Outcome: September 2020

Nothing new on the interest rate front

Australia appeared to have weathered the Covid-19 crisis exceptionally well, better than most of its OECD counterparts, but the current outbreak, prompting stage 4 restrictions in Victoria, is putting a dampener on this success. The economy remains fragile and a long way from returning to normal. The inflation rate, based on the latest ABS CPI estimate from the June quarter (-0.3% year-on-year) remains far below the RBA’s official target band of 2-3%. As in August, the RBA Shadow Board’s conviction that the cash rate should remain at the historically low rate of 0.25% again equals 94%, while the confidence in a required rate cut to the lower bound of 0% equals 6% and the confidence in a required rate hike equals 0%.

The official ABS unemployment rate ticked up again, to 7.5% in July, the highest jobless rate since October 2001. Other labour market measures improved, reflecting the brief rebound of the Australian economy after the first lock-down: total employment increased by 114,000, the participation rate increased from 64.1% to 64.7%, the underemployment rate dropped from 11.7% in June to 11.2% in July. However, monthly readings of the labour market under the current circumstances are fraught, and there remain widespread concerns about the potential fallout from a protracted recession.

The government’s proposal to extend JobKeeper and JobSeeker, albeit at tapered rates, passed Parliament this week. This will clearly help avoid a big fall in the unemployment rate come October. The overall fiscal stance should become clearer once the new budget is announced on 6 October 2020.

The Aussie dollar consolidated its recent climb, most recently trading around 73 US¢. Yields on Australian 10-year government bonds rose slightly, to just above 1%. The yield curve in short-term maturities (2-year versus 1-year) remains flat, while the yield curves in mid-term versus short-term maturities (5-year versus 2-year) and in higher-term maturities have convexified. The stock market remains range-bound, with the S&P/ASX 200 stock index staying close to the 6,000 mark.

Globally, at least when looking at infection rates, the pandemic is still in full swing and worsening in many large economies. Countries’ reactions to a second infection wave are likely to be less stringent compared to the first wave, however. Thus, the outlook for the world economy looks very uncertain. In its June 2020 World Economic Outlook update, the International Monetary Fund revised its forecast for global GDP in 2020 to -4.9%. Geopolitical tensions between China and the West, including Australia, are not showing any signs of easing. Tit-for-tat diplomacy is a cause for concern, with a real possibility of increased trade restrictions and a substantive fall in Chinese demand for Australian exports (mining, education, tourism).

Consumer confidence retreated for the third consecutive month: the Melbourne Institute and Westpac Bank Consumer Sentiment Index came in at 79.5 for the month of August, compared to 87.9 in July. Month-on-month measures of retail sales are extremely volatile, having contracted by 17.7% in April, then increased by 16.9% in May, and increased again, albeit much more modestly by 2.7% in June. Given the second Covid-19 wave, this number may well turn negative again. Credit conditions, as measured by the average bank lending rate, remain unchanged.

On the producer side, the message is mixed. NAB’s index of business confidence fell into negative territory again, equalling -14 in July, following a second quarter rally from -66 to +1. The manufacturing and services PMIs, on the other hand, improved for the third consecutive month. Capacity utilization increased slightly, from 76.66% in June to 76.86% in July, bankruptcies fell, the Westpac-MI Leading Economic Index softened, and the small business sentiment index fell to its lowest in nine years. These measures were taken before the recent resurgence of Covid-19, so are likely to deteriorate in the near future. The housing market is holding up surprisingly well in the current conditions. Taken together, new home sales in June and July were the highest in two-and-a-half years. The construction PMI, after nosediving in April, recovered for the third month in a row (from 21.6 to 42.7 in July).

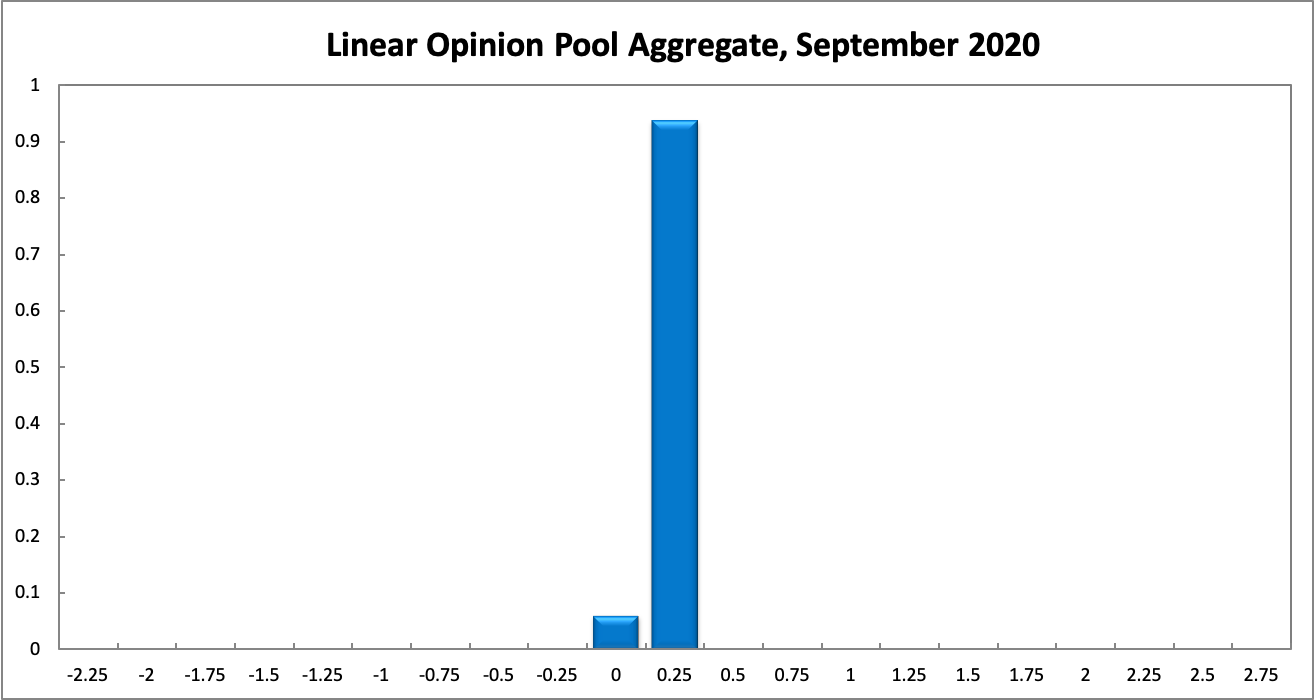

For the fifth month in a row, the probabilities associated with the Shadow Board’s recommendations remain unchanged. The Shadow Board attaches a 94% probability that the overnight interest rate should remain at the historically low rate of 0.25%. It attaches a 6% probability that a final rate cut, to the lower bound of 0%, is appropriate and a 0% probability that a rate rise, to 0.5% or higher, is appropriate.

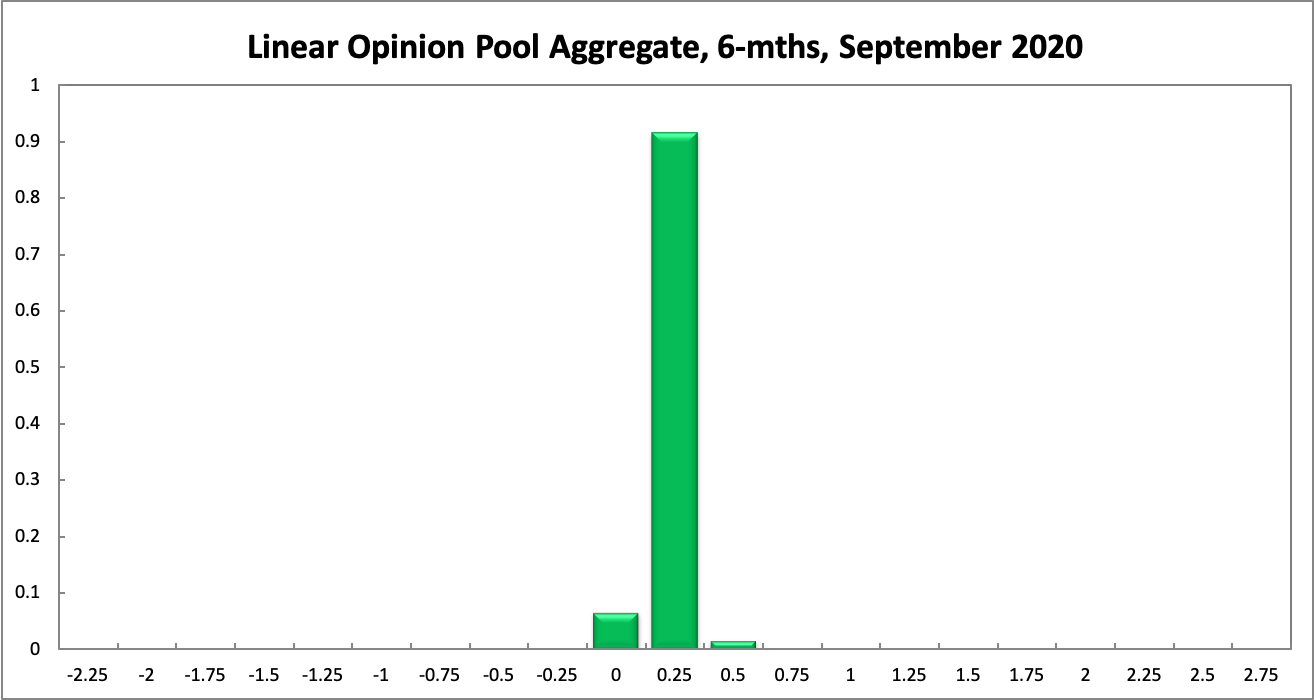

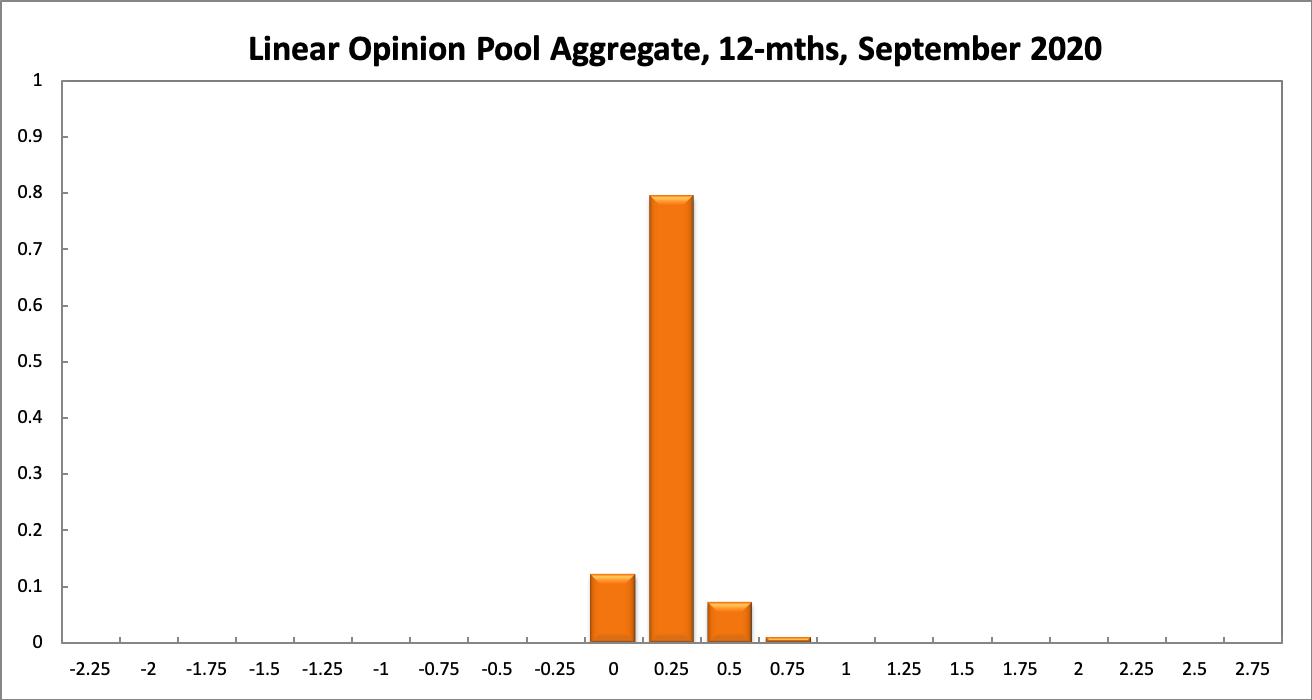

The probabilities at longer horizons have shifted slightly to the downside: 6 months out, the confidence that the cash rate should remain at 0.25% equals 92%, the probability attached to the appropriateness for an interest rate decrease equals 7%, while the probability attached to a required increase equals 2%. One year out, the Shadow Board members’ confidence that the cash rate should be held steady dropped from 84% to 79%. The confidence in a required cash rate decrease doubled from 6% to 12% and in a required cash rate increase slipped from 9% to 8%. The range of the probability distributions over the 6 month and 12 month horizons is also unchanged, extending from 0% to 0.75%.

Aggregate

Current

6-Months

12-Months

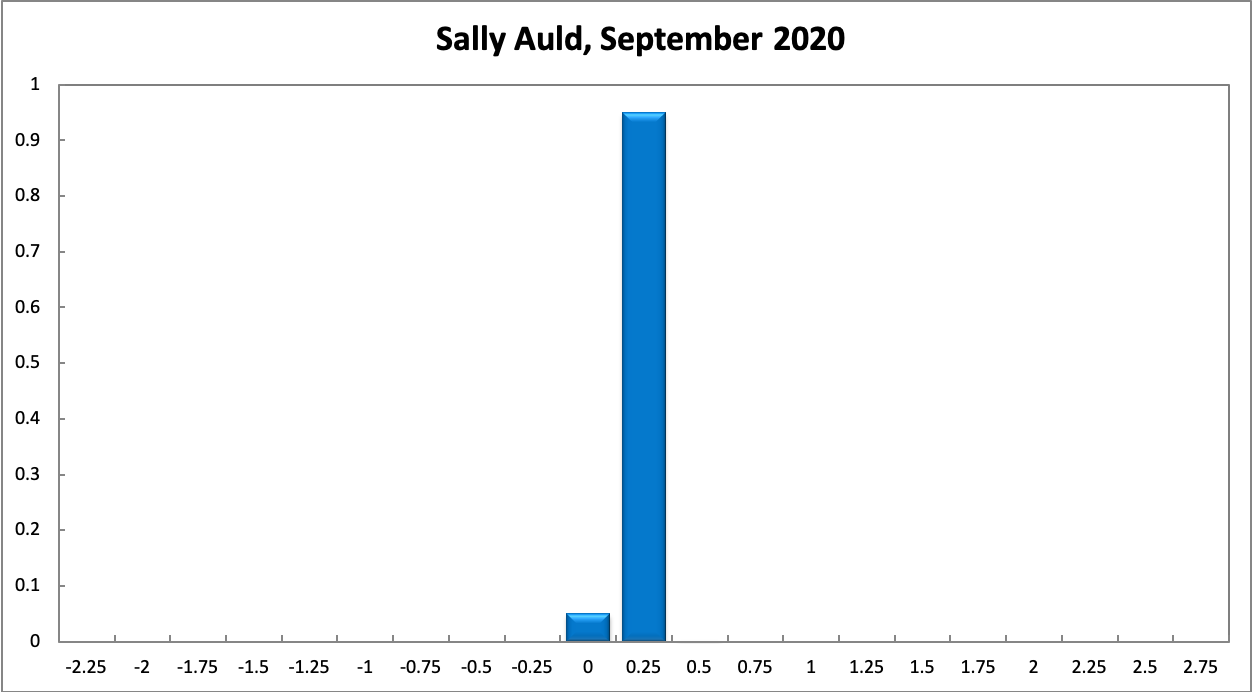

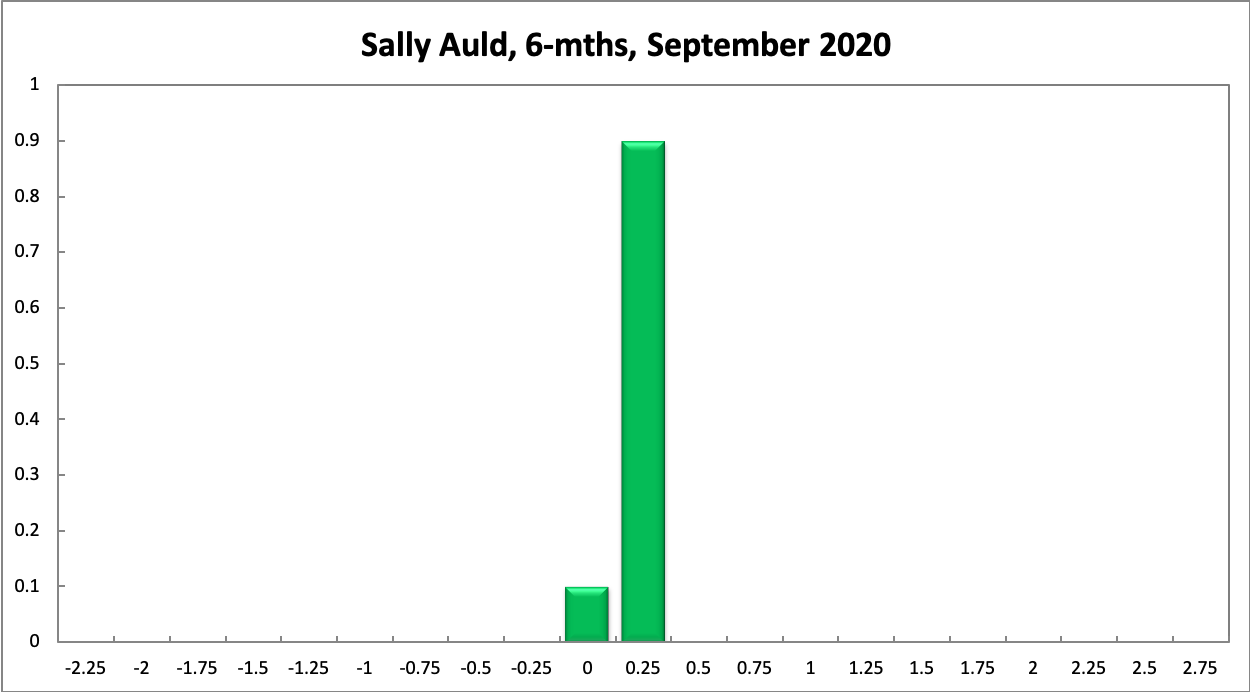

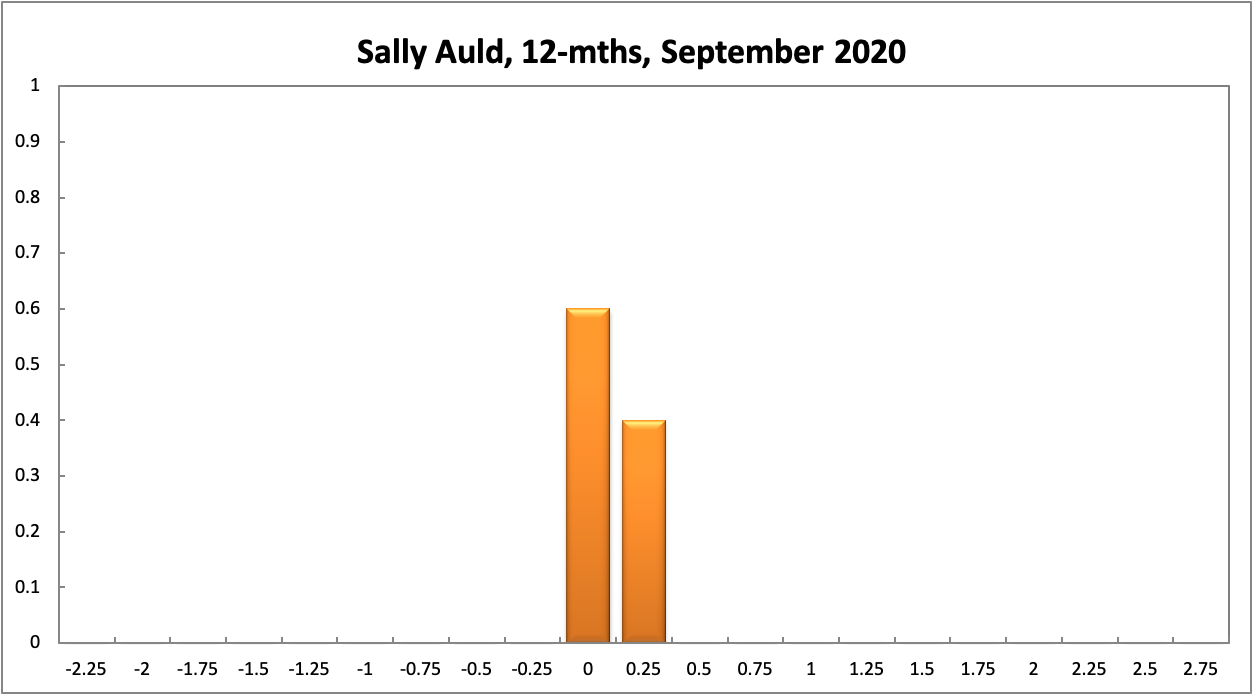

Sally Auld

Current

6-Months

12-Months

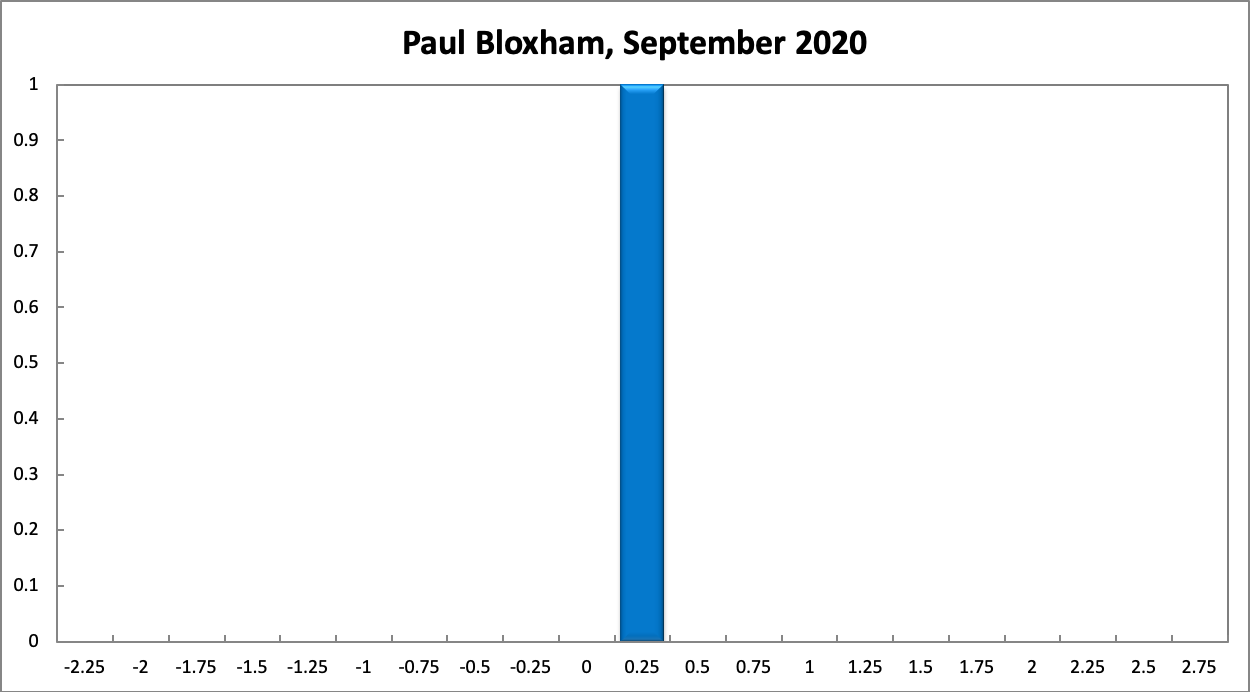

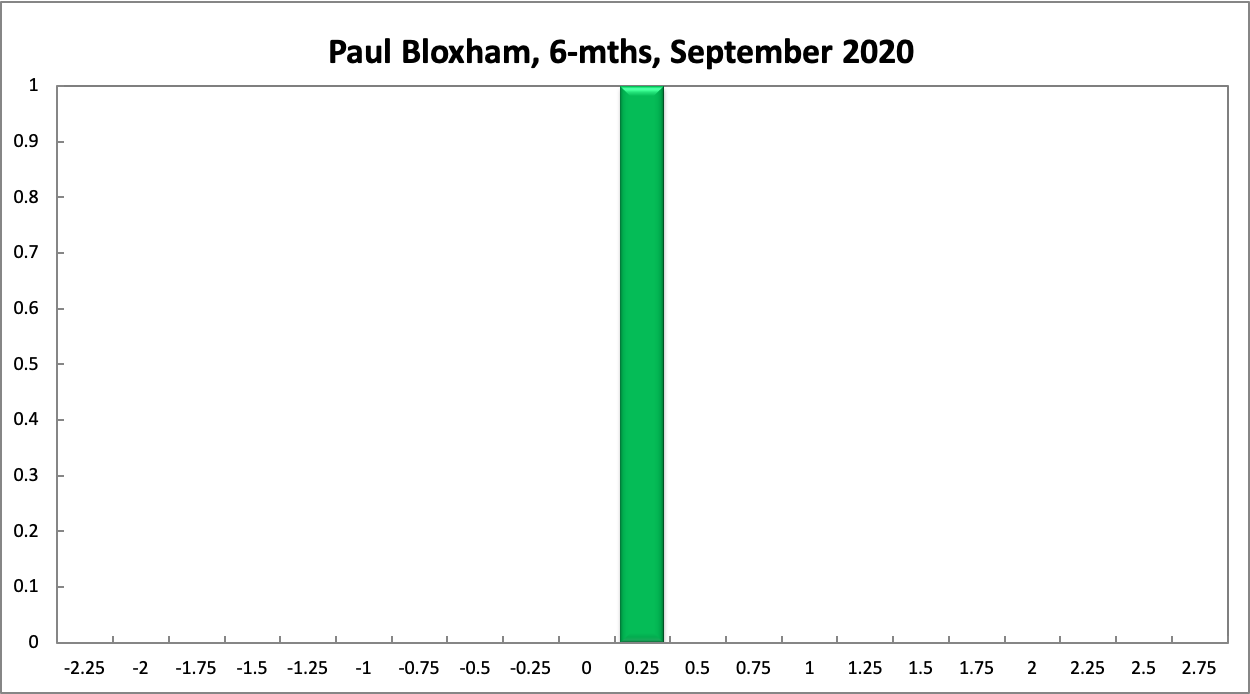

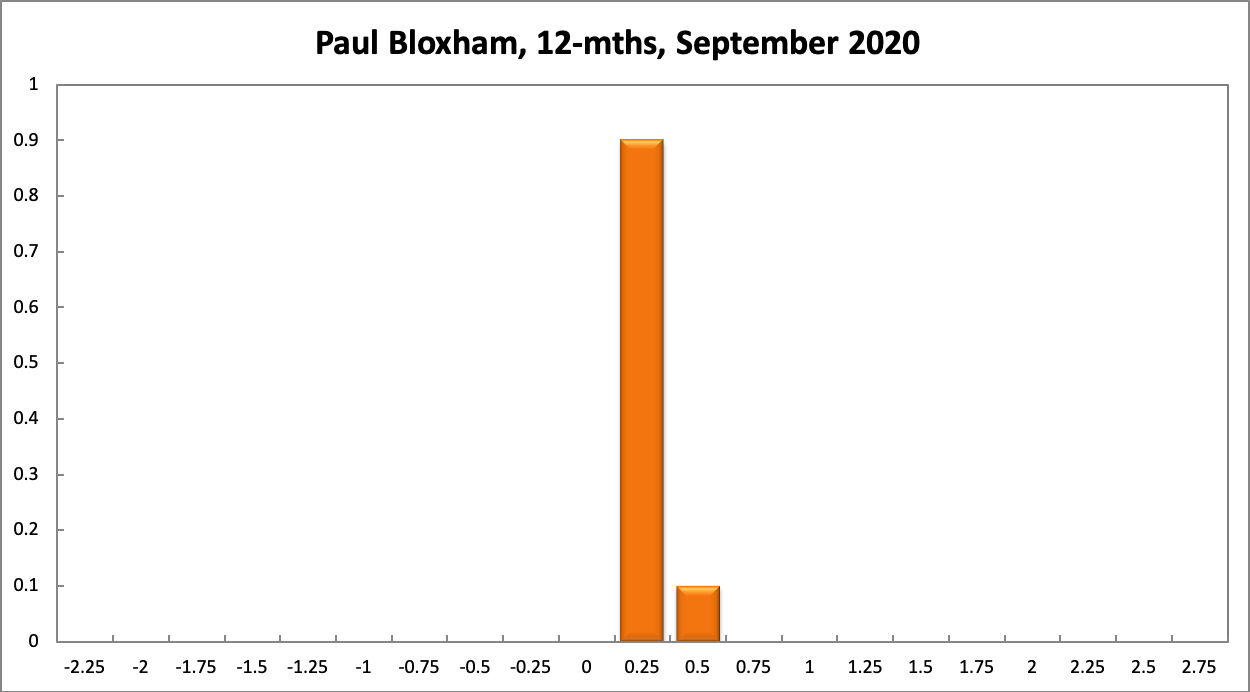

Paul Bloxham

Current

6-Months

12-Months

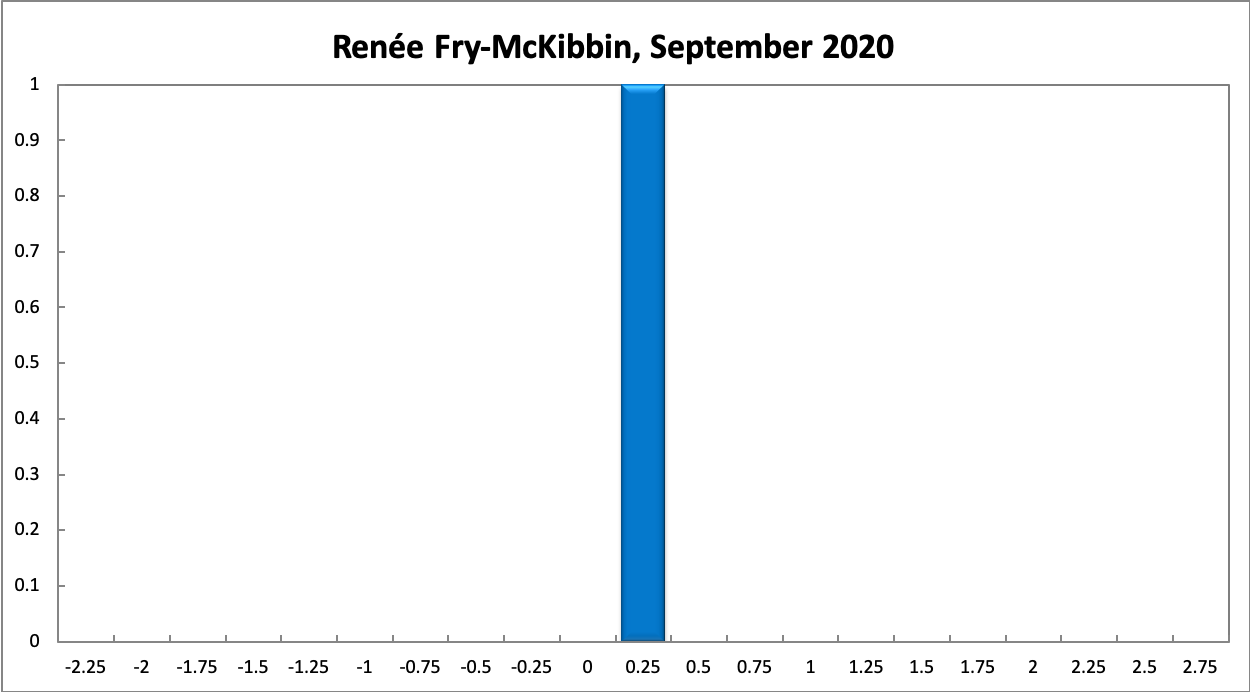

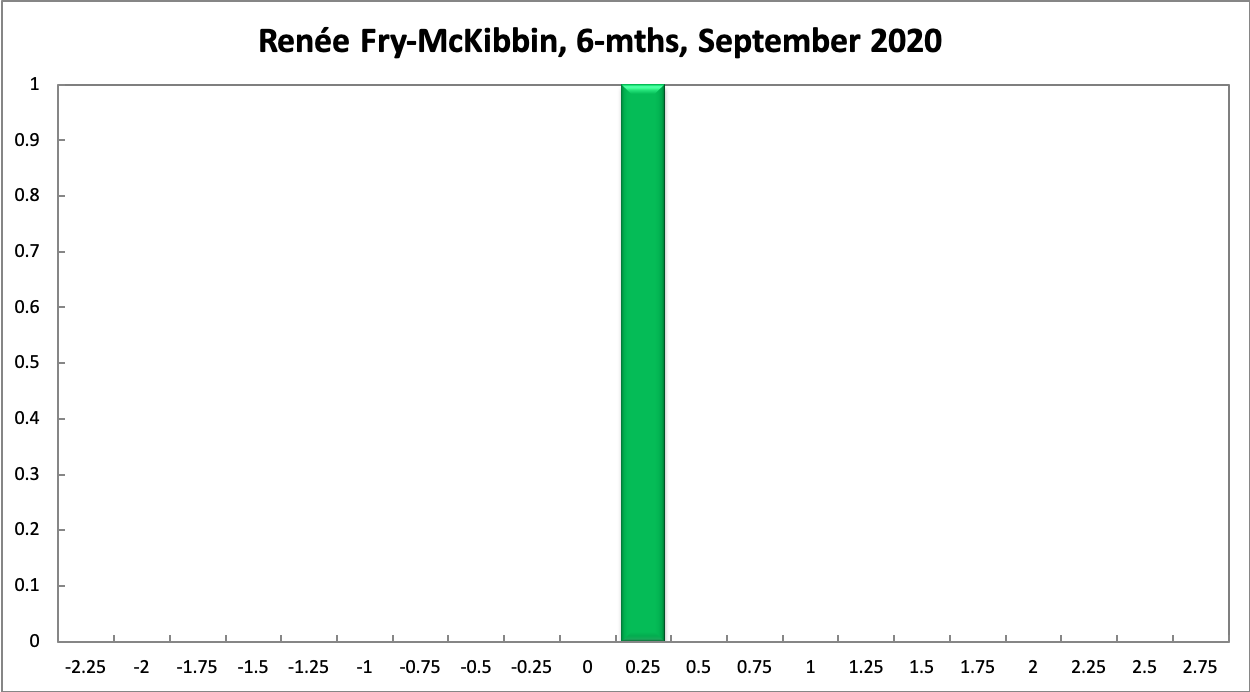

Renee Fry-McKibbin

Current

6-Months

12-Months

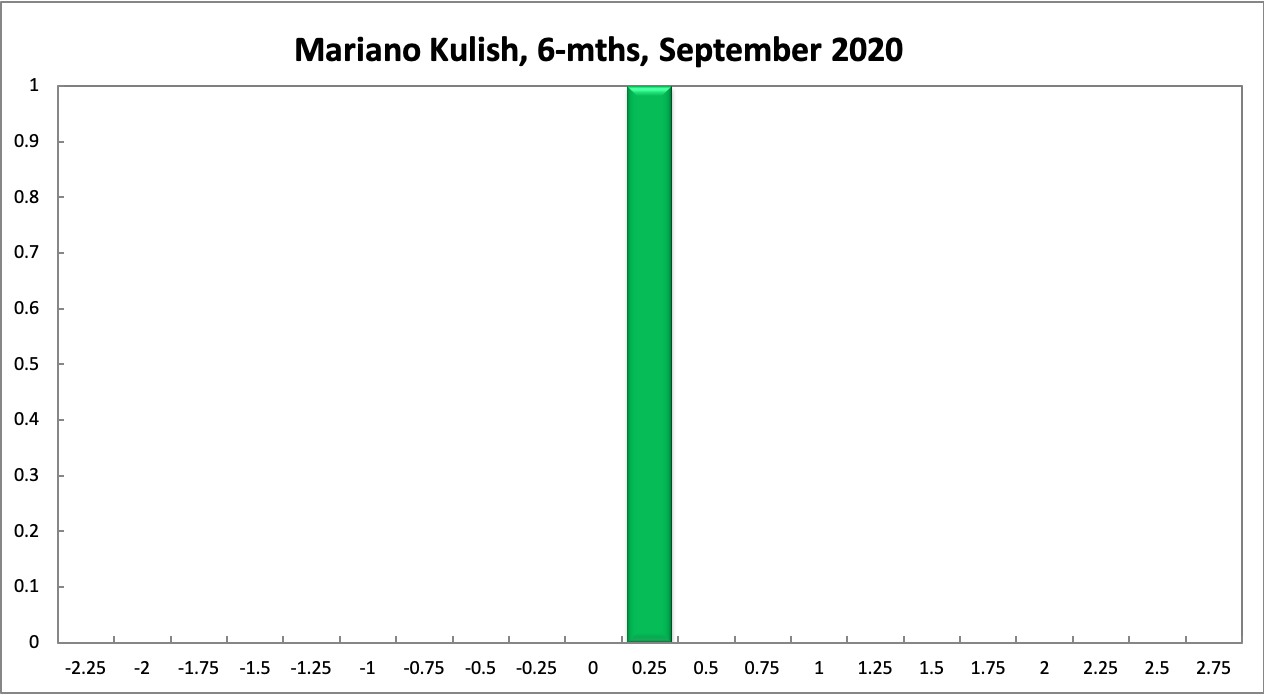

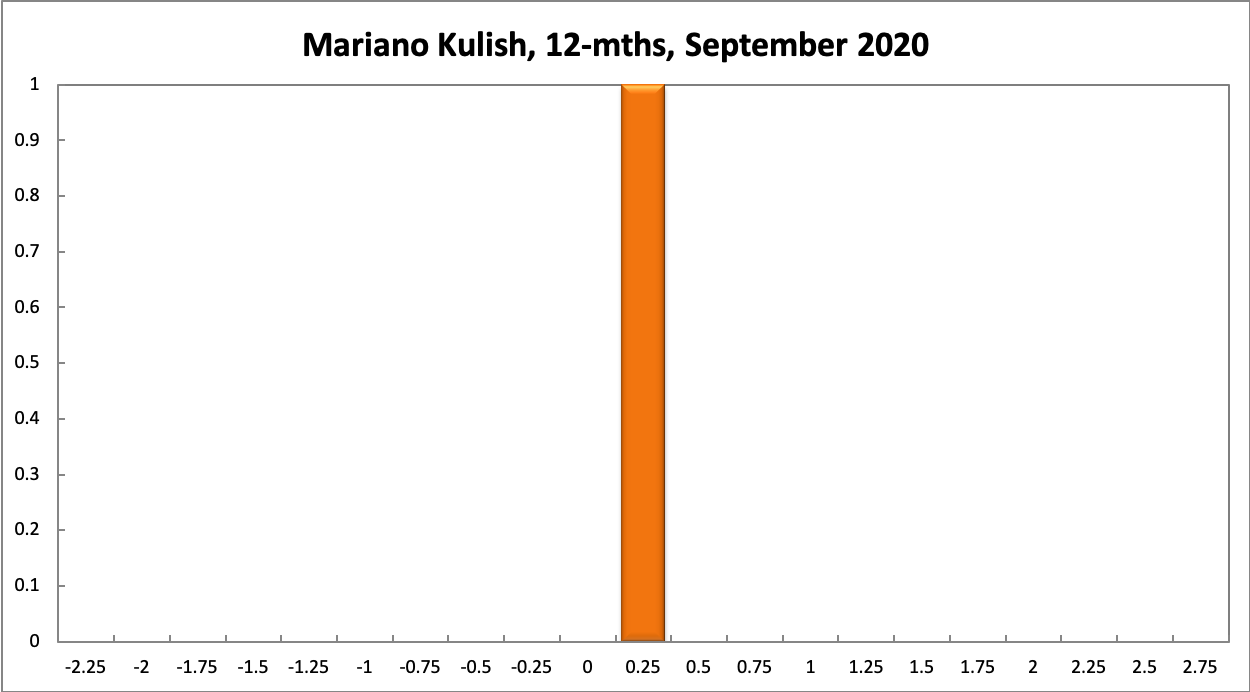

Mariano Kulish

Current

6-Months

12-Months

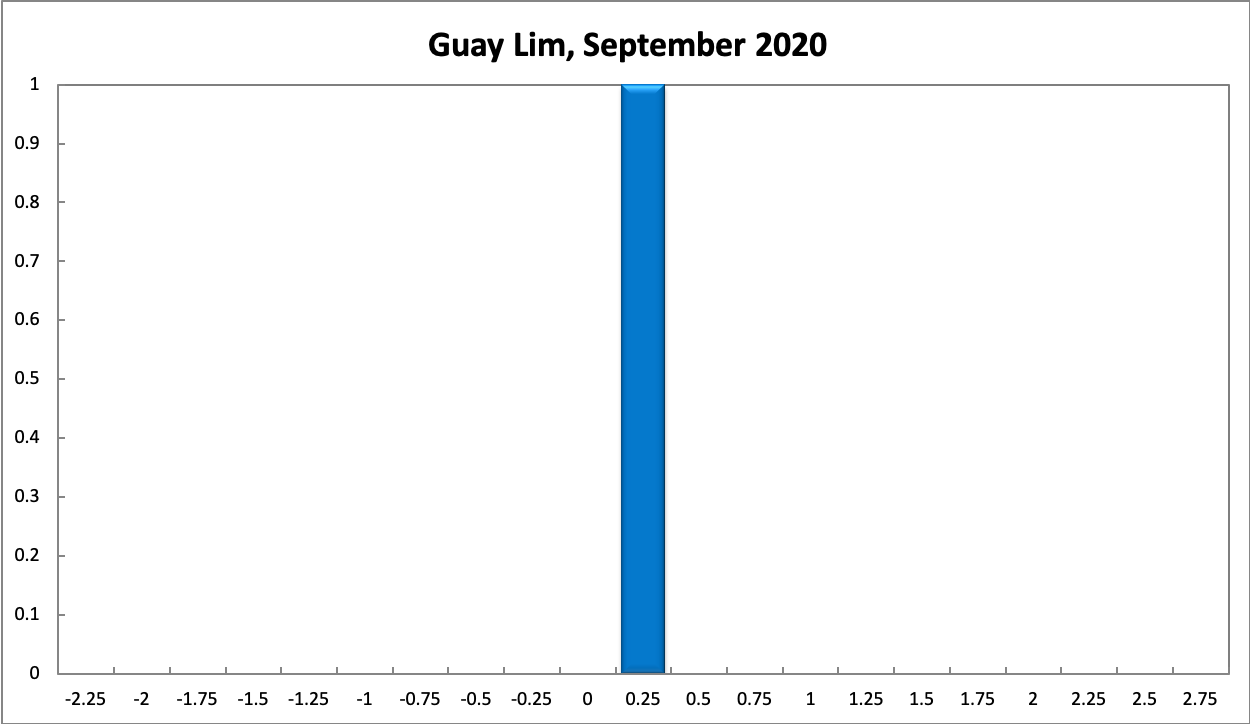

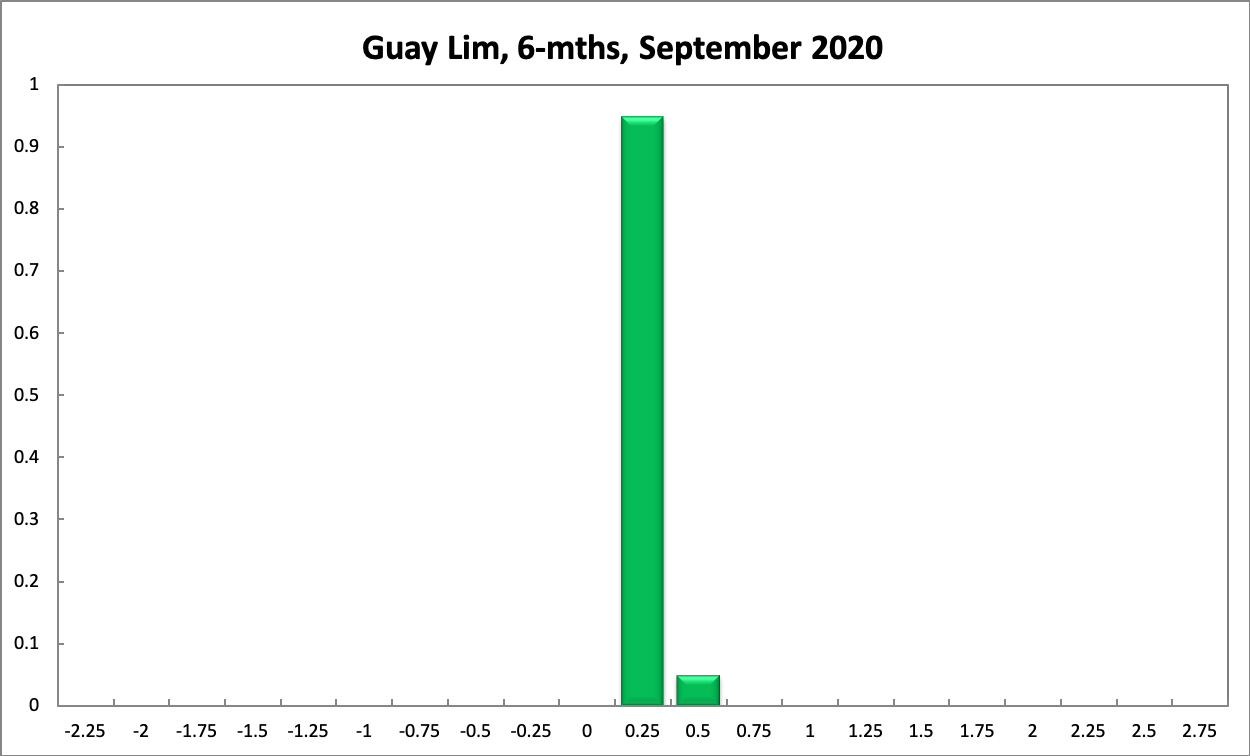

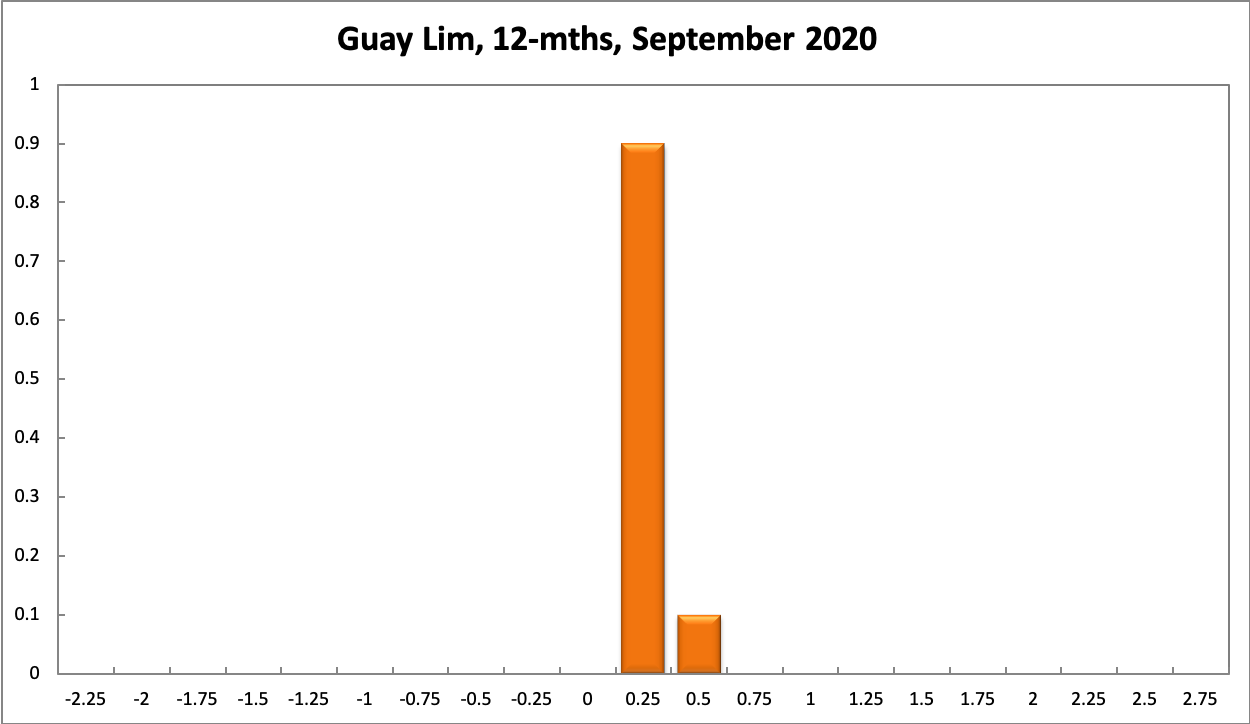

Guay Lim

Current

6-Months

12-Months

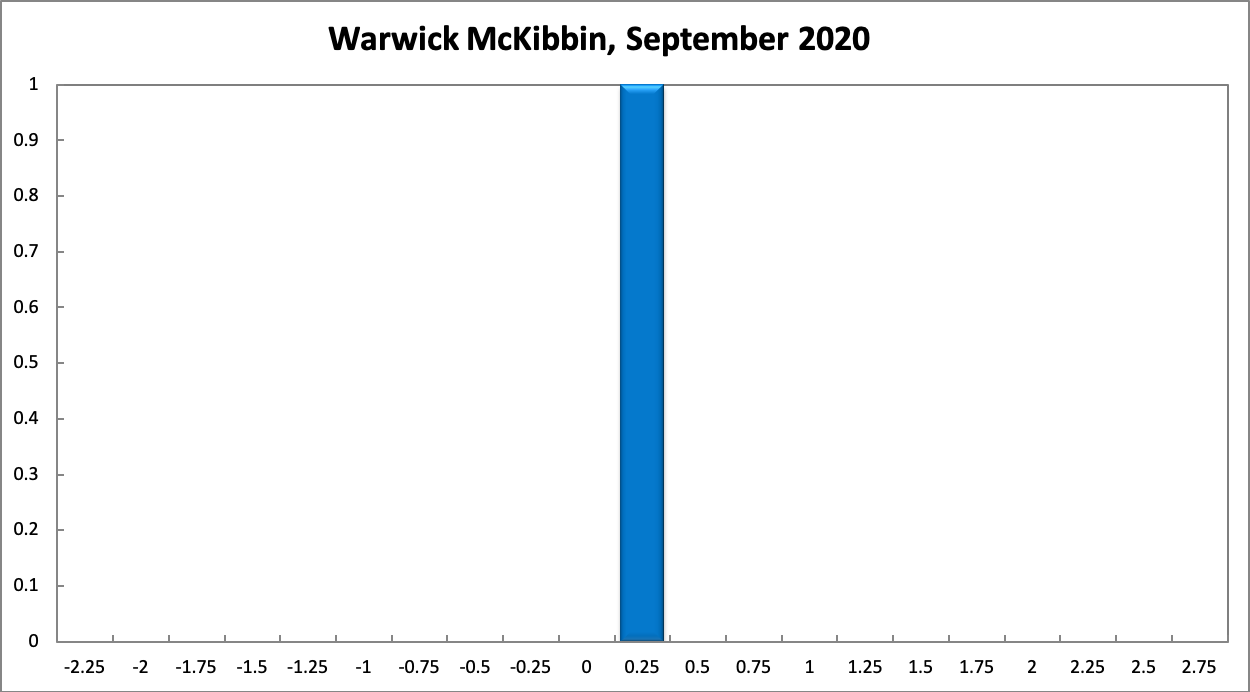

Warwick McKibbin

Current

6-Months

12-Months

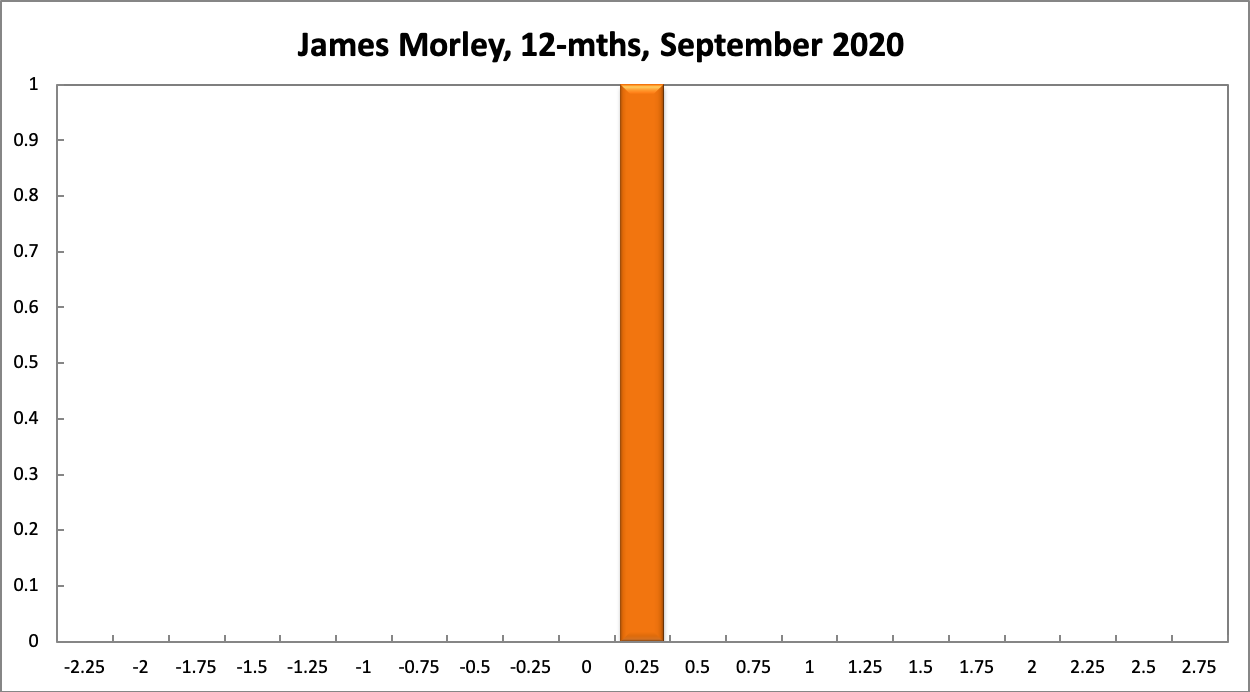

James Morley

Current

6-Months

12-Months

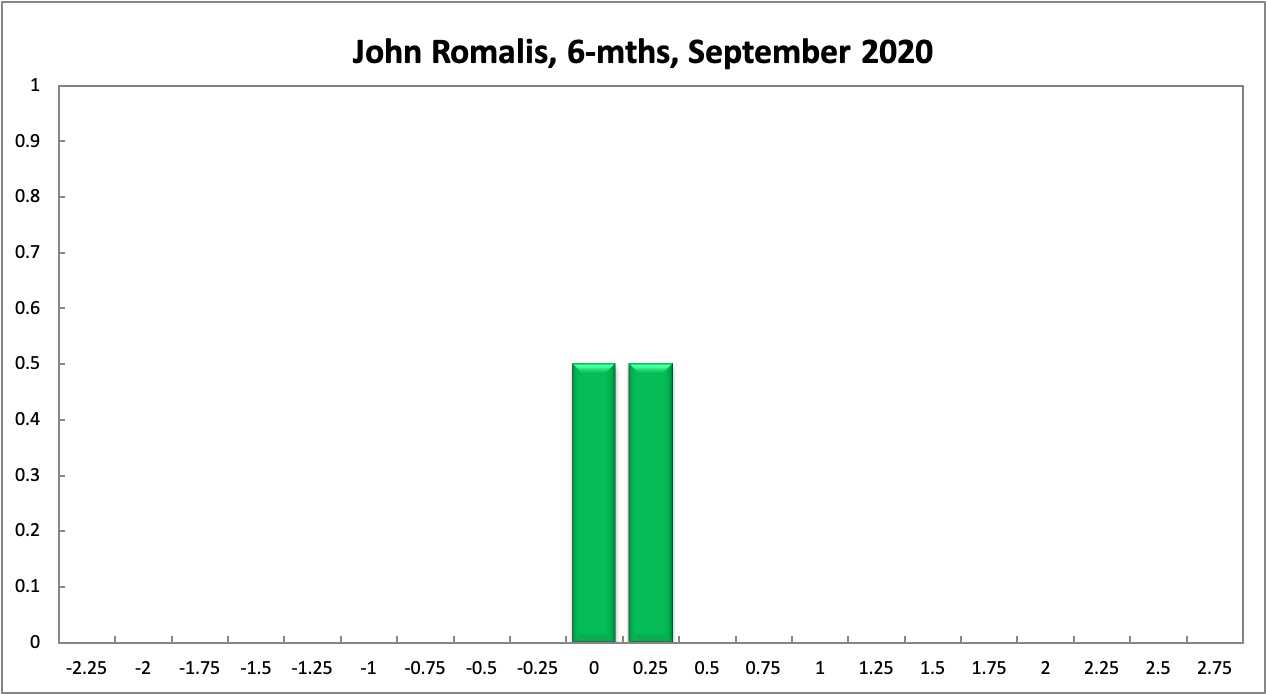

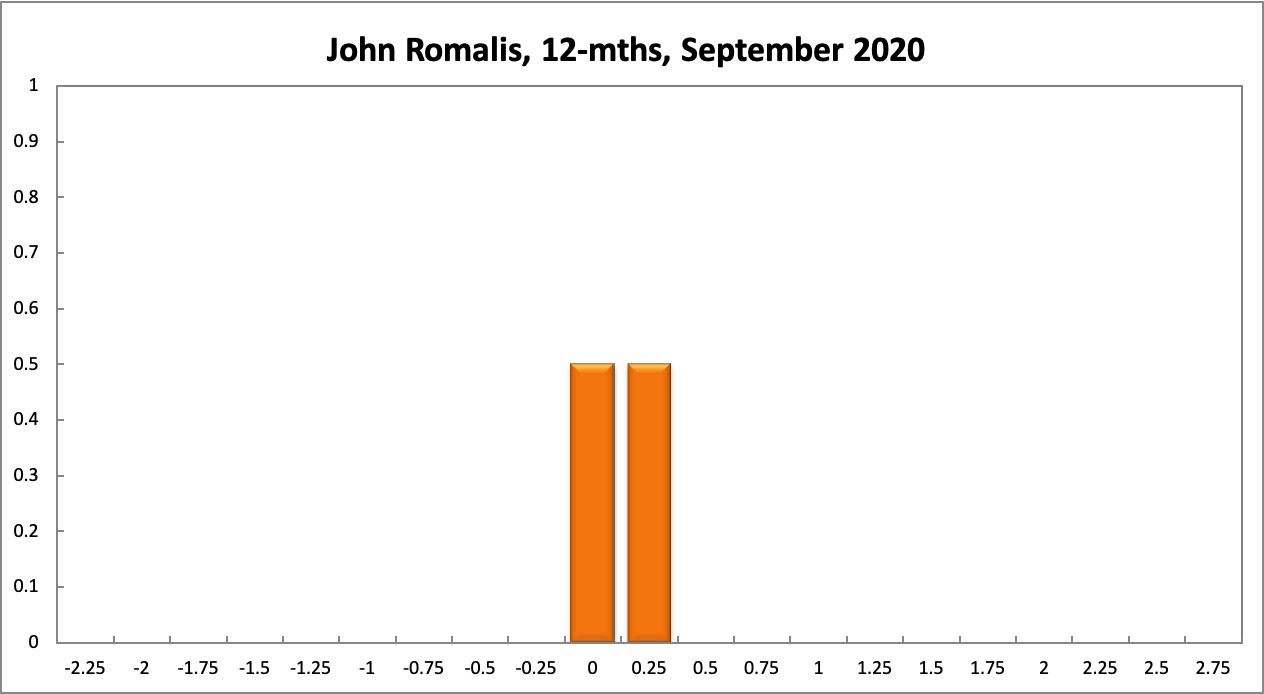

John Romalis

Current

6-Months

12-Months

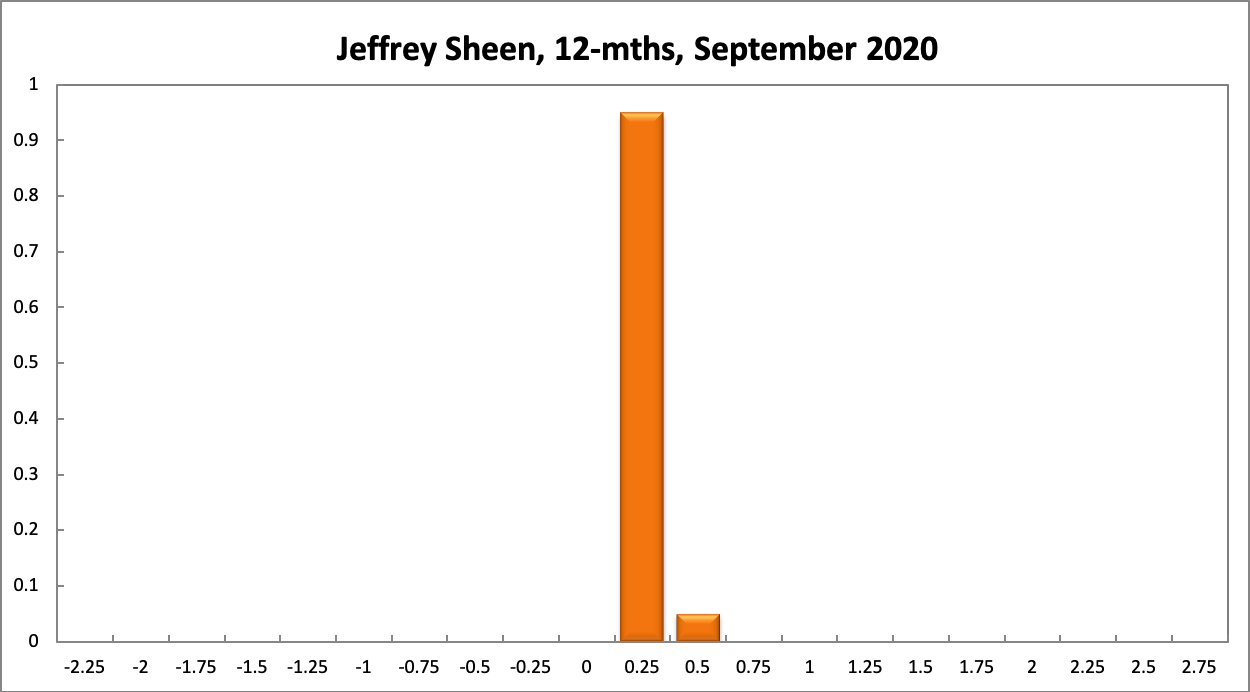

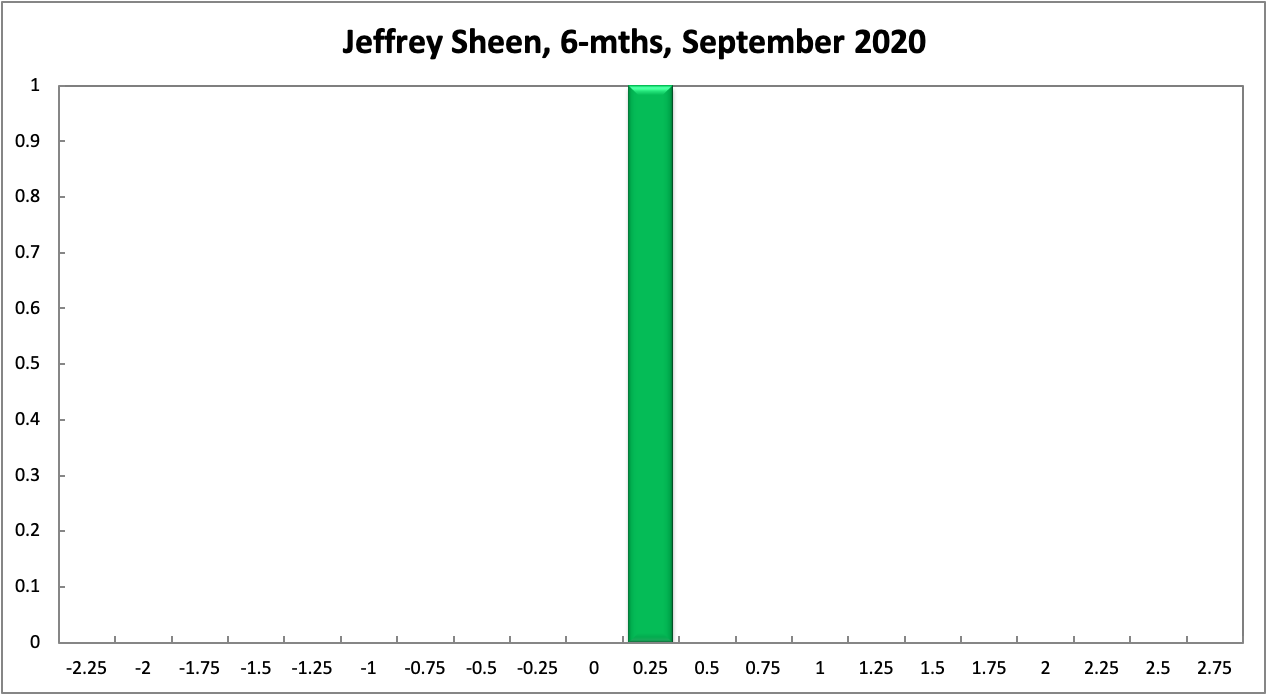

Jeffrey Sheen

Current

6-Months

12-Months