There have been further signs this month that low interest rates are supporting the economy, including improvements in consumer sentiment and the housing market. Despite some wobbles in Europe, associated with Cyprus, the global economy has generally shown further signs of improvement, led particularly by conditions in the US and China. Given this, there would little reason to consider shifting the Australian cash rate this month.

Outcome: April 2013

Return Gradually to a Neutral Stance

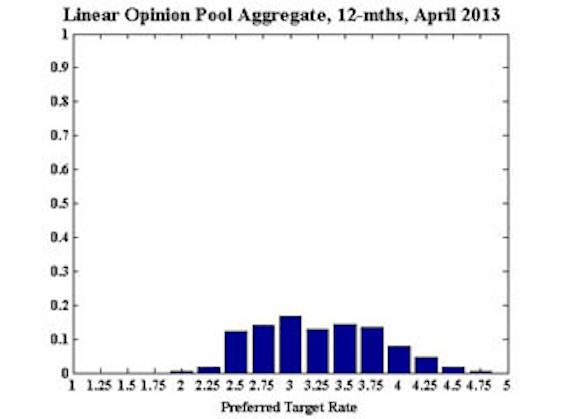

The consensus of the nine members of the Shadow Board is that the Reserve Bank of Australia should leave interest rates unchanged from March at 3.00%. But the balance of risks implies that rates should rise within the next 12 months to return monetary policy to a neutral stance.

The probability that rates should rise in the next 12 months remains at around 1/2, exceeding the risk that rates should be lower, which is under 1/3.

Although domestic conditions have been relatively stable, political and fiscal turmoil in Europe continues. Recent US data indicate more promise of sustained economic growth. Gradual tightening to a more neutral policy stance, following the recent period of monetary accommodation, would be the prudent path for Australia, although not risk free.

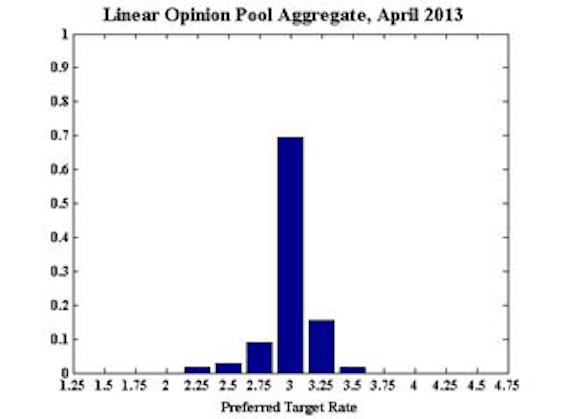

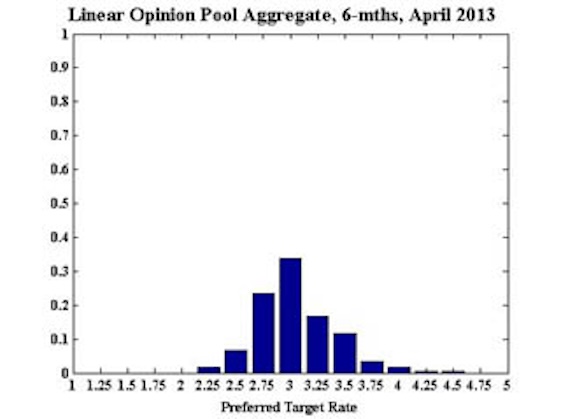

Aggregate

Current

6-Months

12-Months

Paul Bloxham

Current

6-Months

12-Months

Comments

Mark Crosby

Current

6-Months

12-Months

Comments

Still considerable uncertainty about appropriate settings at the 6 to 12 month horizon with Europe finding new ways to antagonise markets and avoid solutions to ongoing problems. In other parts of the world the outlook is more stable, but weaker commodity prices will likely weaken output and employment growth over the next 12 months.

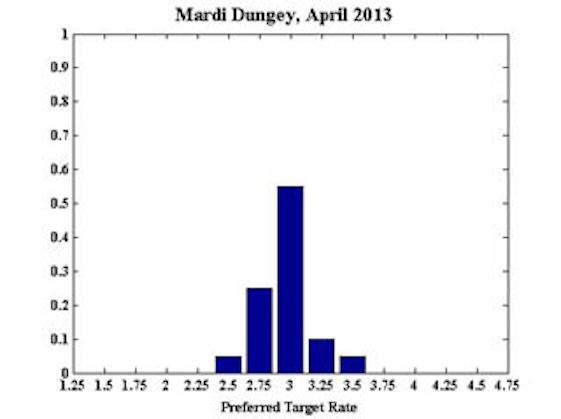

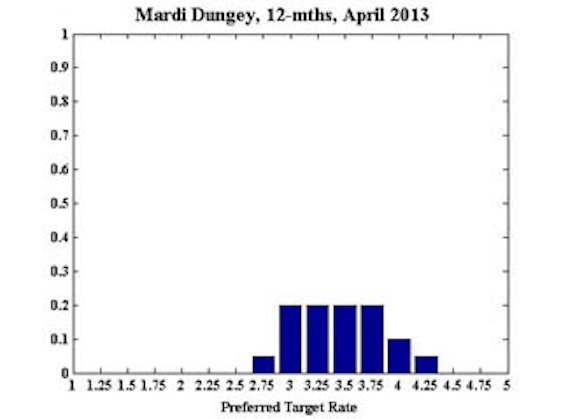

Mardi Dungey

Current

6-Months

12-Months

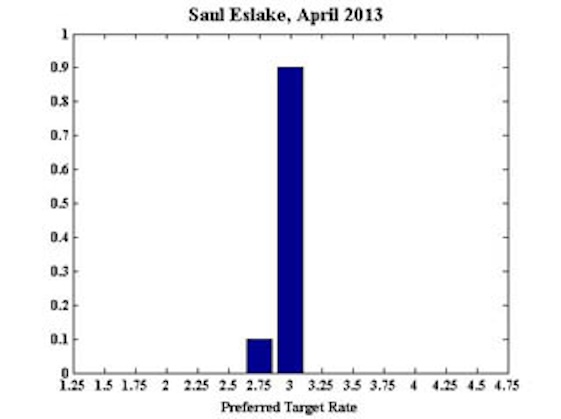

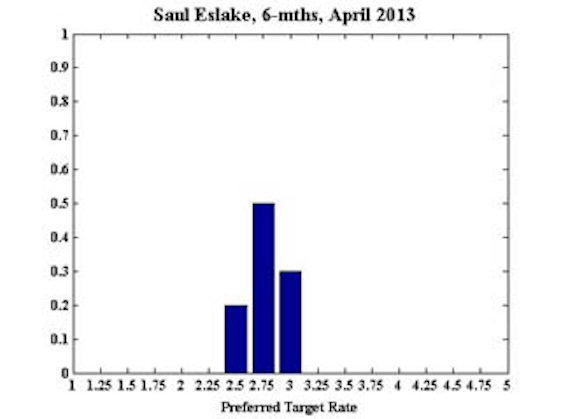

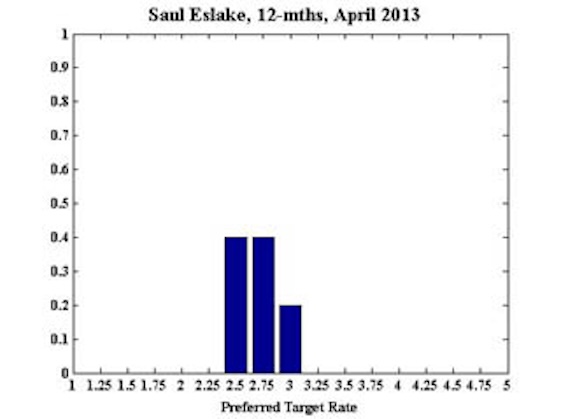

Saul Eslake

Current

6-Months

12-Months

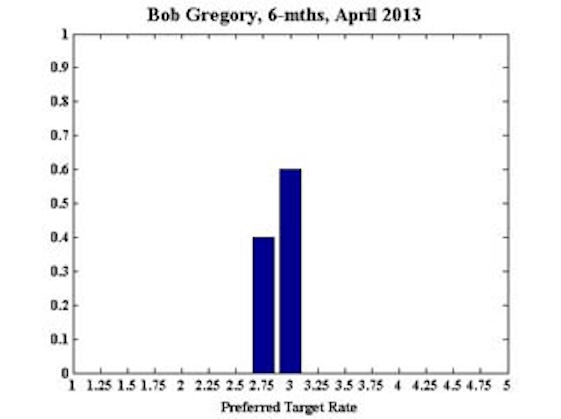

Bob Gregory

Current

6-Months

12-Months

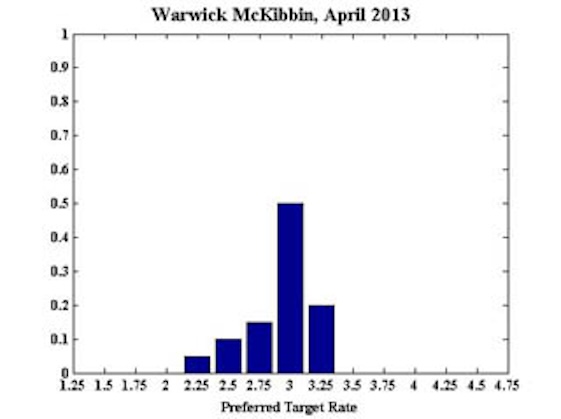

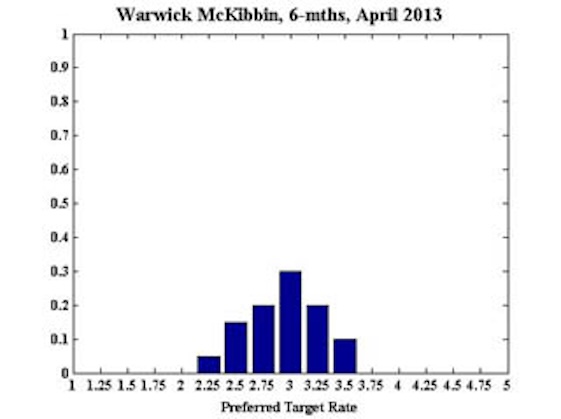

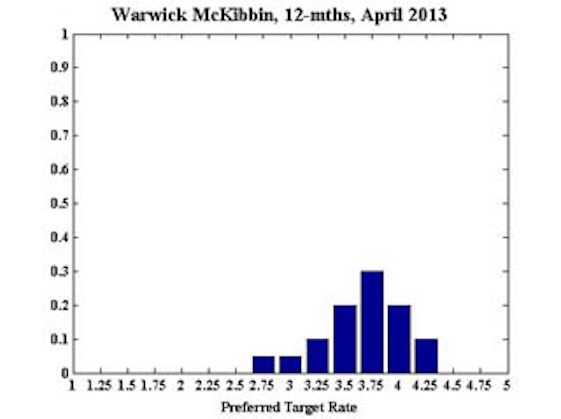

Warwick McKibbin

Current

6-Months

12-Months

James Morley

Current

6-Months

12-Months

Comments

A Gradual Return to Neutral: Domestic economic conditions remain quite stable with inflation at 2.2% and the unemployment rate at 5.4%. Despite ongoing political woes in the US and Europe, recent economic developments, especially in the US, suggest less risk for the Australian economy. Given this background, the policy rate should gradually be adjusted back to a more neutral level after the recent period of a more accommodative stance.

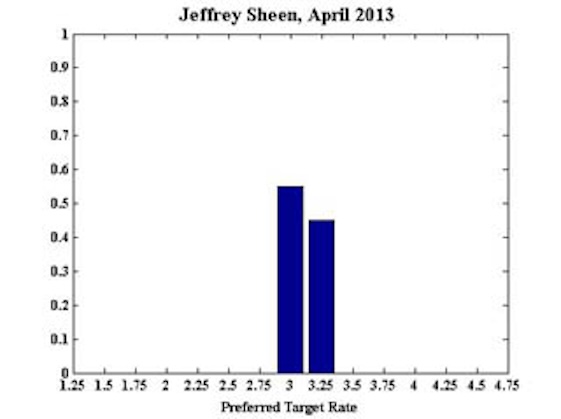

Jeffrey Sheen

Current

6-Months

12-Months

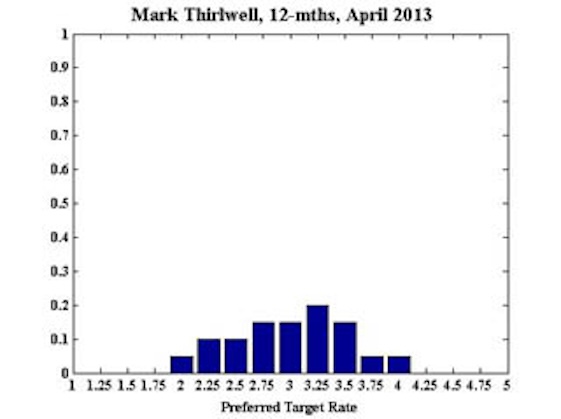

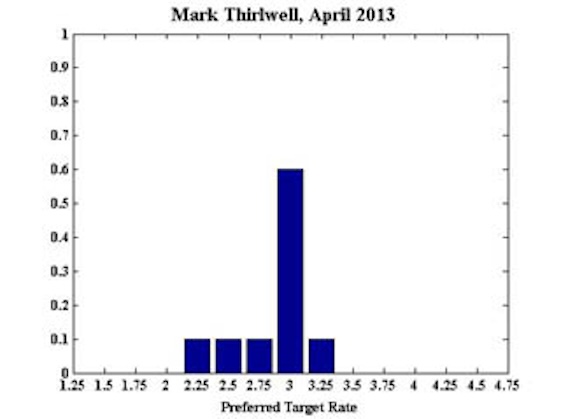

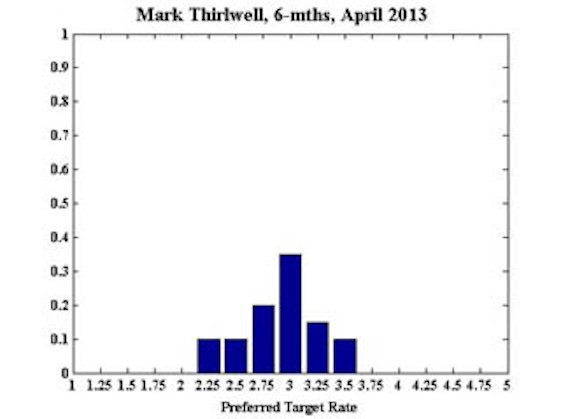

Mark Thirlwell

Current

6-Months

12-Months