In August, Australia’s monthly Consumer Price Index (CPI) indicator rose 3.0 per cent over the year, up from 2.8 per cent in July and the highest annual rate since July 2024. Housing costs (+4.5 per cent), food and non‑alcoholic beverages (+3.0 per cent) and alcohol and tobacco prices (+6.0 per cent) were the largest contributors to inflation, according to the Australian Bureau of Statistics (ABS). Underlying measures were more subdued: trimmed‑mean inflation slowed to 2.6 per cent while the CPI excluding volatile items and holiday travel increased 3.4 per cent in the same period. National accounts showed GDP expanding by 0.6 per cent in the June quarter and 1.8 per cent over the year, supported by household consumption and government spending. Wage growth is moderating; the Wage Price Index rose 0.8 per cent in the quarter and 3.4 per cent through the year, down from 4.1 per cent a year earlier. Thus, the RBA is not far from its dual mandate of full employment and price stability but considerable risks on both the upside and downside remain. Consequently, there is a strong consensus among Shadow Board members to keep the overnight rate unchanged at 3.60 per cent, attaching a 71 per cent probability that this is the appropriate setting, while being equally uncertain about the possibility that the overnight rate might need to be lower or higher.

The labour market remains relatively tight but has begun to cool. Employment unexpectedly fell by about 5,400 in August, reversing July’s rise. Full‑time positions dropped sharply, and hours worked, in seasonally adjusted terms, declined 0.4 per cent. The unemployment rate remained at 4.2 per cent and the participation rate eased to 66.8 per cent, down from 67 per cent in July. Annual employment growth slowed to 1.5 per cent from 3.5 per cent in January, and the Reserve Bank of Australia (RBA) expects joblessness to drift up to around 4.3 per cent.

Financial conditions have become more accommodating following three cash‑rate cuts this year, and the Reserve Bank is expected to hold steady at its late-September meeting, according to Reuters. Bond yields have declined since the August cut, while the Australian dollar has traded near US$0.66. The yield curve remains inverted at the very short end (2y–1y: -4.5 bps) but exhibits normal convexity further out (5y–2y: +28.0 bps; 10y–2y: +85.8 bps), still consistent with expectations of a slight easing of monetary conditions as inflation settles inside the target band. Borrowing costs are feeding through to the housing market: the total value of residential dwellings increased by $213.8 billion to $11.56 trillion in the June quarter and the mean dwelling price rose to just over $1.0 million. Equity prices remain supported by low rates, having posted new highs in early August, though the OECD cautions that stretched asset valuations could pose financial‑stability risks.

Consumer spending has regained momentum. Household consumption rose 0.9 per cent in the June quarter, contributing 0.4 percentage points to GDP growth. Discretionary expenditure led the increase, particularly recreation and culture, transport services and hospitality. End‑of‑financial‑year sales and holiday timing boosted tourism‑related activity, while higher health spending and a reduction in energy rebates lifted essential consumption. Consumer sentiment, however, remains subdued despite recent rate cuts. The Westpac‑Melbourne Institute Consumer Sentiment Index fell 3.1 per cent month‑on‑month to 95.4 points in September 2025, below the neutral level of 100, after surging to 98.5 points in August. Trading Economics reports that the decline reflects renewed unease over the economic outlook and interest rates: expectations for economic conditions over the next 12 months fell 8.9 per cent to 92.2, and the five‑year outlook fell 5.9 per cent to 92.7; the time‑to‑buy index for major household items slipped 3.4 per cent to 98.2 and unemployment expectations rose 4.6 per cent to 131.4. On the positive side, perceptions of family finances improved modestly, with the index for family finances compared with a year ago rising 2.6 per cent to 86.3 and expectations for the next year edging up 0.9 per cent to 107.7. These figures indicate that pessimists continue to outweigh optimists, as consumer confidence has averaged around 100 points since 1974 and the September reading remains well below the long‑run average.

Business sentiment presents a mixed picture. Job advertisements are holding above pre‑pandemic levels and business surveys report moderate hiring intentions. Yet the surprise fall in employment and recent announcements of workforce reductions by major banks and other large employers point to softer labour demand. Private investment grew only marginally in the June quarter and public investment contracted due to the completion of major infrastructure projects. Government consumption, in contrast, increased 1.0 per cent, reflecting higher spending on social programmes, election activities and defence.

The international backdrop is turning less supportive. The OECD’s Interim Economic Outlook notes that global growth was surprisingly resilient in early 2025 but is expected to slow, with world GDP growth projected to ease from 3.3 per cent in 2024 to 3.2 per cent in 2025 and 2.9 per cent in 2026. Growth in the United States, China and the euro area is forecast to decelerate markedly over the next two years. Headline inflation in the G20 is likely to moderate from 3.4 per cent in 2025 to 2.9 per cent in 2026, but the report warns that the disinflation process has stalled in many economies and that risks from higher tariffs, fiscal strains and over‑valued assets could lead to weaker outcomes. On the positive side, easing trade restrictions and rapid adoption of artificial intelligence could bolster global demand and boost productivity.

Australia therefore faces a cross‑current of stronger domestic spending and a softening labour market, alongside a likely slowdown in global activity. Inflation has edged higher but remains within the Reserve Bank’s 2–3 per cent target band. With wage growth moderating and domestic demand still supported by fiscal measures and relatively low interest rates, the RBA appears close to achieving its dual mandate of full employment and price stability. After last month’s 25 basis point rate cut, the Shadow Board assigns a 71 per cent probability that holding the overnight rate at 3.6 per cent is optimal, a 15 per cent probability that reducing the overnight rate to 3.6% is appropriate, and a 14 per cent probability that raising the rate above 3.60 per cent is warranted. Hence, there is a strong consensus to keep the policy rate unchanged.

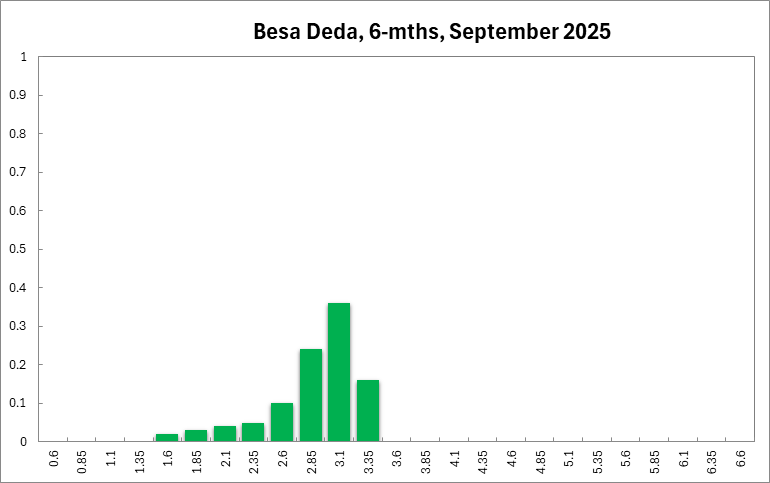

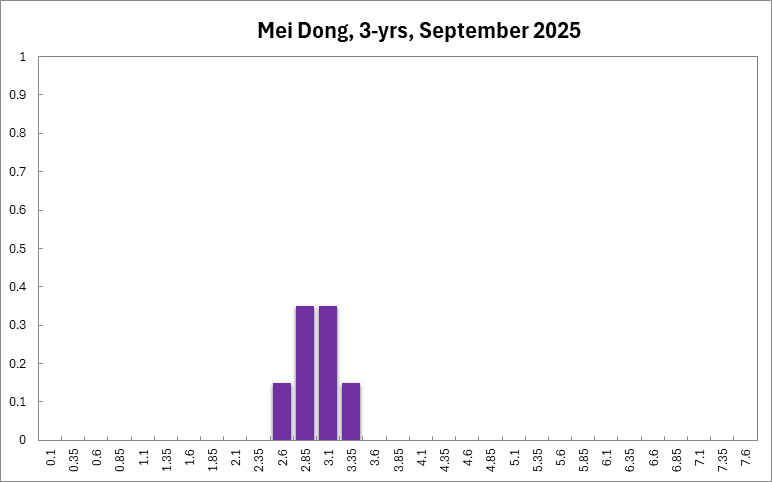

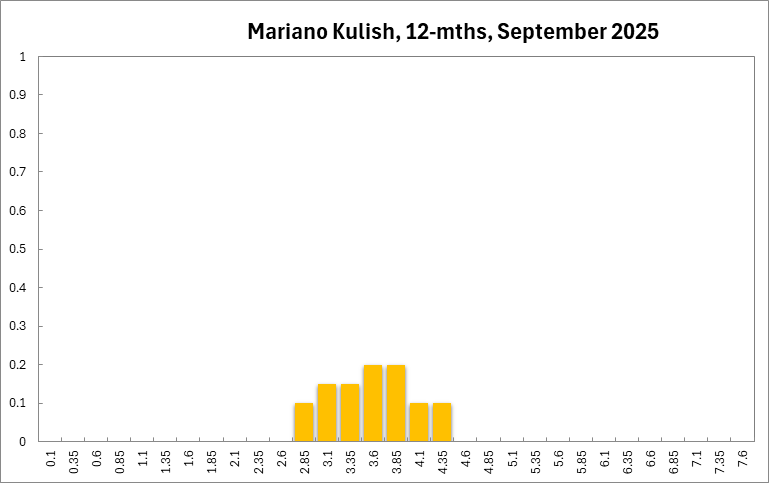

Six months out, the Board attaches a 58 per cent probability that the cash rate should be lower, 24 per cent that the current setting (3.60 per cent) is optimal, and 17 per cent that a higher rate is required. At the 12-month horizon, probabilities are 63 per cent (lower), 13 per cent (unchanged), and 24 per cent (higher). Three years out, the Board attaches a 66 per cent probability of a lower rate being optimal, 11 per cent to the current setting, and 24 per cent to a higher rate.

The distribution for the current recommendation has widened by 25 bps, to a 3.10%–4.10% band. At longer horizons, the implied ranges are 1.60%–4.35% (six months), 0.10%–4.85% (twelve months), and 0.10%–5.10% (three years), showing that there remains considerable uncertainty at longer horizons.