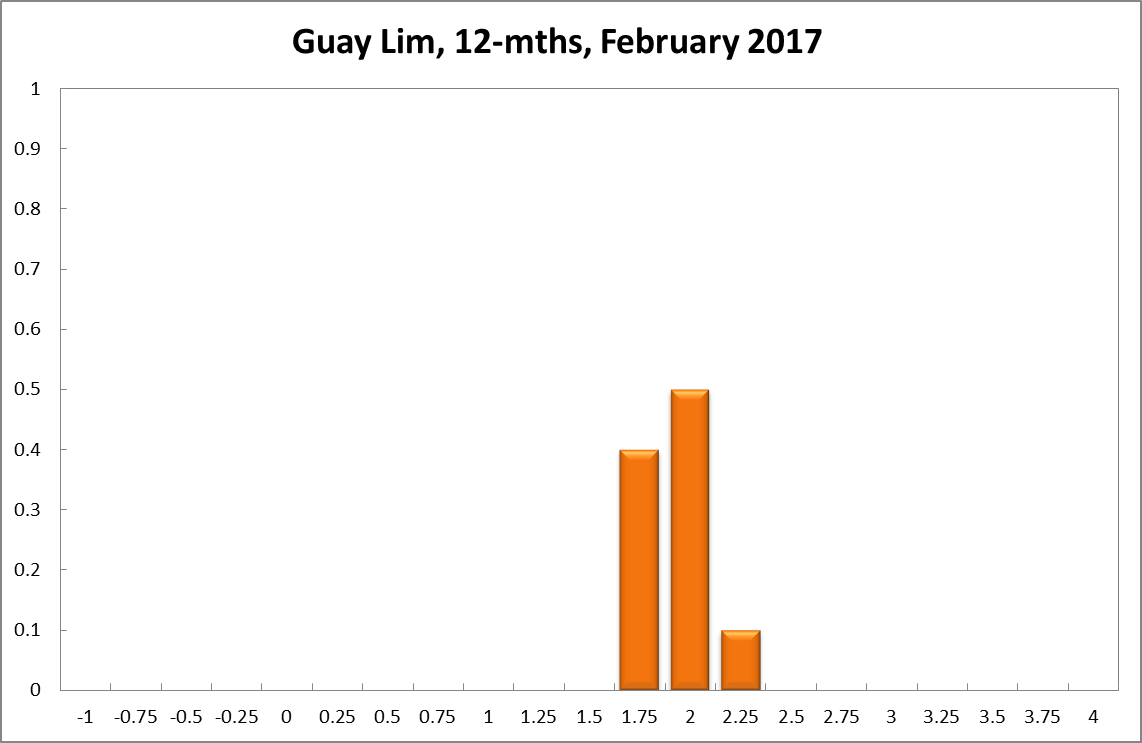

Guay Lim

Current

6-Months

12-Months

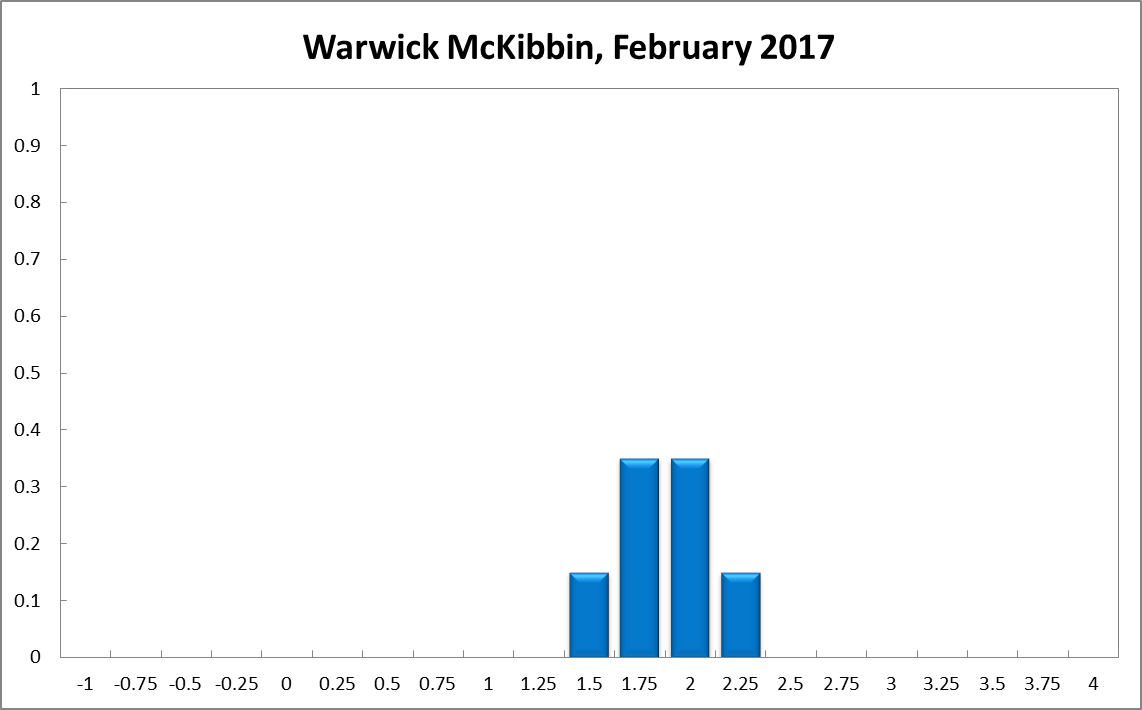

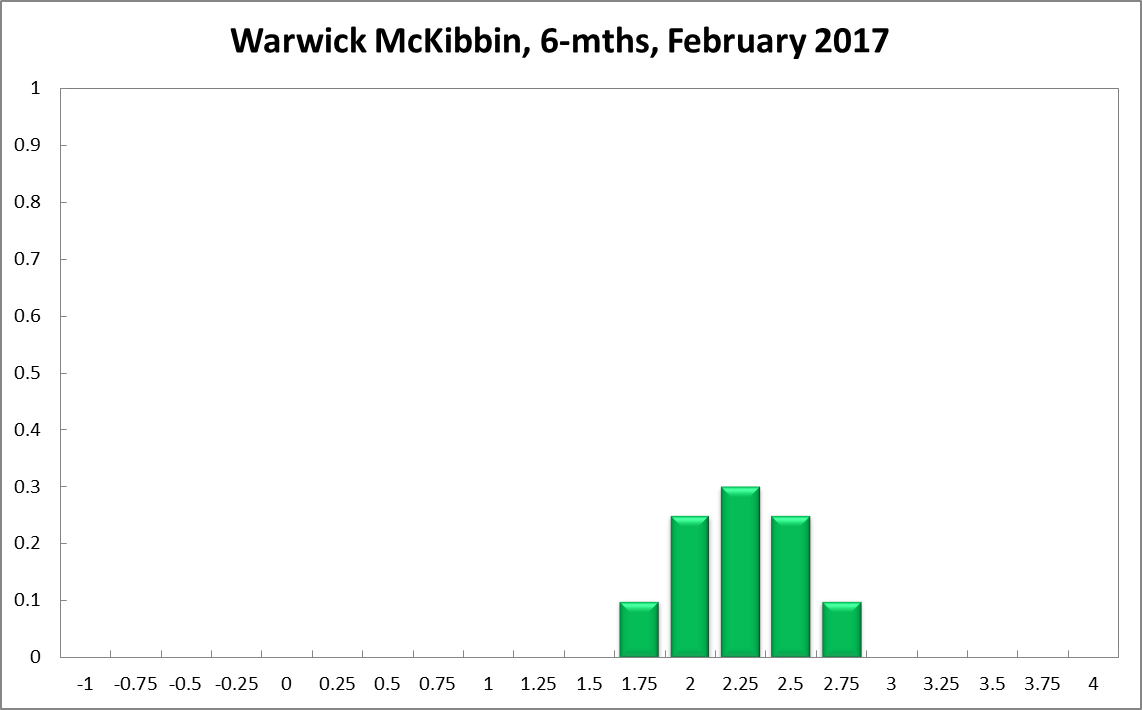

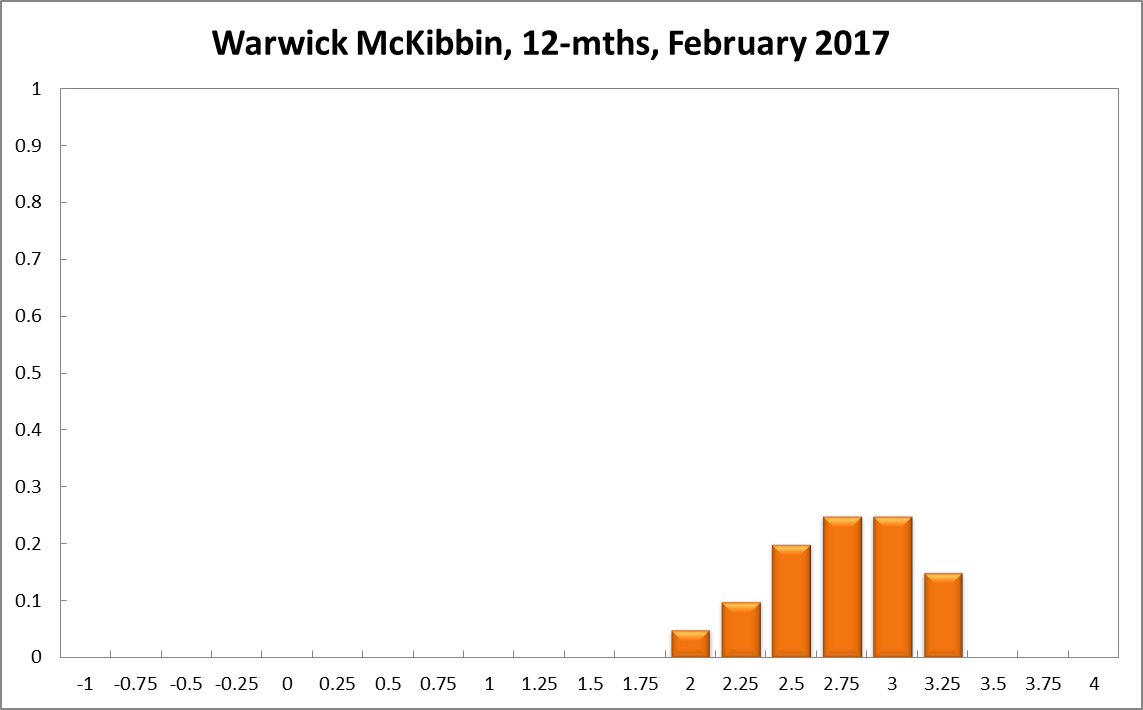

Warwick McKibbin

Current

6-Months

12-Months

Comments

The policies to be implemented by the Trump Administration are yet to be clear but the range of spending proposals on defence and infrastructure and company and household tax cuts imply very large fiscal deficits and excess demand at a time the Fed was already likely to be raising interest rates. This suggests rising short term and long term interest rates in the US which inevitably will pull up interest rate in Australia.

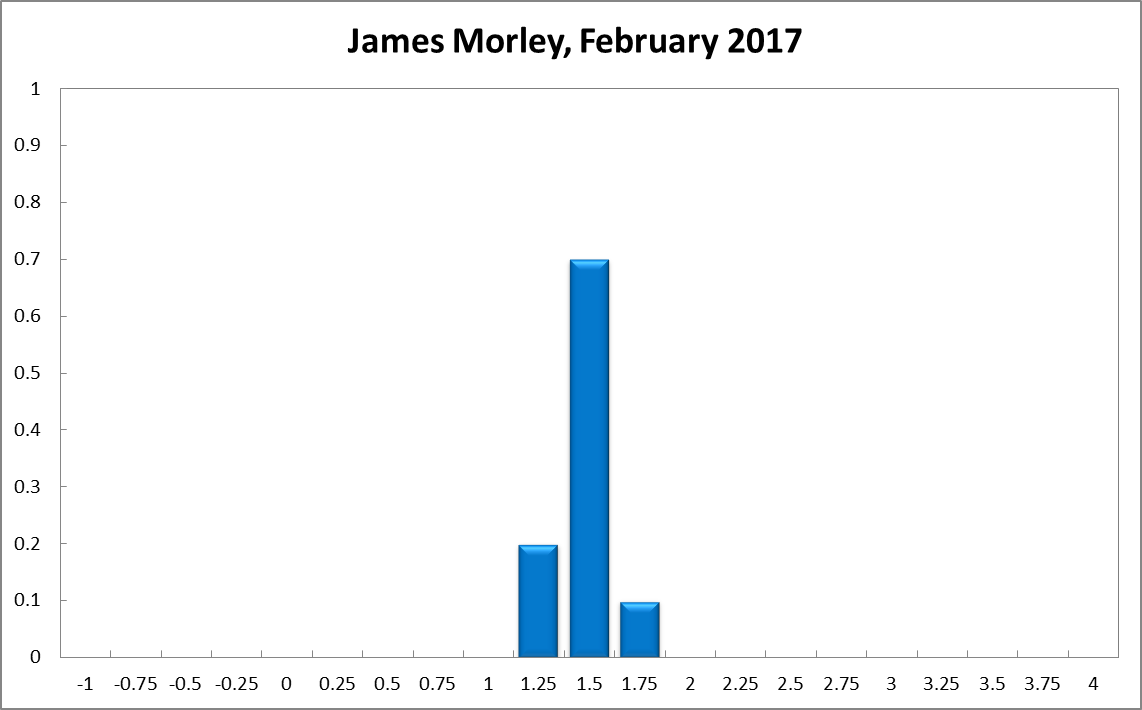

James Morley

Current

6-Months

12-Months

Comments

Given inflation continuing to be below the RBA’s target range despite some recovery in commodity prices, as well as the massive downside risks for the global economy following the U.S. Presidential election, the RBA should hold its policy rate steady at this meeting. The next direction is most likely to be up as inflation can be expected to return to the target range in the medium term. But the risks of negative financial market and trade shocks are quite elevated at the moment and the RBA should look for some reduction in those risks before starting a tightening cycle.

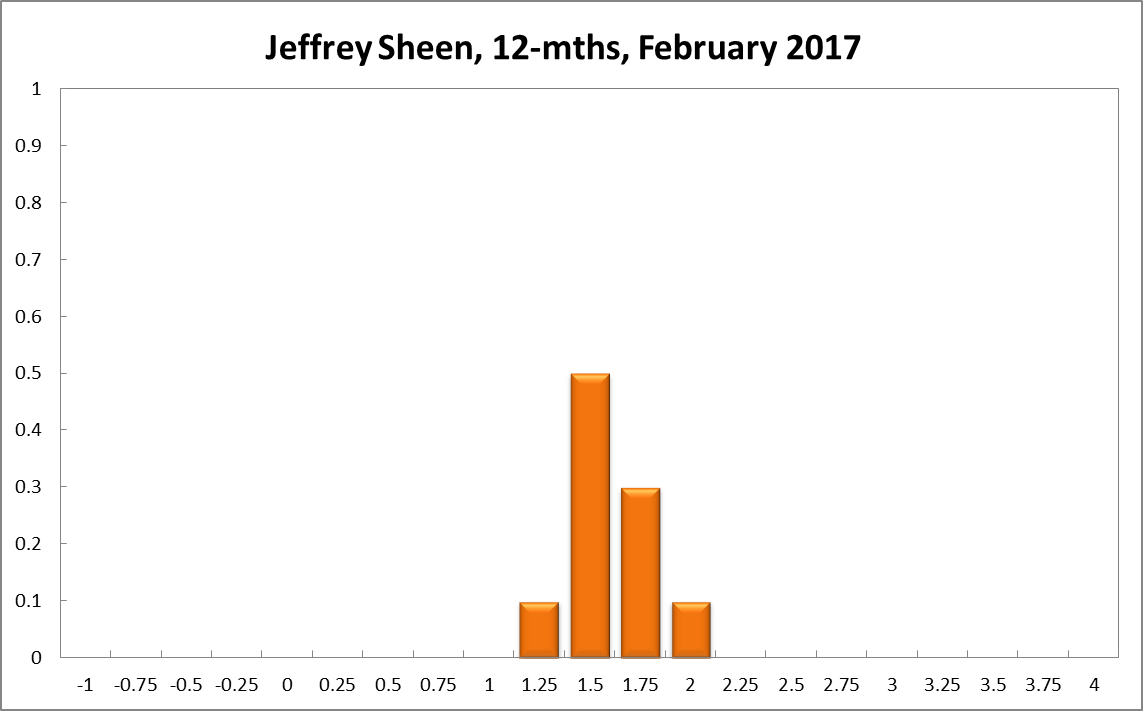

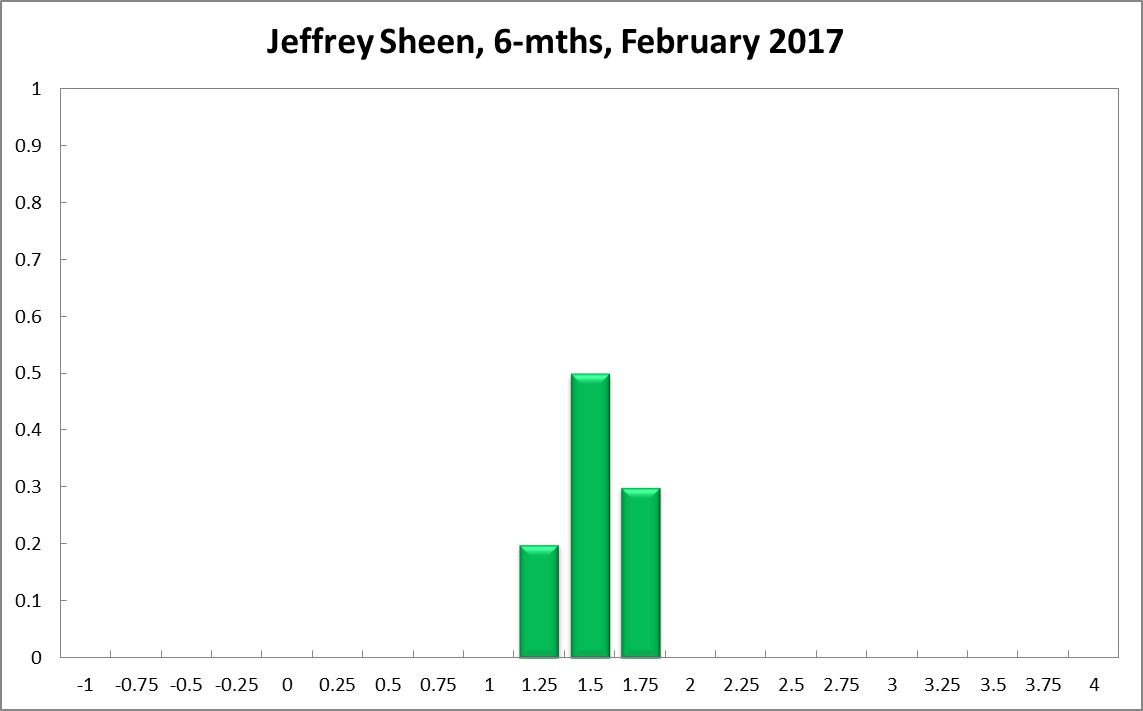

Jeffrey Sheen

Current

6-Months

12-Months