Shadow board favouring rate hold, just

With Victoria successfully containing the corona virus and lifting stage 4 restrictions, Australia’s overall Covid-19 statistics (infection numbers and death rates) look comparatively benign. The inflation rate, based on the latest ABS CPI estimate, has returned to positive territory, equalling 0.7% year-on-year in the September quarter (after equalling -0.3% year-on-year in the June quarter), but still remains far below the RBA’s official target band of 2-3%. The RBA Shadow Board’s conviction that the cash rate should remain at the historically low rate of 0.25% continues to be strong. It equals 56%, while the confidence in a required rate cut to below 0.25% equals 44% and the confidence in a required rate hike equals 0%.

The official ABS unemployment rate edged up to 6.9% in September. Other labour market measures also deteriorated: total employment fell by nearly 30,000, the participation rate fell from 64.9% to 64.8%, youth unemployment increased as did the underemployment rate, to 11.4%. Easing of restrictions, especially in Victoria, could improve these numbers in the immediate future; however, the labour market, and the economy more generally, remain fragile.

Whilst the federal budget delivered on 6 October 2020 remains expansionary, jobkeeper and jobseeker payments have been extended beyond September 2020, albeit at tapered rates, adding to the hardship facing many low income households. At the same time, the budget contains $4bn in subsidies to firms hiring young workers who had previously been receiving jobseeker, in an attempt to lower youth unemployment. The tax cuts disproportionately benefit middle and higher income households and are therefore going to generate less economic stimulus than if they were targeted at low income households.

The Aussie dollar, subject to increased volatility, has continued to remain range-bound between 70 and 72 US¢. Yields on Australian 10-year government bonds dropped further, to below 0.80%. The shape of the yield curve is largely unchanged: in short-term maturities (2-year versus 1-year) it remains flat; the yield curves in mid-term versus short-term maturities (5-year versus 2-year) and in higher-term maturities are displaying normal convexity. The stock market rallied in the first half of October, then pared most of the gains in the second half; the S&P/ASX 200 stock index is now just below 6,000.

By far the biggest concern for the global economic outlook is the dramatic worsening of the Covid-19 pandemic, particularly in the US, Europe and South Asia. With a vaccine still months away, the prospects of a swift economic rebound are rapidly diminishing. Two weeks ago the International Monetary Fund projected that global GDP will contract by 4.4% as a consequence of the pandemic. Many of the advanced economies are likely to fare considerably worse, which makes Australia’s projected contraction of 3.75%, according to the Australian government, look almost respectable. China’s GDP, after shrinking in the first half of this year, is expected to grow by around 3% by the end of 2020. Most of these numbers are likely to be revised downwards by the end of the year. The US presidential election could also end up being a source of instability for the global community.

Consumer confidence strengthened further: the Melbourne Institute and Westpac Bank Consumer Sentiment Index rose from 93.8 in September to 105 in October. Last month’s measures of retail sales will not be released until 4 November. Flat private sector credit growth points to a continuation of households and firms attempting to de-lever and repair, or preserve, their balance sheets.

On the producer side, the message is mixed. NAB’s index of business confidence improved yet again, rising from -8 to -4 in September. The manufacturing and services PMIs worsened slightly, but capacity utilisation, after dropping, inched up again, from 76.13% in August to 76.89% in September. Bankruptcies, 275 in August, is the lowest in 15 years. A major concern is that among the surviving firms are many “zombie” firms which will fold as soon as government assistance is withdrawn, or significantly curtailed. Recent housing market data remains surprisingly strong: the Australian Industry Group/Housing Industry Association Australian Performance of Construction Index climbed from 37.9 in the previous month to an 18-month high of 45.2 points in September. New home sales increased 3.8 percent from the previous month, and the value of new loans granted for owner-occupied homes remains high, at $16.28 billion in August (latest figure).

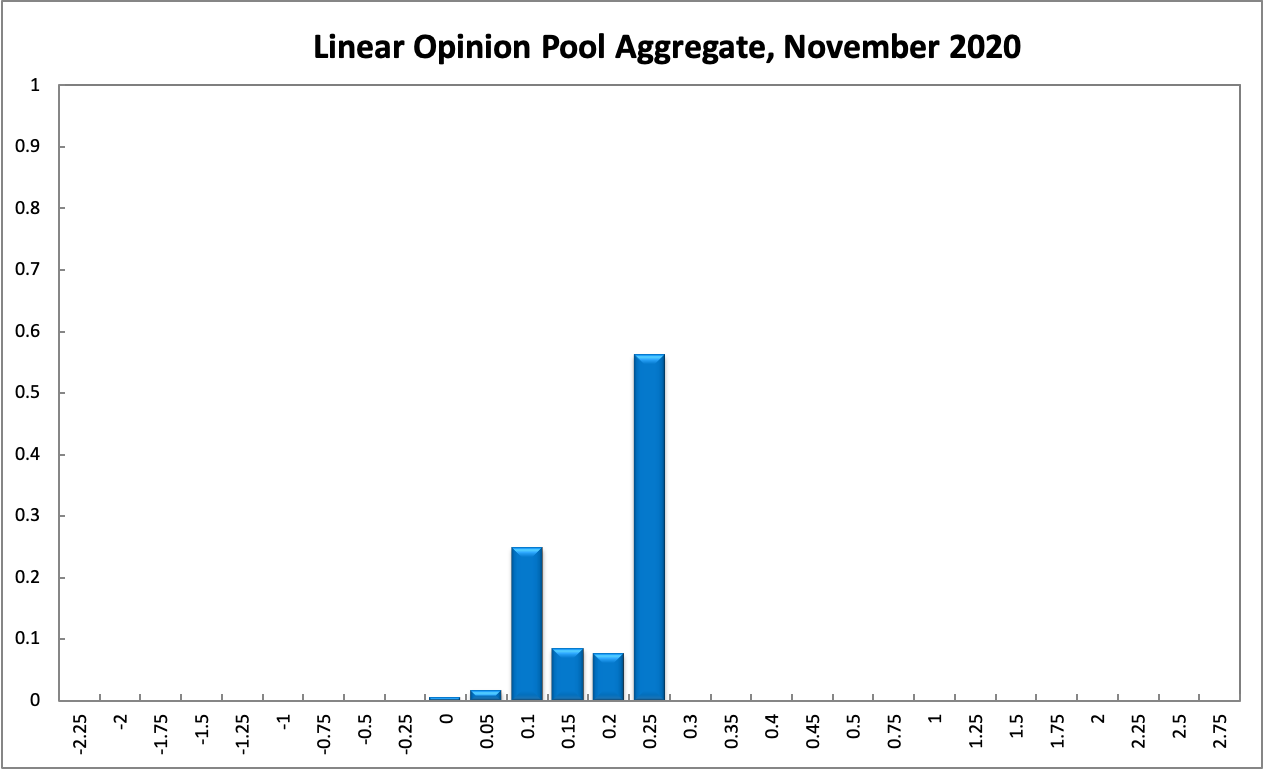

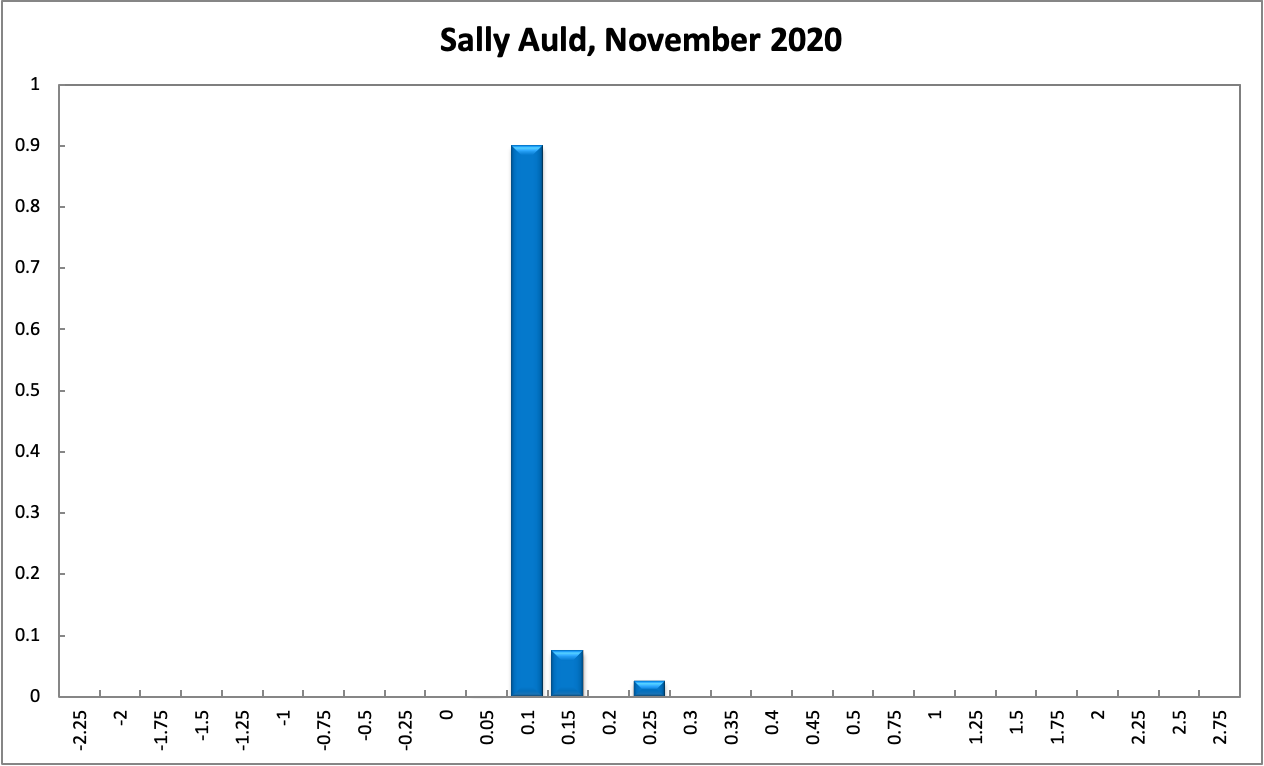

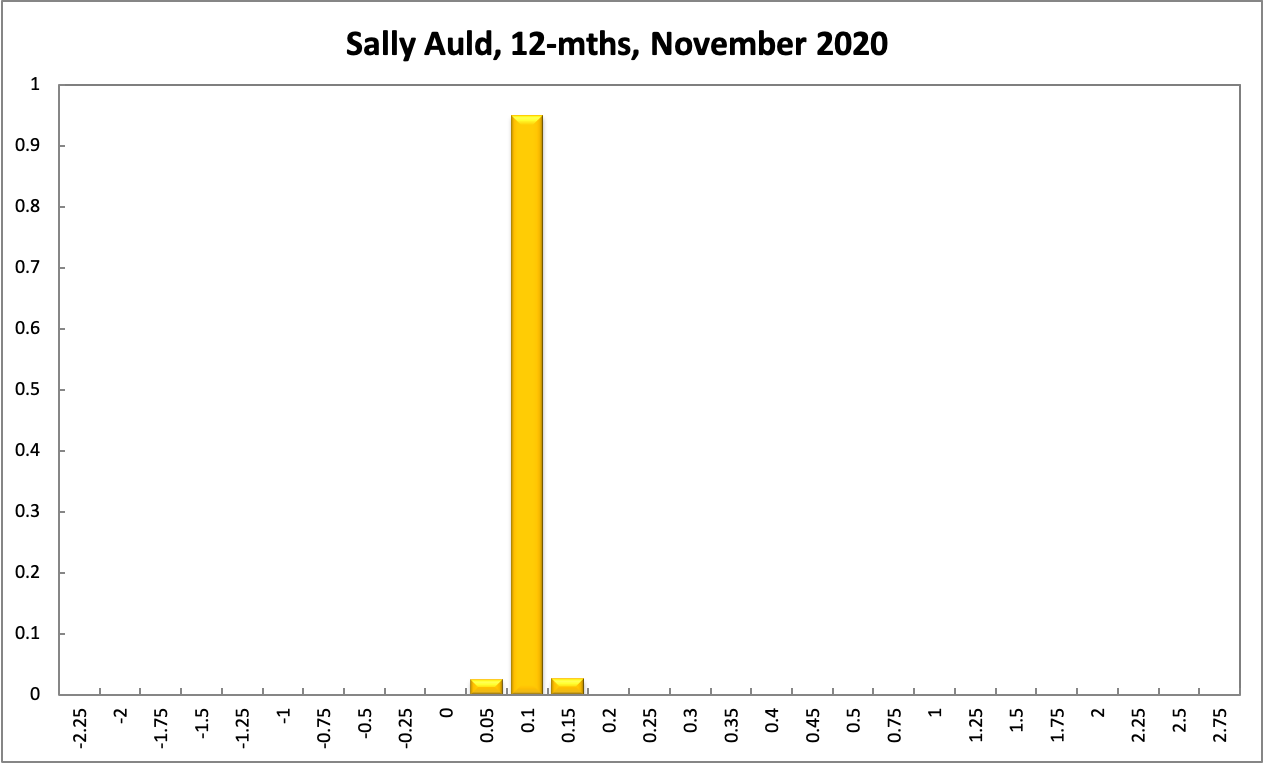

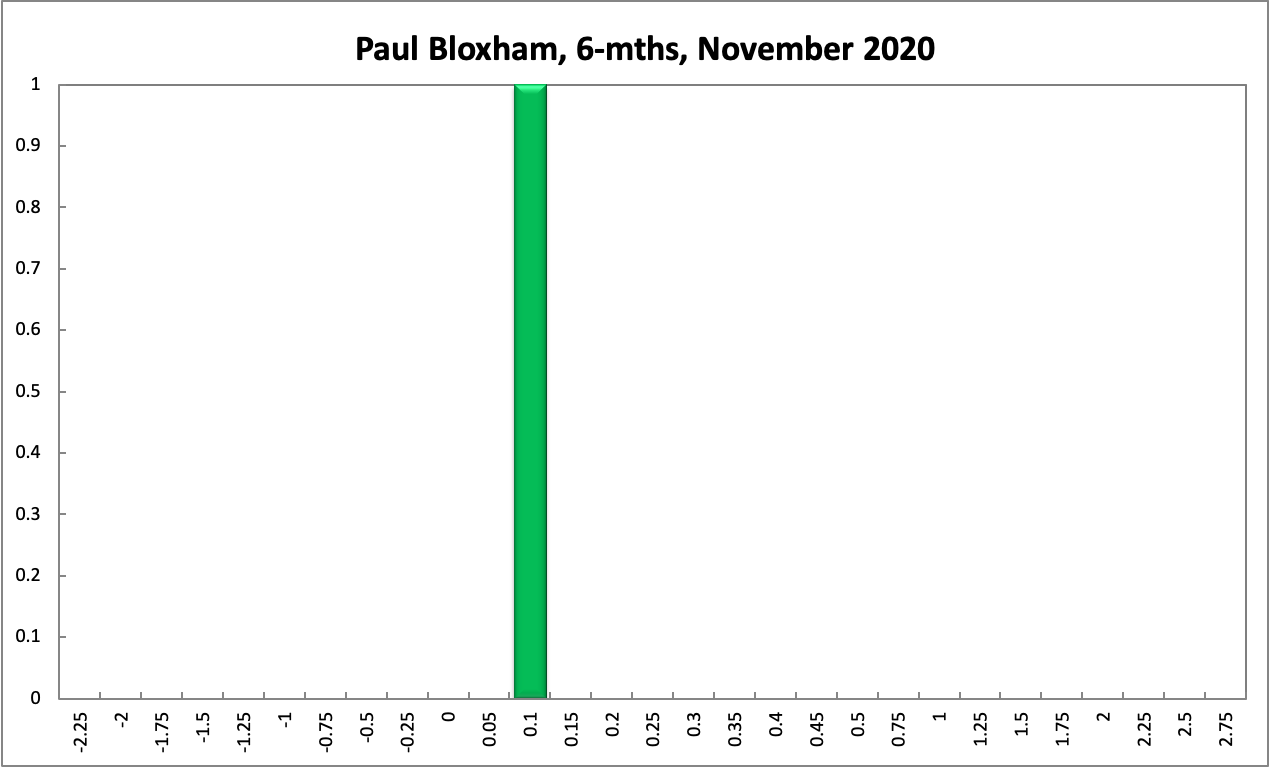

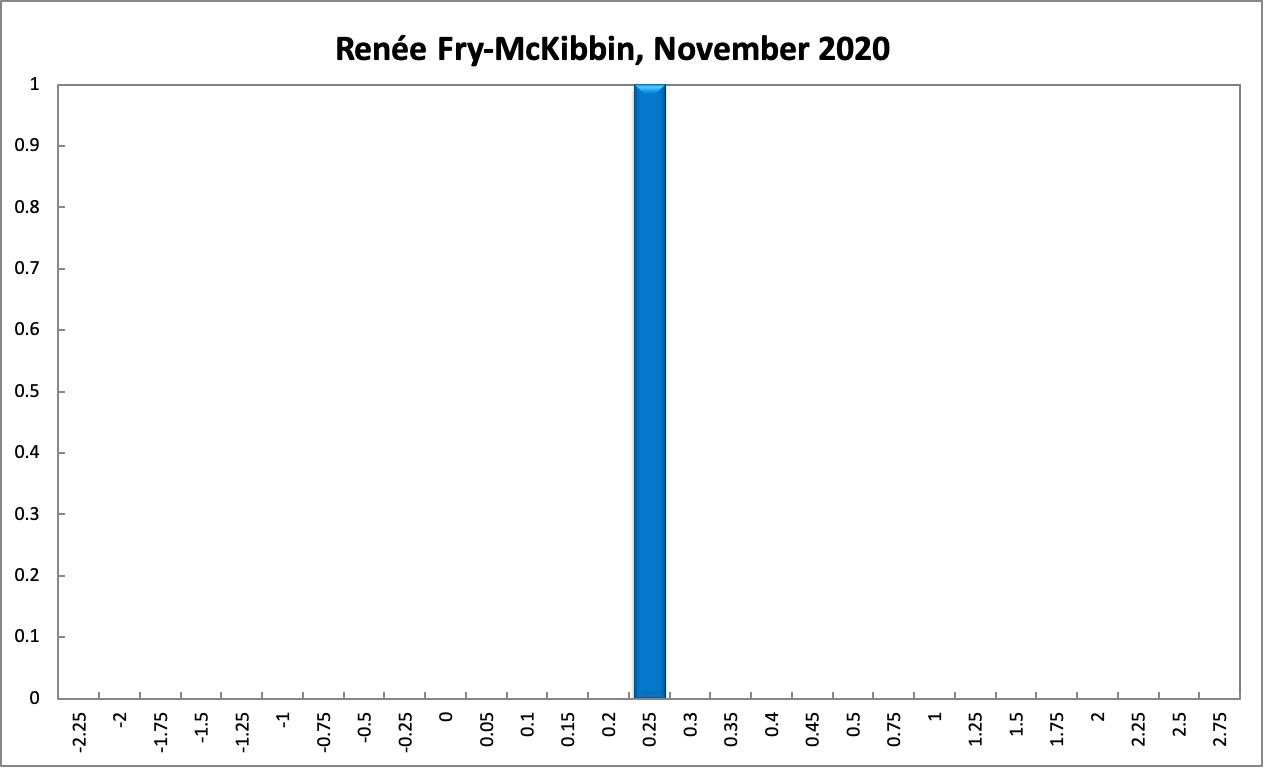

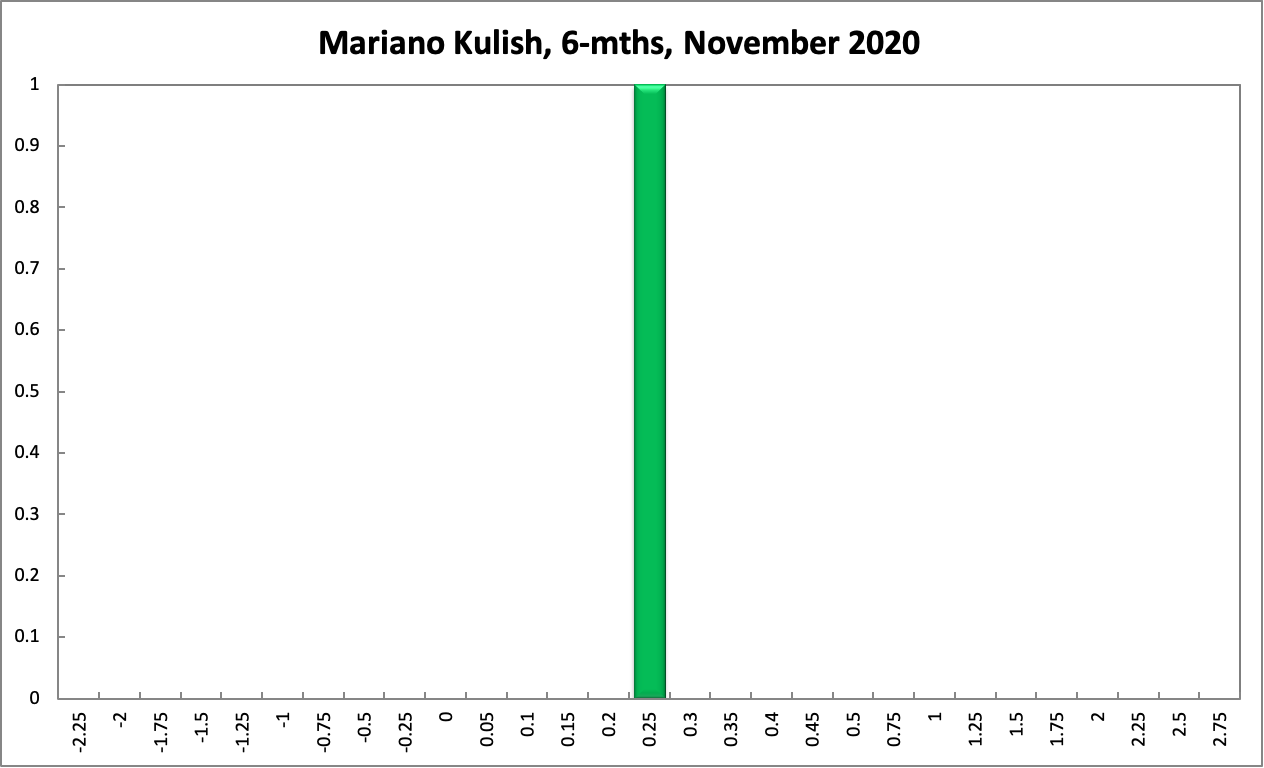

Starting with the October round, Shadow Board members were given the option to attach probabilities to interest rates in increments of 5 basis points, instead of 25. This generates significantly more granular distributions. For the seventh month in a row, the Shadow Board recommends keeping the overnight rate on hold; however, there is now also significant probability mass attached to a rate cut. In particular, the Shadow Board attaches a 56% probability (78% in the previous round) that the overnight interest rate should remain at the historically low rate of 0.25%. It attaches a 44% probability that a further rate cut to below 0.25% is appropriate. The Board attaches a 0% probability that a rate rise is appropriate, unchanged from previous months.

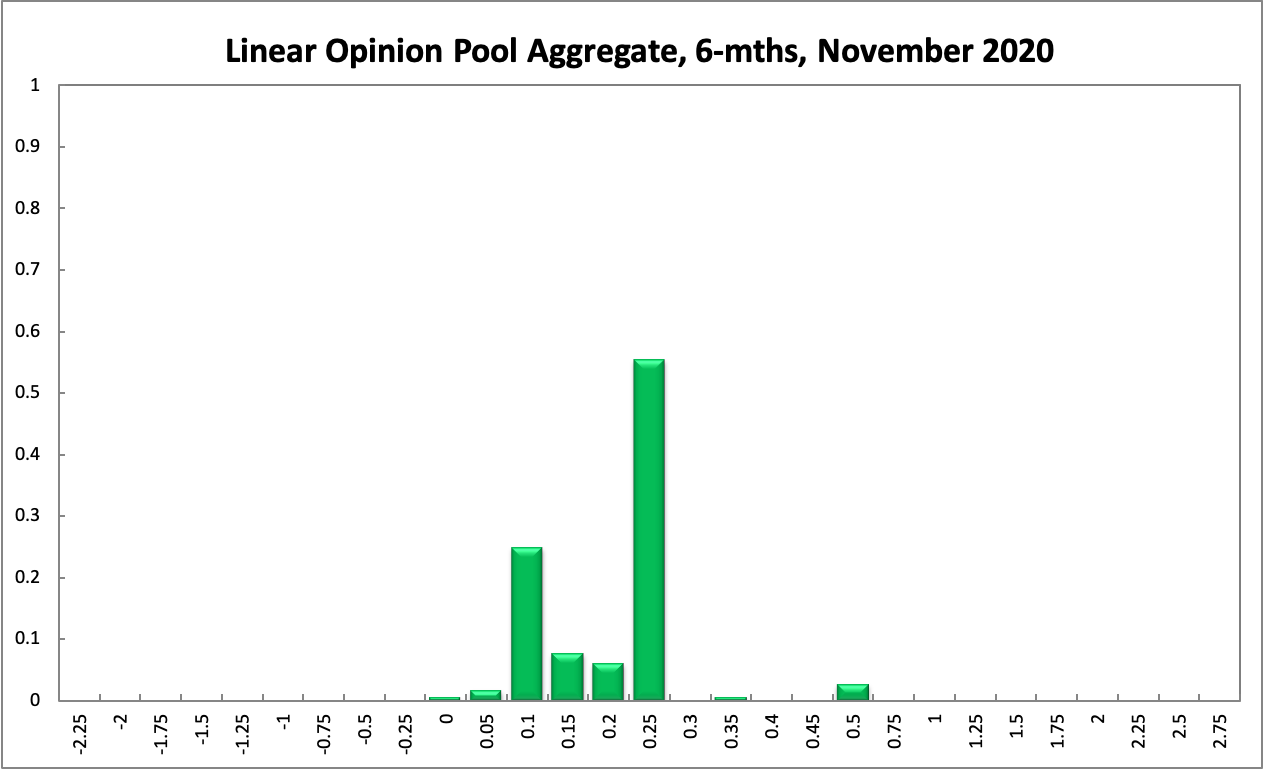

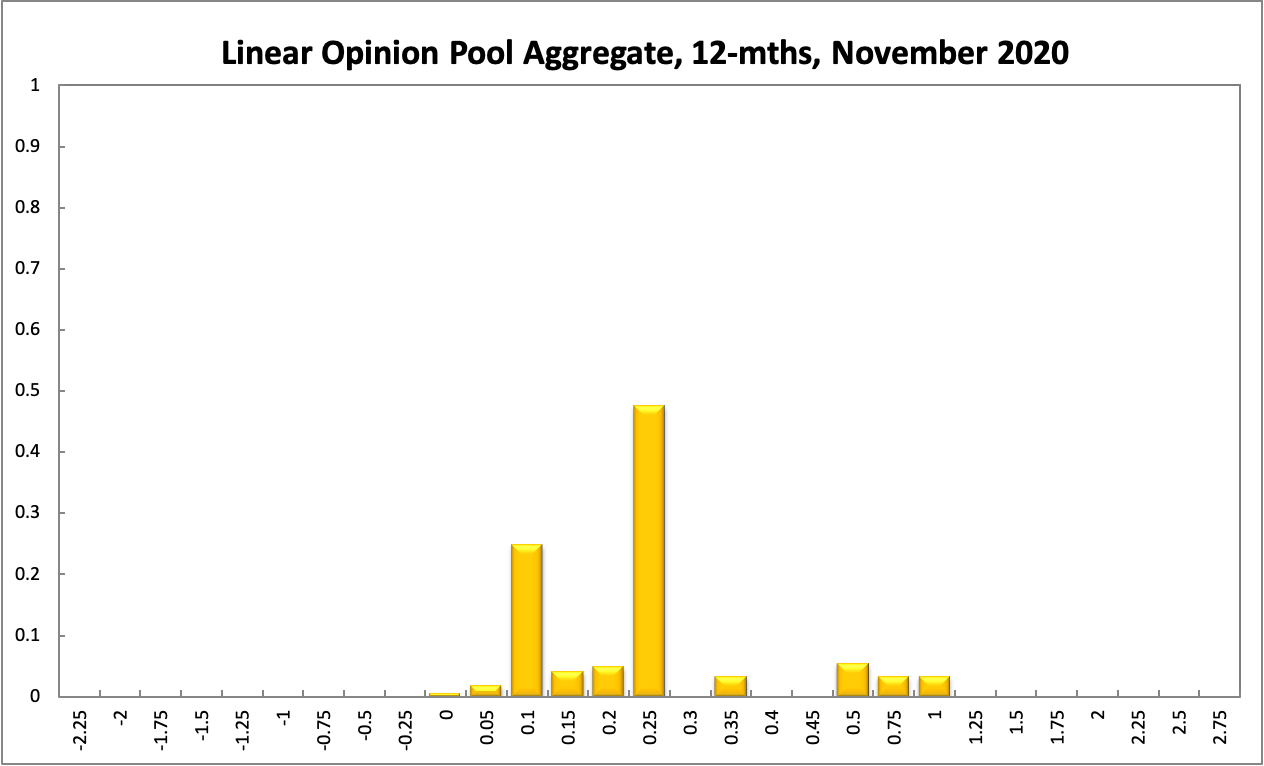

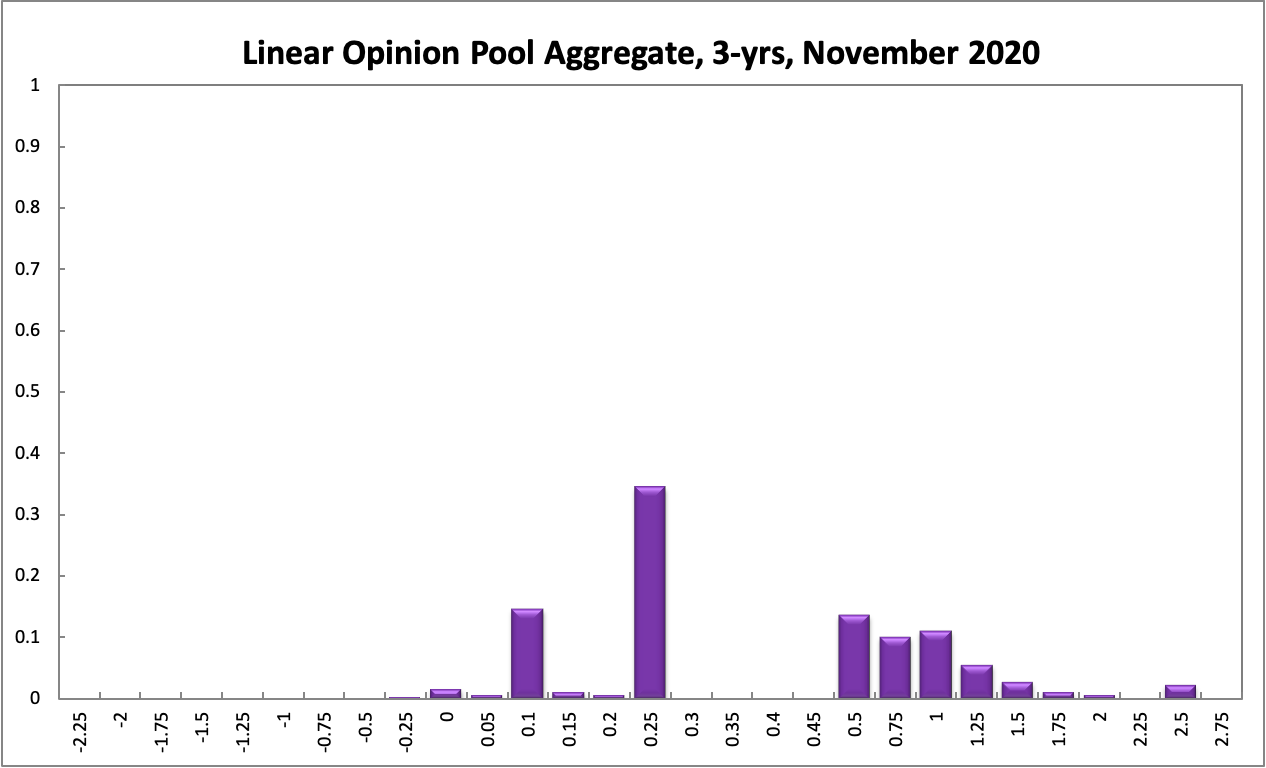

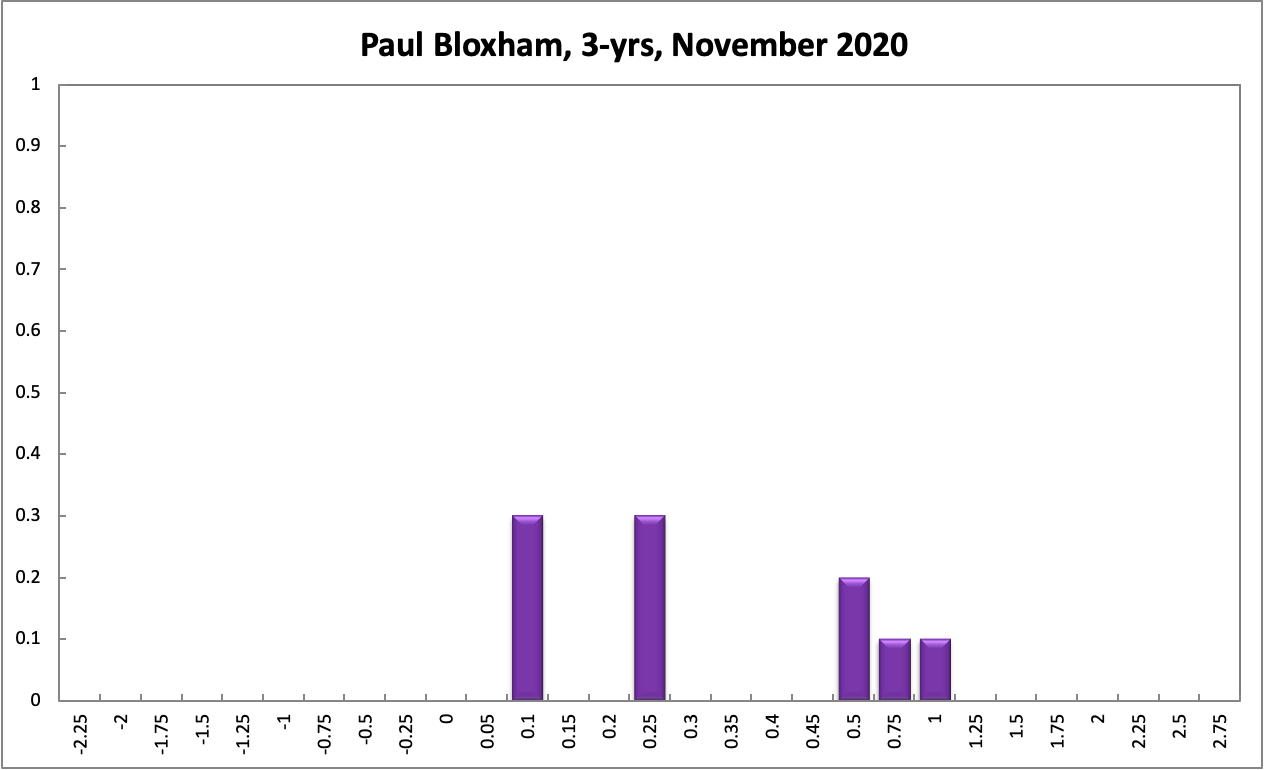

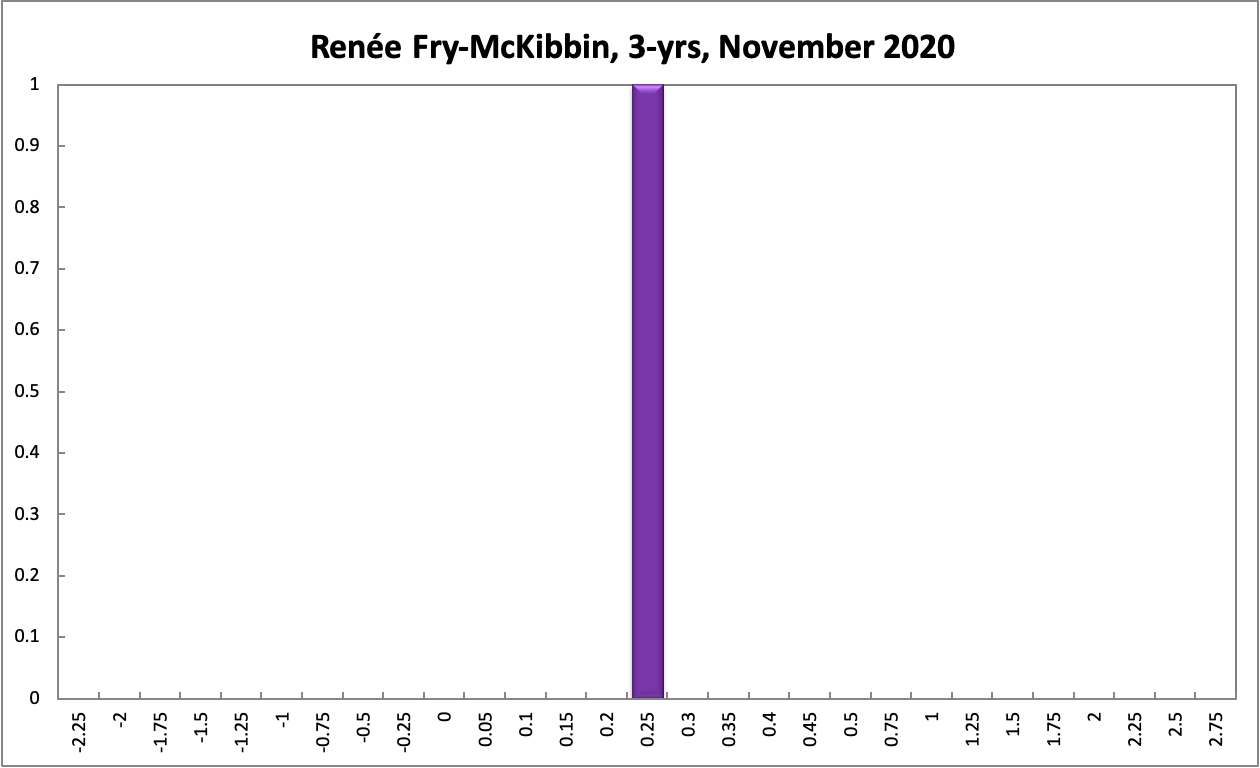

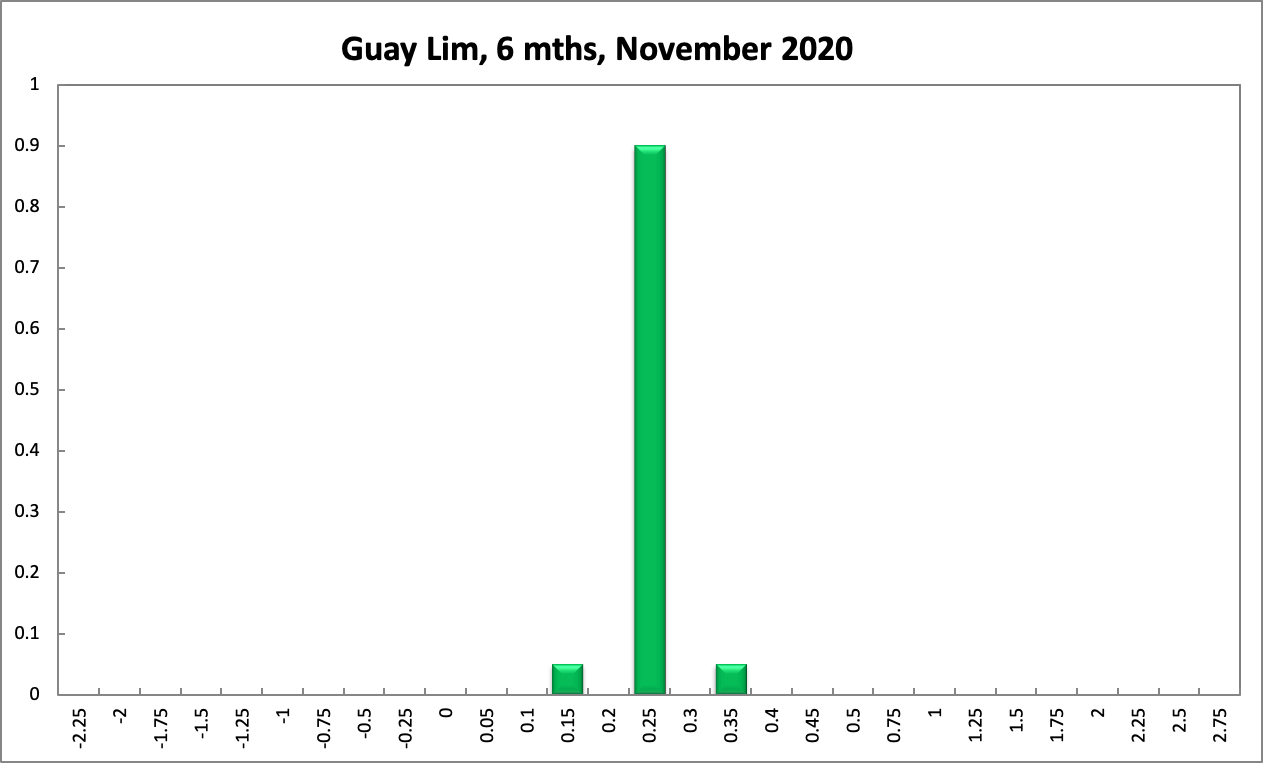

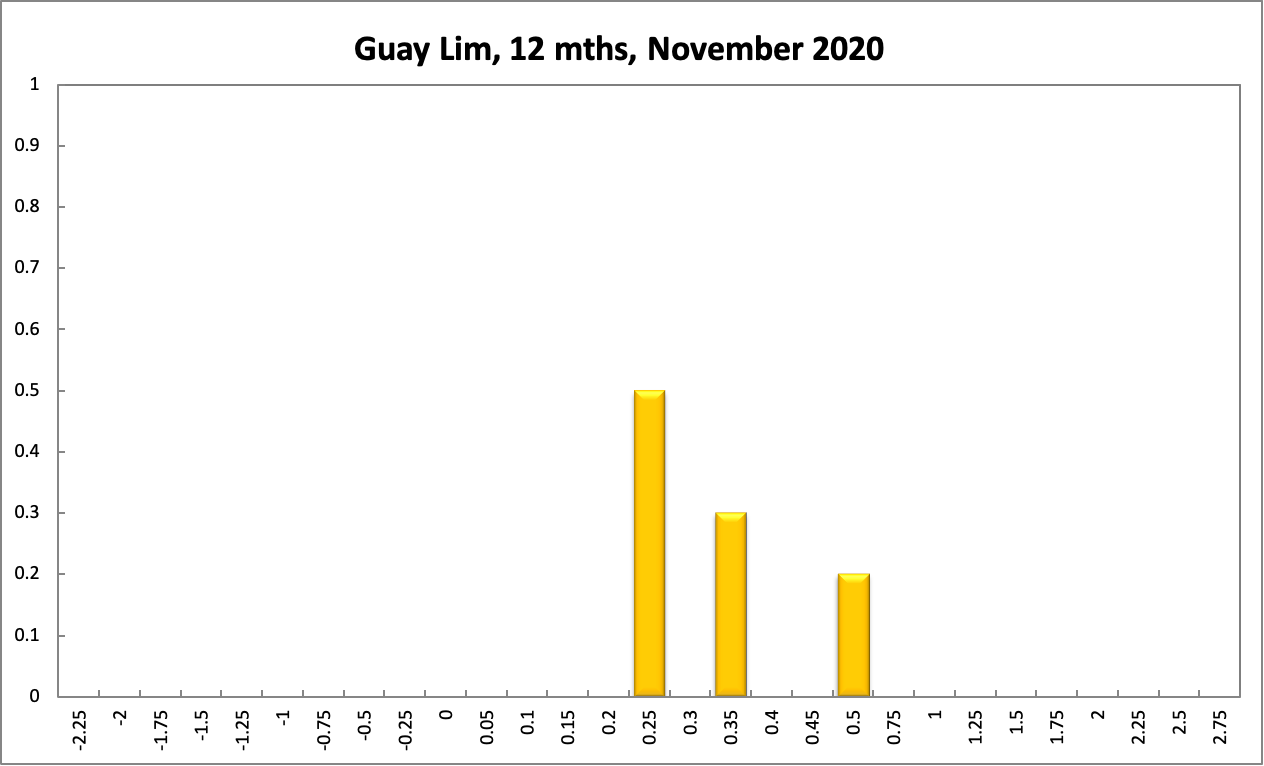

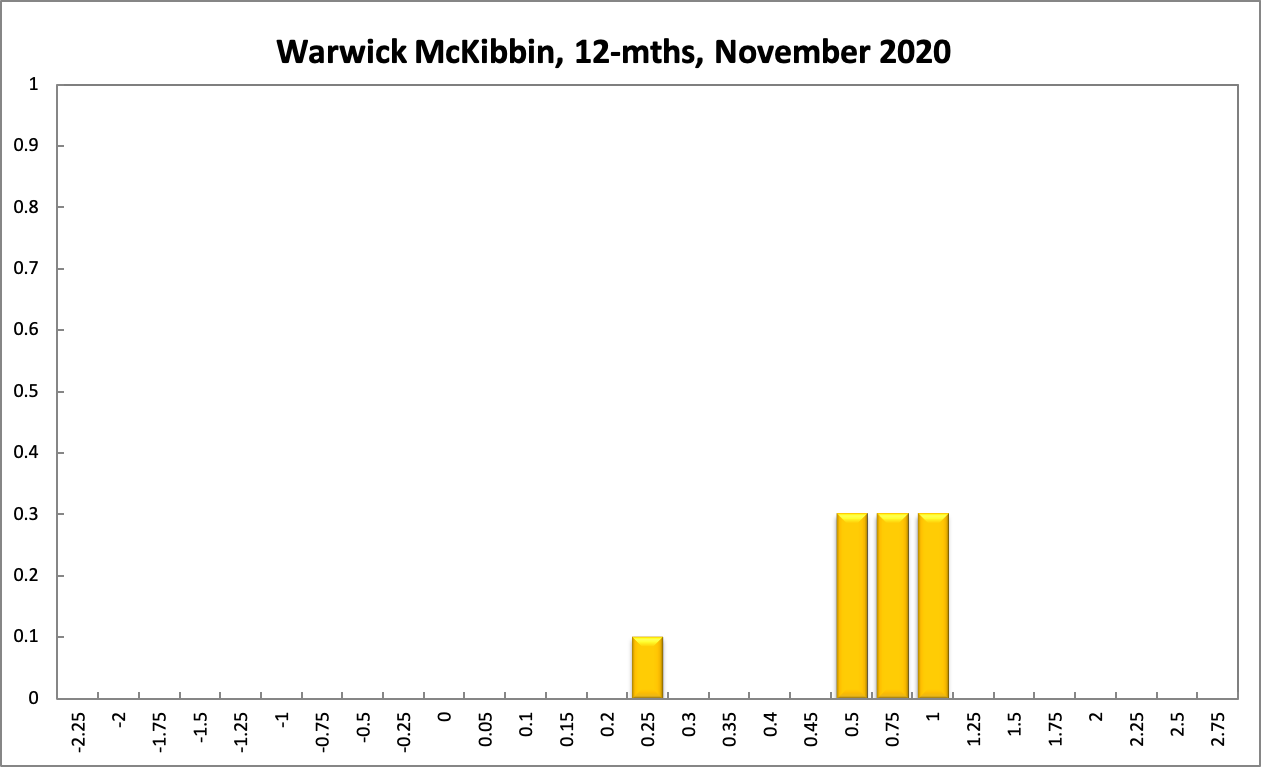

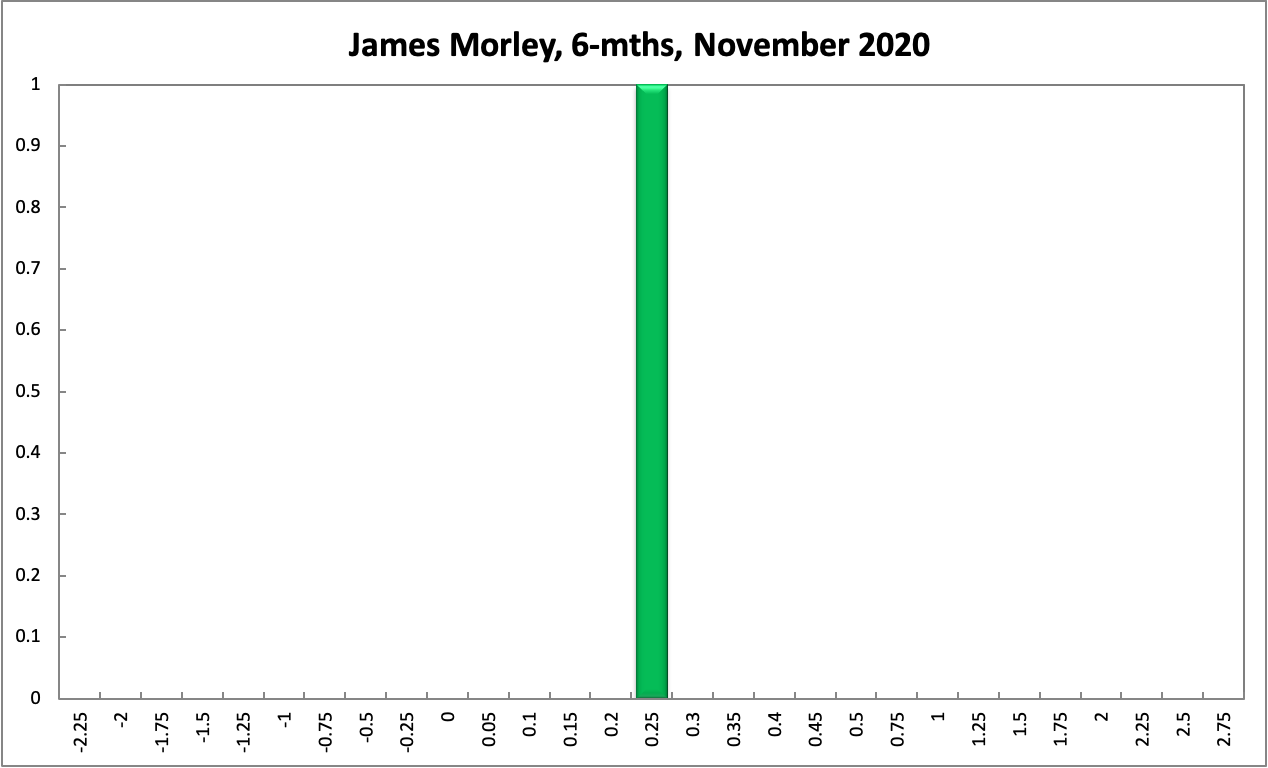

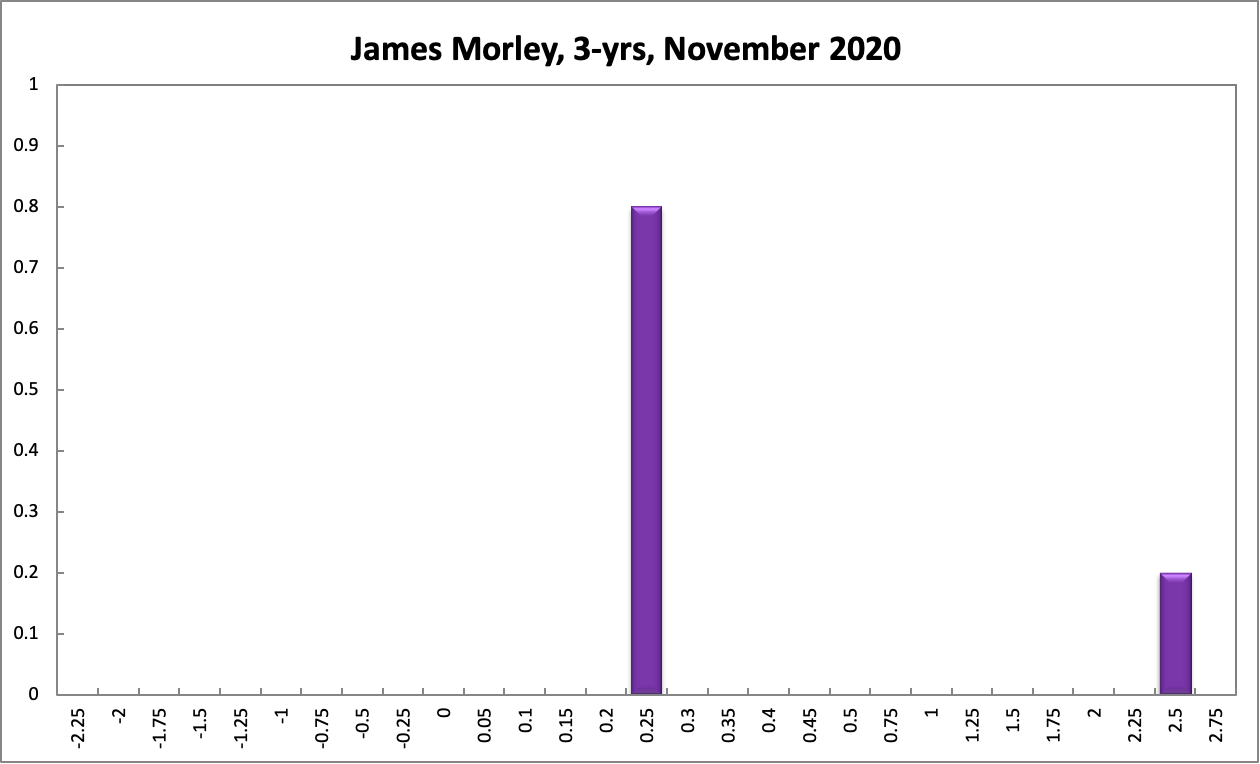

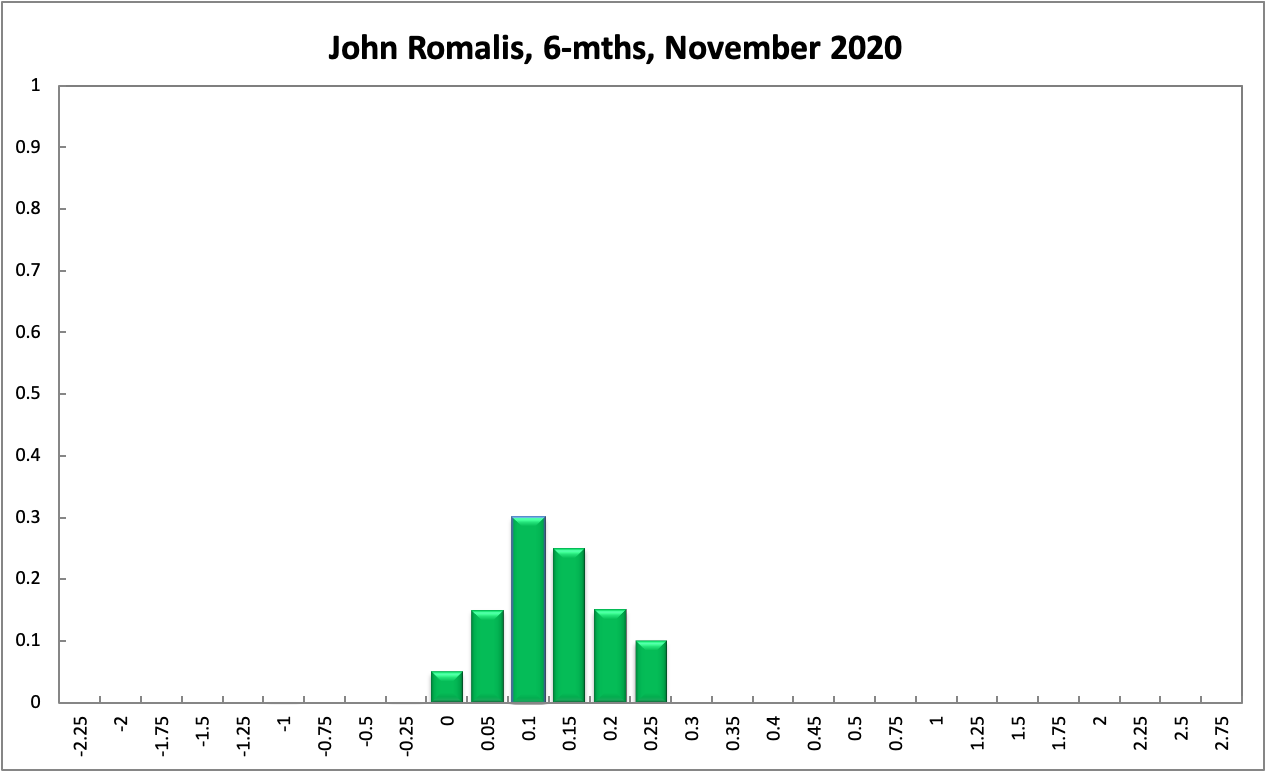

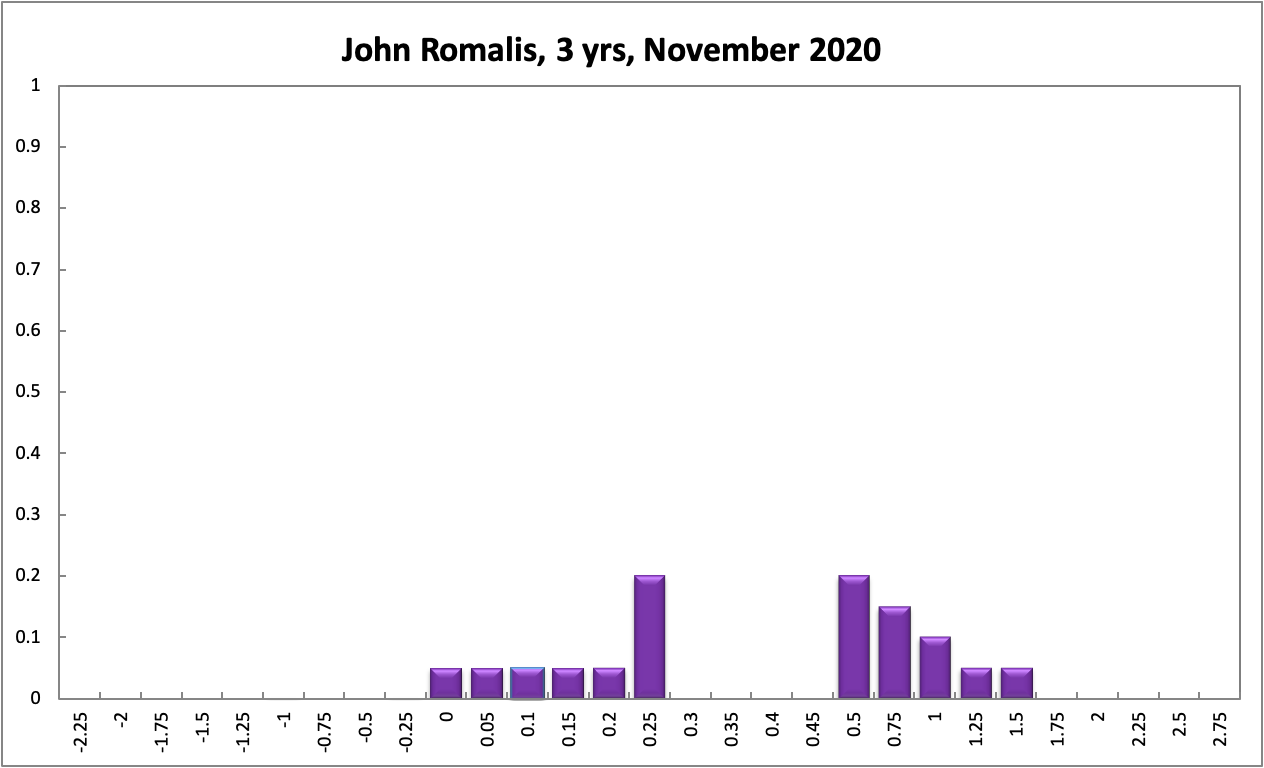

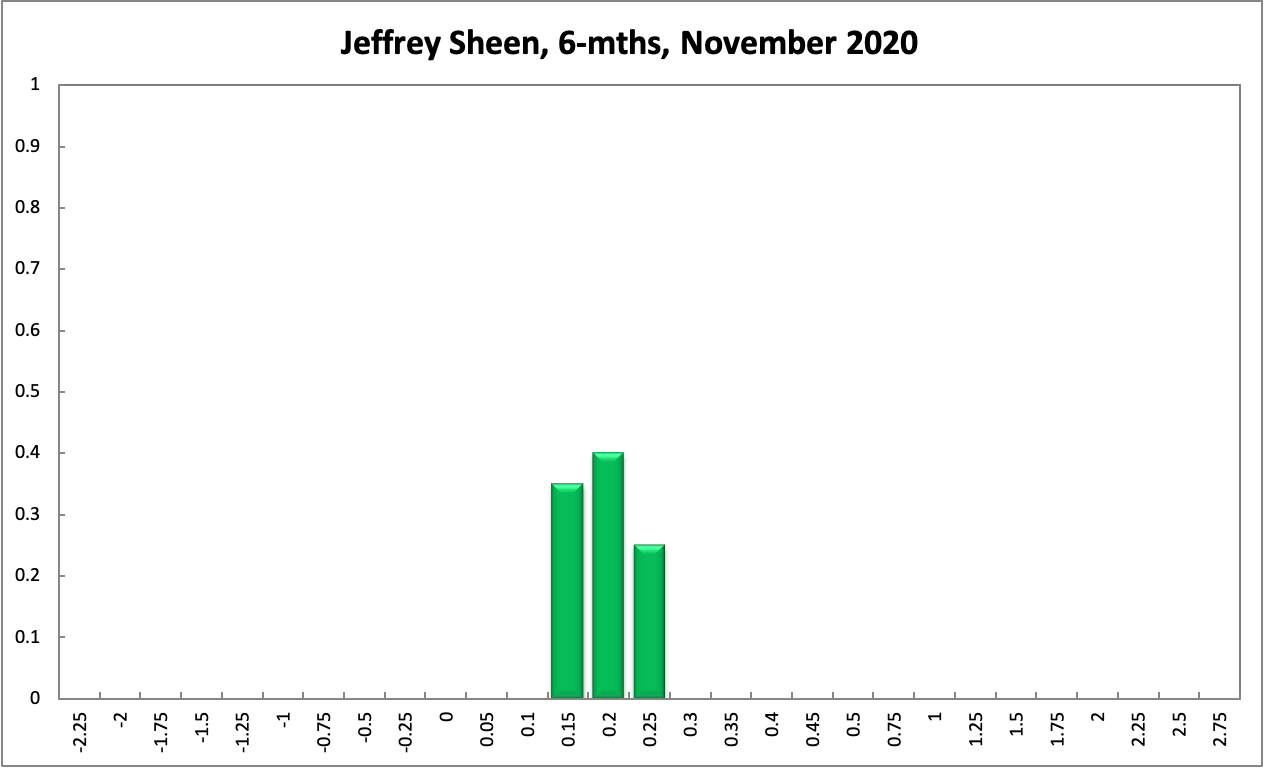

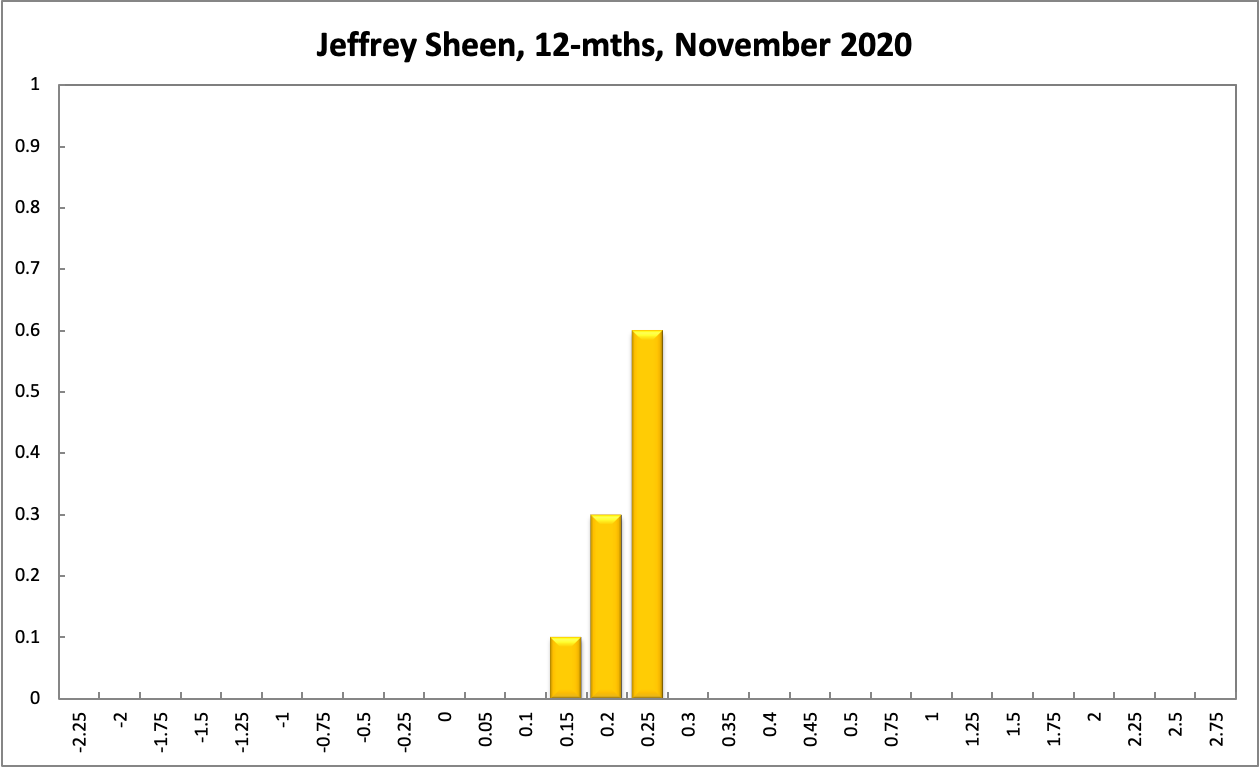

Not only are Shadow Board members invited to make recommendations in smaller increments, but they are also asked to provide recommendations for the interest rates 3 years out, in addition to 6-month and 12-month horizons. The probabilities at longer horizons have shifted to the downside: 6 months out, the confidence that the cash rate should remain at 0.25% equals 56% (76% in the October round), the probability attached to the appropriateness for an interest rate decrease equals 41% (up from 23%), while the probability attached to a required increase is 3%. One year out, the Shadow Board members’ confidence that the cash rate should be held steady dropped further, from 66% to 48%. The confidence in a required cash rate decrease, to below 0.25%, increased to 37% and in a required cash rate increase remains unchanged at 16%. Three years out, the Shadow Board attaches a 34% probability that the overnight rate should equal 0.25%, a 19% probability that a rate lower than 0.25% is appropriate, and a 47% probability that a rate higher than 0.25% is optimal. The range of the probability distributions over the 6 month and 12 month horizons is unchanged, spanning 0% to 1%. Unsurprisingly, the range of the probability distribution for the 3-year recommendation is much wider, extending from -0.25% to 2.5%.